Hello, fellow Forex traders !

Social networks have changed our lives, becoming 14 years of its existence and development from the confidential communication tool in a General news platform. In 2019, no one doubts the huge impact of messages in social networks, especially if the account owner is the head of state.

In today’s article we will look at how currency speculators can use to trade Forex Twitter the Donald trump. If you are not subscribed to it, but trading in the Forex market, this article can turn you into one of the most devoted of his followers!

Along with personal user accounts over time, began to emerge in the corporate and political accounts. Among the latter, the largest number of subscribers managed to attract Barack Obama – the first African-American President.

He chose Twitter, a convenient platform for the publication of news and short messages, allowing himself to deviate from the official channel @’s presidency and to communicate “with people” through personal account @POTUS acronym from the first letters of the names of official office of the President of the United States.

Having a liberal arts education, Obama could joke, had the talent of the writer, which led to a record speed of set followers (the record was recorded by the Guinness Book of Records in 2015). Its successor, the 45th President of the United States — the complete opposite because of a poor vocabulary, rankings, controversial reputation. However, this did not prevent Donald Trump to collect 64.6 million followers on the personal account @RealDonaldTrump.

Posts in Twitter are changing the form of governance of the XXI century

In 2011 Matthias Lufkens introduced a new term – “Twitter diplomacy”, explaining in a detailed article that 97% of countries have accounts in this social network and publish posts with the official communique, which can be recognized before they fall in the news and business press.

Donald trump in 2017, raised the political importance of social networks to an unattainable height. Exclusive news from Twitter the President recognize not only the journalists and the business press, but also the White House. Officials often “shrugged” when asked for comment. Later, they began to recognize that some of the communication in advance was not discussed and was the personal viewpoint of the President.

The head of state, unlike any other Minister or Deputy, the written posts refer to the expression of personal opinion. Every word is politics, affecting international relations and the economy.

Politicians of high rank rarely or never allow writing messages without moderation team that checks the words on the ethical, legal and political norms. Donald trump is the only head of state permitting the publication of personal opinion, ambiguous phrases, open discussion and insulting other politicians.

Social phenomenon of the trump

Donald trump takes the second place by number of tweets among the politicians of the world (the first king of Saudi Arabia). The President of the United States is using two accounts, having inherited from Barack Obama the right to @POTUS and running a private account, @RealDonaldTrump.

According to linguistic analysis, Twitter for trump is a tool for sufficient straightforward and uncompromising criticism of the opponents, constant praise of the individual, demonstrate the superiority of the United States.

The President understands and is aware of the power and influence of his own words, trying to inflict maximum damage to the selected enemy individual companies or the state. In this respect, the term “diplomacy” is not well suited to the pressure of verbal attacks, where there are thin strokes, and invitations to negotiate. Chapter one economy in the world has a capacity of 140 characters, the threats and negativity or expresses complaints or grievances.

Fundamental analysis of Twitter Donald trump

As mentioned above, the 45th President of the United States “mere words”, clearly bringing 140 characters tweets thoughts and ideas and hinting at future action. Linguists are still arguing, what exactly is deliberate or innate poverty of language, but it is quite black and white and clear for the traders, even beginners with a minimum level of knowledge about the stock market, currencies and commodities (particularly oil).

The main rule is to sell everything that is criticized, not paying attention to praise, which usually refer to published statistics, which prove, according to the President, America’s greatness achieved under his leadership.

This phenomenon is known as MAGA – acronym for a campaign slogan “Make America Great Again!”

Analysis of criticism of Donald trump easy seriality and focus, the US President will not give up in progression towards the goal. He tries to go to the end while independently and publicly don’t close the topic, considering the goal is achieved, or the conflict is settled.

Here traders are very easy to track the subject matter for publications in the business press and wait for the new batch of tweets, while the topic is not exhausted. Below are historical examples of messages and reactions of each market of interest to Donald trump. From the examples it is clear that the only adequate response to another post it was criticized the push of a button “SELL”.

Despite the influence of the person and power of the American economy, the impact of the verbal message of the President looks for traders as regular news, which is trading within one to two hours, reinforcing the trend or the countertrend making a sudden movement.

Is also important time of the day: published in night session tweets will greatly affect Asian markets or currency, while other tools will show moderate reaction.

Verbal influence Donald trump on the Forex market

The message in the social network of the U.S. President traditionally affect the dollar, slightly affect the Euro, Mexican peso, canadian dollar and Japanese yen. Possible random attacks against any currency, under the verbal onslaught of the fall of the ruble, Turkish Lira, Indian rupee.

