Have you ever wondered what is the difference of Forex from other markets?

The currency, of course, present trends, but most of the time it’s still a zigzag motion, subject to mean reversion. It is on this idea is built accurate intraday strategy Beat The Market, about which speech will go today.

This is a combination trade in the channel and on trend, which takes the best from the two methodologies.

Forex TC Beat The Market – the exact strategy for M15

Indicators BTM was actively discussed also on the forum, the trading system transformed, in the resulted in the finished version, which will be described in this article. Users and coders of our website, a joint effort with Forex Factory managed to write a “Lite” version the original BTM, while maintaining the level of profitable trades, without losing the accuracy of the inputs.

I would like to thank for the result to all involved in the work presented below effective trading system Beat The Market strategy.

Indicators strategies posted on the forum with open source, which allows to adapt them to any other trading platform. Trading system works on the M15 timeframe, but the trend specifies the major time period H4.

The idea of the strategy

Investors prefer to trade in the stock market, constantly growing in the long term. Currency pairs of developed countries do not have such clearly defined long trends. The Hanukkah menorah is no exception, despite the steady weakening of regional currencies against the Euro and the dollar, sections of strong falling of national currency short-term.

Most of the time currencies are traded in the wide corridors of the flat. This attracts speculators who are able to work in both directions of the market, unlike investors, more prefer Buy&Hold strategies.

Long chunks of fluctuations in the channel will often help you to trade successfully on the grid or Martingale strategies, especially not choosing the direction and exploiting the frequent returns to the medium of currency pairs exchange rate.

Based Beat The Market strategy also is the principle of regression to the mean, but the trading system uses short term trends coinciding in direction with the medium-term trend, “borrowed” on a larger timeframe.

Preparation for work

Files trading system are copied to the folders via the option “data Directory” in the menu Metatrader 4. Those who are not familiar with the algorithm can read the detailed installation instructions trading strategies, it is in the menu on the home page.

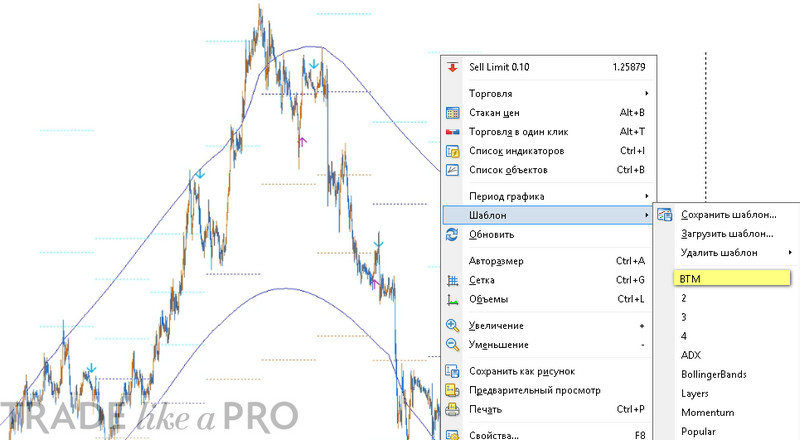

After restarting the Metatrader 4 trading system on the chart is set through the menu with the right mouse button, using the option “Template” -> BTM.

An alternative is to add indicators on the chart independently from “Navigator” window or from the menu “Custom”. After installation, the trader must the indicator TMA (Triangular Moving Average) in the form of a channel, pivot levels and to the up and down arrows.

With the TMA indicator connected important feature of the strategy is its trend channel is based on time frame H4 on start, interval M15 chart. The last values of the boundaries are sometimes redrawn, but this does not affect the signals of the trading system, built on the fifteen-minute candles. The TMA indicator is used as a reference value for a trade in the direction of the higher timeframe trend.

Pivot levels show areas of stop, a rebound or a possible reversal in the exchange rate, they also serve the trader benchmarks for setting stop loss or take profit.

