Hello, fellow Forex traders!

Hello, fellow Forex traders!

In the comments to the articles, you often ask me to tell about the system Sniper: does it make sense for her to trade, the divorce or not and what are the reviews.

Trading strategy “Sniper” is an example of the successful combination of common rules of technical analysis tactics money management and aggressive marketing promotion. As a result, hundreds gave their blood for the classical technical analysis.

Today we understand the rules of the system “the Sniper”, the secrets of its success among the population, and also consider examples of transactions.

Was there a boy ?

Today’s material is devoted to the strategy of “Sniper”, which for six years has been subject to ongoing discussion in the Internet. Despite “long life” and the reference system from different sources, she’s more successful marketing the product than the Grail. The creators of a well thought out method of distribution of the strategy among the newcomers, collecting it in a simple and reliable tenets of trading, which picked beautiful names, to knock associative array and provide “a nice package”. This allowed the desire of most newcomers that come to the market “trade now”, and the network spread rave reviews of the has provided customers.

Due to the lack of indicators it is impossible to establish clear rules following the strategy and conduct of its tests, to prevent the threat of discharge of the Deposit. There are a lot of questions on the correct determination of levels of resistance and support, as well as a flat used in the trade. The purpose of this document is to show that the rules-based system of “Sniper” are simple principles that cannot be improved.

However, after 2016 the author of the strategy has managed to automate its algorithm and diversify additional units. However, the principles of their construction do not differ from the General tenets of the strategy. Today, analyze this strategy in the most detailed way.

Characteristics of the trading system “Sniper”

Platform: MetaTrader 4

Currency pairs: any

Timeframe: M1 D1

Trading hours: during the day, no rollover, except when the release of important news

Recommended brokers: Alpari, RoboForex, Exness

The basic principles of the strategy

“Sniper” is an intraday trading system for trading according to the trend determined by the direction of the break of “night flat”, with subsequent confirmation in form in the course of levels of support or resistance.

The strategy has a clear point of entry early in the day, and contains the basis of the classical theory of the Dow Jones with three market phases: accumulation (flat), jerk (pulse) and correction (reversal).

In fact — traders first trade of the day in the direction of “candles of London” playing the opening of the European stock exchanges, which is accompanied with liquidity and volatility. This so-called strategy of “London explosion”.

In fact — traders first trade of the day in the direction of “candles of London” playing the opening of the European stock exchanges, which is accompanied with liquidity and volatility. This so-called strategy of “London explosion”.

The author does not insist on a large amount of deals, offering to hold the trade until the trend is developing “our way”. Make the charts was “psychologically easy” to follow the trend, Pavel Dmitriyev utilizes the tactics of translation stop to breakeven, but does so through profit, by closing 50% position. Beginners extremely important to “feel the money” at the start and not know “the bitterness of large losses”, so the stop loss and profit is 10-20 pips.

The author does not insist on a large amount of deals, offering to hold the trade until the trend is developing “our way”. Make the charts was “psychologically easy” to follow the trend, Pavel Dmitriyev utilizes the tactics of translation stop to breakeven, but does so through profit, by closing 50% position. Beginners extremely important to “feel the money” at the start and not know “the bitterness of large losses”, so the stop loss and profit is 10-20 pips. To avoid “knocking out stops”, the “Sniper” prohibits trade during the release of economic news. Using input after a pulse, leaving behind a flat area, which acts as a natural obstacle to any rollback.

To avoid “knocking out stops”, the “Sniper” prohibits trade during the release of economic news. Using input after a pulse, leaving behind a flat area, which acts as a natural obstacle to any rollback.

Take profit strategies are defined in privatnih points where the most possible reversal. The author of the strategy considers these points, the highs, the lows, the closing price of the previous day, as well as support and resistance of higher timeframes.

These levels are laid out in advance, prior to bidding. The trader may closely monitor the price behavior to achieve privatnih areas to obtain a signal of a reversal in the formation of the first zone of the flat, opposite the trend. By the way, is a universal rule change trends, because quotes can be deployed sooner or later drawn the key levels.

These levels are laid out in advance, prior to bidding. The trader may closely monitor the price behavior to achieve privatnih areas to obtain a signal of a reversal in the formation of the first zone of the flat, opposite the trend. By the way, is a universal rule change trends, because quotes can be deployed sooner or later drawn the key levels.

Terms the strategy of “Sniper”

Terms the strategy of “Sniper”

Trading system introduces the names of the levels of resistance and support, moving away from the conventional trading professional slang.

