Hello, fellow traders!

Any trader deep down dreams of a “breakeven” strategy that will give only positive emotions, without the pain of losing trades.

In this post, we will try to create such a trading system by combining the fundamental strategy with the tactics of averaging. Meet Vanilla Martingale.

The theme of Martingale does not lose popularity in the Forex market. The strategy of averaging unprofitable positions attracts traders:

- The absence of stop losses – fixing losses is hard on the emotional state;

- By successfully sitting out a loss – working off losses brings the trader more joy than profit;

- Smooth growth of the total profit.

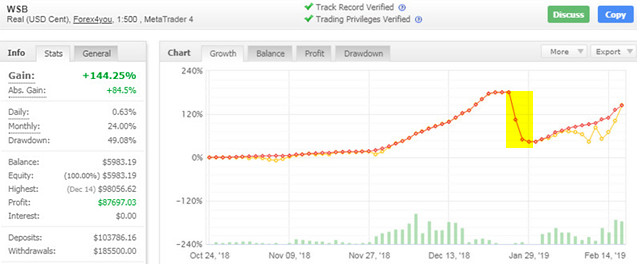

The last thesis is an indisputable fact that makes it easy to calculate the martingale from the equity line. If you see a smooth increase in the yield curve in Myfxbook statistics or PAMM reports, this is a 100% sign of work on the tactics of averaging and increasing losing positions.

The figure above visually shows the reason for the main criticism of Martingale. Averaging unprofitable positions in order to accelerate loss recovery can bring the account draining closer if the trader:

- Opened orders against a long-term non-recoil trend;

- Mistakes with money management, did not calculate the size of orders and lost the account on the first deep correction.

In addition to these two problems, there are others. It is more correct to call martingale a tactic, not a strategy, it is just a rule for averaging a loss and increasing positions. The trader will have to additionally develop or select methods from ready-made strategies:

- Trend definitions

- Entry points

- Rules for closing positions and reverse trading

- Money management, etc.

It turns out such a complex trading system with many settings and rules that Martingale rarely trades “hands”, using instead the advisors that are in enough on the Tlap website and forum.

What is Vanilla Martingale?

Martingale attracts beginners in the Forex market, but so-called “vanilla” strategies are more suitable for beginner traders. They represent trading according to simple and understandable rules – the intersection of moving averages, oscillator signals.

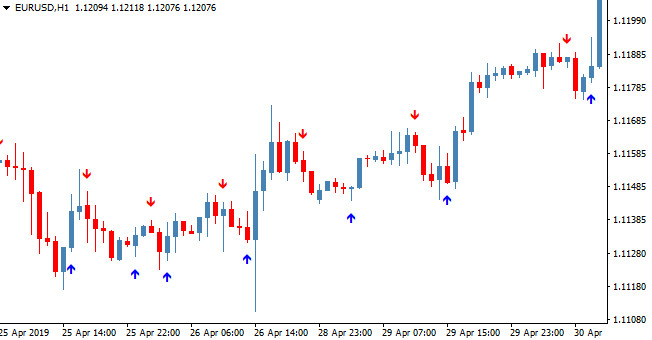

Two or three sets of filters – no more, to avoid errors. The low accuracy of the signals is compensated by the absence of errors, which are the main reason for the loss of the deposit. The ideal option for a beginner is arrow indicators.

Forex martingale cannot be attributed to vanilla strategies, but it is only on first glance. The correct selection of instruments, visualization of entry levels on the chart and the compensatory mechanism of losses simplify trading with averaging and increasing the position.

Moreover, the vanilla Martingale allows you to build a pyramid, turning into a deposit overclocking strategy.

Choosing currency pairs for Vanilla Martingale

Choice currency pairs with a unidirectional trend is the easiest way to simplify martingale trading. In this case, the trader will trade only in one direction, and the long-term trend guarantees the closure of all hung trades over time.

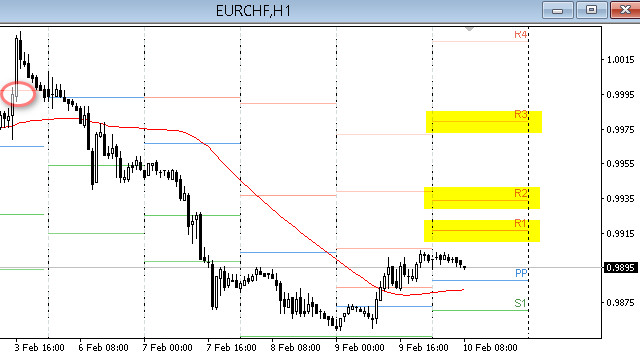

Note that the EURCHF pair has had a single digit downtrend for 50 years. Part of this historical graph is a curve fit to the past for clarity, the euro only appeared in 2002.

it is necessary to choose an instrument with a growing long-term trend in order to compensate for losses at the moments of positive rebounds of the EURCHF pair. This task turned out to be difficult: over a period of 50 years, a more or less unambiguous upward trend was observed in the rate of the SGDUSD pair.

