Hello, fellow traders!

In today’s world deeper into our lives penetrate artificial intelligence, samebecause voice assistants and analysis of Big Data. Ordinary people encounter this most often in the form of applications for smartphones, but the fact remains — neural networks, or samebecause computer system is everywhere, even if we can’t see them.

For many years, the commercials since 2006, the programmers try to implement neural networks in trading. The idea seems interesting to set up a trade automatically the ever-changing market. But what about in practice?

Many of us are constantly searching for new strategies and trading tactics in the Forex market. Each found, the system shall be tested for a historical period of various lengths. Ideally, testing should identify those patterns that would work for a sufficiently long period of time.

In reality, it is unsolvable problem – the trading system “drained” after working for three months to several years. Extend the “service life” helps optimization, but in the end you have to look for another approach to the Forex market.

The phenomenon of failure of Forex trading strategies give a lot of explanations, but you should pay special attention to one of the reasons that can eventually undermine all the efforts to make money on currency speculations, — the evolution of neural networks. What it is, and how artificial intelligence could affect trading in our today’s material.

When work on the Forex market were large

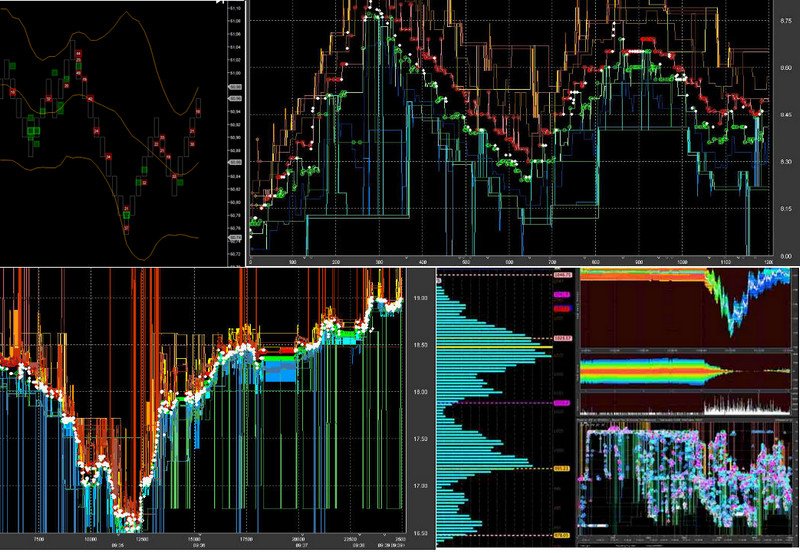

Many traders covering the runs of the test all history currency trading, since the beginning of the 90s up to the present moment, often notice a drop in performance strategies for the periods 2001-2008 and 2013. They attributed the failure of the trading systems with the economic crises, but this is just one of the reasons, while not the most important.

The Forex market of the nineties literally “gave” the money to the bidders that have established trading terminals are connected to the Internet, and using fairly simple tactics described in the books of the traders of the eighties. Earnings did not prevent even temporary lag, bugs, platforms, large spreads, slow connection to the world wide Web.

The struggle for ping and low Commission brokers began in 2001 when the market began to appear EN masse robots and scalping strategy that changed the shape of the trends. The development of robotics has forced the market makers to rely more on the analysis of the order flow of customers, “hunt stops”, to apply different tricks driving a crowd using automated strategies.

Traders said the same thing: the trading platform of the XXI century began to analyze the flow of orders futures and Open Interest of options, trading volumes were compared with candlestick analysis (VSA), the market has taken programmers and mathematicians, who created a variety of advisors.

In 2008, the strategy has gone beyond Boolean mathematics: the market began to learn non-linear indicators and econometrics, which it was impossible to “repeat” in standard commercial terminals. Unofficial ratings of Forex brokers fixed at this point, the drop in performance from the clients.

New approaches not yet widely spread among traders due to the specificity of the topic in econometrics, but also of the complexity and cost of using an analytical programs. However, in 2013, there was one “problem”: on the Forex market began to develop artificial intelligence that can almost not leave possibilities for manual and automatic earnings.

