Investing in PAMM-accounts may seem very easy in theory, but in practice often have to wait prolonged periods of drawdowns to the Manager, and if not to close the investment account with a loss.

A competent strategy Manager selection and determination of optimal time of entry and exit from PMMA will help to avoid losses.

Today we will examine one of the tactics of investing, the author of which is a well-known financier Jack singer, a very original and effective.

The purpose of the user of the PAMM-accounts service in an ideal – to achieve a guaranteed return on investment with minimal risk of care less. The problem is that the ratings of managers and bid history cannot guarantee future profitable results. Manager can merge the account due to the human factor or software failure when using robots (expert advisors).

To hedge the risks of losses PAMM investment tactics help:

- Diversification – selecting multiple managers;

- A limited drawdown, the investor avoids accounts with a maximum loss of more than 30%;

- Antimartingale.

The last point is a subject of constant dispute, the method of averaging with increasing lot size is widely used on PAMM-accounts. In the hands of a professional, regulatory risks, it can be profitable for a long time, but the layman merges the account at the first of the long-term trend.

Limit drawdown to choose simply by looking at trade statistics; the main problem lies in diversification. The investor needs to choose the aperiodic account managers, able to cover the losses of each other, giving an overall positive result.

This challenge managed to solve the Jack Singer, the famous canadian financier and a major developer, who died at the age of 95 on 2 February 2013.

This billionaire for several decades actively and successfully invested in various mutual funds, distributing funds among several hundred or even thousands of asset managers, mutual Funds and hedge funds.

Gradually moving away from business in twenty-first century, he shared his own strategy of choosing investment instruments, which includes three points:

- Ranking funds (managers);

- The time of entry into the investment;

- The time of the withdrawal or replacement of the Manager.

The algorithm for selecting the Trustee from Jack singer

The strategy is based on a modified algorithm proposed in the late 90-ies of Jay Keppel, trading for 25 years on currency, stock and commodity markets, who wrote 4 books on futures, seasonal trade and rules of investing in stocks and funds.

Famous Manager offered investors Fund Management Alpha Investment strategy of selecting managers for the trust management, based on the rating of relative strength of performance for the semiannual period. The time of investment, is determined by signals moving average EMA with the 28-week period.

Jack singer was replaced by a complex formula relative strength in the selection of the rating on the difference between annual profit and maximum loss. The entrance point in the investment portfolio determined by short-term MACD, and the output – MACD with large values of the periods of moving averages.

