Hello. Below are a few recommendations for trading in the Forex market on 8.08.2017

Calendar of anticipated events

17:00 USA. The number of open vacancies on the labour market

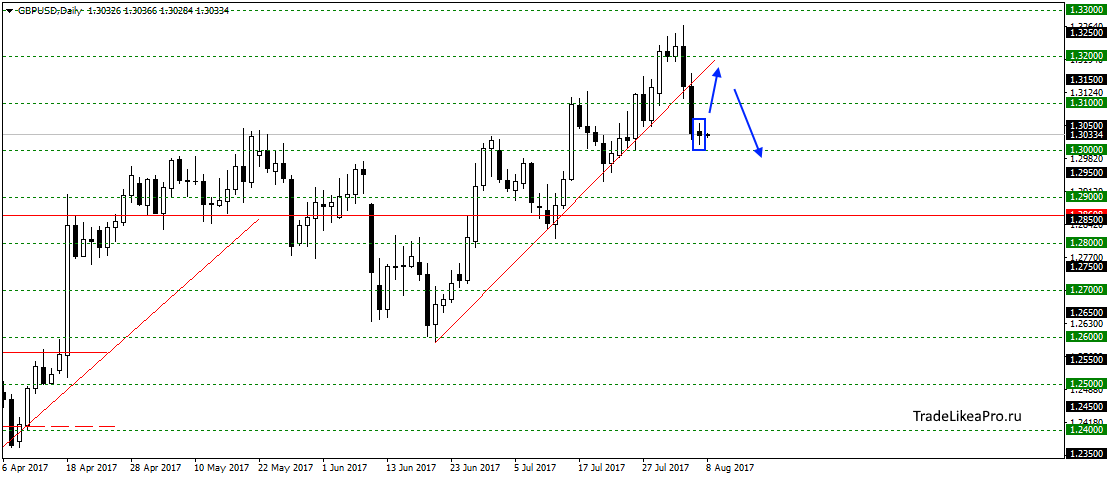

GBPUSD

On GBPUSD has formed a Doji in the area 1,30500. Will probably start a correction back to the previously broken trend line. Then try to break down the trend is downward.

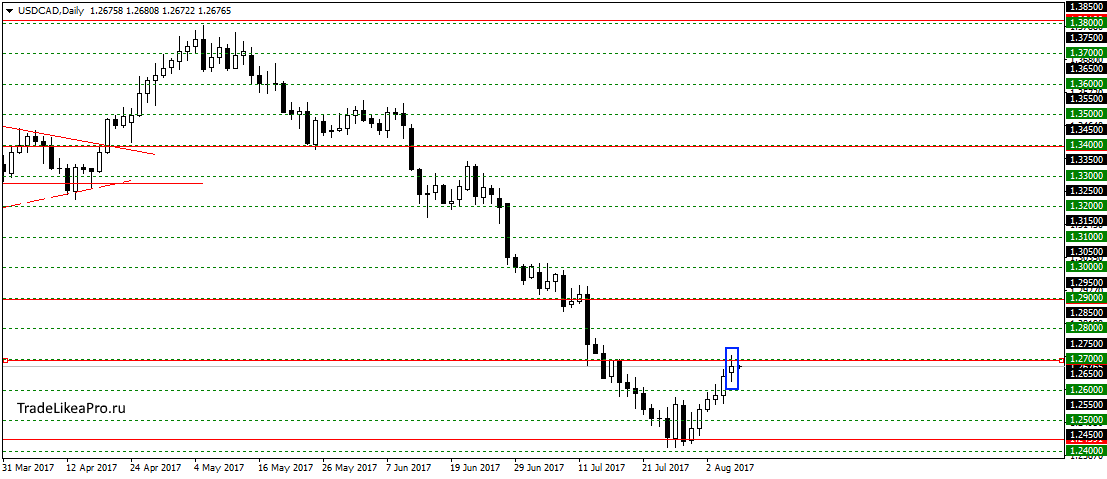

USDCAD

On a pair USDCAD in the same pattern Doji and price stopped in the 1,27000. May complete the correction and will resume the down trend. Consider there sales.