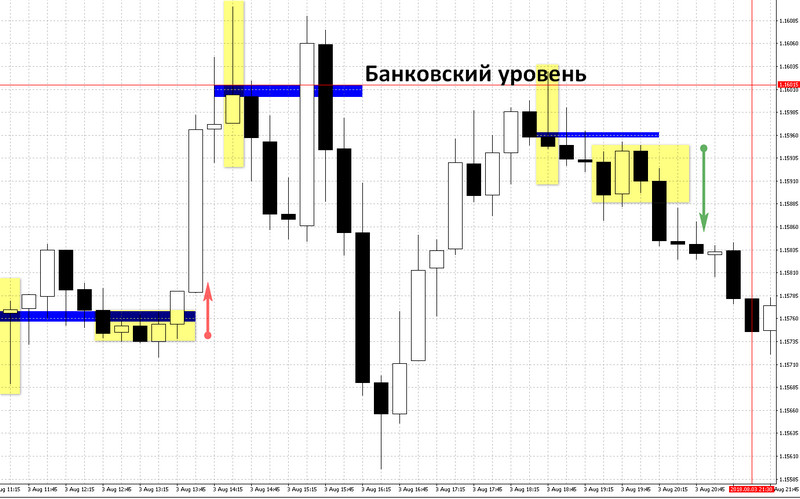

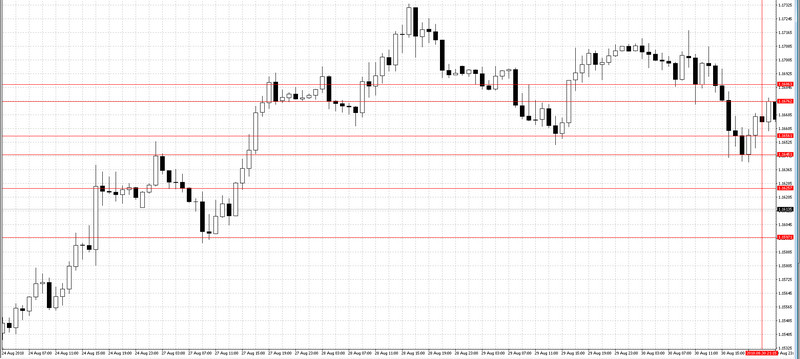

- Bank level (BU) — the closing of the previous daily candle in GMT (minus 3 hours GMT);

- Levels conducted through the points of minimum and maximum prices of the previous trading day;

- Levels of support and resistance of higher timeframes (M30, H1, H4), called “total impulse levels” (TIU);

- The level of Abrupt Change in Trend (URSTA) is a candle with a long tail in the direction of the trend on a 5 or 15-minute range, after which begins the turning movement;

- Switching levels (PS) — upper and lower bounds of the flat on M5-M15;

- The area of Consolidation (storage) – flet that occur during the Asian session;

- Safe – closing 50% of position to take profit equal to stop loss.

Renamed patterns and the elements of the Forex trading strategies that are included in the TS “Sniper”

The newcomers turned to the study of strategy “Sniper”, it is proposed to start with testing two elements – Bank Level, and Zones of Consolidation.

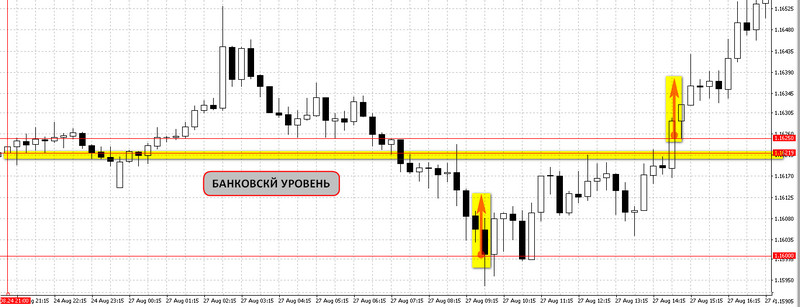

Bank level is given by Pavel Dmitriev for know-how. He argues that the shift to 3 hours, you can determine the price level, desirable for transactions of large banks.

In fact trade using the closing price of the previous day as the level of reversal investigated in detail Larry Williams book “Long term secrets to short-term trade.” A debate about the meaning of the displacement of the closing time of the day discussed in detail in the materials of our website.

The closure of the day – a significant level for a reversal, but clearly not a Bank, evidenced by a daily published tables of orders of large banks. Financial institutions are not linked to the closing price of the day.

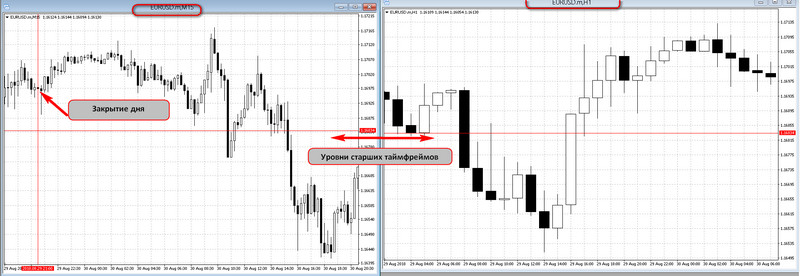

The example below shows that on Monday, August 27, two banks opened buy on EURUSD at the price of 1.1600 and 1.1625.

Bank level on Friday 24 August amounted to 1.1620. As you can see, first Bank bought the Euro “at the bottom”, much lower than Bank level, and the second opened at the end of the day.

Bank level on Friday 24 August amounted to 1.1620. As you can see, first Bank bought the Euro “at the bottom”, much lower than Bank level, and the second opened at the end of the day.

