A Simple Trick to Reduce Risk in Trading

A Simple Trick to Reduce Risk in Trading

Watch this YouTube video

Difference between averaging and pyramiding

Averaging is strengthening a losing position by opening additional orders against the price movement.

Let's say we went long on EURUSD (buy order), but the price continued to fall. The next purchases of the currency pair will accelerate the increase in losses if the bearish trend continues.

On the other hand, several entries below the opening level of the first order average the total price of the position, and in the event of a bounce, we can earn more on the target close on the take profit than we expected when entering the first trade. The problem is that if the downward movement continues, a multiple increase in loss can lead to a margin call – the requirement to replenish the deposit and the forced closing of orders.

There are no described risks in pyramiding – the tactic of strengthening a profitable position.

Pyramiding is the strengthening of a profitable position by opening additional orders in the direction of price movement.

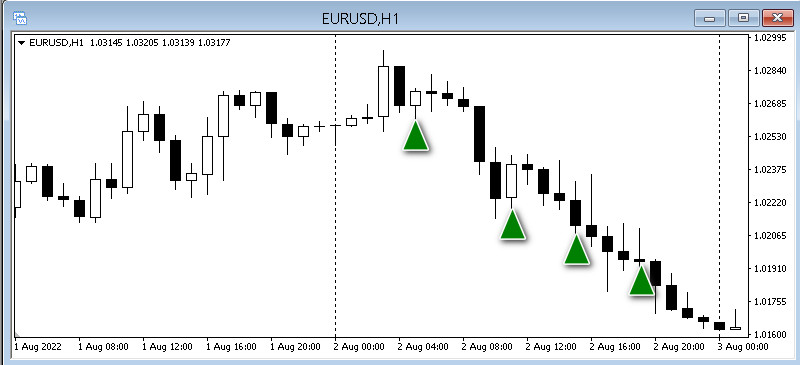

If in the above example we opened a short (Sell order) and added orders as profits appeared , then each new low would increase the paper profit.

In this case, the risks can be reduced to zero by placing a stop loss (loss limit) on the average price.

The purpose of this article is to attempt to combine the benefits of averaging a position on a loss and increase profits on successful trend following by minimizing the loss of the opening trade. The described technique can be used in any trading strategy.

The article uses material from webinars on working with zones by the famous trader Tom Dante, the Russian translation of which is posted on our forum.

Zone Work or Risk Sharing

The algorithm for working with the zone is quite simple:

As usual, we find the entry point according to the rules of the existing trading system. In the example posted below, this would be a counter-trend trade on a pin bar – going long for a bounce off the level.

The only difference is in the entry tactics: you need to break the deal into parts, optimally into three, but other entry options are possible (1/4, 1/5, etc., as you like). If a regular trading order is 0 .3 lots, then the first deal opens 0.1 lots. The remaining two inputs are kept in stock and brought to the market:

- As profits grow – pyramiding;

- As losses form – averaging.

Which levels to enter?

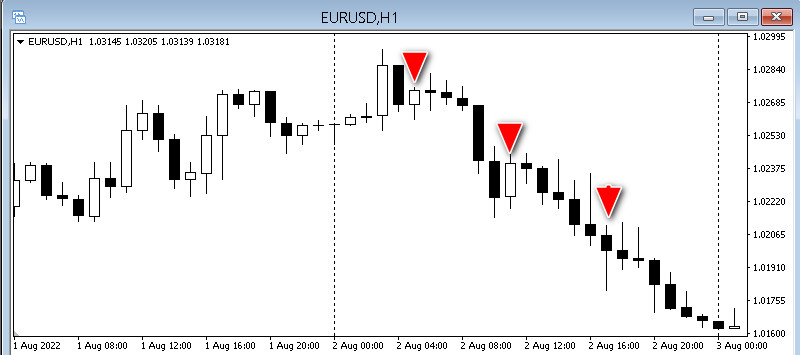

A trader should not deviate from the rules of the strategy, new positions are opened only as signals appear in the direction of an already open transaction. In this example, candlestick analysis was used, so the second position is opened by 1/3 with the appearance of a bearish engulfing pattern, even with a small entry beyond the opening price of a falling candle.

Two orders in the market, the second entry turned out to be higher than the first, and this means that the pyramiding tactic was used. If the rate continues to rise and shows, for example, an inside bar, then the third (last) deal will be used. However, in the event of a sharp drop or below the level of the first entry, a trader can also enter on a pin bar during a rebound, despite the fact that this can already be considered position averaging.

Combining the two tactics is quite acceptable, because the main task of tactics – distribution of risks. Suppose a trader uses the standard risk management settings, allocating 3% of the deposit per trade.

The tactics of splitting orders will reduce losses at the start if the price moves to the stop loss, because the position is only 1/3 filled (or less, at the request of the trader). Subsequent trades will improve the entry price and emotional background due to the “second chance” effect.

In theory, a trader may experience discomfort if the rate changes sharply in the right direction, but the Forex market is quite technical and this rarely happens. Most likely, subsequent pyramiding trades will slightly increase the average price, and the following entry signals will only confirm the correctness of the trend forecast.