What is a neural network in simple words

The theme of neural networks “shot” in 2011, and for 8 years it has penetrated into all spheres. Now no surprise with the voice assistants that control “smart homes,” face detection etc.

In the second decade of the XXI century the network of medium complexity beats grandmasters at chess, but artificial intelligence of the highest order capable of solving complex logical problems. A striking example of the possibilities of AI is a title of the champion of Chinese checkers, the of neurorobot Google.

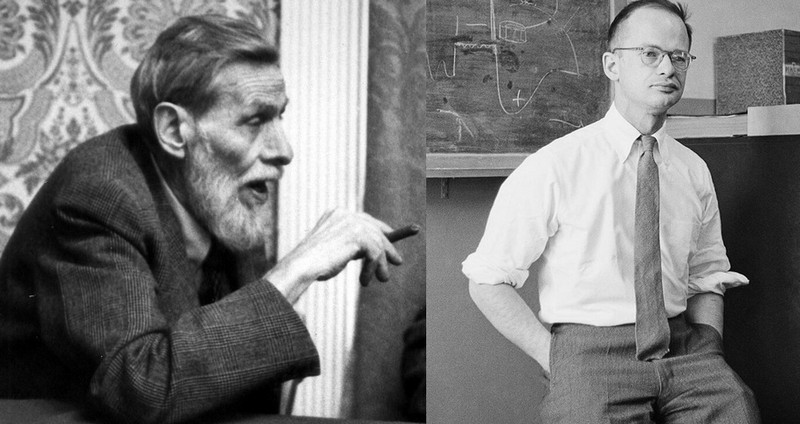

This development is nearly a century of evolution: few people know that the first created the neural network will soon be 80 years old. Thanks Warren Makkalou and Walter Pitts scientists began to work on creation of computing, like the neuron of the human brain.

Each of them can be a mathematical algorithm that is configured for processing input data in a specific format. Running this system parallel computing output neuron, searching the results of the work in order to adjust the results under the correct answer.

Answers provides, is called the process of network training, which is a mandatory step towards the creation of the neural network. Output neuron should strive to build the calculation process among the neurons so that when you receive a different output to find the human results.

Setup or “training” the network before it is started very similar to the testing strategies and the chain is repeatedly runs the calculations and highlights with the help of weighting factors the most significant for the correct answer algorithms. The user defines the work of artificial intelligence in mathematical report errors.

Same as in Forex trading strategies when the network starts to produce again and again a satisfactory result, start forward testing on a real, but past events with known outcomes. If the network passes these tests, it is taken into operation. Never know until the end what and how to learn artificial intelligence: the result and the process of work of algorithms of neurons inside this “black box”.

Here are two examples. First from the theory of face recognition. Any of us in General are familiar with the process of making a sketch – selection of the lips, forehead, oval face, etc. the neural Network has solved this problem on your own and you simply.

Neurons fill the box, either photo x size in pixel, by analyzing which one can find the boundaries of the image. After removing of the blurred areas starts counting diagonally and horizontally. It turns out that the “measurement of persons” to obtain unique amounts relevant to the specific person, if you follow the scale and proportion are not difficult to define.

Another curious case, we often recall when training neural networks, – the attempt of the us military to teach the UAVs to detect military equipment, recognizing its type from the air. Many show shot in various conditions of aircraft, tanks, guns and helicopters, led to the fact that the AI was perfectly determine weather conditions, but have not learned to look for equipment.

How dangerous the application of artificial intelligence in the Forex market?

The neural network will change the currency speculation, brokers can go back to the tactics, something similar to “kitchen”, only on a global scale. Virtually limitless possibilities of neural networks can be applied against the crowd, not predicting exchange rates, and the model behavior of each individual trader. Market makers and Prime brokers will be able to choose the counter-strategy is, hunting for stops, widening spreads at the time of the withdrawal applications to the markets, to put phantom volumes in the glasses ahead of, not after the fact.

Designed and launched a startup Sentinent Technologies, a neural network can emulate 1800 working sessions, predicting with high accuracy to a trillion (!) cognitive models of the behavior of real traders. The system is trained on the flow of orders taken from the bid books of exchanges and brokers servers.

The quality and quantity of data – the key to successful training of neural networks; archives tick trades broken on specific accounts, — the seller in the market of data mining. The term refers to a separate industry, mining, analyzing and formatting the primary input information for the neural network.