Selection of entry levels and tactics of averaging/increasing positions

Entry points at pivots – levels calculated using the open, close and high of the day – will greatly simplify the martingale strategy.

The lines are plotted on the chart automatically using the indicator. A trader can place three pending orders in advance at the beginning of the session on R1, R2 and R3 for short, S1, S2 and S3 for long.

Statistically, touching the price of the first lines R1 and S1 leads to a correction in 60% of cases, R2 and S2 in 80% of cases , and almost always the price rolls back from R3 and S3. It is logical to assume that at each level, except for R1 and S1, a trader can increase the lot size with a coefficient selected using money management.

EURUSD – vanilla martingale benchmark

The EURUSD currency pair, which has the dominant trading volume on Forex, will greatly simplify the vanilla martingale, acting as a benchmark.

- The growth of EURUSD will cause a weakening of the USD, which will give a signal for a short on the USDSGD pair.

- The falling EURUSD will weaken the EUR, which will give a signal for a short on the EURCHF pair.

Only one of these instruments is traded while the EURUSD local trend develops.

How to predict the direction of the EURUSD trend?

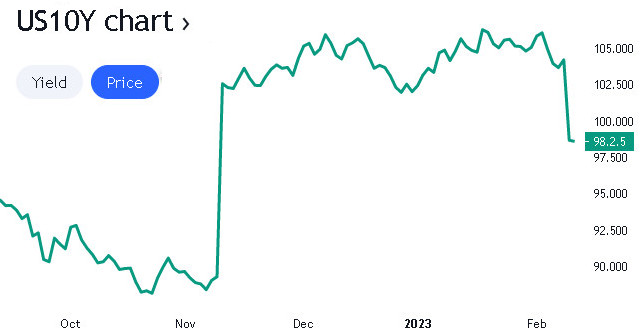

The rate of the Forex currency market largely depends on the monetary policy of the financial regulators of the ECB and the FRS. US rates are of great importance, the forecast of their growth and actual increases are directly reflected in the yield of Treasury Treasury bonds.

The ten-year bond chart is ideal for the role of an indicator of the Forex market trend. Just take their price, not the yield curve.

As long as the US10Y Treasury is below zero on a 10-day period, the dollar will strengthen, which means that only EURCHF is traded. A rise in yield above relative zero on a 10-day period will force a switch to short USDSGD.

Three-hour candles will reduce the number of false signals. When changing the direction of the trend, you need to wait for the moment when the price consolidates above/below zero during the daily session.

Trading system characteristics

Platform: Metatrader 4, 5

Currency pairs: EURCHF and USDSGD, or AUDCAD and EURGBP, or AUDCHF and EURSEK

Timeframe: any intraday

Indicators: Pivot Points, US10Y chart

Trading time: around the clock

Recommended brokers: Alpari, RoboForex, TickMill

Login Rules

1. Determine the direction of the trend according to the chart of three-hour candles US10Y. If the Treasury is above zero for more than a day on a ten-day period, open USDSGD pair for transactions, if below zero – prepare to open positions on EURCHF.

2. All positions on the pairs are opened only in one direction, coinciding with the global trend. In this sense, trading on EURCHF and USDSGD is carried out only from short (SELL).

3. Place pending orders at the beginning of the session on US10Y bonds that match the trend conditions. To do this, we put the Pivot Points indicator on the chart, which draws resistance lines R1, R2, R3 and support lines S1, S2, S3 intraday.

4. We are interested in R-levels because of the trading conditions from short only. We sequentially place three Sell Limit orders on the corresponding lines. The first one is one trading lot, the second one is with a coefficient of 1.2, the third one is 1.5.

The strategy has no stop losses.

Money management and calculation of the Vanilla Martingale trading lot

The historical chart of the selected currency pairs shows a maximum correction level of 30%. The trader will have to leave a reserve for the losses of the second pair, the rate of which may diverge and not cover the loss of the first position.

Ideally, we get 0.01 lots per $500 deposit. Let's open 6 knees, and the amount increases to $ 3000. It is clear that a cent account is more suitable for the vanilla martingale strategy.

How to build a pyramid?

The long-term trends of the selected instruments guarantee that transactions will enter the profit zone. In this case, it is advisable for a trader to open new positions, increasing the overall leverage and profitability of the strategy.

The pyramid requires a mandatory stop loss at breakeven for all existing orders so that an unexpected “shoot through” does not “kill” the deposit.

Conclusion

Despite the title “Vanilla Martingale”, the presented strategy requires the trader to have sufficient experience when working with grids of orders.

The tactic of averaging and increasing losses is dangerous if money management is wrong. One negative news is enough to drain the deposit in a day or several hours of very strong fluctuations.

Download the Pivot indicator

Forum thread