Trending Videos

Takeaways

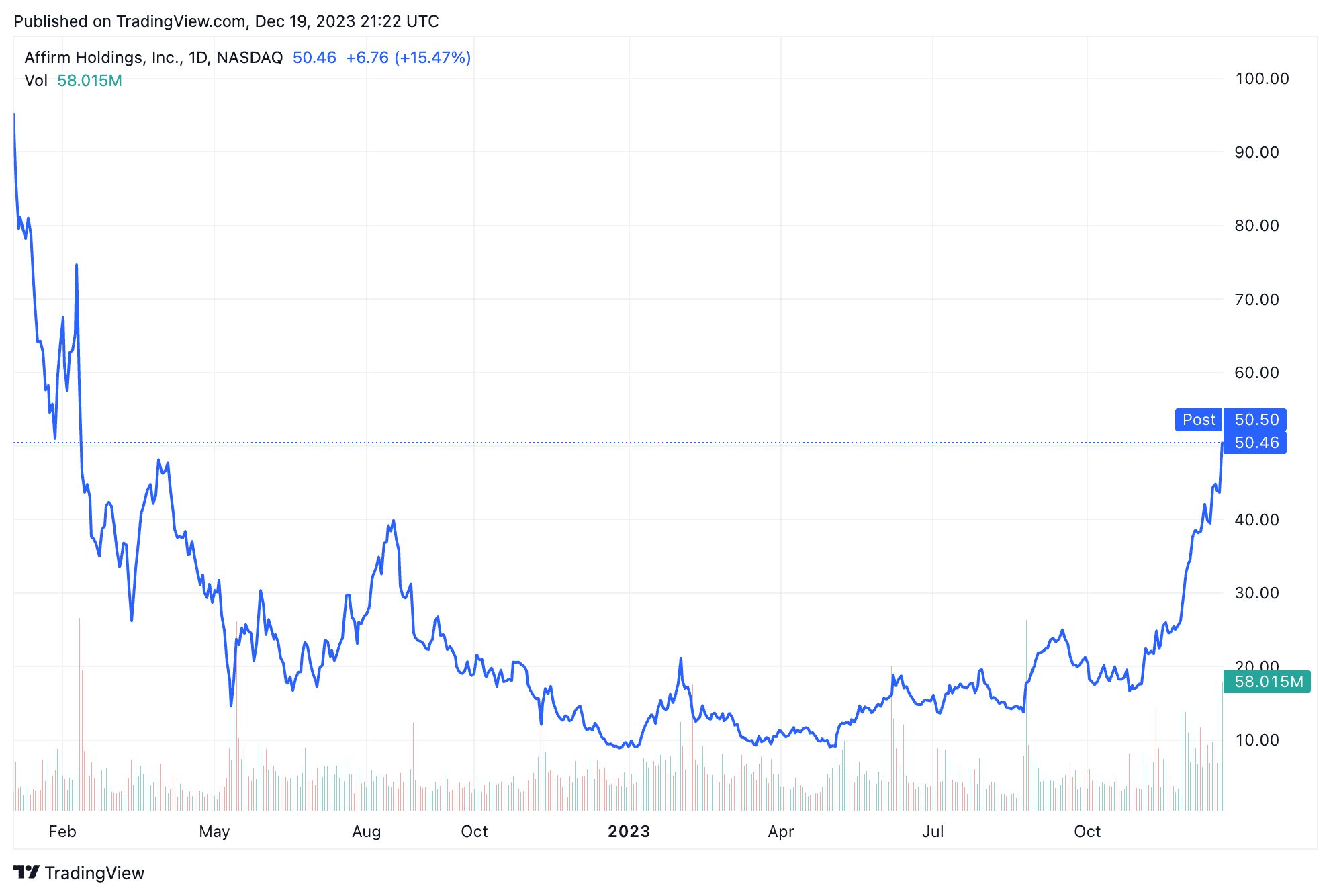

- Shares of Affirm Holdings gained 15% to their highest level since February 2022, as the payment network expanded its buy now, pay later (BNPL) relationship with Walmart .

- The company's BNPL option will now be offered to shoppers using Walmart's self-checkout kiosks.

- According to Affirm, a study indicated that a majority of customers wanted the BNPL choice at checkout.

Shares of Affirm Holdings (AFRM) rose 15% on Tuesday after the payment network announced that it had expanded its buy now, pay later (BNPL) relationship with Walmart (WMT).

The company said its BNPL feature would be available to customers at self-checkout kiosks in 4,500 Walmart stores in the United States.

Pat Suh, senior vice president of revenue at Affirm, said recent research from the company showed that 54% of Americans want retailers to offer the BNPL option at checkout. She added that providing this service at Walmart will “help even more consumers increase their purchasing power during the holiday shopping season and beyond.”

Affirm explained that, with In Walmart stores, its BNPL feature is available on walmart.com, the Walmart app, and at Walmart Vision and Auto centers across the United States.

The actions of Affirm Holdings gained 15% to close Tuesday at $50.46, their highest level since February 2022.

TradingView

Do you have a news tip for news journalists? Investopedia? Please email us at tips@investopedia.com

Source: investopedia.com