Good afternoon ladies and gentlemen Forex traders.

What are we looking for in the strategies for trading ? Accuracy, understandable and clear rules, the lack of superfluous information on the chart and creative approach. All these qualities combines trading system RBICAO, combining trading on unusual charts (range bars), the legendary, the Awesome oscillator and the Ichimoku, and Price Action. The cocktail was surprisingly concise and elegant, — TS no wonder popular in the West for several years.

Characteristics TC RBICAO

Platforms: MetaTrader 4, Ctrader.

Currency pairs: AUDCAD, AUDJPY, AUDUSD, EURCAD, EURJPY, EURUSD, GBPAUD, GBPCAD, GBPJPY, GBPUSD, NZDJPY, NZDUSD, USDCAD, USDCHF, USDJPY.

Time Frame: M2

Trading time: European and American session.

Recommended brokers: Alpari, RoboForex, Forex4you

The idea at the basis of the vehicle RBICAO

The idea that lies at the basis of the strategy is quite simple. It consists in the capture of the movement after the flat. As a rule, the channel breakout causes subsequent strong price trend momentum, it is a movement and we need to catch.

Exit position with profit-taking occurs at divergence, the divergence of the direction of movement of quotations with the readings of the indicator Awesome Oscillator (AO).

It would seem that the idea is nothing new, but much greater interest is the approach to the solution of the problem, which makes use of custom graphics, the classic indicators combined with Price Action and levels of support and resistance and divergence. The result is a cocktail that hits the target.

Tools TS RBICAO

The system Assembly is as follows (timeframe – M2):

And the usual M5 chart looks like this:

Different graphs due to the specificity of formation of Range Bars charts. Details about Range Bars we wrote here.

The main difference between Range Bars charts is that they are not tied to time. In our case, a new bar occurs only when the price will make a swing on the old 5 points in any direction from the point of closure of the previous candle. With a smaller range of fluctuations is not a new candle, regardless of how much time has passed — at least 10 minutes, at least an hour. While the price will not move 5 points — new plugs will not.

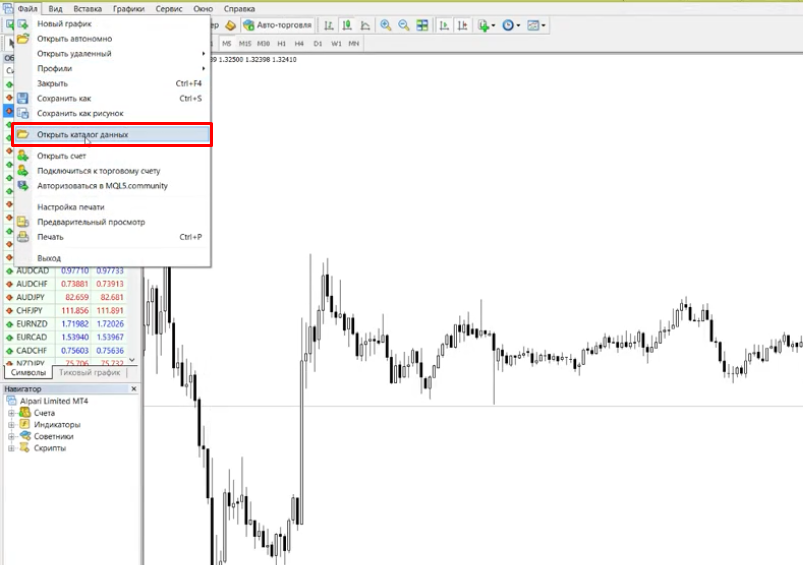

Installation Range Bars is as follows:

- The archive with the strategy find the MQL4 and templates folder and copy them;

- The folder must be inserted in the terminal data folder and agree to replace;

- To restart the terminal;

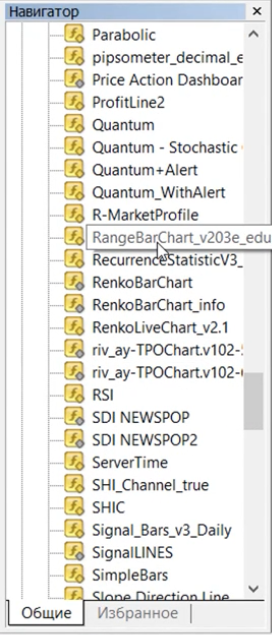

- After that, open chart of the currency pair for which you want to build Range Bars, go to the “Navigator” panel, select the directory “Indicators” by pressing ” + ” and find RangeBarChart and drag it onto the chart;