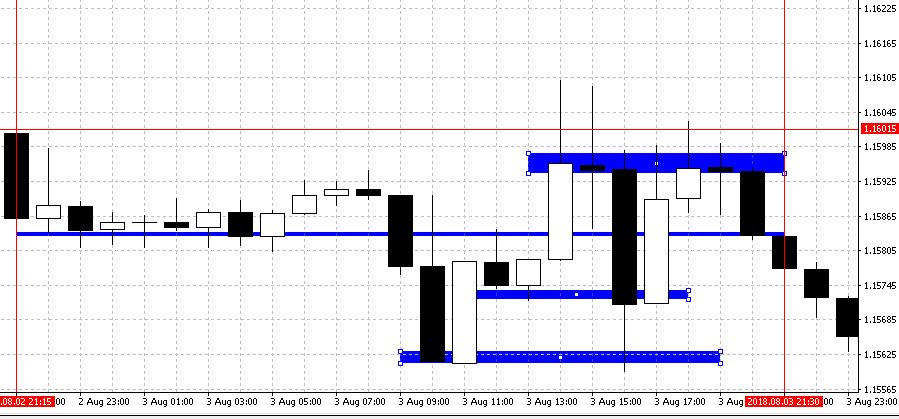

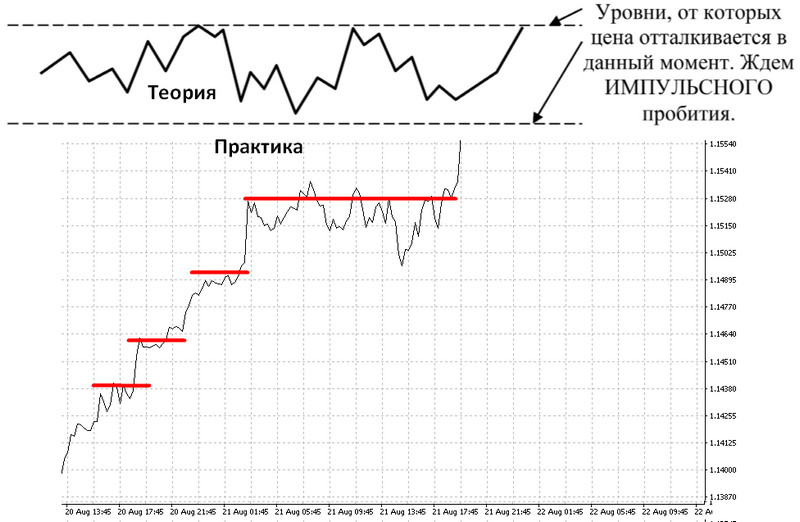

The area of consolidation as a consequence of low liquidity “Asian session” that occurs in the absence of European and American traders. Low trading volume at this time of day allows you to overcome local resistance and support and create a trend.

The area of consolidation as a consequence of low liquidity “Asian session” that occurs in the absence of European and American traders. Low trading volume at this time of day allows you to overcome local resistance and support and create a trend.

On the chart of any currency pair is clearly seen in the consolidation of the quotes drop-down on the evening, passing on the morning hours.

The biggest cause of confusion of the name “pulse rate” and “total impulse level.” That’s why this is happening.

The biggest cause of confusion of the name “pulse rate” and “total impulse level.” That’s why this is happening.

Total impulse level is a line of support or resistance on a larger timeframe. Sometimes the author of the strategy says about the zone, but only because the exact line is difficult to determine. The reason is that the author’s wording about the many contacts and kickbacks quotes from this level.

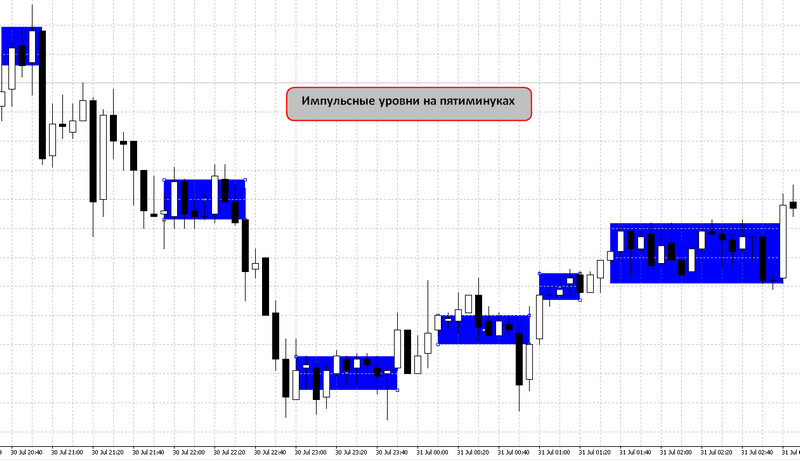

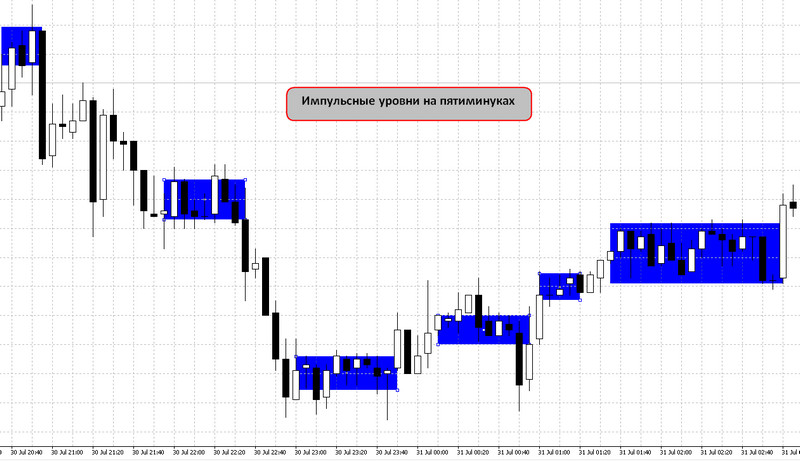

However is the line, not area, whereas Pulse rate is really a range of prices, moving horizontally, without the trend. Built this area, in contrast to the total impulse level, working on small time frames: M1, M5 or M15, depending on the preferences of the trader.

However is the line, not area, whereas Pulse rate is really a range of prices, moving horizontally, without the trend. Built this area, in contrast to the total impulse level, working on small time frames: M1, M5 or M15, depending on the preferences of the trader.

