Hello. Below are a few recommendations for trading in the Forex market on 5.07.2017

Calendar of anticipated events

11:30 UK. The index of business activity in the services sector

21:00 the United States. The publication of the FOMC protocols

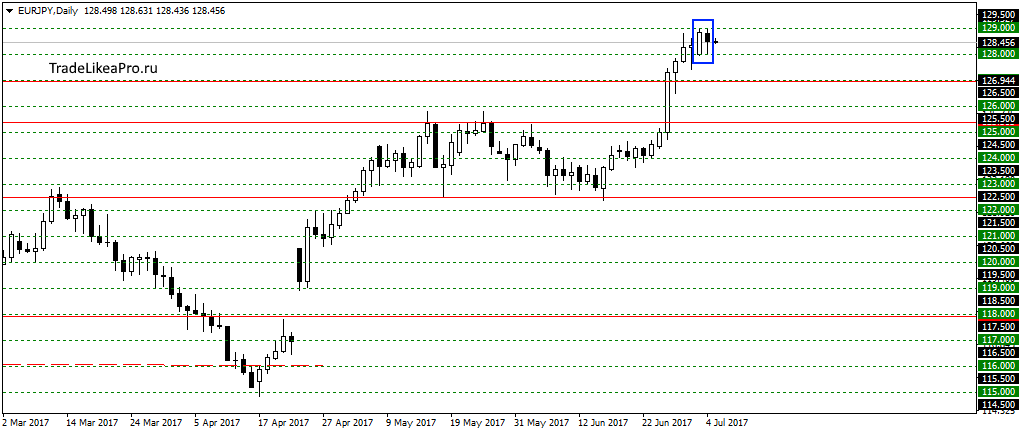

EURJPY

On EURJPY formed the pattern inside bar. Any serious support from the pattern, no, but maybe go in a downward correction after prolonged growth. Sales do not see here. I want to see continued growth in the area of 132.00.

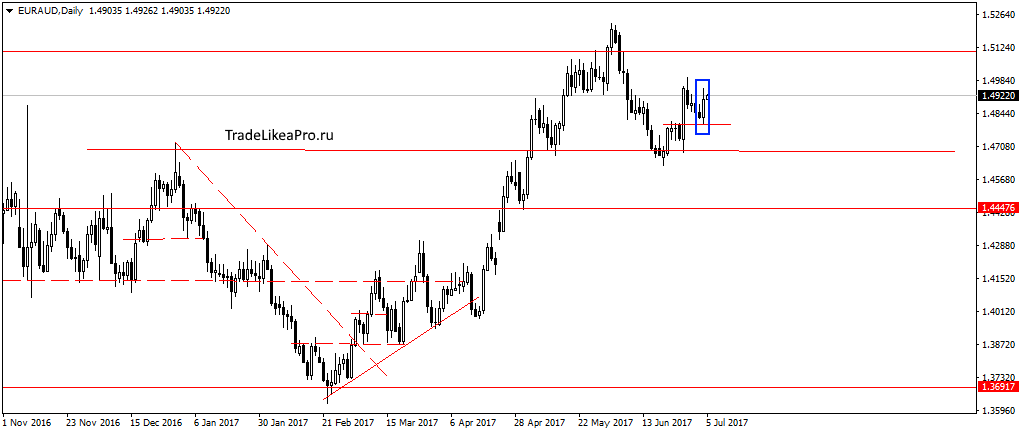

EURAUD

On the pair EURAUD has formed a good pattern of Absorption bounced off previous highs. A long downward correction looks like finished and should wait for the resumption of the up trend. Consider purchase here.

