Hello, fellow traders and readers interested in the topic of trading on the Forex market! After the article about the Open Interest in currency options and futures, which described a trading strategy on the analysis of the volume of positions in derivatives, in the comments arose the question about the marginal zones.

The tactic is interesting because based on real data and characteristics of the market of currency futures. It combines two ways to trade on the basis of short-term and medium-term analysis of the levels of support/resistance and “breakdown.” The latter term is unique, as the trading defining the “zone of least resistance to the trend.”

The article presents alternative material, without intersecting with the above on the Internet strategies the use of marginal areas. Build and work the levels justified from the point of view of traders currency options on the Chicago stock exchange CME.

Chicago – the center “the currency of attraction” or the role of CME in Forex

The Forex market is decentralized, the overall interbank platform registers and distributes the transactions of institutional clients. The platform is designed to exchange large amounts currency amounts unit transactions amount to millions of dollars. Basically, she traded legal entity, a private customer can enter in the Forex market through the intermediation of the Bank, where the minimum lot you need to shell out $100 thousand, the transactions take place with a minimum shoulder.

Exchange take a much smaller margin to bring to the markets lots for $100 thousand, leaving only a few percent of their value.

Such positions can’t access the interbank Forex market, in contrast to the thousandth of transactions of Bank customers where the size of the shoulder is covered with real money in a financial institution. Exchange simply does not, trading “inside” derivatives that substitute for currency.

Before the advent of Forex brokers the first currency speculation in stock exchanges in the form of futures, the mechanism of the turnover of these derivatives is described in the article about Open Interest and vanilla options.

To date, currency derivatives are present in almost any national exchange, but an international center of trading is considered to be the Chicago stock exchange CME, whose turnover reach to $90 billion a day (futures + options).

Given that most of the contracts – deliverable, the actual repayment currency at the end of the term of the derivative (expiration), it turns out that the Chicago stock exchange under security and insurance trading buys and sells up to 30% of the total turnover of the Forex market.

Such statistics allows traders to use various open data Chicago Board exchange foreign exchange positions to analyze and forecast future trends, in particular, statistics on margin.

Features of the currency margin on futures exchange CME

Every Forex trader knows that the margin Deposit depends on the leverage of the Forex market; if the selected size of 1 to 100, the broker keeps 1% from the open lot size. In the event of a rollover “through the night”, the trader may lose money (or earn) on the swap.

The Chicago stock exchange operates in a dual mode of calculation of the margin Deposit, lowering the initial margin for a futures contract at the time of the American sites and increasing 4 times on the medium-term open position.

This mode allows you to avoid the risks of default at a time when sites are closed, and then disabled the clearing. Is the process of tracking and covering the real currency of the issued contracts in short and long, and forced the closure of the futures stopped out.

On the exchange it looks a bit differently than Forex broker, a trader gets a margin call — requirement to add funds to the account, and if the conditions are not met, the contracts close at the following opening session.

What is the margin zone of the Forex market?

The marginal zones on the Forex market are called the levels of margin call is established on a short-term (intraday) and medium term requirements of the exchange CME that relate to the positions carried the day.

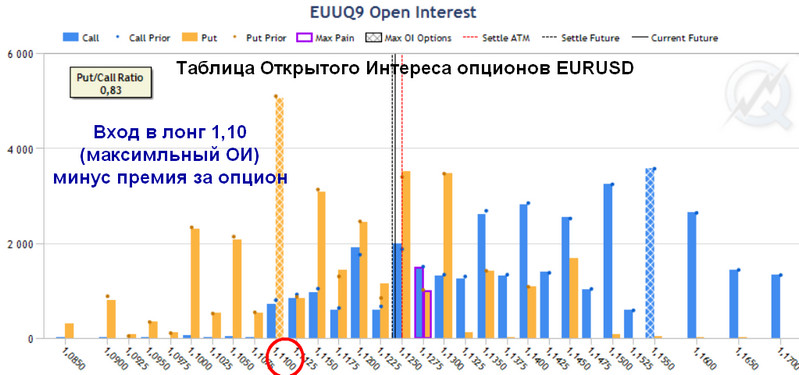

They are calculated in points for each of 10 traded currency pairs on the Chicago area. It is better to choose those pairs that have options is the issue of liquidity tools and the ability to add additional filters in the strategy. We are talking about stranah described in the article about vanilla options, where there is max OI.