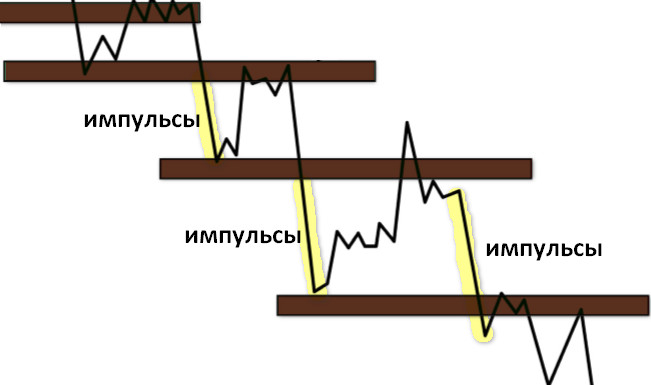

Therefore, Pulse rate is a classic flat, is known since the publication of the Dow theory as the zone of accumulation or low liquidity. The authors of the strategy had to spend many years to automate the rules for finding the Pulse Level. However, there is a strategy Stairstep Breakout System that allows you to reliably build and sell at platovym levels following a trend.

Therefore, Pulse rate is a classic flat, is known since the publication of the Dow theory as the zone of accumulation or low liquidity. The authors of the strategy had to spend many years to automate the rules for finding the Pulse Level. However, there is a strategy Stairstep Breakout System that allows you to reliably build and sell at platovym levels following a trend.

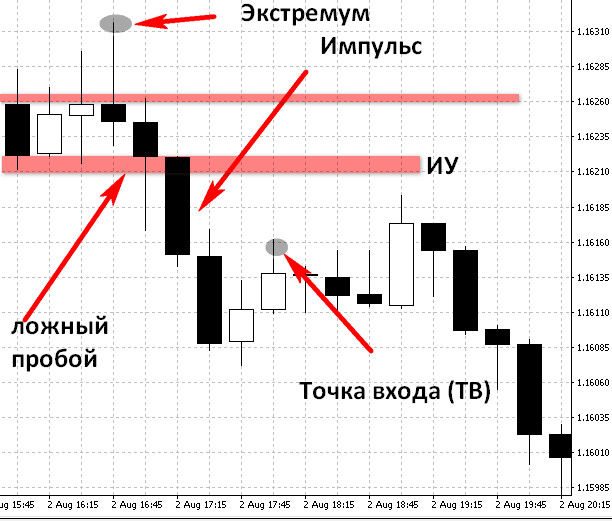

The level of the Abrupt Change of Trend is easy to detect the figure of the Price Action called a pin bar. Its distinctive feature is the appearance of a large tail in the direction of the trend. The logic of waiting for the reversal is clear: the movement has encountered strong opposition from the opposite side.

Box is the perfect marketing find Paul Dmitriev. Tactics 50% exit take profit equal to stop — copied by many developers. Nothing new in it, this approach is equivalent to the widespread acceptance of money management – the transfer of positions to breakeven. However, the idea of the fact of fixing of profit at the expense proved an interesting psychological finding.

Rules strategy

The strategy of “Sniper” is composed of trend and counter-trend parts for trade. All trades are opened after the formation of the pulse levels – areas of price consolidation on the timeframe M1-M15:

- Sell trades are opened at the conditions of formation of the current level below the previous pulse level and pulse breakdown of the lower boundary of the float;

- In turn, buy trades are opened at the conditions of formation of the current level is higher than the previous pulse level and pulse breakdown of the lower border of the flat.

Flat zones are determined by the TC “Sniper” as the range of variation between the levels of local resistance and support. They are determined by the maximum number of contact points and rollback to the horizontal movement of prices. But experience shows that their length can be any, it is important the presence of the pulse.

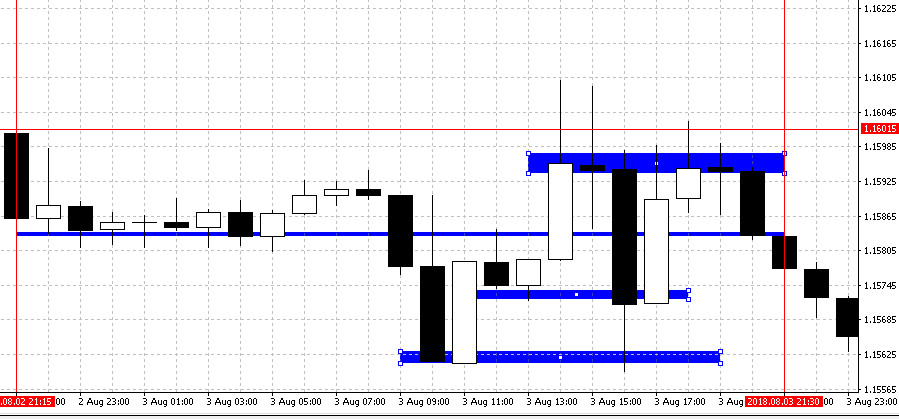

Market entry is carried out after the breakdown of the boundaries of the flat in the direction of the trend — a candle with a wide range. The trend is determined by the location of the pulse level relative to the previous such level. The market entry takes place after the pullback, under the following conditions:

Market entry is carried out after the breakdown of the boundaries of the flat in the direction of the trend — a candle with a wide range. The trend is determined by the location of the pulse level relative to the previous such level. The market entry takes place after the pullback, under the following conditions:

-

- If the pulse candle range exceeds 4 points from the lower or upper boundary of a flat, depending on the direction of the entrance;

- If the retracement level was at least 15 points from the lower or upper extreme points of the price, depending on the direction of the entrance.

- If the pulse candle range exceeds 4 points from the lower or upper boundary of a flat, depending on the direction of the entrance;

Countertrend trades are executed at the banking levels, total pulse levels and at the level of the abrupt change of trend.

Countertrend trades are executed at the banking levels, total pulse levels and at the level of the abrupt change of trend.

