What you NEED TO KNOW about CHOOSING a Forex timeframe for a BEGINNER?

What you NEED TO KNOW about CHOOSING a Forex timeframe for a BEGINNER?

Watch this YouTube video

What is timeframe

The time frame on a trading chart is the time a candle/bar is formed.

It can be from one minute to a month.

You can compare this with a change in the length of a cm, inches, meters, kilometers.

Timeframe is the first input parameter that you must set when opening a price chart.

Briefly about each timeframe

- Weekly(weekly) – long-term trends and important levels.

Trading for those who know Zen, or for those who have very little time, because you can check the charts once a week. - D1 (daily) – levels on daily charts allow you to trade swings.

In the good old days, when there were no computers, the only timeframe was D1.

All classic indicators and candlestick patterns are designed for D1. This is one of the reasons why technical analysis works best on D1. But on day trading, you pay swaps when a trade is rolled over to the next day.

Check once a day. - H4 (4-hour charts) are good entry points for intraday positional trading, ideal for marking fibo levels.

Checking the pair once a day. - H1 (hourly timeframe) – the most accurate and optimal time frame for intraday trading. The second after D1 in terms of value for a trader.

The technical analysis works well, it is convenient to separate trading sessions.

Check every hour during the London and American sessions. It's better not to leave positions overnight. - M30 (30 minutes) – not yet scalping, but not trend trading either. An unpopular specific timeframe “for an amateur”. I highly do not recommend for beginners.

Check once an hour. - M15 (15 minutes) – more accurate entries on signals from H4 and H1, the maximum timeframe for scalping.

Very popular in indicator strategies, the most accurate of the short-term ones.

Check every half hour. - М5, М1 (5 minutes, 1 minute) – scalping for people with iron nerves and a lot of free time.

Check every 5-10 minutes.

How to choose the right timeframe for you

How much time can you spend trading?

How often can you check charts? (You can trade from your smartphone.)

If you can only devote a limited amount of time to trading on a daily basis, then you should definitely consider trading on daily charts.

If you can only devote yourself to analyzing the markets Weekend, a weekly time frame is ideal.

In a nutshell, the time frame you can trade depends on how much time you can spend trading.

Do the following:

What is your trading style?

- Scalping: M15 and below

- Mean reversion: M15 – H1

- Trend trading: H1, H4

- Swings, position trading: D1

- Long-term trading: W1

How fast can you analyze the market?

Even if you can afford to watch the market all day long, it doesn't mean that you have to devote all that time to the market.

The faster the time frame, the less time you have to perform analysis. To succeed on fast timeframes, you must be able to interpret price action with confidence.

Consider your ability to read price action signals, as well as your trading personality.

Is your strategy compatible with the selected timeframe ?

Some traders claim that setups on slower time frames are more reliable and there is more noise on faster time frames.

This is not always the case.

What is more important is that to make sure your trading strategy is compatible with your timeframe.

Some methods work best on daily charts while others work well on fast sub-minute timeframes .

Do the following:

You need to evaluate your timeframe for the performance of your strategy. Make sure they are compatible.

Stop size on different timeframes

If the stop loss size on the D1 timeframe seems too large for you to manage money properly, use cent accounts.

Stress on intraday timeframes

Obviously, when trading on lower timeframes, you experience more stress.

The lower the timeframe, the more often you make trades and the more commissions you pay Broker

Because every time you make a trade, you pay a commission in the form of a spread to your broker.

Also …

The longer you are in the trade, the greater the risk.

The “shorter” the trade, the easier it is for your algorithms to predict events in the market.

Do not switch timeframes

It happens that a trader opens a deal, but he does not like how it looks. Then he starts flipping through different timeframes to find the one on which the deal would look profitable. If you use a time frame justification system, that's a sure sign of a bad trade.

Don't switch from one time frame to another. It ruins your trading outlook.

Don't confuse yourself with moving to lower timeframes

See:

If you open a position on a daily timeframe, then manage this trade on the daily timeframe as well.

The big mistake you can make is to go down to a lower time frame, get scared and close your position.