The margin value is taken from the specifications of the futures daily, the Deposit is slightly “floating”, more serious changes in margin can indicate:

- Upcoming holidays when stock exchanges are closed.

- The economic crisis is “strap” margin grow due to anticipated future volatility of trading, the exchange is seeking to avoid a large number of margin calls.

Where to look and how to calculate the margin zone of the currency pair?

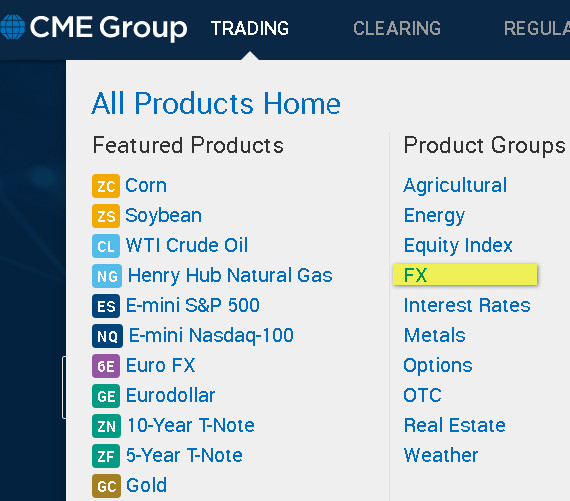

Find the margin levels will help the specification of the futures on the CME exchange website, in the section “trading” section “FX”.

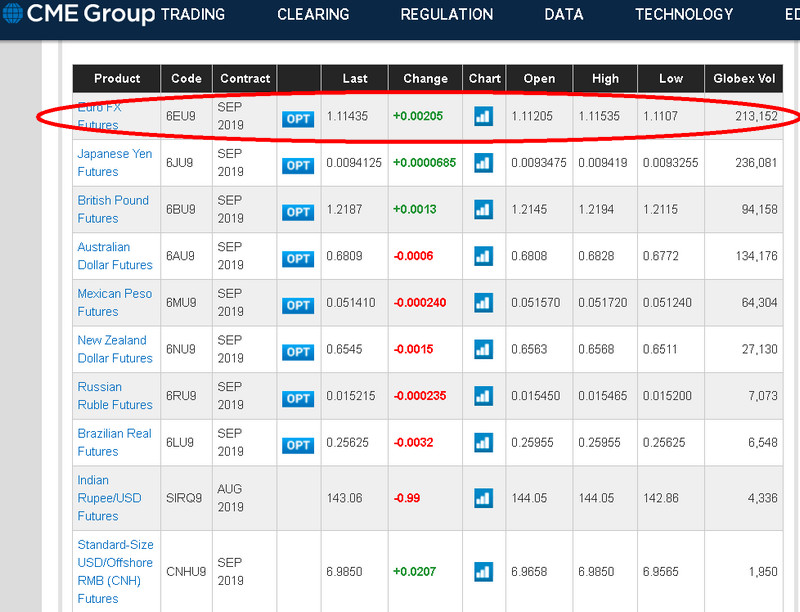

In the table, select required currency pair, for example Euro FX corresponding to the Ticker EURUSD. All futures have a default base dollar USD, so traditionally, upside-down Forex pairs recorded here in a direct quote — JPYUSD, CHFUSD etc.