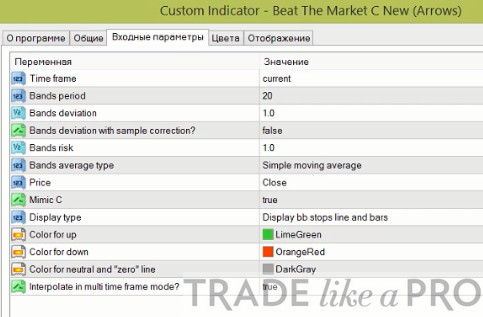

Places specific inputs for the strategy indicated by arrows in accordance with the Bollinger Bands indicator that does not repaint the signals. The indicator settings by default, you can see in the tab “Input parameters” with the installation of BTM trading system on the chart.

Rules of entry

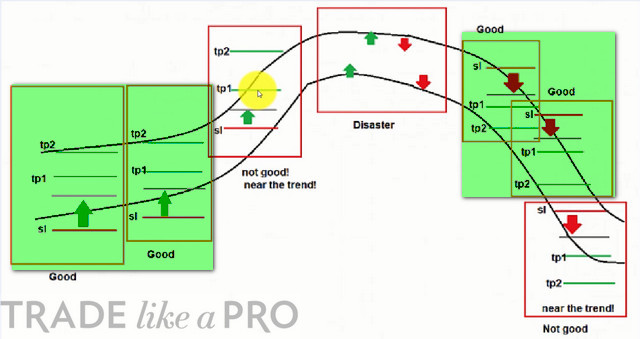

All transactions are made only on the arrows in the direction of the trend on a larger timeframe, if the quotes are at a sufficient distance from the pivot levels and the opposite signal of the boundaries of the TMA. Closing takes place in two stages – on the first and second pivot points levels closest to the entrance.

A SELL order is opened after the close of the candle on which the arrow originated, subject to the following conditions:

- TMA curve is directed downwards at an angle of at least 30 degrees (tangent);

- The signal is close to the upper limit or in the middle of the channel.

The arrows close to the lower boundary or in the reverse direction must be ignored by the trader. No trade is open, if the next pivot level gets to the lower border of the TMA or below it.

A BUY order is opened by the opposite set of conditions:

- Curve TMA is pointing up at an angle a tangent of at least 30 degrees;

- The signal is close to the lower boundary or in the middle of the channel.

The trader ignores the arrows that emerged close to the upper limit, or the signal for SELL. No trade is open, if the first pivot level is at the upper limit or above TMA.

The author of the strategy does not recommend to trade is growing, flat areas where the slope of the lines TMA less than 30 degrees, but in special cases, for example, in the “night trade”, trading in both directions can be justified.

Schematically, the rules of trade the author has depicted in graph reminder: the best BUY signals on the lower boundary of the TMA, SELL – at the upper boundary.

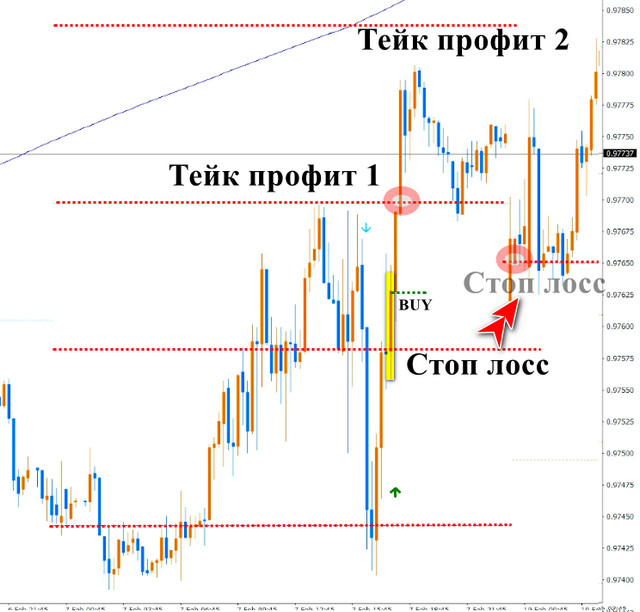

Money management, TP and SL

The next to open trade pivot levels indicators Beat The Market strategy act as take-profits and stop-losses. They act as an additional filter to the trades.