According to statistics, novice traders are much more likely to “go into the red” at the initial entry than immediately get a profit, and averaging turns out to be more profitable, covering the lost profit from pyramiding.

Important details

In progress with strategy a trader may want to increase the number of averagings or build a higher pyramid. This would be a violation of the rules of tactics that do not increase the risk inherent in the strategy.

- Never go beyond the initial risk. Never, never exceed your initial risk by adding to your position! Decide when you open your first trade how much you are willing to risk. You cannot go beyond that risk.

- Each of the orders must be a complete trade in itself.

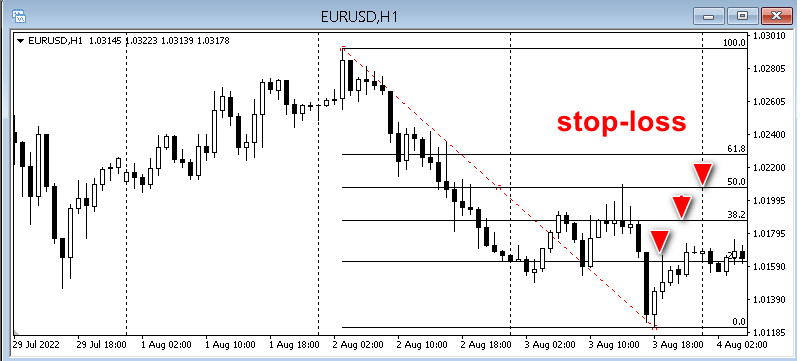

For example, you are trading Fibonacci levels. The rules of this strategy involve trend entry on a pullback in anticipation of a reversal at 23.6%, 32.8% or 50%.

Regardless of the entry point, the trader places a stop at the 61.8% line. This rule should not be changed even if the decision is made to use risk-sharing tactics, such as entering 1/3 position at each level. Splitting trades does not cancel the usual take profit and stop loss levels of the strategy.

Combining timeframes when trading with daily candles

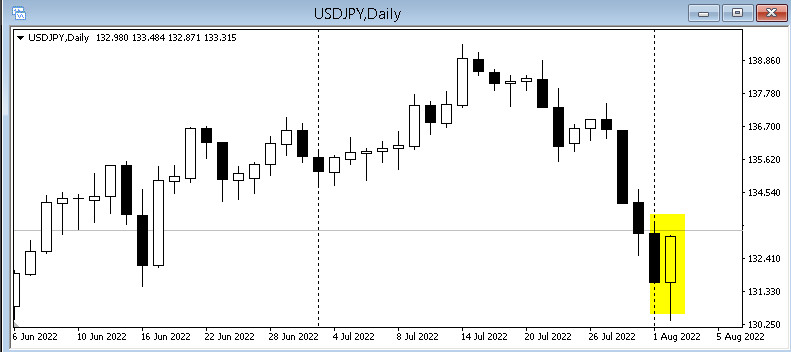

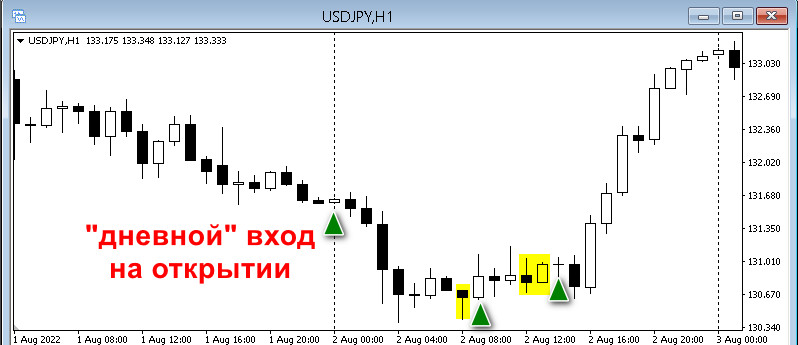

Using the position splitting tactic allows you to improve the entries on the signals of the trading strategy on the daily chart. This method is relevant for highly volatile currency pairs, such as USDJPY.

Having determined the daily entry candle, for example, by a pin bar, we enter not at the opening price of the next day, but wait for signals in the same direction on H1.

Traders of the yen know that there is a high probability that the price swings during the day will be below the entry point. As soon as the H1 candles draw a reversal, the trader can open 1/3 of the position. This tactic will significantly reduce the size of the stop, which on daily candles can reach hundreds of (old) points.

We also open subsequent trades on H1 as signals appear on the daily chart.

Order Size

Intraday trading can provide as many entry levels as day trading, especially when the pair is trading sideways. In this case, you can increase the number of position divisions.

It is not necessary that these divisions be multiples. The size of each of them can be tied to the strength of the signal or leave most of it for the final, from the trader's point of view, entry.

For example, at a stronger level, enter with a lot of 0.2, and at a less significant one – with a lot of 0.1.

Conclusion

Averaging tactics combined with pyramiding can effectively optimize the risks of a strategy without changing the trading rules. Order splitting is suitable for volatile pairs, reducing the stop value by improving the average position price, and helps with timeframe combinations.

The use of tactics does not cancel the risk management rules: do not exceed the standard trading lot size, stop level loss and take profit.

Tom Dante forum webinars