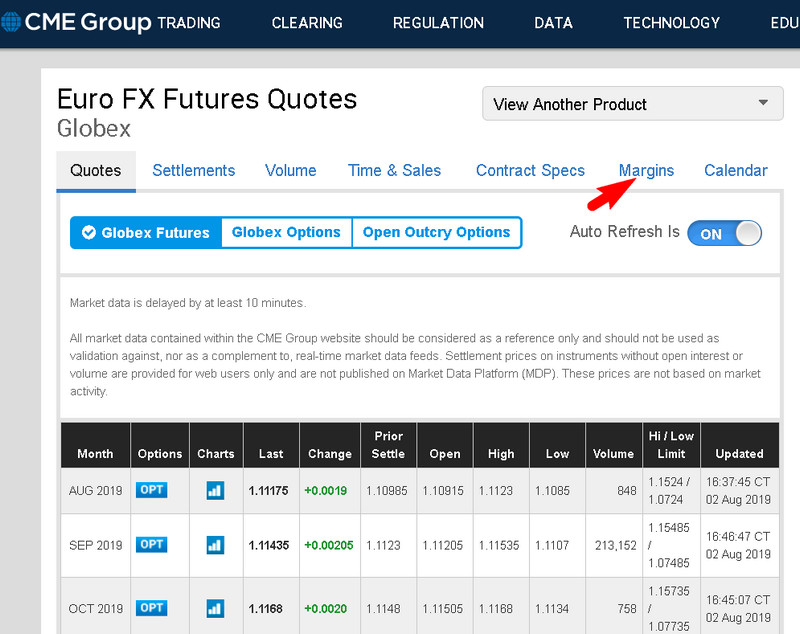

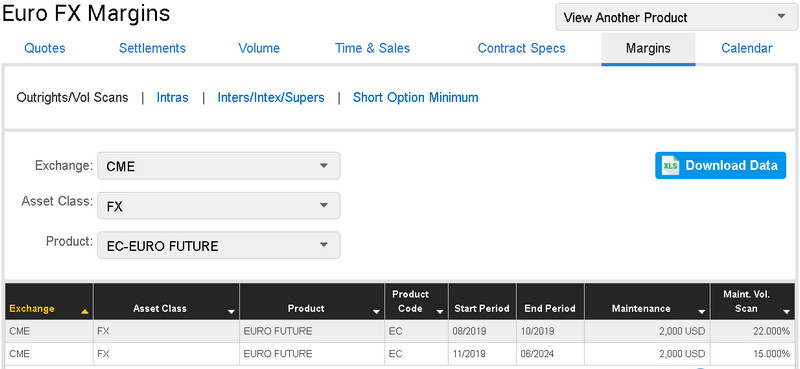

Here you can learn the details of the contract specifications, margin is “hidden” under the option “Margins”:

Open it and see that for the right to sell one futures mid-term you have to pay $2000.

It is up to that size, the exchange raises the margin at the end of the session (2am GMT). The trader receives a margin call demanding to close the debt before the next auction. If lack of funds is critical, the current position or part of them will be closed under the terms of a stop-out.

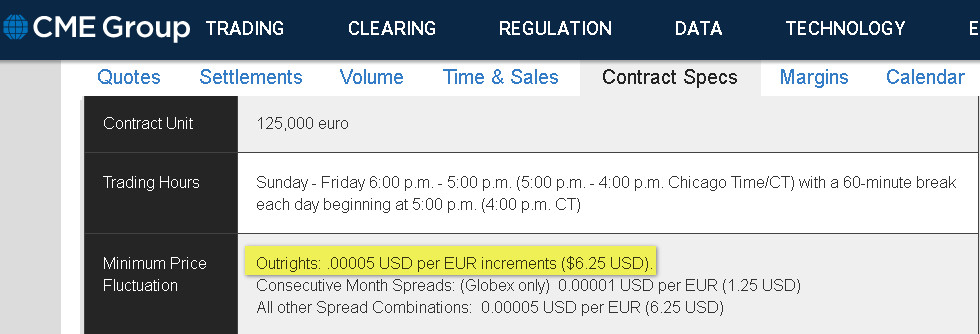

Menu option (2) contract specifications will calculate the cost of points full margin coverage. Half of the point is estimated by the exchange at $6,25 therefore, 1 PIP = us $12.5. Dividing full collateral (in this case $2000) for this number, will receive 160 points.