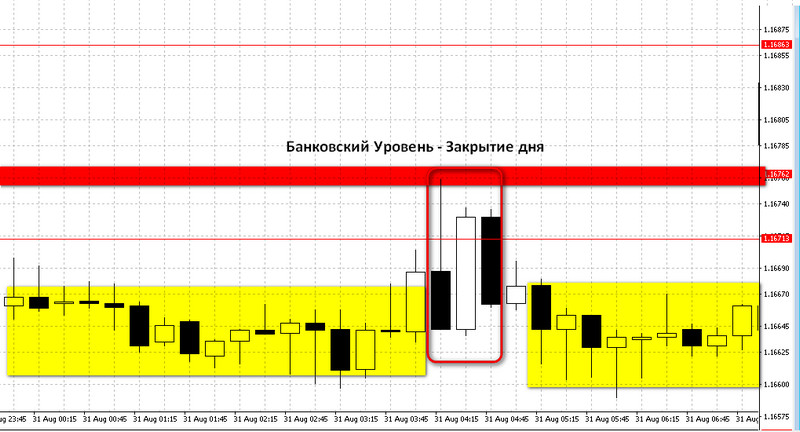

Bank level is conducted at the point of the last closing price at 0:00 GMT. In most cases the quotes of the current session will unfold after the breakdown of Bank level. So at work timeframe M1-M15 trader waits for the formation of flat in the direction of the retracement. This will be the first pulse rate to enter according to the rules described above.

On the same principle of transaction on pullbacks from the resistance or support of higher time frames that the strategy called total impulse levels.

On the same principle of transaction on pullbacks from the resistance or support of higher time frames that the strategy called total impulse levels.

A trader needs to keep track of them during the session and carry on candle chart M1-M15. Therefore, trade is conducted on the two graphs, and additionally open ranges M30-H4.

A trader needs to keep track of them during the session and carry on candle chart M1-M15. Therefore, trade is conducted on the two graphs, and additionally open ranges M30-H4.

When approaching, the breakout and price reversal, as in the case of Bank level, should be determined on the M15 the pulse level and waiting for input of pulsed breakdown rates during the rollback.

When approaching, the breakout and price reversal, as in the case of Bank level, should be determined on the M15 the pulse level and waiting for input of pulsed breakdown rates during the rollback.

The level of the abrupt change of trend is a pin bar, after which there is a reversal of quotes. Upon detection of such candles on M5-M15 the trading rules require to note this level and be ready to go to retaste — return rates with the formation of a zone of the pulse level. But in this case, the trader proposed to wait for the momentum breakout in the opposite direction of the trend. That is down from the resistance or up from support level, a sharp change of trend.

The level of the abrupt change of trend is a pin bar, after which there is a reversal of quotes. Upon detection of such candles on M5-M15 the trading rules require to note this level and be ready to go to retaste — return rates with the formation of a zone of the pulse level. But in this case, the trader proposed to wait for the momentum breakout in the opposite direction of the trend. That is down from the resistance or up from support level, a sharp change of trend.

It is logical to assume that a reversal pin bars often coincide with the closing of the previous day or levels of resistance and support.

It is logical to assume that a reversal pin bars often coincide with the closing of the previous day or levels of resistance and support.

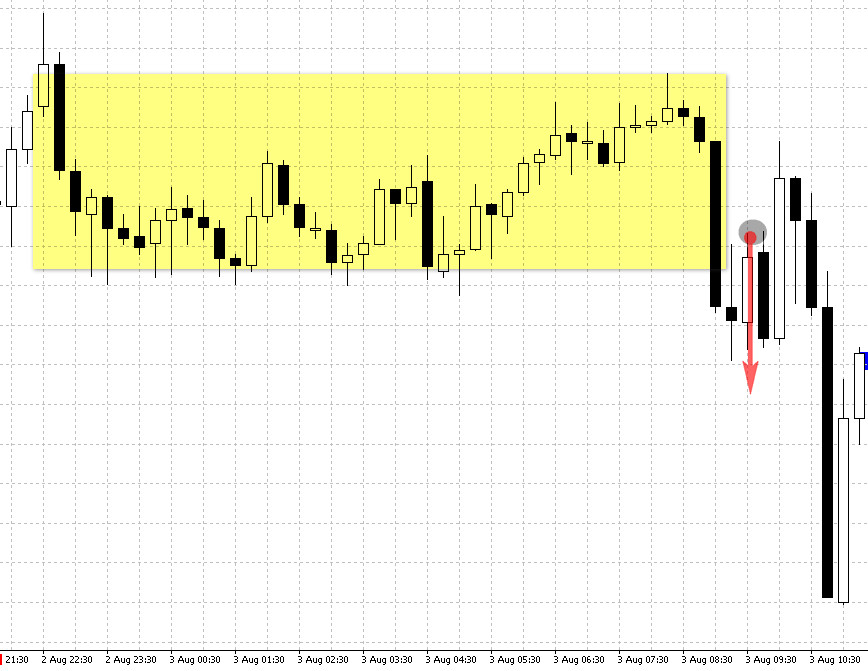

How to start a session, or consolidation Zone, as a first entry point of the “Sniper”

“Night session” dedicated trading system “Sniper” special “area of consolidation”. The trading strategy involves the day to open the transaction in the direction of the pulse output for this zone. The width of the flat should not exceed 20 points, and rollback after a pulse should be close at least 25 points.

Safe, and money management

Safe, and money management

Entrance two orders is a prerequisite of the strategy. One of the orders closes at pre-set take profit equal to stop loss (typically 15-20 points). Stop loss is usually placed for the maximum or minimum candles of the zone pulse level. Early closure of one of the orders provides a breakeven in the second case, stop operation and psychological support of the trader in terms of profits.