Another pillar that determines the success of the system, the number of neurons in the “black box”. The higher it is, the greater the computing power that went beyond the standard CPU. Designers and creators of the neural networks used chips made to order for special integrated circuits. Idea taken from the miners of cryptocurrencies, mining Bitcoin and other coins on ASIC hardware.

Even if the brokers will not be able to study the model behavior of traders and to be successful against strategies of the crowd, they will create superior predictive system, which cannot be repeated in the trading terminals. Modern trading system, operating on the stock markets, commodities and currencies, read and understand the news, recognize patterns, which are the analyst and the brain of a supercomputer. So, for example, the robot Emma.

Some companies use traders directly in order to teach it the most successful strategies that have passed the competitive selection. The company Numerai holds regular tournaments, not hiding their goals and even take the winners to receive regular dividends in proportion to the contribution to the overall trading system of the neural network.

Mark Lind from the Department of the IBM company, designing and launching of a neural network for corporate orders, has highlighted the “eurobum” at the end of 2017. More than 90% of raised the IT giant networks in the sector have been applied to the forecasting of rates of foreign exchange and stock markets.

The system virtually never used technical analysis, working with real data inventory and cash flow by analyzing the business press and financial indicators, production data, political news, reports on the quality of products of independent experts and even the weather. The algorithms of neural networks IBM is not so much predicted market prices, how many have studied the reaction of the crowd to certain fundamental news and indicators that affect not only the market but also in social networks.

This trend proves the thesis that the company’s study not the behavior of the market and the reaction of the crowd at events, some of which can be predicted, to know using insider information or cause indirect manipulation, not linked to the trades. In this case, Regulators will not be a reason to punish large companies.

Artificial intelligence in large investment funds and banks

One of the first companies to apply artificial intelligence to predict market movements, was Renaissance Technologies — a company run by talented mathematicians, essentially hiring employees with zero knowledge of trading and technical analysis.

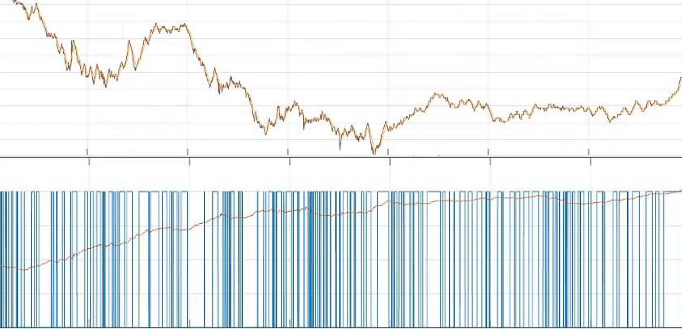

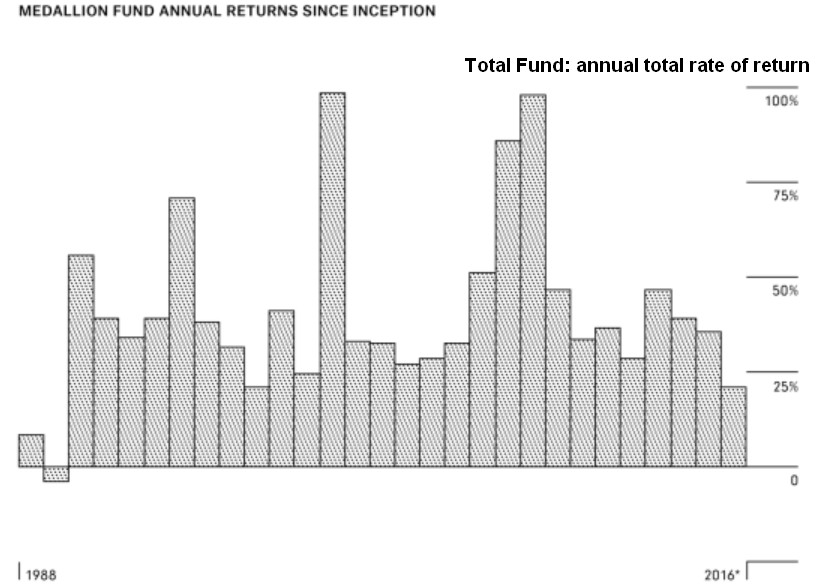

The company has a low turnover of staff who were able to create a fully robotic Medallion Fund, which showed average yield 35% per annum over the 20 years of investment management.