This is our medium level of support and resistance, defining the maximum level change rate of the currency pair. It has the countertrend orders Sell Limit/Buy Limit, giving you the opportunity to capitalize on the pullback or reversal of quotes.

Daily trader works with pending orders Buy Stop/Sell Stop on the level “breakout” at the borders of low margin, reduced by 4 times, i.e. in our case, 40 PP.

How to build on the chart margin area Forex?

As mentioned above, the margin requirement for currency futures traded on the Chicago area, almost always the same and vary within 10%. These intervals are plotted pairs after determining the medium-term level of support/resistance. He was equal, 160 PP, to display the thickness of the zone is necessary to add +16пп.

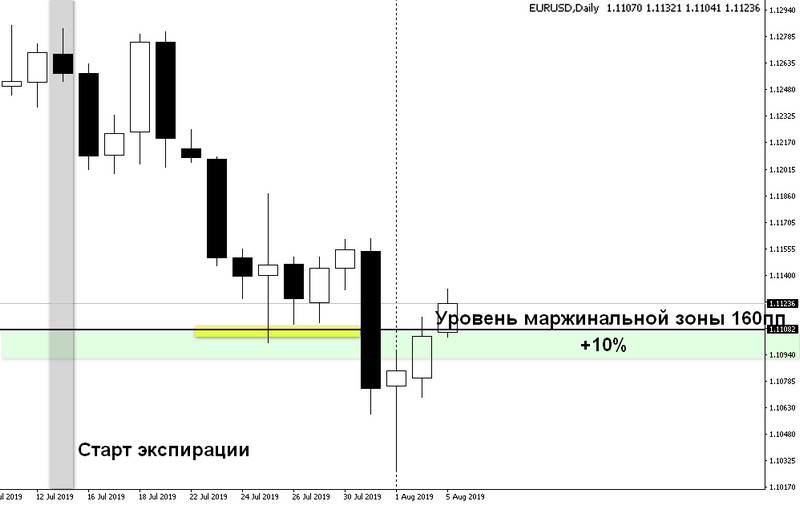

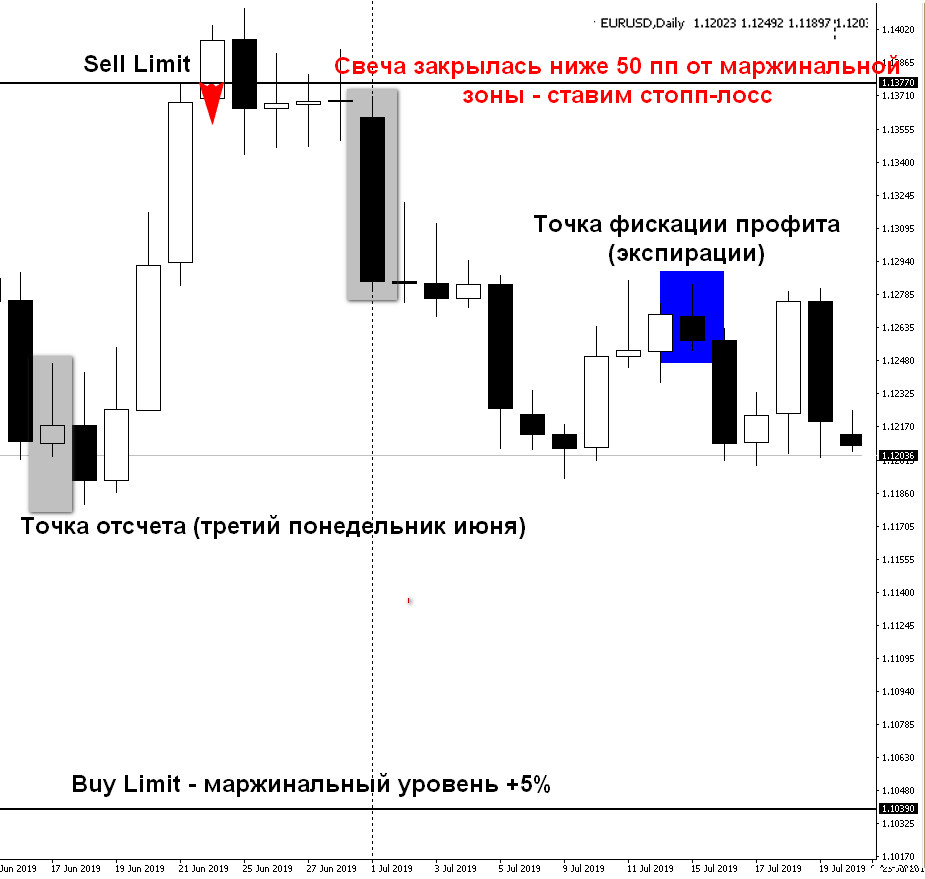