The example below shows how the closing price of the candle the entrance closed one point below TP 1. The second level of TP is at the upper boundary of the TMA, both of these circumstances to cancel the BUY signal.

The meaning of the two take profits due to the fact that the first level of profit works far more often than the second, so tactics money management involves limiting losses.

Marking the first profit, the trader should move the stop loss to breakeven. Next position is accompanied by trailing stop, placed at each pivot level is located above the entry point.

Given the specificity of rare triggering of take profit 2 the trader can close the position at take profit 1, to increase win rate.

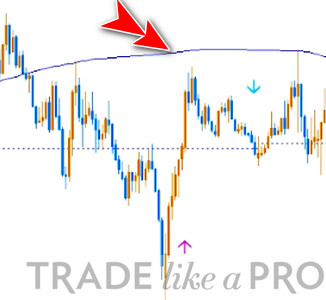

It may happen that a trader will not find the level of the pivot point on the graph to set a stop loss – this happens when an arrow appears directly on the border of the TMA, as in the situation shown in the figure below. In this case, you can use nearest to transaction extrema of quotations, in particular local maxima.

When trading it is not recommended to exceed the traditional parameters of money management, allocating 1% of the Deposit per deal. The lot size for a specific value of an account balance can be calculated on our website by using the “lot Calculator”.

Examples of transactions BTM

On the EURJPY chart the line TMA showed a strong trend down, which opens up the ability for transactions to SELL. The resulting signal in the form of the arrow indicates the candle, the closing price of which depends on the lower bound of the moving average line.

A trader needs to refrain from sales due to the close proximity of the signal to the lower line of the TMA and the output of the first level of the take profit below this range.

A similar situation of abandonment of the transaction occurs on a buy signal near the level of take profit 1. The main reason for the refusal was disproportionate profit stop loss. The graph shows that the distance to the take profit 1 is four times less than the pivot-stop.

Another argument of the failure of the deal – TP 2 intersects with the line of the TMA; try to look for deals where both levels are located inside the channel.

The figure below shows that the arrow-down occurred on a gentle flat plot of TMA. The transaction is open because of the time of occurrence of the signal, 7-30, which can be attributed to the “night trade”.

The closing price of the candle where the arrow originated, located very close to the pivot, where must be placed the stop loss, so a protective order moves above the line of the TMA to the next level.

After triggering the take profit 1 appears opposite the entry signal to long, but at this point, the TMA shows a clear downward slope, which makes the rules of the strategy to only pay attention to SELL-inputs. They do not appear to trigger the take profit 2, closing completely the original position.

The trader held the deal for about a day, catching the medium-term trend through moving average TMA constructed by the signal H4.

The following is an example of short-term purchases: strong growth closed at take profit 1 for 15 minutes. The figure below shows that the entry was justified because the potential profit was more than exposed feet.

After take profit 1 the second level of profit could not be taken into account because of its location directly on the line of TMA. A trader had to hedge trailing stop, which is triggered after 24 candles in the moment of trend reversal.

As mentioned above, the signal candle is not redrawn, but the education signal has the nuance of an advancing arrow occurs before the close of the candle and may disappear in the process of its formation. If the trader does not wait for the closing price and made the entrance and the signal disappeared, then such a position is necessary to close the market.

Conclusion

Strategy BTM is easy to use, tested in real trading traders Forex Factory and our forum. Dial indicators will help beginners not to miss the signals, the lowest frequency which allows you to trade multiple instruments.

If you decide to use it in trading, do not forget about the filters-details: take profit, coinciding with the tops of the flat areas, a reasonable approach to the choice of stop loss, the mandatory observance of the rules of money management.