According to the recommendations of the trading strategy, the trader should not exceed 10% of the share Deposit on a single trade. If it is completely drained, the auctions should be stopped for one day.

According to the recommendations of the trading strategy, the trader should not exceed 10% of the share Deposit on a single trade. If it is completely drained, the auctions should be stopped for one day.

Not:

- To trade the news or leave their output on the open market for both transactions;

- To enter inside pulse level;

- Increase lots during the session.

Examples of transactions classic trading system “Sniper”

So as not to hammer your head invented by Paul terms, we will call the formations in their names and will not mention the various pulse levels, Bank levels, and other fantasy author TC.

Before the start of trading in the chosen pair on the chart should be applied to the closing day and the levels of support and resistance of higher timeframes.

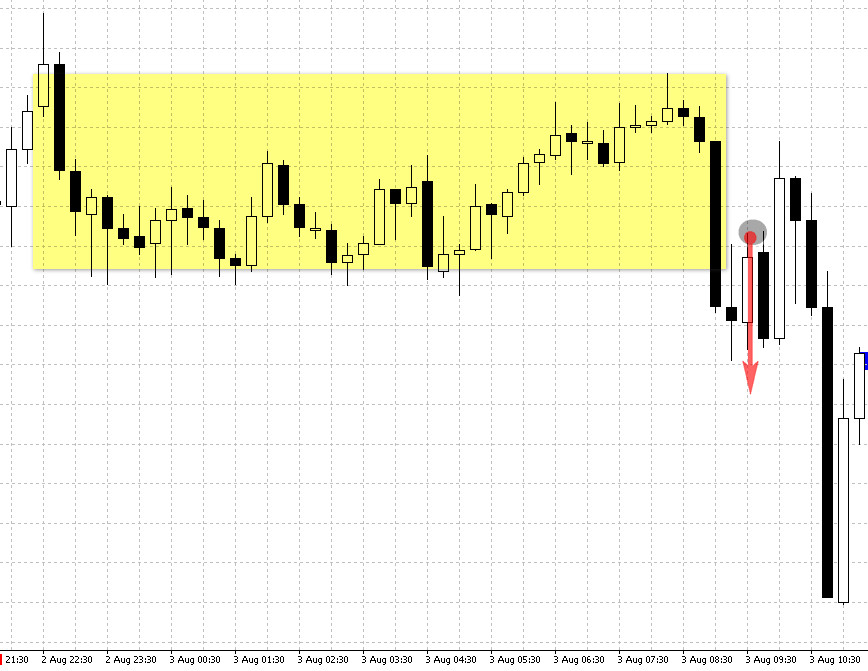

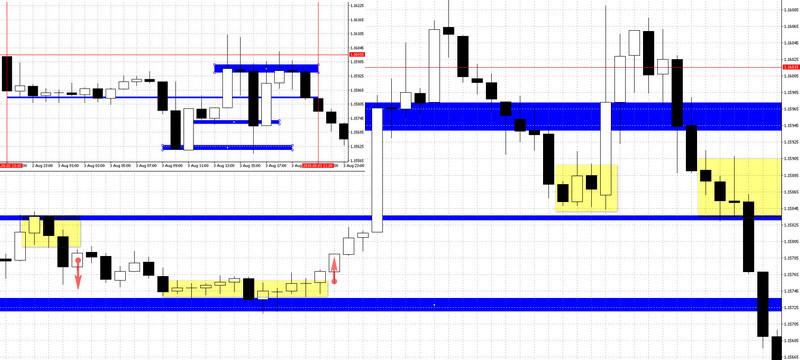

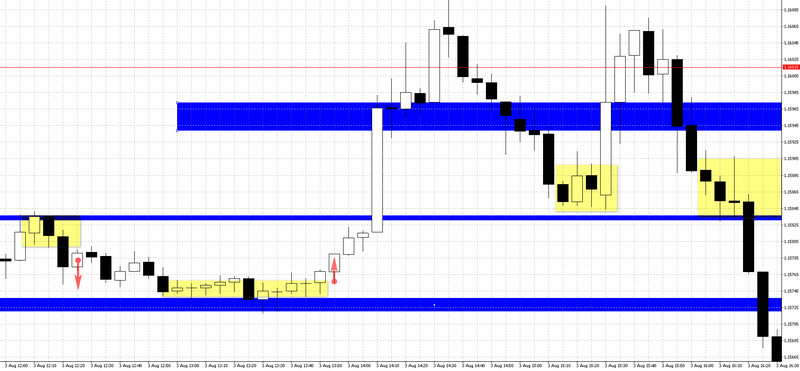

After that the trader must go to the candle of the working range and the labeling range, occurred during the Asian session. Candle breaks up at 4:30 in the morning, but it was impossible to enter, as it formed a pin bar, which arose near the close of the last session. In this case, the trader has to expect the formation of a flat band under the pin bar and enter in the opposite direction. In our case, expect the short.

After that the trader must go to the candle of the working range and the labeling range, occurred during the Asian session. Candle breaks up at 4:30 in the morning, but it was impossible to enter, as it formed a pin bar, which arose near the close of the last session. In this case, the trader has to expect the formation of a flat band under the pin bar and enter in the opposite direction. In our case, expect the short.