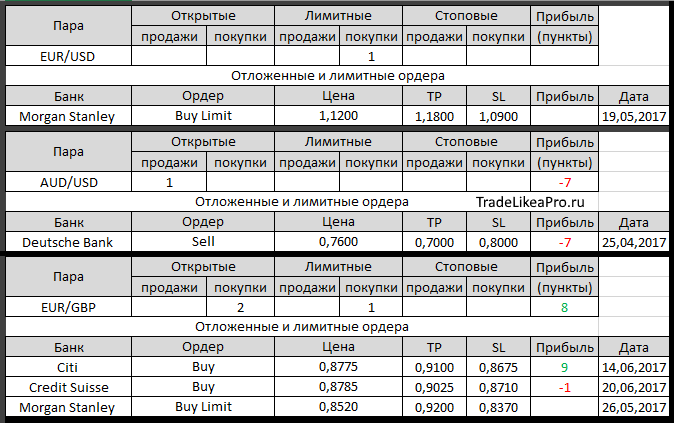

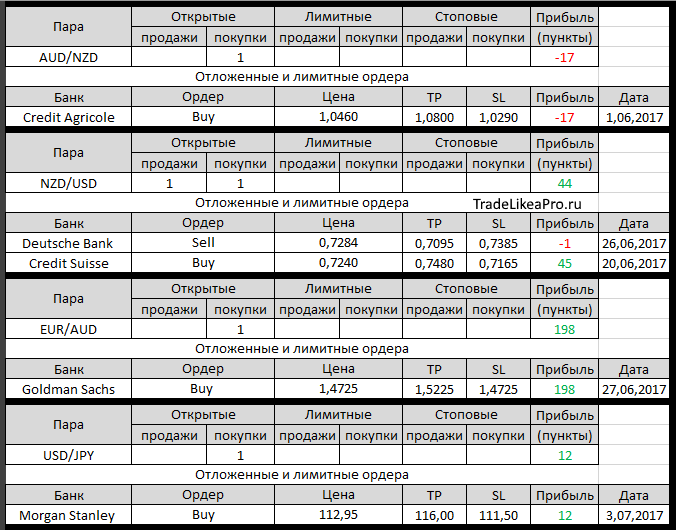

Open orders big banks

Changes in 4.07.2017

- Societe Generale changed SL to 1,0470 buying on AUD/NZD

- UOB otstupite buying on AUD/USD at 0,7690 of 0.7630.

Loss-60пп - Citi is triggered a Sell Stop on the AUD/JPY with 86,25

- ANZ work TR for sale on AUD/CAD at 1,0180 targets 0.9900.

Profit +280пп - Societe Generale was closed by SL at breakeven in buying USD/CAD at 1,0460 1,0470. Profit +10пп

Fundamental analysis

APR

A stock Asia-Pacific markets closed with a decline today because of the growing tensions on the Korean Peninsula have refocused investors ‘ interests on the assets of safe Harbor, including JPY, bonds and gold. In addition, the celebration of independence Day in the United States and a small number of economic data in the region contributed to the decline in trade volumes and risk appetite in General.

The broadest regional index MSCI rose by 0.1%, while Japan’s Nikkei eased 0.6 percent, while South Korea’s Kospi closed flat. E-Mini futures on the S&P 500 weakened slightly. ASX in Australia fell by 0.35%, while the canadian TSX fell by 0.34%. Gold firmed 0.3% and is trading at $1227.31 per ounce.

USD fell 0.27% to JPY 112.97, and the us dollar index decreased by 0.1% to 96.127. On the economic front, data — reduction index of purchasing managers for China, from 52.8 in may to 51.6 in June. On the geopolitical front, North Korea said it tested a newly developed Intercontinental ballistic missiles that can carry a heavy nuclear warhead. South Korean and American troops on its part issued a series of missiles in the waters off South Korea to demonstrate its capabilities for precision response.

Europe

European shares traded lower, although it is worth noting that the descending trend was formed directly in the end of the trading session, but was strong enough to block the early intraday gains. This result led to the global decline in risk appetite and low trading volumes in the United States, as well as a statement of the chief economist of the ECB Peter Pratt, who urged patience and waiting the required rate of growth of inflation. Such comments in light of the recent events were estimated as a deviation from early bearish targets of the Bank.

The pan-European Stoxx 600 fell by 0.29% to 382.30, while Germany’s DAX fell 0.31% to 12437.13 and the French CAC 40 slipped 0.40% to 5174.90. As already noted, investors expect more aggressive statements about monetary policy of the ECB, but faced with the current amendments to the agenda that, in combination with ultra-low rates charged by the Central Bank of Switzerland last week suggests that the tightening monetary policy of the European Bank will not happen soon.

EUR, however, traded slightly higher most major currencies, adding 0.01% against the USD and entrenched at the level of 1.1358. This can be explained by the fact that the current pace of economic growth, the ECB remains generally favorable, as evidenced by both production and consumer sentiment, breaking multi-year highs last week, not to doubt, at least in the long-term prospects of tightening.