Hello friends Forex traders!

Today we will talk about simple ways to improve the work of advisors. Without making code changes, changing the settings and optimization. What everyone can do, but what few people pay attention. And also touch on the subject of what to do, if the robot has ceased to be profitable.

Incidentally, part of the methods could also be applied to manual trading, so perhaps useful points for yourself extract and the proponents of the classical trade.

4 easy ways to improve the work of the advisers

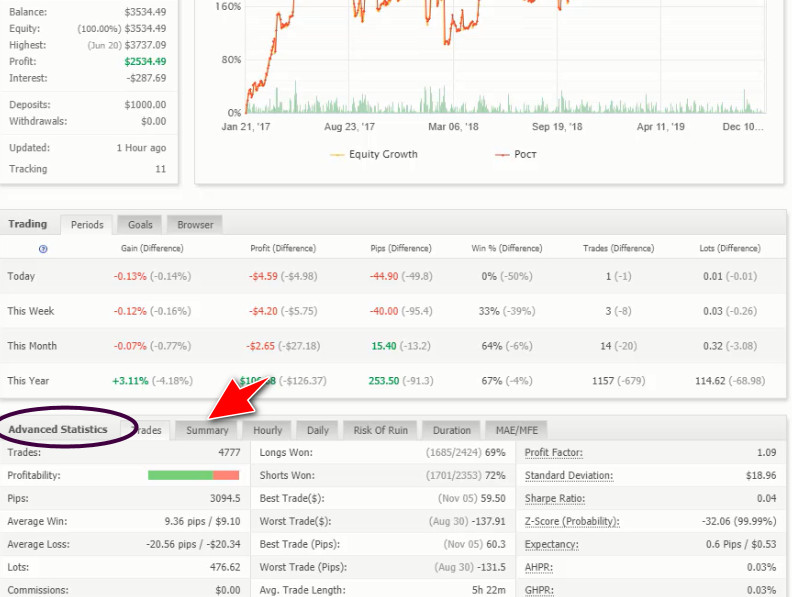

The strategy is tested in 2017; as seen in the figure above, the last period of trading similar to flet, which makes one wonder about optimization. How to do it without changing the presets – learn four simple tips that will suit any strategy, including manual trading.

1 — Remove unnecessary pairs

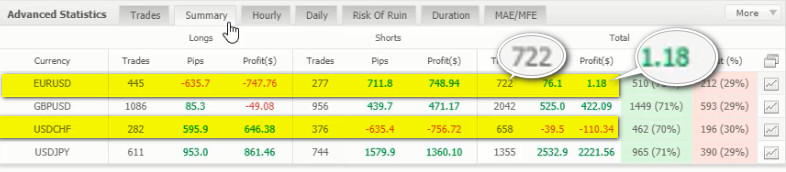

The scalability of the algorithm for other pairs – this is a definite plus, allowing you to diversify your strategy and reduce losses. It is written in many theories, but the statistics – are stubborn things. To see it, refer to the Advanced Statistics option by clicking the tab “Summary” on the page of Myfxbook monitor :

The EA to trade on four currency pairs, almost 3 years of trading have given sufficient historical data for determining “candidates for elimination”. The EURUSD brought $1,18 in 722 trades – ideal for the broker but bad for the trader his earnings barely covered the spread. USDCHF and leaves the list of trading instruments due to losses.

In the analysis of other instruments such as stock indices, it makes sense to consider separately the trading results in the long and short. The stock market is often in a prolonged growing trends and strategy can bring more losses for short positions. In this case set in the EA settings “Only Long”.

2 — optimization of the trading time

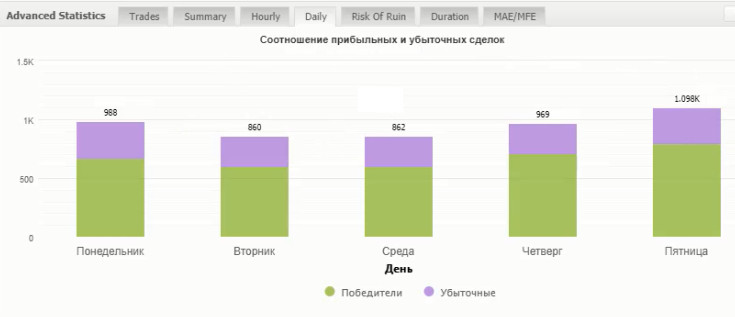

Traders familiar with the works of Larry Williams, known about his numerous tests of the impact of trade policies on different days, weeks and months. Monitoring of myfxbook allows you to keep track of summary statistics for each work day of the week in the tab “Daily” section of the Advanced Statistics:

In this example, the EA trades positive throughout the week, but if a losing day is found, you should define it a day. The example below shows a situation where the robot should only be run once a week, on Tuesday:

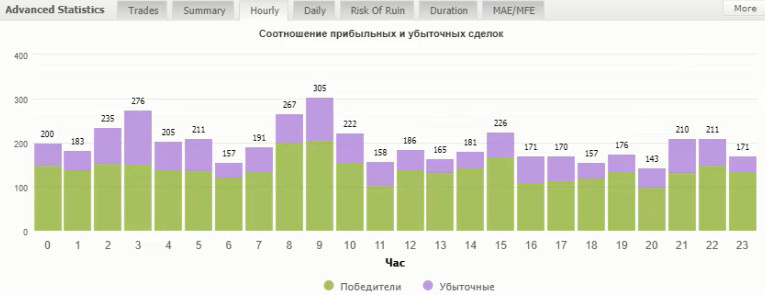

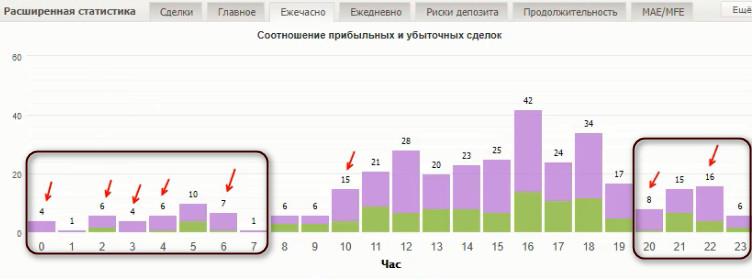

If the EA is actively trading intraday, you should analyze the hourly chart. In the example, there is no special claims – statistics everywhere showing the percentage of profitable trades above 50:

Often you can see a picture of the low efficiency of transactions early morning and late night because of low liquidity of trading in the Asian session. The situation shown in the screenshot below:

How to limit the time of work of the advisors in the Forex market, written a detailed article on our website.

3 — the Principle of non-interference

When trading within the day, sometimes even in the medium-term strategies, traders are advised to avoid trading in the time of the release of important fundamental news, and they shut down advisers. The paradox of this situation is that the tests do not do that, and it already indicates a controversial use of such actions.

The EA is not immune from the market force majeure, which occur often and affect stronger than “unexpected” data or unexpected change in the rate of the Central Bank. Suffice it to recall the actions of the national Bank of Switzerland, the closure of banks in Cyprus, a large sale of gold “at market price” of China, Pexit referendums, elections, Donald trump, etc.

Negative reaction to fundamental news does not fundamentally change the picture of the loss due to the inherent calculation of money management, but positivity can bring enormous profits, if instead of TP is a system trend following. To deprive yourself “practicing” news means to intervene in the rules of the trading system, which took into account the profits from the news.

4 — Sandbox

If the adviser ceased to be profitable immediately after launch or a little later, do not rush to optimize, try to minimize the lot size and set the strategy to “Nickel” or a demo account. The thing is that the correct idea underlying the trading system may be subject to seasonal periodicity of obtaining of profit and loss.

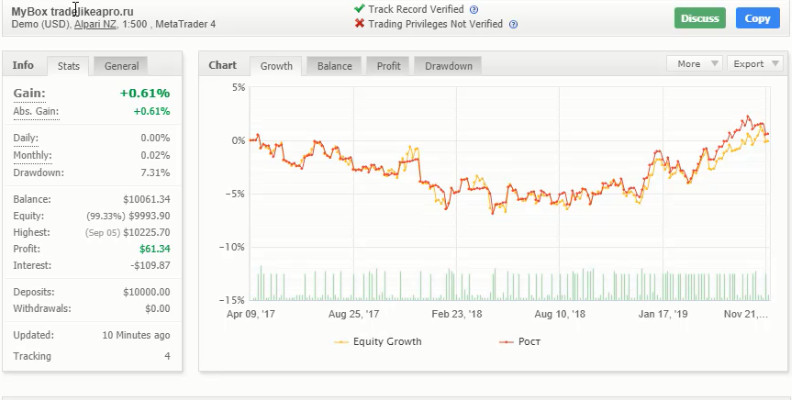

As example, the strategy of “night scalper”, almost perfectly flat working in low-liquid Asian session. The picture below shows the periodicity of the equity Advisor of this type. Profitable plots alternating with periods of loss, but it’s not a problem of tactics – it develops the activity session.

By placing the counselor in a kind of sandbox, continue to monitor performance. As soon as a stable and growing yield will be established for six months, start to gradually increase the lot size or put the system on a real account.

Eventually it will be possible to establish the average duration of profitable trading period and to determine the duration of unprofitable time. This will help to pre-plan the high and low investment.

Many of the ideas are on the market with a certain periodicity – the same night scalpers a few profitable years are replaced by several unprofitable years, the breakthrough strategies, grids, and many other classic tactics are similar periods of stagnation and periods of profitability. It’s like farming: it is harvest time and a time when you need to wait out the winter. Come “spring” and you can return to this tactic.

Conclusion

On our website published a lot of running ideas and strategies, a concept which has stood the test of time and will reliably work on. Many of them cannot be globally improved by optimization of the adviser, changing parameters which will increase profit only at some, not necessarily long, the site of the auction.

The trader will not be able with the help of tests to take into account the volatility, the dynamic cyclical nature of markets, changes in monetary policy of Central Banks, the global economy. This can be done by simple changes in trading activity within the day, within the week or by the abandonment of the currency pairs that have changed the fundamental conditions.

Listed in the material the tips are based on existing trade statistics, therefore, do not require testing and do not affect the parameters of the trading algorithm of your EA.