Characteristics of strategy

Platform PAMM: Alpari

Trading platform: Metatrader 4

Indicators: MACD

Script: opamm_manbeastVo11

Selection rules for PAMM managers

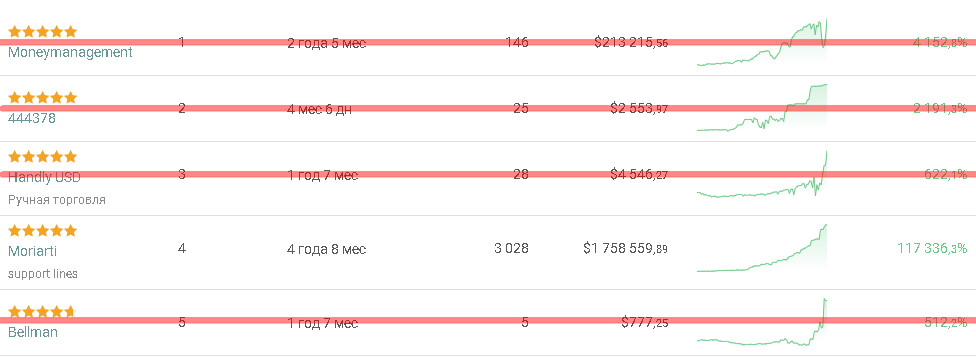

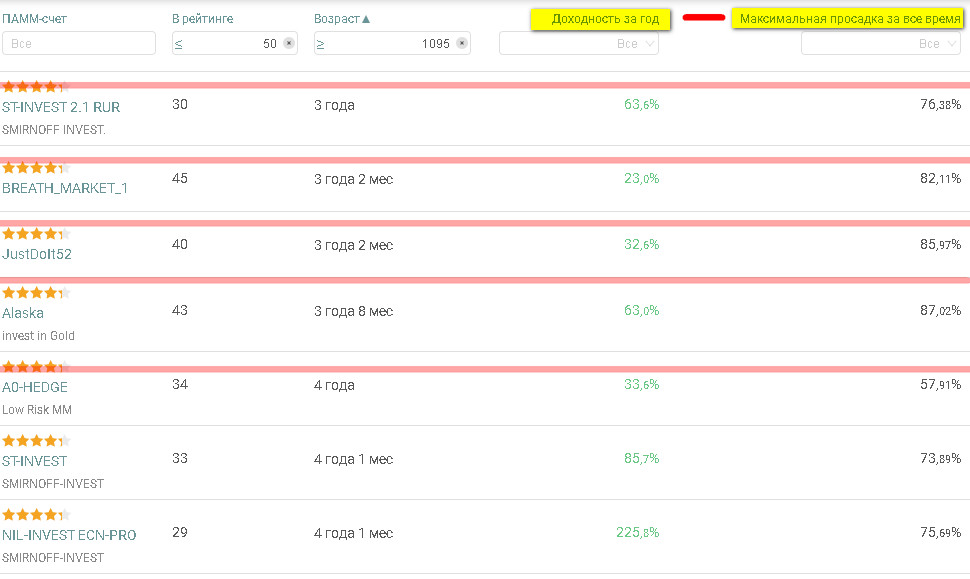

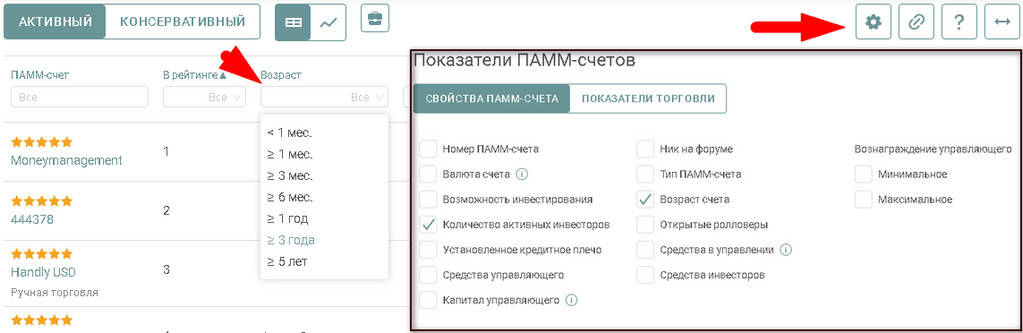

Open the rating of PAMM accounts of the broker Alpari, excluding accounts with a term of office less than 4 years.

The choice of a specified period due to the cyclical nature of the Forex market. A four-year cycle acts as a probationary period for managers and demonstrates the ability of a strategy to work on the long sections of the rising and falling trends.

Adjust the table by clicking the filter columns: the age of the accounts in the rating, annual income, maximum (for all time) drawdown.

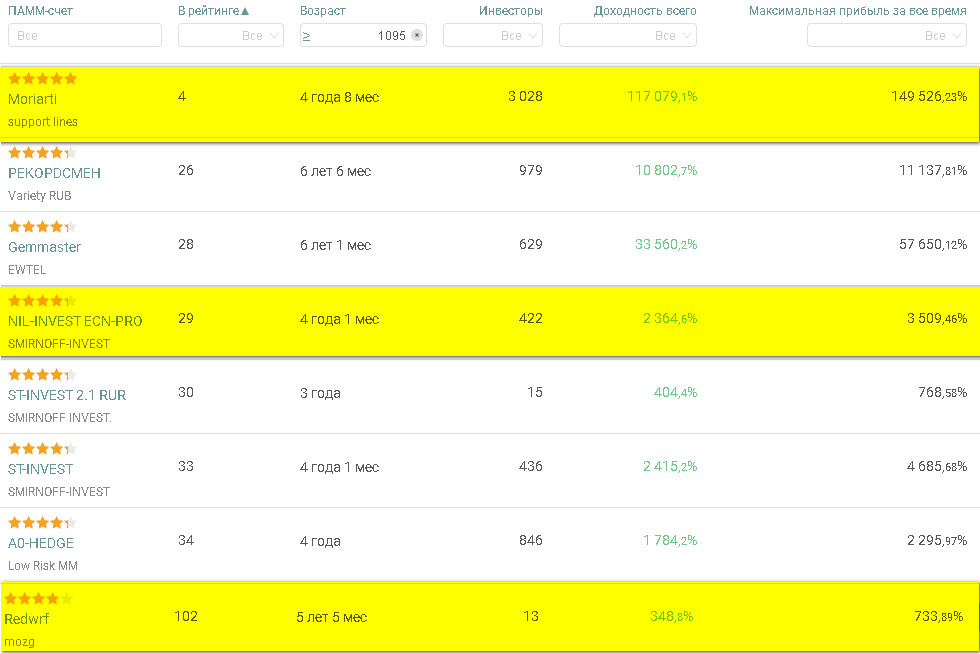

Create your own rankings, selecting them according to the greatest difference (Delta) obtained by subtracting the maximum drawdown of annual return, while excluding negative results.

