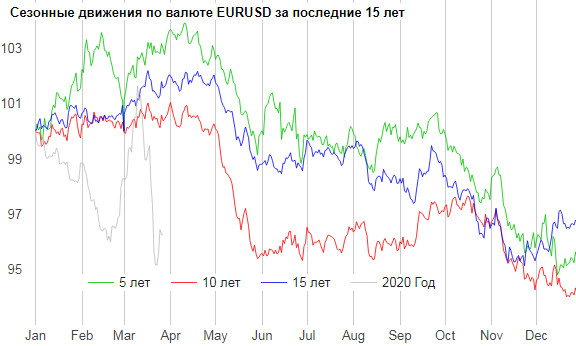

It’s no secret that Forex currency pairs, like any other instruments, have a so-called “historical memory”. Movements during periods of local and global crises often coincide to the level of mirroring, which allows analysts to successfully draw analogies and predict future market movements. Corrections from resistance and support levels work according to the same principle.

Today we will try to understand a very unusual topic. We are ready to bet that you may have heard about affine transformation, but you did not even guess about its application in the context of trading. And there is something to see even for currency speculators who have seen a lot)

An ideal example of such constant coincidences is the chart of our Forex seasonal fluctuations service, which allows predicting global trends with a high degree of probability.

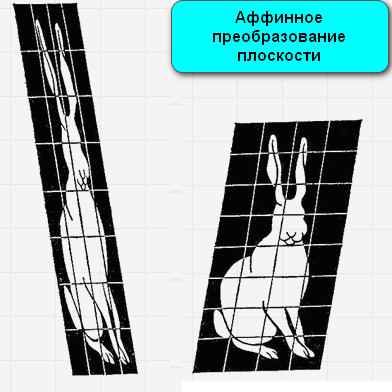

It is inconvenient to compare and compare the movements of currency pairs in the past and at the moment, they can be replaced with simple elements of geometry figures – horizontal and inclined lines in the form of price channels. If we consider the historical memory of the market to be a proven fact, then the resulting figures are subject to affine transformation, capable of conducting a graphical analysis in advance on the site of the “future” until the moment when the price appears there.

Affine geometry in trading

Affine geometry describes methods of transformations and projections of figures, the prerequisite of which is the preservation of their shapes and properties. Simple examples of affine transformation are: a straight line projected onto another plane as parallel or intersecting; a square stretched to a rectangle, etc. Preserving proportions in affine geometry is not necessary, it is only important that the square never turns into a triangle.

Affine geometry works in trading, starting with simple examples of the transfer of price channels, when quotes break through the boundaries and shift to a new level in another area of the chart.

More complex examples: Elliott waves, various graphical patterns (Hartley and similar figures), candle analysis. Every time a trader looks for exactly similar combinations of candlesticks, rising and falling waves on the chart, without paying attention to their proportions.

Identification and projection of patterns allows you to determine entry points, profit-taking levels and loss limits. The methods of graphical analysis are not suitable for all traders, especially beginners are often confused:

- Making mistakes in the construction due to ambiguous rules for the image of figures;

- Skipping patterns due to lack of experience;

- Showing inattention to emotional stress.

The last factor is a big problem of trading, on the subject of which many books have been written, including by Van Tharp and Mark Douglas. It is difficult for a trader to concentrate on a “working” chart and not notice the dynamics of changes in candles. Affine transformation solves these problems, since the lines are built on a “blank field” in the future period of the chart, transferring price corridors from the past without changing the size of the channels built automatically.

Characteristics of the trading system

Platforms: any where there is a package of graphical tools

Currency pairs: any

Timeframe: D1

Trading time: beginning (end) of the session

Recommended Brokers: Alpari, RoboForex, TickMill

Description of the trading system

On the chart of daily candles, divided by monthly segments (CTRL+Y in MT4), we find sections of the uptrend and downtrend.

We describe the found nearest uptrend and downtrend using linear regression (LRI). We transfer the received channels a month ahead in the form of a grid. As the price appears on an empty section of the chart with our grid of quotes, we trade breakouts and countertrends according to the rules described below.

Rules for building a grid

The price corridors described by LRI are built in strict limits of the month. The start and end points for the convenience of plotting will give period separators, which can be enabled on the “General” tab in the properties window of the graph, called through the right mouse button menu, or by the quick access option (F8 key).

Linear regression is located in the Insert menu under the Channels option. This is an automatically calculated tool based on a formula that determines the angle of inclination and the location of the midline. It is removed at an optimal distance from all candle closing prices in the area selected by the trader.

One of the LRI boundaries is postponed to the level of the maximum deviation of the exchange rate of the currency pair in any direction. The second one is built at the same distance parallel to the middle line.

At the last candle of the current month, the trader conducts the first channel of linear regression. The next step is to find and build a channel opposite to the first trend. In the figure below, there was a downtrend in the last month, so we need to look for the nearest uptrend, in the example it was two months ago.

Both linear regressions should be transferred (affine transformed) to the still empty section of the next month. A prerequisite is to maintain the distance between parallel lines using equidistant channels.

The lines of the current LRI can be extended using the equidistant channel tool. In the same way, you can copy the upward regression by plotting its average line from the closing minimum of the last candle of the month.

The resulting grid is built into 2 cells up and down from the middle line – this is due to the principle of the normal distribution of a random variable (σ) used in Bollinger bands and other indicators. 95.45% of the random variable values are located within 2σ, which gives a high probability of correction at the second constructed level.

Rules for working on the strategy

The rules for working on the strategy are standard – the levels transferred earlier can be used for trend and countertrend trading.

A short position is opened if the slope of the linear regression in the previous month was down, the tail of the growing candle touched the upper limit, but the closing price remained inside the channel.

If the regression in the previous month was directed upwards, then a long position is opened under the same conditions.

The short is also opened when the candle breaks the line of the descending channel, if the next candle closed below the upper line. Long opens on “mirror” terms.

Two consecutive candlesticks with a closing price above or at the level of the linear regression channel of the previous month cancel trades on the trend. In the case of long, the situation is reversed – two falling candlesticks should break through the ascending channel.

Countertrend transactions are made according to approximately the same rules, but in the second superstructure. The figure below shows the strengthening of the trend, shifting quotes to the second level of regression of the previous month, which is parallel and coincides with the size of the ascending channel.

A growing candle breaks through the upper border with its tail, but closes inside the channel – this is a signal for a short.

Money Management Strategy

The transferred channel lines are ideal targets for take profits. When trading on a trend, a trader can partially fix a position at the second levels of the channel or close a deal when the regression lines break in the opposite direction (the two-candle rule).

Trades on the trend and against the trend are accompanied by a stop loss at the maximum / minimum of the candle, the tail of which has broken through the channel, or on the second candle that has returned to the channel.

Conclusion

Linear regression of the range of the next month allows the trader to quickly take into account changes in volatility. The figure below shows that during the crisis, the sharp strengthening of the US dollar in the EURUSD pair failed to break through the second zone of linear regression.

The reverse movement in the form of a strengthening of the euro and an even greater increase in the volatility of the daily trading range also “fit” into the linear regression channel.

This shows that such a technique has a right to exist and can be used by currency speculators in Forex trading.