- In the settings change the value for PipRange 5.0;

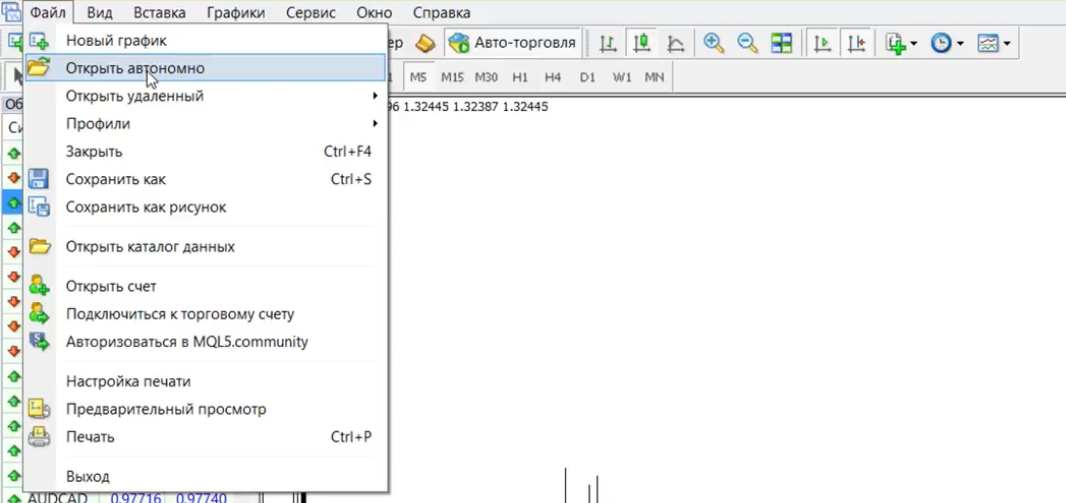

- Go to “File” — “Open offline”.

In the list find schedule “GBPUSD, M2” and click “Open”.

On a chart click the right mouse button, select “Template” and RBICAO.

After all these points you’ll see a graph in the form in which it should be. It is worth remembering that the schedule that is tied to the indicators to build Range Bars, can not be closed, otherwise the system will cease.