The levels are symmetrical, top and bottom, the reference point is the beginning of expiration – every third Monday of the month. It is also the boundary cancel previous levels.

The dimension of the zone depends on the volatility of the market, in crisis conditions, the bands are expanding after a growth margin. The exchange insures the position of a trader and their security funds from default.

The rules for constructing medium-term margin areas

1. Medium margin zone are built once a month, the starting point is the third Monday of every month (open price of daily candle), so as before, the Friday, end of the previous monthly futures contract.

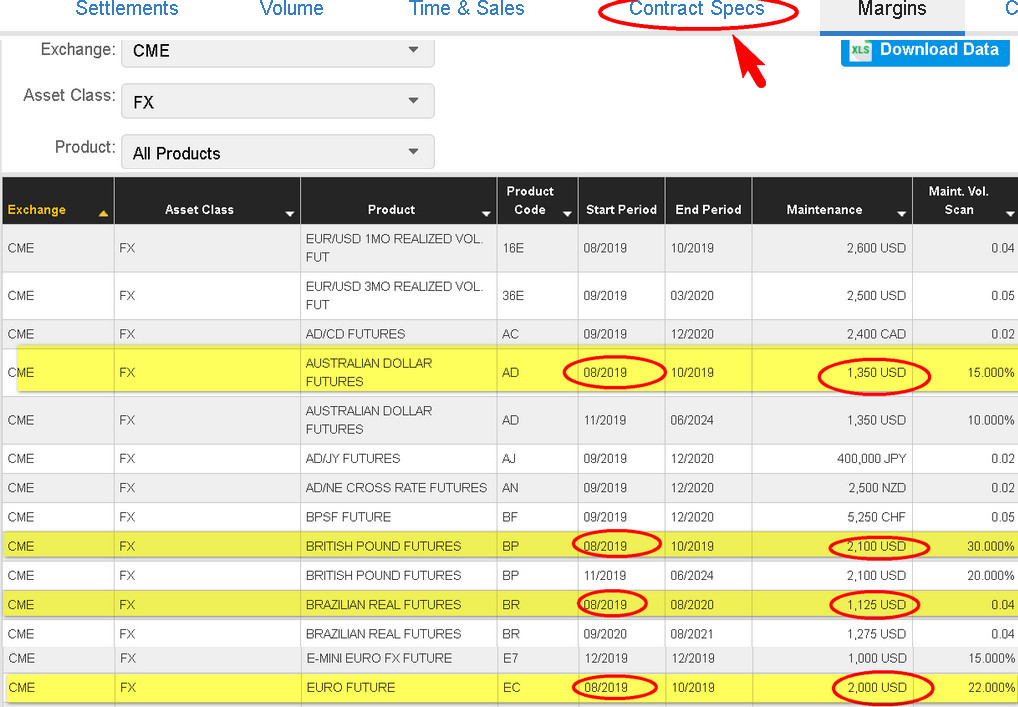

2. Go to the link on the CME website, put in the settings of the opened table exchange CME, below in the — the FX section and select from the list the currency futures we are interested in couple or offered to the “All Products” to display a list of currencies.