The greenback is suffering from the developments on the two topics that have become permanent:

- China – trade agreement or sanctions;

- Fed policy;

- A currency war.

In the first case everything is simple – any promise to introduce a (complement) sanctions turns into a sharp appreciation of USD to all currencies.

Investors have “cache”, dropping the action and “Parking” the money in dollars or Treasury bonds of the United States. Tweets with a positive assessment lead to the fall of the dollar as a “stash” goes to buy shares in companies that may benefit from resumption of trade relations and expansion procurement of American goods in China.

For example, on 18 June 2019 EURUSD fell ahead of the fed meeting but the tweet just woken up (6-34 in NY) President, who promised to meet with the leader of China at the G-20 summit, marked the bottom and eased the pressure of the bulls.

As mentioned above, traders should consider the time of day and short duration of tweets. In this example, the tweet came in the European session, so called more lively response than unexpected messages on the night of the 6th of may.

The American President has decided that China is delaying the negotiations, and it’s time to enter regular duties. Surprised all investors, members of the official delegation of the United States, residing at that time in Beijing, and the foreign Minister of China, who just could not find the words, but was after this incident most loyal followers @realDonaldTrump.

The Forex market has responded to this event two weak candles down on EURUSD, and the pair had continued the growing trend.

The main reason for criticism of the fed is a well-known leader of the American nation was disappointed in the successor Janet Yellen. She was a supporter of the hawkish policy, trump was waiting for their own candidate, who came to replace it, low, almost zero rates.

Powell was disappointed with the “boss”, raising the rate; after this event, the periodic attacks on the fed was the cause of the weakening of the US dollar.

Any criticism is perceived by traders as evidence of two possible events: the removal of Powell’s from the post or assignment of the FOMC, which will lead to lower interest rates. The result was a second event, but trump manipulated the dollar with this topic in 2018.

Criticism of the fed’s policy affects the weakening of the dollar more than “kicks” of China. For example, in late March, late evening post trump allowed the bulls almost completely redeem the dollar strengthening over the two candles at the end of the day.

In 2019 on Twitter @realDonaldTrump there is another topic that can be a constant source of weakness of the American currency. The US President decided that a national currency is especially devalued (especially in China) and threatened to unleash large-scale currency war.

The tweets came at the end of the day, but called the volatility, which resulted in a reversal and a weakening dollar.

The canadian dollar is now rarely falls into the area of attention and criticism of trump, the country is one of the first to fall victim to the sanctions and gave up on the “discretion”. The American President “knocked out” of Canada’s new trade agreement to replace NAFTA, sometimes threatening another round of sanctions via Twitter.

You can highlight a clear pattern: canadian dollar falls whenever the President accused the country of unfair trade conditions, i.e. in 99% of tweets. The reaction pair to the negative message of solid growth.

For example, in June 2018 trump was offended by the speech of Prime Minister Trudeau, considering the boastful speech about the achievements of the canadian economy. It was enough of a message about “earnings at the expense of America” to the market opening on Monday 11 June “loonie left” for 75 points per hour.