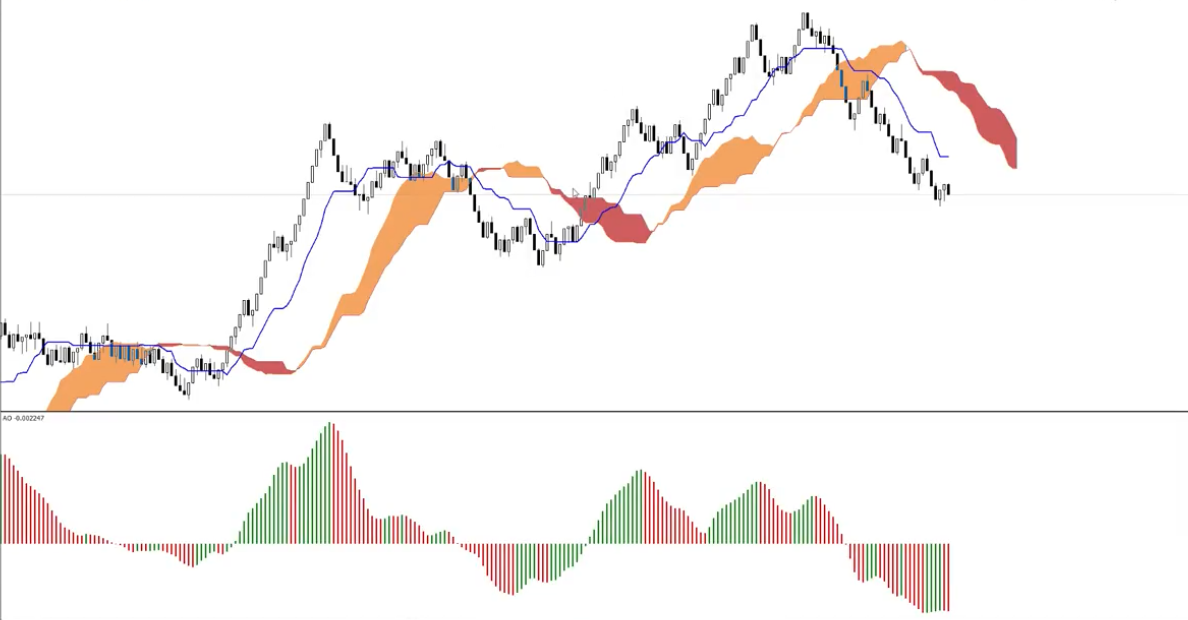

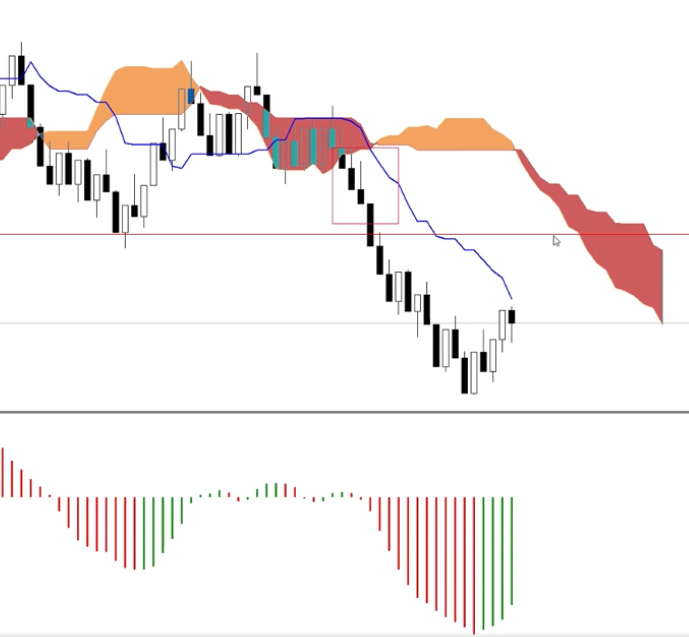

In addition to Range Bars on the chart there is also the Ichimoku cloud, which you can also find detailed and extensive article on our website. Also at the bottom you can see Awesome Oscillator.

The settings for indicators is as follows:

- Range Bars – 5 points;

- Awesome Oscillator – standard settings;

- The Ichimoku Cloud Is 9, 16, 26.

Entry rules for strategy RBICAO

The deal to sell (short) open a pending order type Sell Stop under the following conditions:

Pending order should be placed slightly below the level.

Long position for the chosen currency pair (buy) opens a pending order like Buy Stop under the following conditions:

A pending order is placed above the breakout level.

Additionally

Not recommended trades during important news release it is advisable to stop trading for half an hour and continue it after half an hour of waiting. Relevance and time of publication can be viewed in the economic calendar on our website. Three marks is a sign of a ban on trading strategy RBICAO.

The author of the strategy uses to enter pattern 1-2-3, included in the breakdown of the nearest local level (in the presence of other signals for the transaction)

Money management standard – risk 1-2% per trade. The specific size of the position can be calculated using the lot calculator on our website.

Stop Loss and Take Profit

Stop-loss we put for a local extremum, but it should not exceed 20 points.

From the perspective of exit strategies Take-Profit here absolute freedom of action. You can exit at the AO, when the color histogram starts to change and the indicator moves in the opposite direction:

Other options — the return of the price to the cloud and the crossing of the Kijun line, marked in blue, and a divergence signal AO. The latter option is most often used by the author of the strategy.

Try to Take Profit was more Stop-loss. When moving in our direction, you can reduce the stop and to translate the deal to breakeven.

Examples of transactions

As examples of application of the strategy is to consider multiple inputs of the author of the trading system RBICAO.

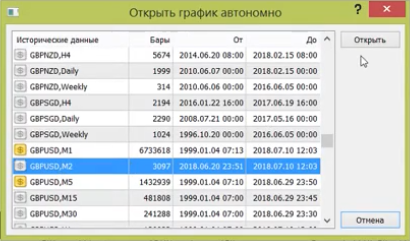

Search entry point starts from the moment when AO crosses the zero mark (1), then the price goes up the Ichimoku cloud (2). The author draws the closest local level and its breakdown includes (3) without waiting for the 1-2-3 pattern. Such inputs are also justified, but if you want more confidence, then you need to wait for the 1-2-3. It turns out the author at the level where price has long jostled each other under the middle line of the Ichimoku. The result has been to 59 points.