The most radical replacement of the traders artificial intelligence occurred at Goldman Sachs, is “forge of cadres for the state Department” reduced the staff at 99%.

Known worldwide investment company BlackRock has entrusted the neural network Aladdin up to 10% of all portfolios and conducts a total audit of all decisions taken by analysts of the companies. This decision was taken after the fall of revenues in 2018. The Fund noted progress of competitors from Asia, which now passes nerobol in the field of investment, on the stock exchange of Hong Kong for several years successfully working Aidyia Limited – a hedge Fund under full AI control.

How artificial intelligence is changing management?

The neural network has replaced investment advisers, personal managers and Trustees. Startups and large companies for several years, offering such assistants, capable of 100% to adapt to each individual client. The neural network learns his preferences and habits, to individually select the level of risk and the composition of the portfolio, to offer the perfect markets and optimal money management.

Such assistants are being developed to BlackRock startup FutureAdvisor, Motif Investing are tested in partnership with JPMorgan and UBS are created on the basis of SigFig.

According to research and surveys by McKinsey, the focus of investors, following the advice of euroconsultants, ahead of the average result in the trust management market “live” analysts at 7% per annum.

In addition to robots from banks and major brokers on the market of financial services there was a separate direction to create eurostrategic “turnkey”, for example, Binatix. And also the whole area of services of data mining – provide inputs for neural networks that is formatted under any given market, as in the case with startup BUZZ Indexes.

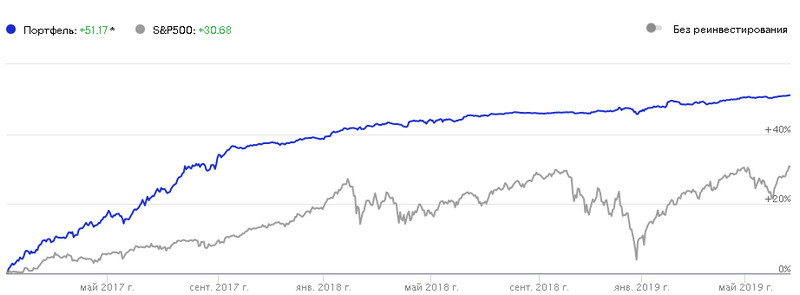

On the Russian market of the neural network used by the company BCS, managing stock portfolios. Robots bring investors from 30 to 70% yield, surpassing the performance benchmark in the form of course S&P.

Robots-consultants, designed the neural networks started in the investment services Yandex.Money (Yammi) and the Bank Tinkoff. The claimed and projected investment returns is a two-digit number. It is difficult to verify because of the small period of work platforms, constituting little more than a year.

How to create your own neural network?

Prediction of the Forex market with the help of artificial intelligence available to “mere mortals”. Neural networks are involved in various Championships, algorithmic trading, conducted by the international Association of brokers since 2008.

To build your own strategy on specialized platforms: neuroshell, matlab, statistica, with deductor or brainmaker. Traders with knowledge of the programming language can take advantage of special services from Google, Microsoft, Amazon, etc.

In order to simplify complex learning processes of neural networks and input selection, a trader can use different templates and applications built on the block type of the constructor strategies.

Conclusion

The first wave of interest in neural nets Forex covered in 2006-2008. The economic crisis and the lack of input data has significantly reduced the ranks of enthusiasts. Traders and company failed to show long-term stable results, which could justify the high cost of trading platforms on the neural networks. The second wave, launched in 2011-2012, led to the production of finished products in 2016-2018, which did not show objective to evaluate the results.

Companies that promote neiromediatorov, and funds managed by the network, hide the graphs of the benchmark; a PAMM account in Alpari launched on neural networks, merged by the time of this writing.

Given a poor or even complete lack of results yield by neural networks (for the whole myfxbook five systems, 4 of which are closed), along with the successes of artificial intelligence in other areas it can be assumed that this topic is used only by large brokers and exchanges.