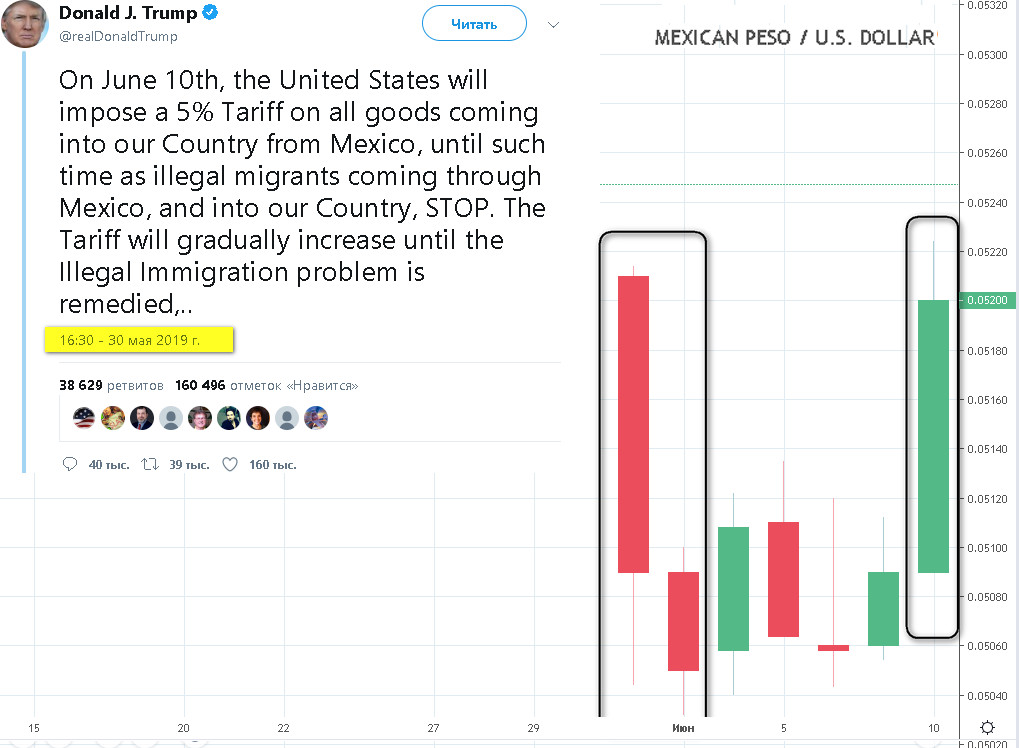

Mexican neighbor experienced a twofold wrath of Donald trump: if the topic of the free trade zone NAFTA after signing a new format of the contract USMCA is closed, the political tensions on the basis of the migration issues torpedo the currency of the country permanently. The business has estimated that losses from the verbal attacks of a strong neighbor exceeded $12 billion it would be Cheaper to buy out Twitter and permanently ban the account of the American President).

The latest verbal attack at the end of may reflected in the currency’s two-day decline and loss of 4% of the cost, this was due to unexpected tweets about the introduction of a progressive scale American fees from 10 June 2019. The evening of may 30 (the night of may 31 GMT) Donald trump has decided to deal with immigration, raising the monthly customs duties on Mexican imports.

Given the example of the history of fluctuations in the Mexican peso ended well, the authorities reacted promptly, sending to the borders of SWAT to stop newly arrived migrants and give asylum to those who have already been in Mexico.

As can be seen from the graph, the satisfaction trump the actions of the neighbour resulted in the return rate of the pre-crisis level.

The subject of fees was raised in relation to India, Russia, Turkey, European Union, and every time this led to about the same depreciation of the national currencies in the interval from several hours to days.

The Japanese currency does not suffer directly, despite the misunderstanding between the two countries over a trade agreement which they are negotiating right now. Donald trump refrained from the usual style of insults via Twitter in relation to the authorities of Japan.

However, any statements against China indirectly impact on the pair USDJPY, and affect the whole Forex market.

Tweet-trampoline and the stock market

The stock market is the main goal of Donald trump, the American President repeatedly presented in social networks and during public speeches historical records of the major indexes of stock as a personal merit. This strategy fits in MAGA, many experts believe that the rate of S&P500 will be one of the arguments to justify the re-elections of the President.

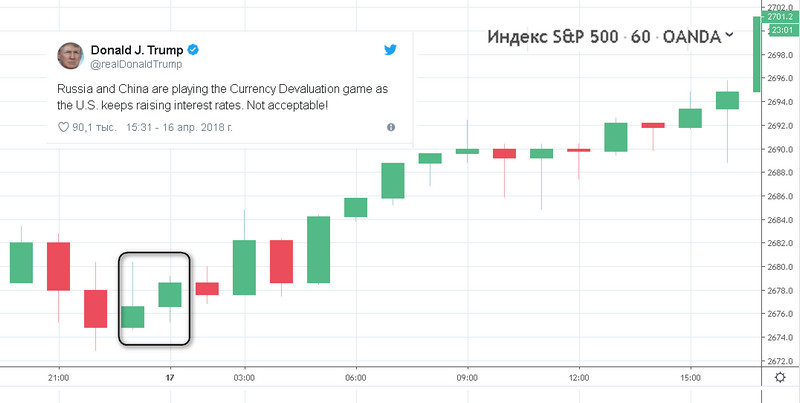

Tweets that weaken the dollar and urging the fed to lower rates, help the growth of the market, as you can see from the example April 16, 2018. Unlike the Forex market where the dollar is quite weak played the prosecution of an American President put forward by China and other countries in special devaluation of the national currency, the S&P index has gained strong growth momentum despite the closed US exchanges.

Donald Trump is not always possible to facilitate the upward movement of stock markets because of the trade between the USA and China, but in this case the negative is a short-term effect. For example, on may 5th (6th Moscow time) an unexpected message to return to the duties has led to a drop in S&P500.

