How to trade EURGBP Strategy, nuances, secrets

How to trade EURGBP Strategy, nuances, secrets

Watch this video on YouTube

Hunting for footsteps of traders in the majors

As the theater begins with a hanger, so trade in the Forex market starts with the selection tools. With high probability it can be argued that most popular among traders is the EURUSD. The other places of the ranking are other major pairs, but each of them has a dollar.

The reasons for this choice are the liquidity, the best trading conditions the brokers and even the technicality or the predictability of trends in comparison with other tools. The irony of the last statement is that any couple having a Ticker USD is the unpredictable bomb to stop the trader.

Many analysts and brokers prefer to keep silent about the fact that included in the dollar position a trader has to a certain extent depends on Twitter Donald trump. The American President in 2018 and 2019, has proven that his message can lead to unexpected fluctuations which are even able to deploy trends. On our website there is an article on how not always thoughtful words of the American leader can affect the exchange rate of any currency pair.

Liquidity – another trap for beginners and professional traders especially for trading within the day. It is provided by the presence of large banks, spending money to hunt for stops or manipulating exchange rates major currency pairs on the Forex market.

The level of pending orders – public or sold by information brokers. The big players put on the market the amount of currency that can collect market depth, in order to reach the level of accumulation of stop loss orders. Activation of the mass of such warrants serves as a catalyst for manipulative trend.

The hunt for stop-loss not give in to any forecast technical analysis, as well as the desire of large banks to end a session with a specific rate of dollar pairs. Previously, such proposals seemed impossible until it was carried out investigation of fraud with interest rate LIBOR. Regulators found associated contractual trade on the Forex market. Those who are not in the subject, you can read a selection of articles in the Vedomosti newspaper.

How do you defend against? Refuse to trade pairs with the prefix USD. In all cases above, the manipulators used EURUSD or other liquid dollar pairs. The choice is obvious – trade “crosses”.

Cross-Forex pairs – what is their advantage?

In the Forex market there are 8 major currencies recognized by the IMF tools to hold foreign exchange reserves. It is freely convertible national currency of countries with developed and stable economy.

It is this feature makes the combination of these currencies in pairs (without the dollar) resistant to external news on the first economy in the world and even a tweet-stuffing of U.S. President Donald trump. Of course, that such pairs are dependent on internal news. Basically this is a standard set of economic indicators, the reaction to that described in any book or encyclopedia on fundamental analysis.

Cross pairs unlike dollar currency instruments:

- Have a unique reaction to the domestic economy;

- Have limited (half-day) volatile period of trading;

- React poorly to the news of the United States that allows you to safely transfer items “through the night”.

The Eurozone Economy

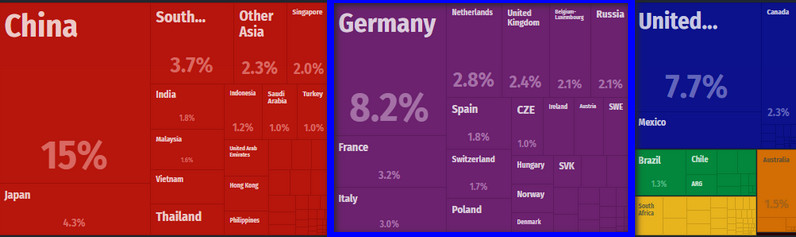

The Eurozone is the second in the world in percentage of GDP, import and export of goods. Spanning 27 countries, the economic model has developed internal market, common economic, international, and monetary policy.

The EU zone covers 27 countries, 19 of them have a common currency, but monetary policy is determined by a supranational body – the European Central Bank. The Euro is the second volume of trading on the Forex (the U.S. dollar) currency in the world.