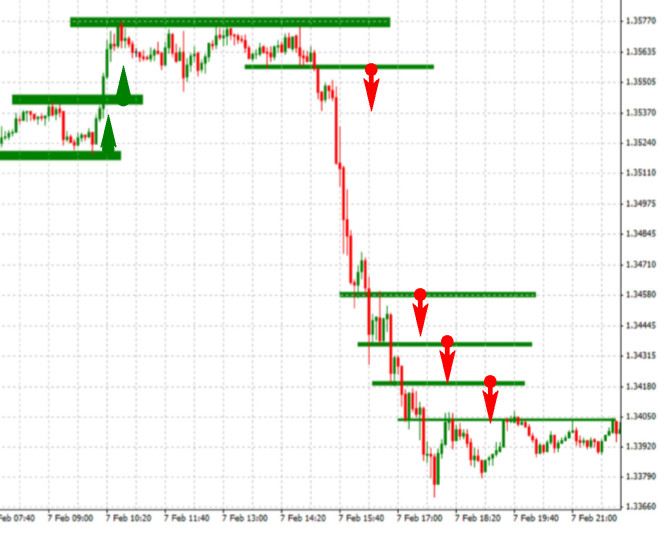

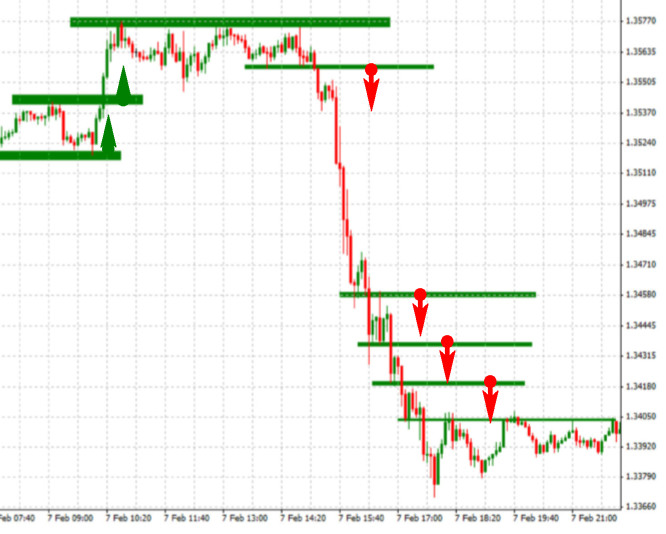

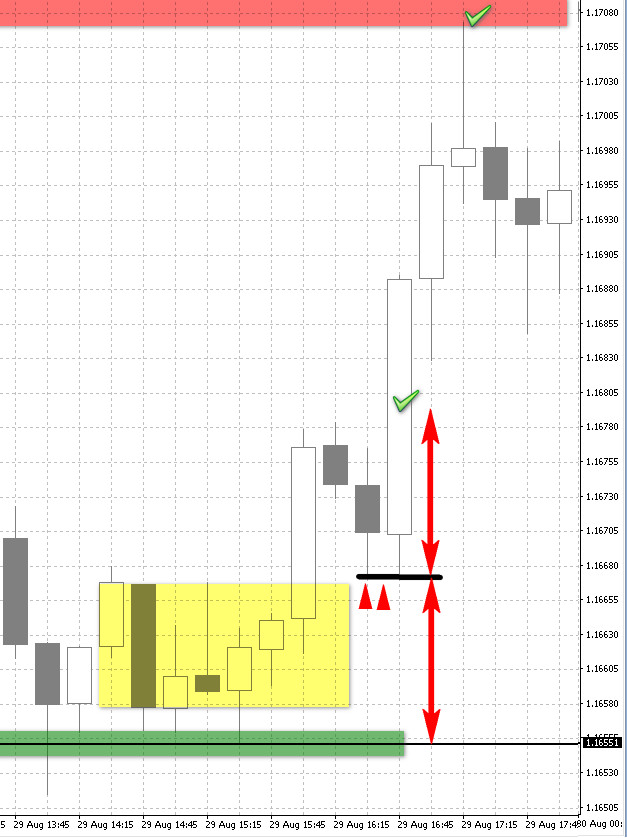

Please note: the area of the flat coincides with previous consolidation flat. In a secret part of the strategy “Sniper”, this formation is regarded as a guaranteed bounce. However, according to the classic rules of strategy we can take only shorts due to the formation of the pin bar, so we ignore output prices up.

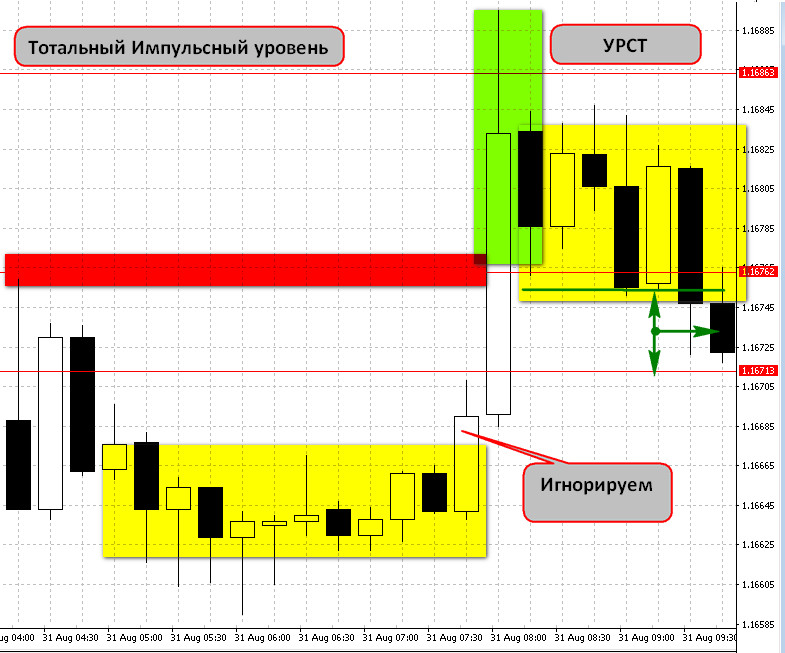

Upside momentum forms another pin bar, coinciding with the resistance senior timeframe. The trader expects the formation of a range of consolidation below this level to trade the reversal on the breakout of local support. When that finally happens — the transaction must be delayed by the lack of momentum – range candle is too small (less than 4 points).