As an example, we will use the proposed Jack singer algorithm for the first page from the full list of rankings Alpari.

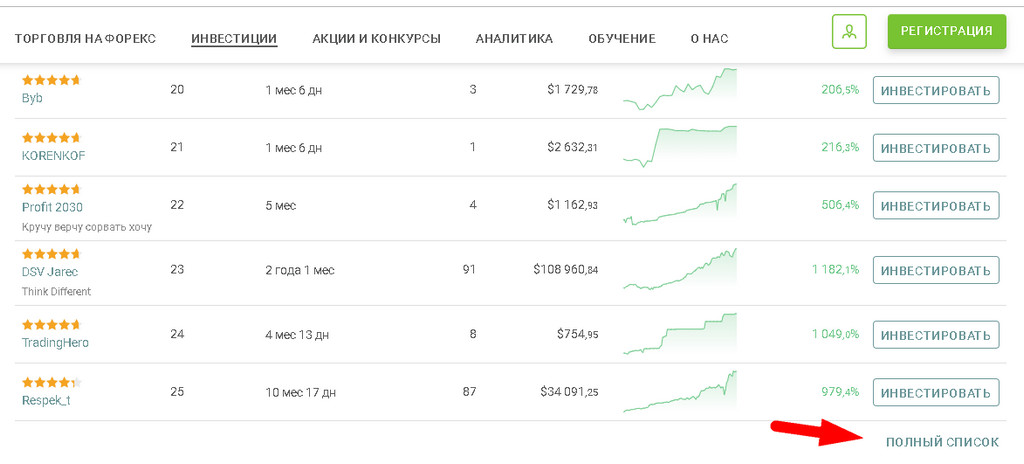

Open the page, go to the end of the table, click “Full list”:

In the Windows column, select the account age more than 3 years and push “Settings” where include the mapping in the column yield “per Annum,” drawdown “the Maximum” all the time.

By results of selection the best data for the Delta discovered on the PAMM-accounts:

- NIL-INVEST ECN PROSMIRNOFF-INVEST – Delta = 150,11%;

- Redwrf Shane – Delta = 118,02%;

- Moriarti support lines – Delta = 73,29%.