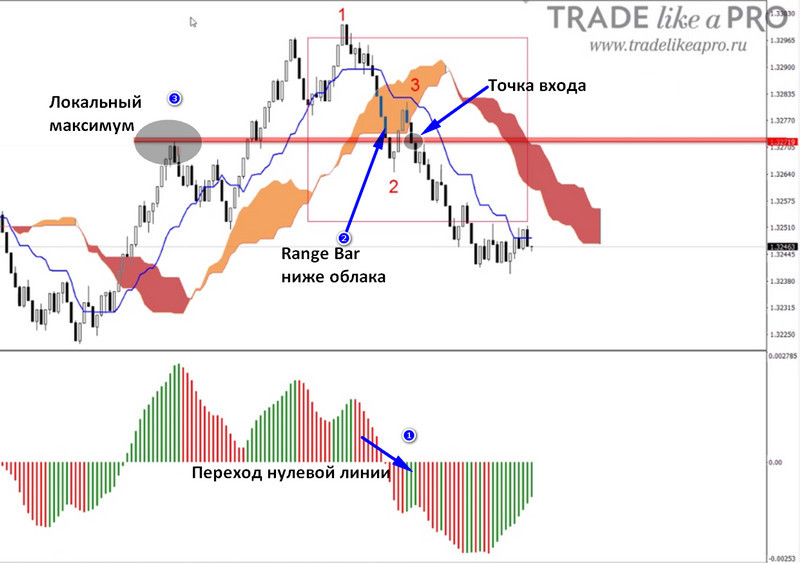

In the second example, the author goes on divergence signal on the GBPNZD pair. The signal search begins with traditional readings of the indicator AO, zero crossing (1). After the release of the Range Bar above the Ichimoku cloud (2), the trader determines the resistance and enters on the breakout of local levels (3), again without waiting for the 1-2-3 pattern.

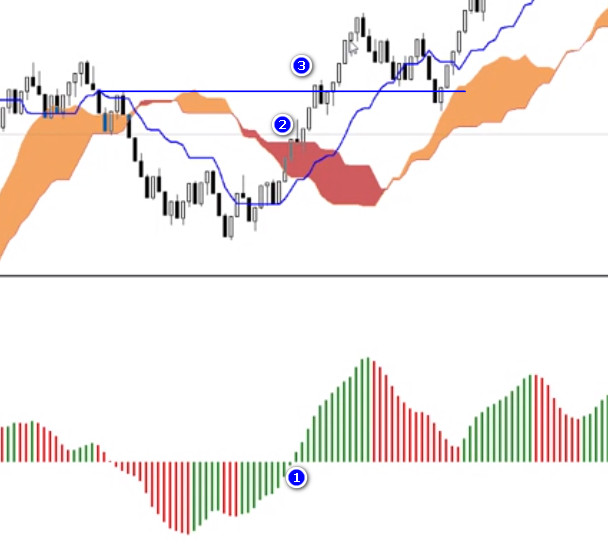

Another example of the GBPUSD instrument. The price crossed the AO and the Ichimoku cloud, the author, again, established the breakdown of the local level without 1-2-3 and came to the divergence.

In the following example, for a change, the author enters and exits on divergences:

When using the strategy RBICAO difficulties may arise in areas of flat, where the Awesome Oscillator shows many crossings of the zero line.

Consider a complex example on the EURUSD chart. There is clearly seen a few false signals, from following which saves the mandatory filter breakdown level.

On the horizontal line And the candle is below the cloud along with the change of the signal of the histogram of AO from positive to negative. But the intersection of local support is not happening, only touch. If they introduced a trader astray, no testing of the pattern 1-2-3 would have saved him from losing the entrance.

At the point In the candle was not able to rise above the Ishimoku cloud early changed the oscillator signal, but the return of a histogram back to a negative value at the point C led to the formation of the two entry signals. The level of support has again served as a filter, otstavki deal, he was still at the same point as for case A.

The situation on the vertical line D resulted in the appearance of three signals: AO moved into positive territory, but the candle managed to close above the clouds and touch the tail line of resistance. Literally 1-2 points decided would take place in this case, the entry on the break of the level or not. The only thing that would have saved the trader from false entrance — netrabota pattern 1-2-3.

Thus, the examples show that adding a filter in the form of a Pattern 123 significantly improves the accuracy but greatly reduces the number of transactions.

And another entrance. AO crossed the zero mark, the graph is below the Ichimoku cloud and intersects the nearest extremum. Here, we would not expect the pattern 1-2-3. We can agree with the author that it is quite rare for this time you can make few successful trades.

A signal to exit on the chart yet, so we continue to wait.

Conclusion

RBICAO or Trading with Range Bars, Ichimoku Cloud and the Awesome Oscillator is a relatively simple and reliable system. The strategy gives high accuracy and allows you to stay out of the market when it is not necessary, so use and practice. I hope you learned some ideas from this vehicle and will be able to adapt them yourself. Remember that you should not blindly copy the structure of the system — use it to develop their strategies. Without the identity of the trader success in the market is impossible.

Download files strategy RBICAO