The UK Economy

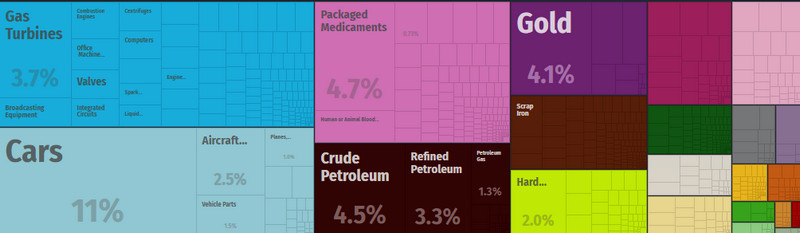

UK ranks 10th in the world export and 11 place in the world import of goods. The main income in foreign trade, bring the cars, on the second place – medical products, the third article – oil and gold.

Unlike the Eurozone and many other countries, monetary policy of the Regulator – the Bank of England (BoE) – agreed with the government and the Parliament of great Britain. Meetings at the rate the Committee was undertaking monetary policy, its members are not employees of the Central Bank, which is represented only by the head of the BoE.

EURGBP – “the neighbor’s cross” in the Forex market

The cross-pair EURGBP ranks first among the crosses on the volume of transactions and eighth place in the Forex market among pairs of major currencies. The EU and the UK are linked to each other geographically and politically, by 2020 it were a single Union. In 2016, the referendum of citizens of the UK voted for option Britain exit, giving the world a new word “Brexit”.

At the global trend, compiled by the weekly candle that takes the count since the advent of the Euro currency in 1999, it is clear that a year out of the EU has coincided with an upturn in the EURGBP.

This observation suggests a long-term strategy purchases; the largest value of the profit factor of such deals is observed in the moments of crisis. Pair always responds to the problems in the global economy the same way – the rise of the Euro, for the simple reason that the economy of the Union more than the economy of the island of great Britain.

In the above picture you can see another feature: the economic crisis of the XXI century raised the pair up to the same levels that allows to build the counter-trend strategy, as well as interim profits.

To trace the beginning of the crisis economic phenomena and its implementation in the prices of currencies will help indicators LEI described in this article. They have successfully predicted all the crises of the XX century on the Forex market; the indicators were last checked in January 2020.

Political crises do not predict the indicators, the most famous of these was the UK out of the EU in 2016. “Divorce” lasted for four years, only 31 January 2020 Queen Elizabeth II formally signed the document, restoring economic sovereignty of Albion.

On the chart it was marked by a growth, which stopped before reaching the level of the 2008 crisis. The strengthening of the Euro ended in the summer of 2019, once there was clarity on the issue of withdrawal from the EU under the leadership of the new Prime Minister, Boris Johnson. Politics aside, and focus again moved towards parity, where the pound had an advantage in the form of high rates.

Global growth adjustment EURGBP

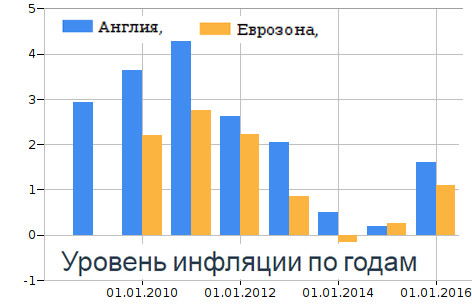

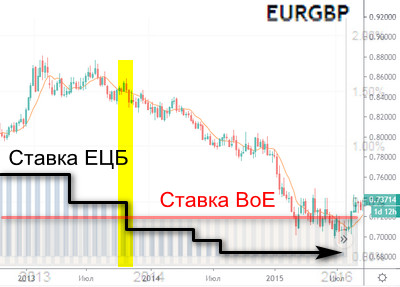

From 2010 to 2016 on the EURGBP chart there is a significant pullback, which is due to the effects of the global crisis of 2008. Like many developed countries, the ECB launched a quantitative easing program QE: the redemption of government bonds and the distribution of soft loans through the REPO markets. It is believed that this led to slower economic growth, required rate reductions.

The Bank of England faced the same problem, but the dynamics of decrease of consumer price growth in the UK was a few percent higher compared to the EU, as can be seen from the summary statistics of six years.

Down trend the EURGBP has acquired a stable direction for the period 2013-2016. At this time the balance of inflation increased reduction of interest rates by the ECB while keeping this rate at a stable level by the Bank of England.