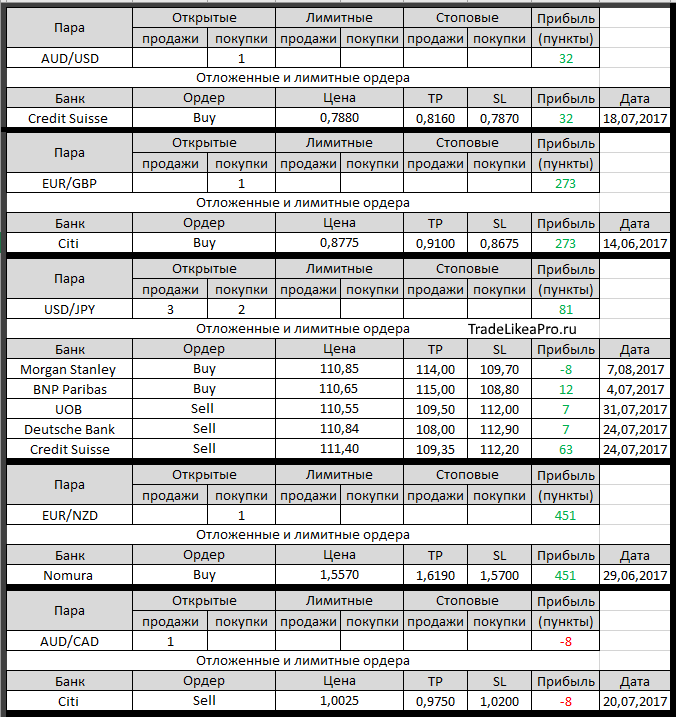

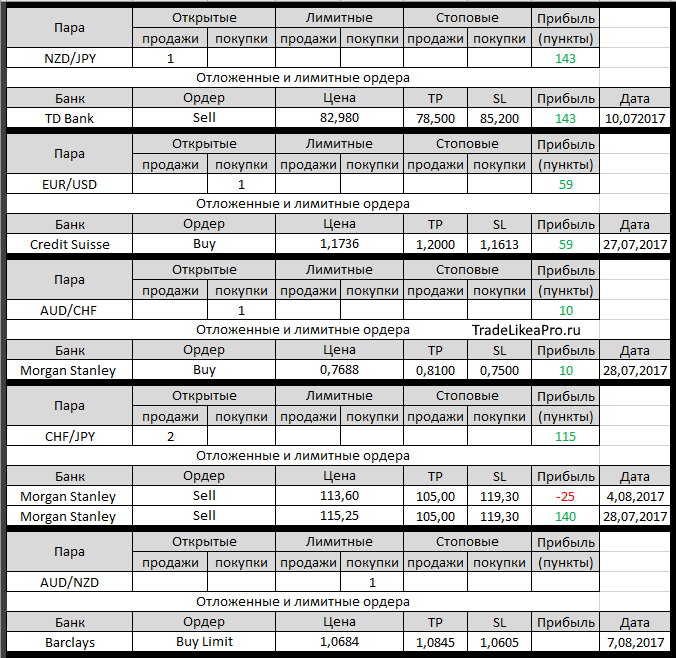

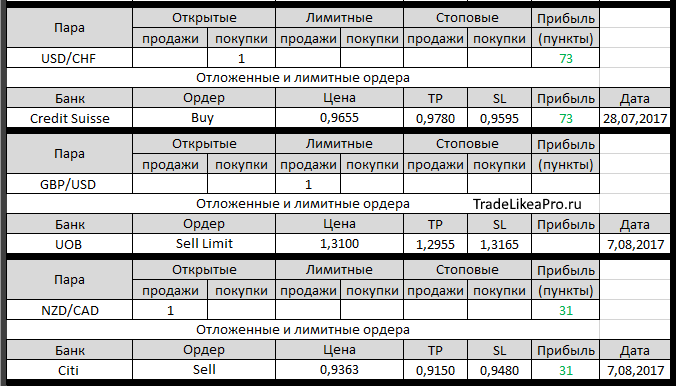

Open orders big banks

Changes in 7.08.2017

- UOB opened a Buy on USD/JPY with 110,75, TR – 112,50, SL 109.80

- UOB closed market a Sell on USD/JPY with 110,55 at 110,70. Loss of -15bps

- UOB has placed Sell limit on GBP/USD with 1,3100, TR – 1,2955, SL 1.3165

- Citi has placed a Sell Limit on NZD/CAD 0,9363, TR – 0,9150, SL – 0.9480

- Citi triggered a Sell Limit on NZD/CAD 0,9363

- Barclays has placed a Buy Limit on AUD/NZD with 1,0684, TR – 1,0845, SL 1.0605

- Morgan Stanley has opened a Buy on USD/JPY with 110,85, TR – 114,00, SL 109.70

- Credit Suisse closed by TP in buying USD/CAD at 1,2465 1,2700. Profit +235п

Fundamental analysis

APR

Asian stocks fell, after data on Chinese manufacturing overshadowed optimistic global growth prospects, resulting in currency and commodities eased in price. Beijing announced that growth in imports and exports in July presented a lower volume than expected.

The MSCI index for Asia Pacific increased by less than 0.1%, while the market of South Korea fell 0.2% and Japan’s Nikkei declined 0.3%. The main markets of China also suffered losses. However, on wall street the Dow rose 0.12%, the S&P 500 added 0.16%, and Nasdaq rose 0.51%. Dow closes at a profit for 10 consecutive session, and is three days from being able to break records in 1987.

In currency markets the U.S. dollar index that calculates the change in the value against six major rivals, was down 0.16%, well below the 93.286, and not far from a 15-month low 92.548. Risk assets and generally muffled, but besides investors expect the negative data on inflation in the United States this week, the Federal reserve is following a cautious approach to the prospects of policy tightening bets.

Europe

The major European stock indices have closed mixed, as the single currency rebounded, despite the strong market position of the shares of mining companies. However, the recovery in the European markets on Monday slowed unexpectedly, and at the same time, Germany released weak data on industrial production.

The Stoxx 600 dropped 0.14 percent, or 0.52 points, to 382.01, while the CAC 40 in France gained 0.09 percent, or 4.45 points to 5207.89, and Italy’s FTSE Mibtel rose by 0.43% or 95.38 points to 22031.17. Among the leading sectors were basic industries, whose index rose 1.69% to 422.55 on the growing demand for steel and iron ore prices in the Chinese trading hours.

EUR strengthened against the CHF and GBP, and 0.06% against the USD, which traded near the level of 1.1808. Against other competitors, the single currency weakened. Since the USD is in a depressed state today, this small increase in EUR can serve as a false signal, while the Federal office of statistics says that industrial production in Germany fell 1.1% with forecasts of 0.2% growth.