Any positive statement in China is played by traders in the stock market, especially in the case of surprise statements. For example, the quiet period of the negotiations, June 18, Trump was enough to say about constructive phone conversation with the leader of China XI Jinping, to ensure strong growth across the global stock markets, including the S&P500.

The stock market and the national currency are linked direct correlation, therefore, any mention of specific countries in the reports of Donald trump turns into a drawdown on the local stock exchange. Particularly hard to “get” the Chinese indexes, on the second place “suffers” from permanent migration the attacks of the Mexican stock exchange.

Action on other markets randomly. Donald trump is unpredictable may “take up arms” to any country, accusing it of trade imbalances or covert state support of individual sectors. In the end, the threat of duties, leading to panic sales of shares at the opening of the exchanges.

A separate line is possible to define the shares of different companies involved in different time under fire of criticism of the American President due to a lack of patriotism. In particular, trump is seeking to return the plants to the territory of the United States, therefore, criticizes automakers and IT companies.

The reverse reaction of investors to the criticism periodicals, it raises circulation and the value of the shares of the publishing house. Praise products retailers turns into a boycott of the buyers, but the publication of such tweets is very rare.

Fight Donald trump with rising oil prices

America will be great again, if oil prices rise above $80 per barrel, this is the case when the value of quotations of “black gold” in advance predicts the appearance of tweets critical of trump. With a strong level of threat, the American President begins to write messages mode enabled Caps Lock.

Well-known economist energy market Philip Verleger investigated the relationship of the messages of the social networks and in oil prices, which allowed him to conclude about the long-term impact of the policy of Donald trump at the cost of a barrel.

Regardless of OPEC policy, the 45th President of the United States will not tolerate oil at $90 – this phenomenon is called “call option trump”. Traders surely begin to gain the position of the shorts when quotes rise above $75, expecting to strengthen all kinds of measures to curb rising prices of black gold.

Tweets — just one of the tools, Donald trump, affects the position of Saudi Arabia and other OPEC countries from within, hold as the last trump card the sale of the government’s stockpile of oil in the amount of 649 million barrels.

The name of the phenomenon arose by analogy with confidence in the policies of the fed: “a call option Alan Greenspan” forced traders to buy the stock based on the belief stimulus measures. Head of the financial Department always meets the expectations with the reliability of the option guaranteeing the transaction at a predetermined price at the expiration time irrespective of the market situation.

How to automatically track tweets trump on currencies Forex

Social networks are gradually becoming a real source of insider information that causes many startups to create various apps with “smart filters” sorting and allocating significant INFOtrend according to the specified settings.

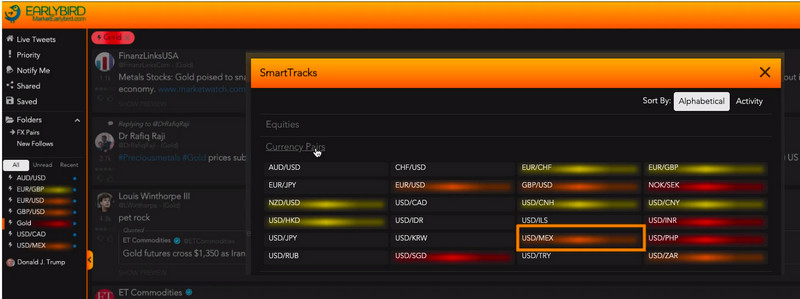

The EarlyBird programme is one such innovative trawls Twitter, approved by the regulator of the EU for compliance with the rules of MiFiD II. The application focused on contextual search relevant information on a given Forex pair.

Despite the absence of the Russian version, works ON friendly trader level. Pre-verificarea own account and installing the application, the trader can choose:

- To track a specific account or all of twitter.

- The currency pair filter all messages, or specific tweets (in this case, Donald trump).

In this case, on the desktop or in the app to show only messages that contain keywords. In the above example the message will get to the filter if there will be the following: Mexico, migration, fees etc. the List is constantly updated and monitored artificial intelligence, tweet appear, even if it is misspelled.

Conclusion

Donald trump became the first President in the world, able to shape the agenda for the media, indirectly by controlling the content business publications, who should discuss or criticize already expressed by the head of state’s position on a particular political and economic issue.

Releasing 11 short messages a day, trump applies to all issues, from dismissals and appointments of officials as it was with Secretary of state Mike Pompeo before the bilateral meetings at the level of heads of States (e.g., North Korea).

Analyzing Twitter with the help of smart apps, the trader gains an advantage over insiders major companies. In the twenty-first century social media replace media, giving news before they appear in the tapes of news agencies.