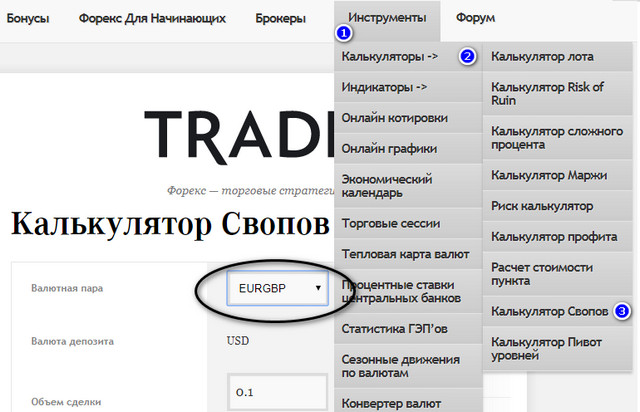

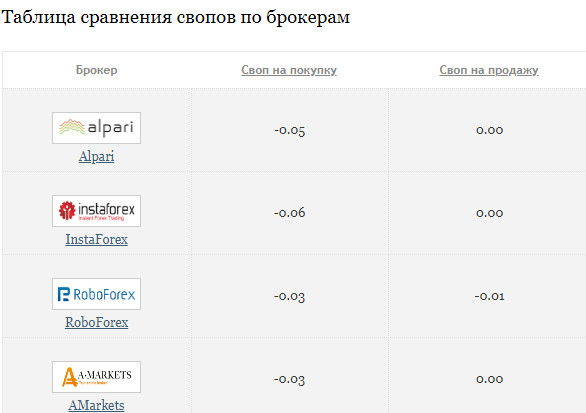

Now the level of interest rates in the Eurozone has gone into negative territory, the Bank of England has lowered this parameter is virtually zero, making it impossible to earning on the carry trade. On our website there is a special functionality for this calculation – Calculator “swaps.”

As can be seen from the tables, leading brokers will charge when you transfer positions EURGBP through the night:

- On longs with negative swap;

- The shorts – zero swap.

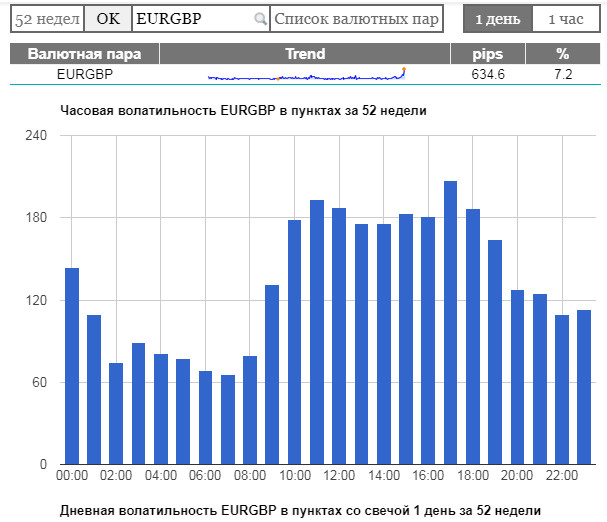

What time is best to trade the pair EURGBP

According to our service the volatility of currencies it is possible to observe the active phase of trading in the European session. The unique property of EURGBP is a decrease in the activity of the American session, which is explained by the absence in the composition of tool USD.

The day trader cannot afford to sit waiting for the fed minutes and do not increase stop loss before the publication of the NFP.

How to trade and what strategies to use?

Pair depends little on the American news, which resulted in the lowest ATR index among highly liquid instruments. This means a much smaller percentage of “broken” stops due to sudden surges of volatility.

The trader will be convenient to use a classic trend strategy with the location and size adjustment stops on the ATR indicator, which allows to account for the growing range of candles within the day. The risk of a large loss is reduced in a short period of active trading, for reasons described above.

- Price Action, support/resistance, trend lines, and other elements of classical technical analysis also work;

- Below H1 because of the low volatility makes no sense to go down;

- Despite the slight movement in General, the currency pair can be nasty spikes, you should take this into account when setting stops.

