Trending Videos

Takeaways

- Nio Inc. shares rose Monday after the Chinese automaker said it would receive a $2.2 billion cash infusion from investment firm CYVN, majority-owned by the government of Abu Dhabi.

- CYVN is paying $7.50 per share, 6% lower than Nio's closing price on Friday.

- After closing the transaction, CYVN will own a 20.1% stake in Nio.

Nio’s American Depository Receipts (ADRs) Inc. (NIO) jumped 5% on Monday after the Chinese electric vehicle (EV) maker announced that an investment company majority-owned by the Abu Dhabi government would buy $2,000,000. $2 billion worth of Nio stock.

Nio said CYVN would pay $7.50 per share in the transaction, 6% below Nio's closing price last Friday.

The automaker said CYVN had already invested $738.5 million in Nio in July and the company also acquired certain Class A common shares from a subsidiary of Tencent Holdings Ltd. (TCEHY) for $350 million. Nio added that with this new acquisition, CYVN would hold a 20.1% stake in the company.

Nio said in its announcement that CYVN would have the right to appoint two directors to the board of directors once the transaction closes, provided it continues to hold at least 15% of Nio's shares. The investment firm could add a member if it had a 5-15% stake.

Chairman and Chief Executive Officer (CEO ) William Bin Li said that with CYVN's cash injection improving its balance sheet, “Nio is well prepared to refine its brand positioning, strengthen its sales and service capabilities and invest for the long term in core technologies to navigate an increasingly intense competitive landscape. “.

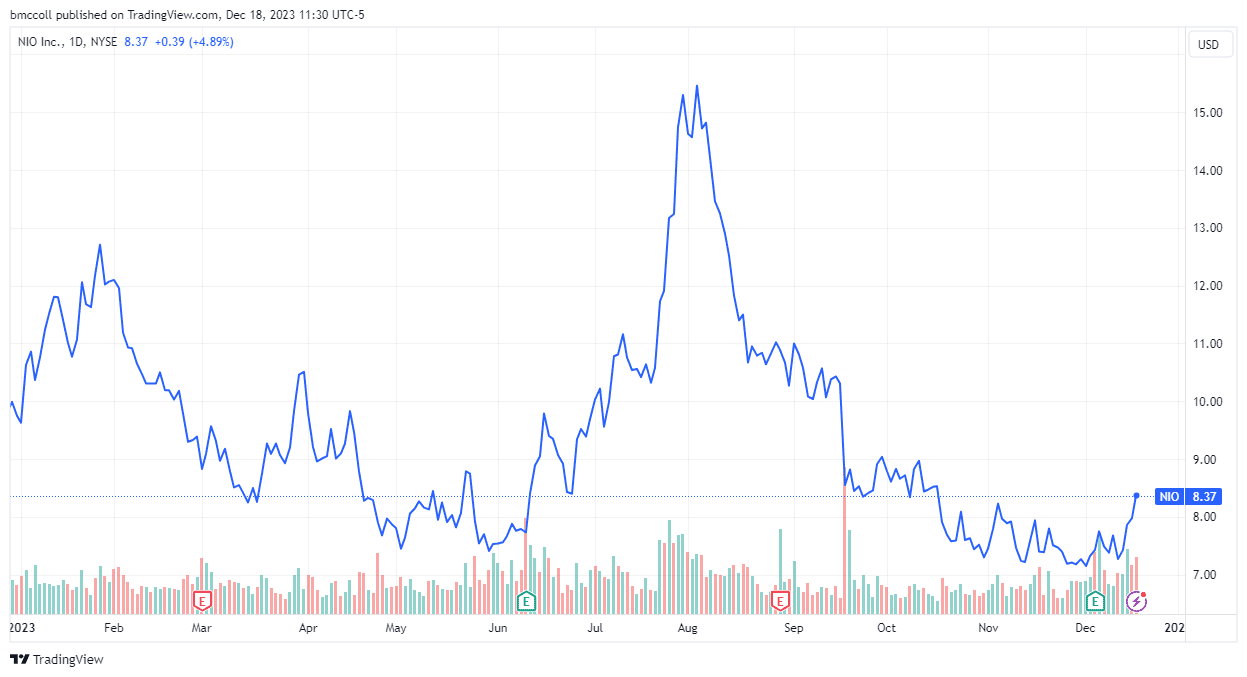

Even with the winnings As of Monday, Nio's ADRs are down for 2023.

TradingView

Do you have a tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com