Pay attention only to the string name of the currency + future (future of the euro, canadian dollar futures, etc.). Select the nearest futures date of fulfillment, in this case 08/2019.

3. After further margin find out the cost of the item (spread) and calculations of the marginal zone, as shown above.

4. Add 10% to the result, putting aside levels symmetrically to the reference point.

At the time of this writing, the margin EURUSD is 160 PP + 16пп (10%), a point of reference zones is the 15th of July.

Despite the static margin of the zone, it can be adjusted with the growth of volatility trading. For example, at the peak of the fall of the Euro in 2014, the margin exceeded 180 PP.

Chart with weekly candles shows the testing signals of the medium-term resistance and support in a critical situation. The trader manages to close a position on the rebound even in a crisis.

As the graph shows, such a long trade would enter at the beginning of the trend and to hold the trade, moving the stop to the upper resistance levels of the marginal zones.

The rules for constructing intraday margin levels

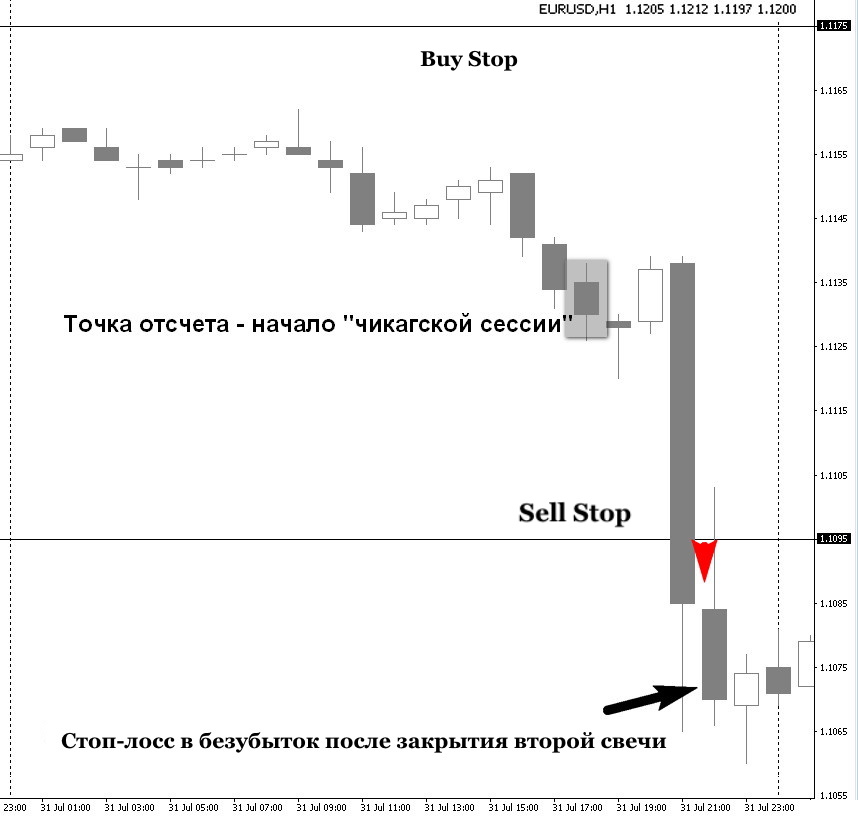

In the example with EURUSD after the start of trading at 18: 00 delayed 40 points below and above the top of the candle.

If the stock breaks through this zone, in 80% of cases they will continue the trend further by giving the trader enough “reserve” to set a stop loss.

How to operate the margin zone on the Forex?

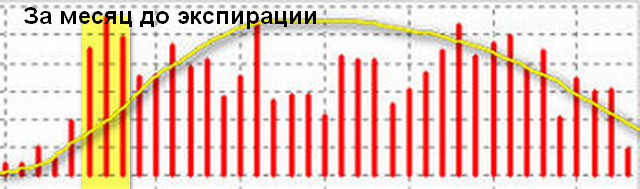

Statistics averages the Open Interest, i.e. held positions in currency futures, looks the same as many other tools — in the form of a bell. Derivatives available three months before the expiration, but the highest number of entries occurs a month before expiry.