Night scalping

The cross-pair EURGBP due to the lack of a strong response to the us session and relatively low volatility has advantages over other pairs in the strategy of “night scalper”. As has been shown above, a pair of low activity from 19-00 till 9-00 – this period three times more than a traditional night trading Asian currencies.

Unlike the “Asians”, at EURGBP no problem with news Central Bank of Japan or the people’s Bank of China. The trader can “easily” determine the boundaries of the flat to sell near resistance or buy at support.

If a trader is difficult to trade manually on our website there are articles describing robots for night scalping with martingale option, and without position averaging. In a separate topic describes the technique of programming your own EA for night trading.

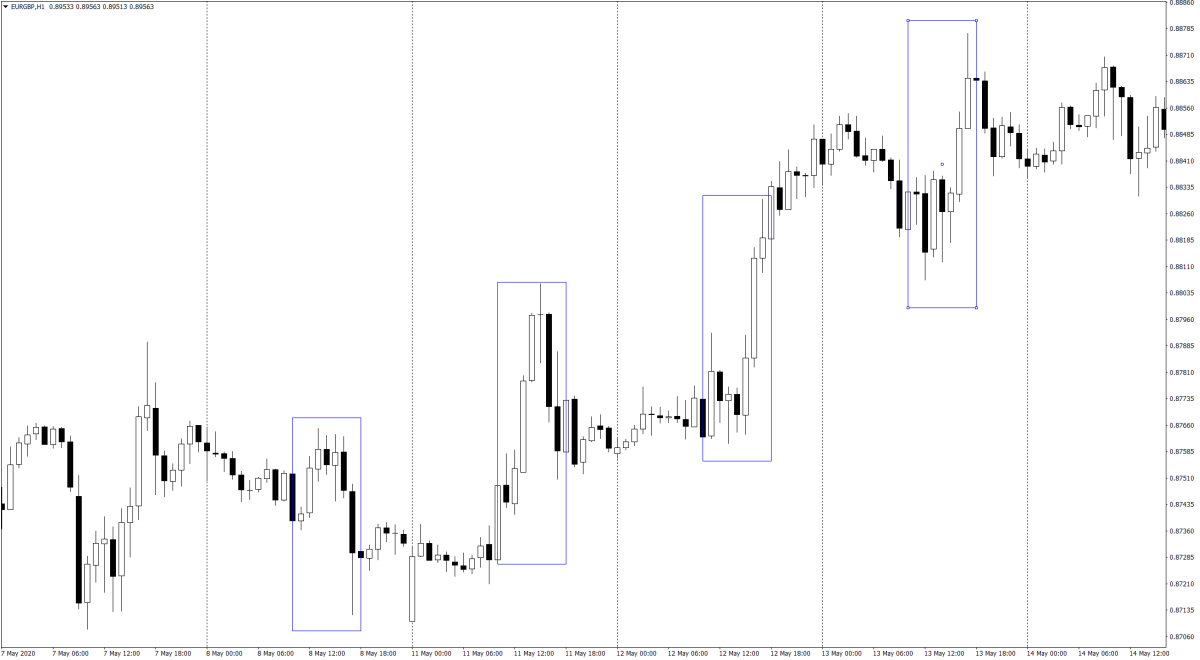

The movement from 10:00 to 19:00

As we explained above, the most active trading times EURGBP – from 10 to 19 Moscow time. And if you open an hourly chart of this pair, you will see that the movement is most often unidirectional. That is, taking the right side of the transaction, you can safely to keep until the evening or place a take-profit at 70 pips (the average daily volatility of EURGBP at the time of writing).