Download the history of trades PAMM managers Metatrader 4

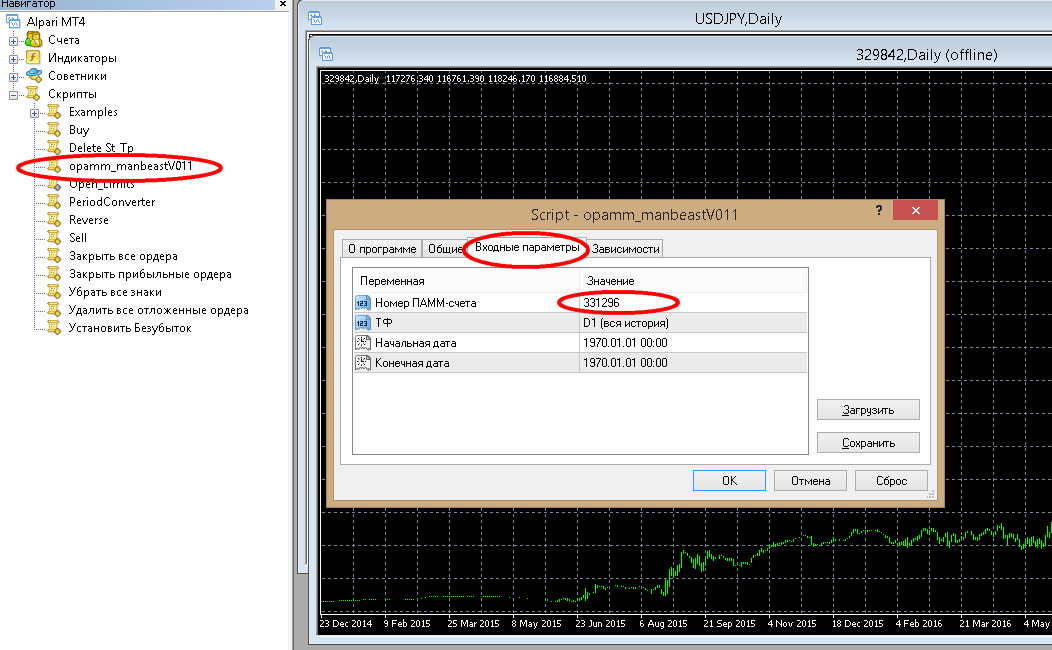

In the second stage Jack singer chooses an entry point in each of the selected portfolios of managers with using MACD indicator. Service on the Alpari website does not provide such opportunities technical analysis. Use the script opamm_manbeastVo11 (you can download it at the end of the article) that allows you to upload the trading history in Metatrader 4, where there is a friend to every trader a standard set of 50 indicators.

Guidelines for configuring, installing, and a description of the script (along with strategy technical analysis PAMM-accounts) can be found on our website.

After the script appeared in the Navigator window, drag it to any chart using the mouse. In the window that opens on the tab “Input parameters” list the number of PAMM account Manager, which can be taken from the table service of the broker Alpari.

Trading history will load in a separate daily chart by pressing “OK”.

The rules of selecting points of entry/exit for PAMM-portfolios

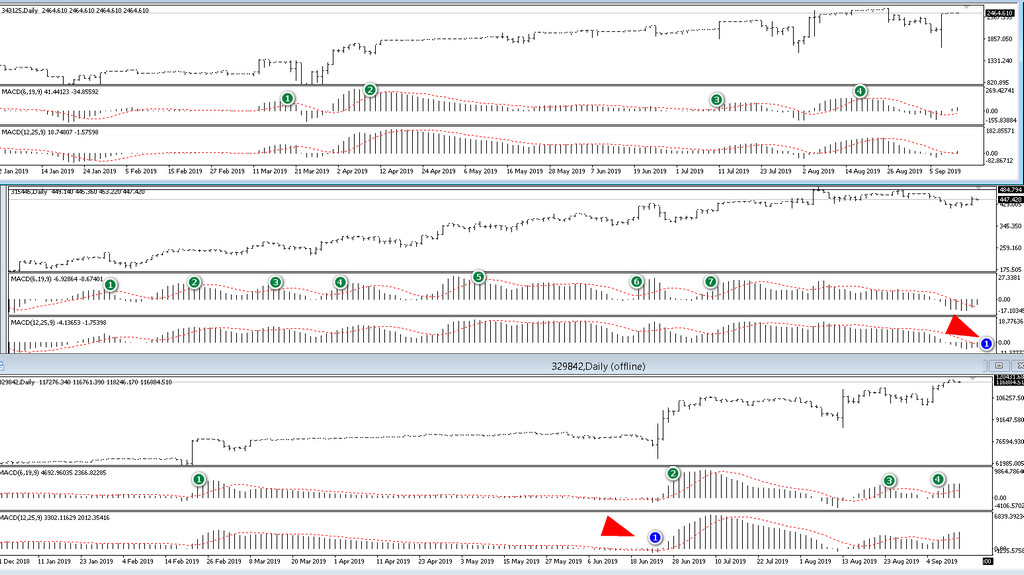

On the loaded graph of the yield of PAMM-accounts, add two MACD oscillator: the first one with the parameters 6, 19, 9; the second, 12, 25, 9.

Invest in this account, when the fast MACD will give a buy signal:

- The histogram bar is above zero and crosses the moving average line.

Investment speak (derived) from the portfolio Manager sell signal MACD slow:

- The histogram is in the negative region is crossed the moving average line.

The effectiveness of the strategy Jack singer

In the process of defining the strategy according to the algorithm of Jack singer was selected three accounts of the broker Alpari rating, were not carried out detailed analysis on the presence/absence of the martingale, and analysis by other standards of mathematical and graphical evaluation.

The assembled system is shown:

- The possibility of long-term holding investment – slow MACD showed the need for the release of the two portfolios, then the investment Manager NIL-INVEST remained untouched for six months;

- The total number of points of additional investment in three selected PAMM-accounts amounted to 15 signals issued by the fast MACD.

The proposed investment policy removes the factor of emotions and helps to systematize the inputs/outputs of the PAMM-accounts.

The idea of Jack singer quite work on modern areas for investment, don’t forget to check our quarterly Digest of the investor.

To download the script opamm_manbeastVo11

Installation and configuration script