If you open a position on the daily time frame, then place a stop loss and manage this trade on the daily time frame too .

If you open a position on an hourly chart, then place a stop loss and manage this trade on an hourly chart too.

If you open a position on a 15-minute chart, then place a stop -loss and manage this trade also on the 15-minute chart.

It is difficult (but possible) to match timeframes

If you are a beginner and hear advice about looking for a signal on H4, but you don’t need an exact entry on M15.

Or H4, or M15, one thing.

When you get more experience, you can combine.

Which TF is the best?

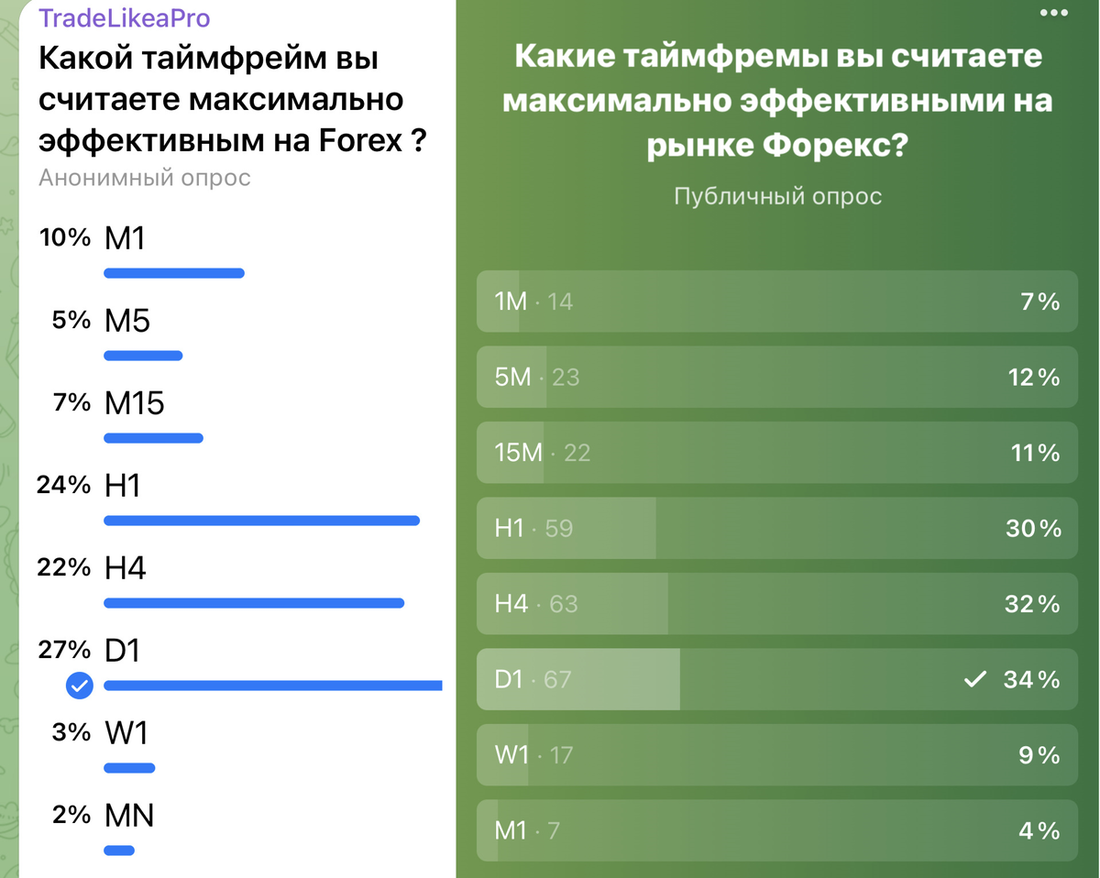

I conducted polls in our VK group and Telegram channel. You can see the results above, and I generally agree with them. D1 and H1 are everything.

Conclusion

For beginners, of course, it is better to start with D1. But if there is a desire and time to trade intraday, then from the hourly chart H1. The most important thing is to try different timeframes and find what works for you, your decision speed, your chart, and your trading strategy.

Forum Thread