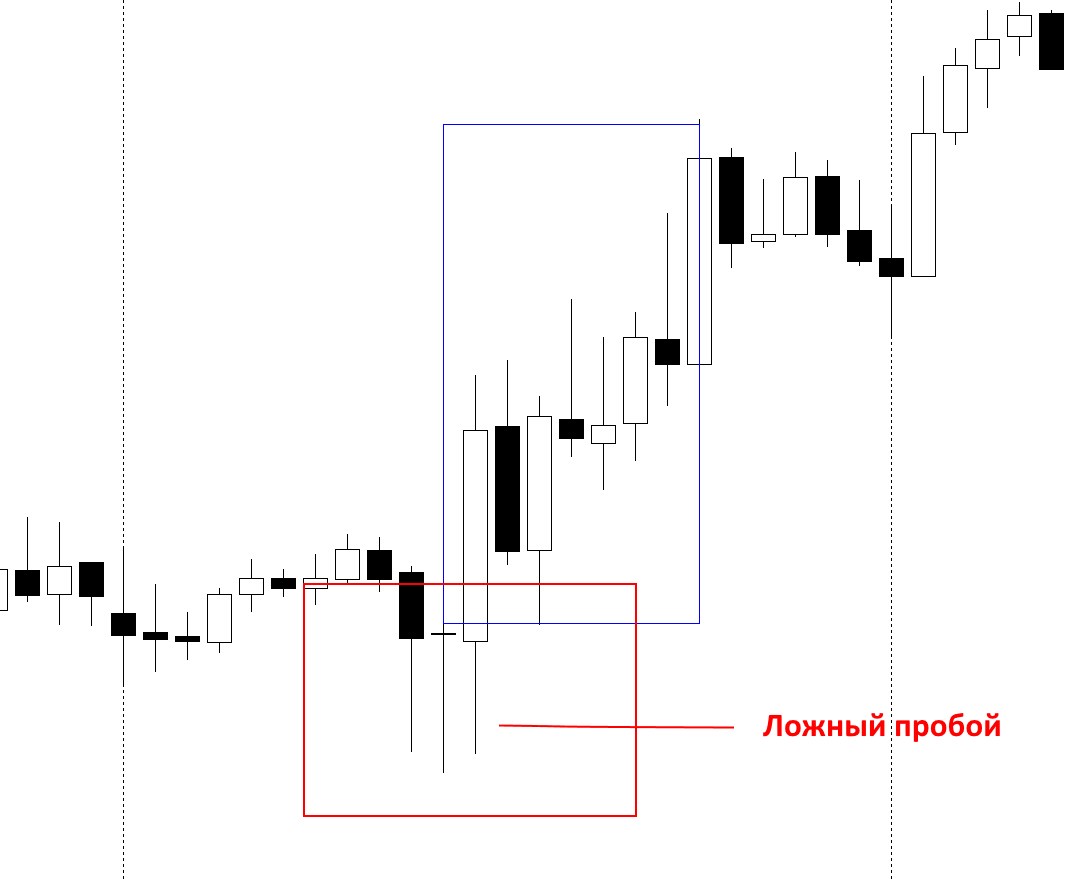

Unfortunately, not always the first impulse in the 9~10 o’clock in the morning happens in the true direction of the subsequent movements, there are days with false breakouts night range:

Partly to weed out these signals will help later entrance, for example, at 12 or 13 o’clock, when a false breakout has already occurred and the couple decided on the direction of the day.

In any case, the strategy can be interesting to think in this direction.

Trends in D1 after a Brexit’

Take a look at the EURGBP daily chart D1.

What do you see? After Breccia pair gives a very clear and understandable trends. Earn – do not want. Even using a simple moving average open a good deal.

Schedule literally “on the books”. How long will this “freebie” is unknown. Maybe a couple of years, maybe longer. But while such easy opportunity to earn money there, why not pay attention to it?

Conclusion

Cross pairs are special currencies that can a careful study to give the trader several advantages over other instruments. This situation occurs because the crosses are not interested in big players, market makers work on them for technical trade without mega-fluctuations in liquidity and “hunt stops”.

These factors allow the trader to create a “niche strategies” that will provide stable medium-term income. In moments of crisis cross pairs can become alternative to dollar tool to hedge income.

Overall, EURGBP – a quiet couple, suitable for beginners and yet allow for trend trading the D1.

Forum topic