Upside momentum forms another pin bar, coinciding with the resistance senior timeframe. The trader expects the formation of a range of consolidation below this level to trade the reversal on the breakout of local support. When that finally happens — the transaction must be delayed by the lack of momentum – range candle is too small (less than 4 points).

Quotes go upstairs, but run into resistance. According to the strategy rules we are required to wait for the turn, so get ready to enter a short after the formation of the flat area beneath the resistance. The sale takes place in the pullback following the breakout with a range of more than four points. A pending order was placed on the support turned resistance, as price has closed below the line on a larger timeframe. The stop size determined the take profit of the first transaction under rule safe.

Quotes go upstairs, but run into resistance. According to the strategy rules we are required to wait for the turn, so get ready to enter a short after the formation of the flat area beneath the resistance. The sale takes place in the pullback following the breakout with a range of more than four points. A pending order was placed on the support turned resistance, as price has closed below the line on a larger timeframe. The stop size determined the take profit of the first transaction under rule safe.

But both trades were closed before triggering the take profit of the first deal because the price is closer to the next level of support for older timeframe.

But both trades were closed before triggering the take profit of the first deal because the price is closer to the next level of support for older timeframe.

The first transaction of the day should hold until it resolves the take profit levels on higher time frames. This allows you to catch the trend, thus the TC did not establish a “pyramid”.

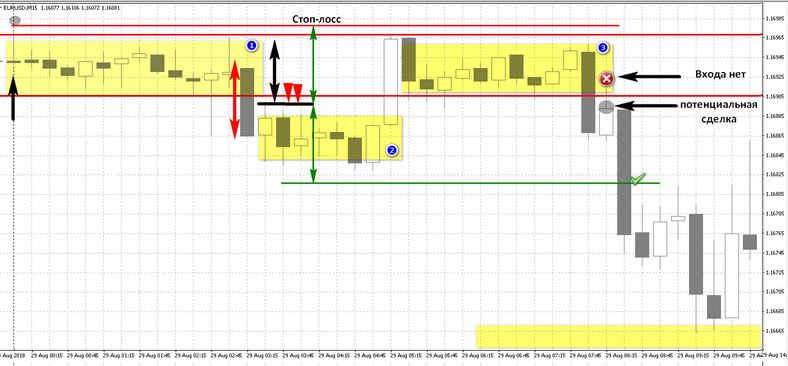

As you can see — flat Asian session was broken down, which gave the signal to enter the two orders under rule safe. Point to the deal gave the pullback candles with a range of more than 4 points, the following pulse breakdown. According to the strategy rules Sniper — correction came at a distance less than 20 points from the top of the consolidation zone, while a stop is placed one tick above the high of the flat.

After the fall formed another level of flat, below the previous one. It is a signal that the trend is down and should sell on the breakout of the lower border. However, the previous transaction is not completed, so the trader should not perform any action.

The pulse that returns the price above the entry level, does not alter the position. Stop did not work — and safe take profit is always equal to the stop loss closes a deal is actually translating the second to breakeven.

Area of flat (1) and (3) coincide, Pavel Dmitriev considers this to be a guaranteed signal of a reversal that happens in reality – quotes EURUSD go down, clinging on the way TP the safe.

In fact — after the first entry point in the second range, because of the bullish reversal of the transaction could not be. But in the third case, she could be on the point of closure of the candles formed after the pulse. In this case we would have ignored the “best entrance” to the maximum of the tail, inside the flat entrance is prohibited.

In fact — after the first entry point in the second range, because of the bullish reversal of the transaction could not be. But in the third case, she could be on the point of closure of the candles formed after the pulse. In this case we would have ignored the “best entrance” to the maximum of the tail, inside the flat entrance is prohibited.

In 2016 and 2017, introducing the concept of “blocks”, Pavel Dmitriev depart from the rules, but in our material, we consider the classical version of the strategy.

After triggering the first take-profit according to the rule of safe, the second part was closed at the support level of a higher TF.

In the theoretical part of the strategy of “Sniper” paid special attention countertrend trades after the formation of pin bars. It is believed that they rarely bring big profits, so in some versions of “Sniper”, after a rollback, these candles opened Loki.

Often the pin-bars coincide with the resistances/supports or the close of the day. Consider the case in which both reversal candles formed on the support and the end of the session, shifted by 3 hours.

The first gave rise to the opening of the transaction, after the formation of the flat area above it and break the momentum above 4 points.

The upward movement was strong, which allowed to close first transaction under rule of the safe within 15 minutes. The second candle of the pin bar brought profit for the second order, as touched offset the closing level of the day.

Conclusion

Conclusion

The review considered the classic version of the strategy of “Sniper”. Changes 2016-2017, which came in the fourth version, introduced the concept of blocks instead of flat, shifting the entrance of the orders to the borders where previously there were stop losses. In the secret parts of learning traders are promised that it will show 100% reversal patterns. The review also paid attention to Loki, the dispersal of the Deposit — input double the number of orders at the levels a counter-trend.

These changes represent the marketing necessary to promote a new version of the strategy, representing all those originally set out principles of trade levels within the day.

Does the strategy of “Sniper”? Yes, because it is a classic technical analysis with the renamed terms. Does it make sense to pay for the “secret” additions and the new version (you can watch/download at the forum for free)? Of course not.