This consideration explains the choice of starting point medium level traders no need to choose accurately the purchase price or sales position is hedged by buying options. They are selected “on the edges” of the collateral, such selection defines a “penny” the cost of the option contract.

Due to the nature of strategy futures “covered” a large number of options. This deliverable contracts that are converted into futures expiry.

At the approach of the exchange rate from medium-term to any zones trader can cover excess options new futures, taken contratrend, not caring about the footsteps. Upon expiration, positions are netted and deducted for the profit of option contracts cover losses on new futures.

Buying/selling futures “knocks down” the rate on medium-term margin areas, new positions invulnerable, because they do not have stops, so the influx of countertrend trades it is difficult to hurt pulse.

Within days the situation is different: due to the high commissions and small time trading traders profitable to sell rather than buy options. This position bears the risk of “limitless” damages, but the quotes have to overcome up to 8 hours 40 points, which is quite rare. When this happens, traders have to urgently get out of positions, “Kroes the market”.

The specifics of the options is that they are difficult to close because of the nonlinear change of supply and demand. Quicker and easier to buy futures, only in this case it will be bought or sold in the direction of the trend.

The strategy of trading on margin levels

Platform: any

Currency pairs: EURUSD, GBPUSD, USDCHF, USDJPY, AUDUSD, NZDUSD, USDCAD

Timeframe: H1, D1

Time of trade: medium term option — any; short — term American session

Recommended brokers: Alpari, RoboForex, AMarkets

Rules for the medium-term strategy

Identify and note the medium margin zone, as described above, postponing the levels above and below the opening price on the third Monday of the calendar month. Pending orders Sell limit and Buy Limit in the middle of the zone boundary, adding 5% to the margin level.

In the future, the adjustment of the position of orders can be only in case of changes in the value of margin. To specify the size after you open the Chicago stock exchange at 1800 GMT (in winter at 19.00) on the website site.

Stop-loss set equal to 100 PP, moving to breakeven after a positive closing of the daily candle bounced off margin level by 50 points or more. TP is missing, the transaction closed on time expiration.

Special conditions

Medium margin zone in 80% of cases (for EURUSD) securely practiced for a rebound. However, due to contrarreloj tactics often there is a return to the trend and closing at the breakeven.

It is a signal that the margin area is breached, but the trader may enter to re-calculate the level at the maximum Open Interest (OI) options. Usually it is next, as it is related with futures various option strategies.

Traders are also useful to observe the change of the maximum level of OI, tied to a specific price of the currency pair (strike), any shift above or below the Sell Limit Buy Limit may be cause for cancellation of pending order.

Rules for the short-term strategy

Before the opening of the Chicago stock exchange calculated the number of points margin currency futures and divide it by 4. This is a conditional border stops, the levels of which are deposited above and below the open price of the candle at 18: 00. Them set two orders “breakdown” Sell Stop and Buy Stop.

After triggering one of them the second is cancelled and set stop loss to open price at 18-00, which is moved to breakeven after a positive close of the second hour candle in the breakout direction (trend).

The deal is held until 21: 00 GMT when no news on the calendar after this time. If the position is in the red, exhibiting a take profit at the price of entering a position and held until the end of the day.

Conclusion

Traders often complain about the unpredictability of the market, but careful observation of the statistics of the transactions or the price action can give “predictable combinations”. The article clearly shows the existence of zones of least and of greatest resistance to the trend, working with a probability of 80%.

By combining this knowledge with the optional levels, or other varieties of resistance levels and support, you can get a fairly reliable strategy. By the way, one of these strategies works very successfully for some time on the PAMM-accounts Alpari. This has been written in the quarterly review of the best managers in the Forex market.