Hello. Below are a few recommendations for trading in the Forex market on 4.03.2020

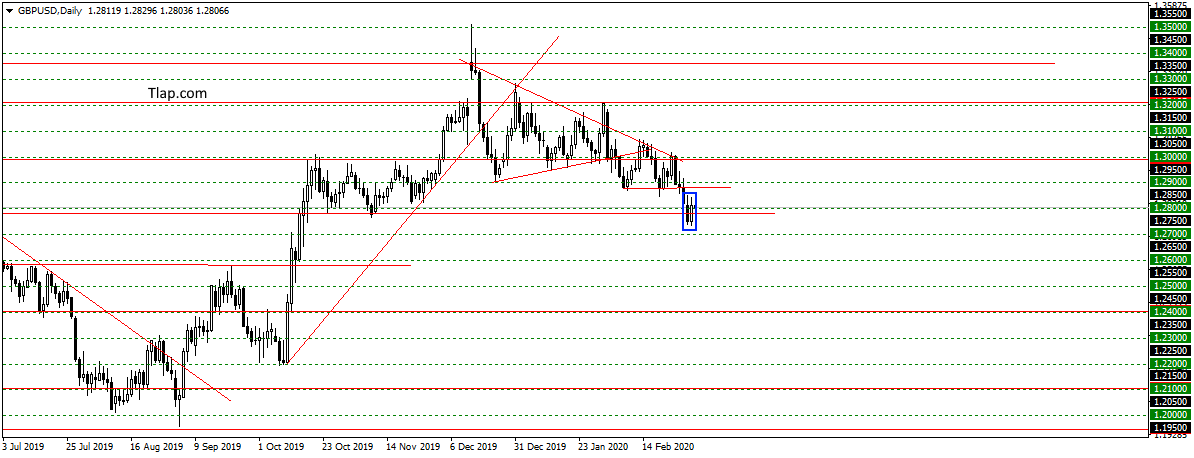

GBPUSD

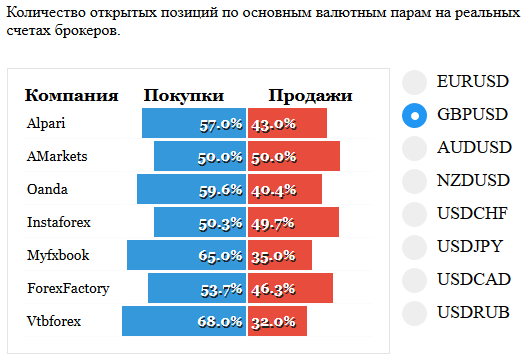

On GBPUSD the second time failed to pass the level 1,27500 and bounced formed a pattern of Rails. Waiting for the correction to reach 1.2900 levels district-1,29500, and from these levels you want to see the continuation of the fall and the trend is down. Buy here do not consider, as they are against the trend.

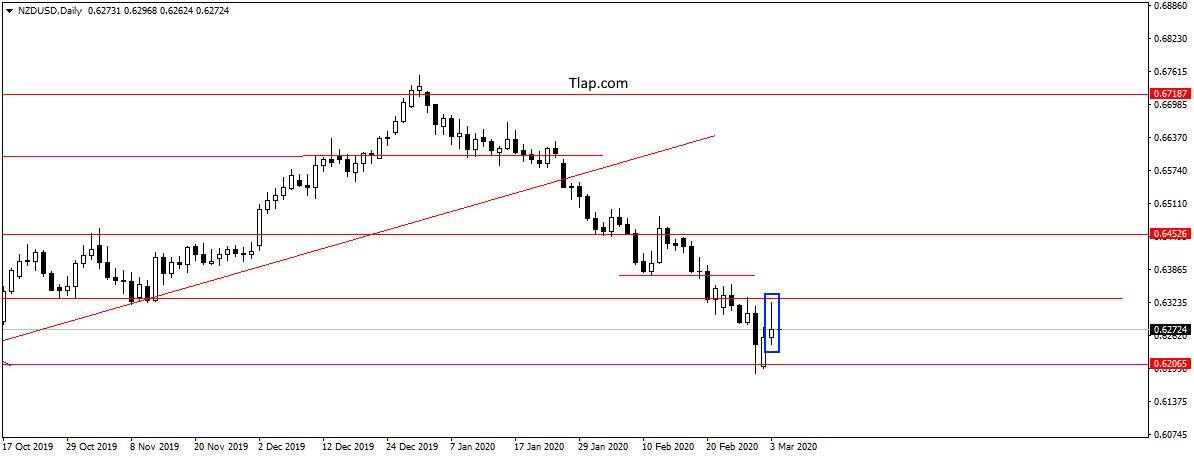

NZDUSD

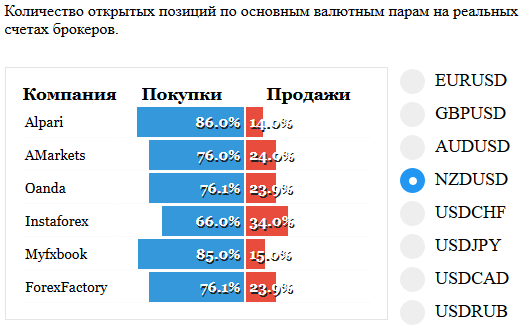

On a pair NZDUSD went to the level of 0,63255 and bounced formed a pattern Pin-bar. Given the preponderance of buyers in the statistics of transactions, the correction can finish and continue the falling trend. Consider here sale, with the expectation of a breakout of the level 0,6206.

Fundamental news

APR

- The Nikkei 225 of 1.22%

- S&P/ASX 200 UP + 0.69%

- Shanghai Composite + 0.74%, The Shenzhen Composite + 0,90%, The Hang Seng Index — 0,03%

- KOSPI + 0,58%

Asian indices continued to rise on Tuesday, after a strong “night” closing of the American market, the unexpected action of the Reserve Bank of Australia and medstatistiki China.

RBA cut rate by 0.25%, and 0.5% remained unchanged 4 months in a row. In China yesterday, was 125 new cases – the lowest figure since the beginning of records of patients with coronavirus in January.

The outsiders – the index of Japan, which is under strong pressure to strengthen the yen. The national currency of the country plays the role of a defensive tool for investors in the Asia Pacific region. The crash of the stock markets has led to increased demand for the yen.

This morning has released statistics of the country:

- China: PMI from Caixin

- Japan: PMI in the services sector

- Australia: GDP

- New Zealand: building Permits

USA

- Dow Jones — 2,94%

- S&P 500 2,81%

- NASDAQ -2,99%

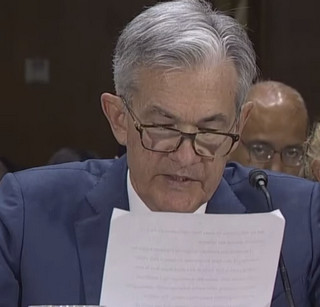

Briefing by the head of the fed Jerome Powell

The main event of yesterday’s session was the “surprise” fed rate cut at its emergency meeting, held for the first time in 10 years.

The discount rate is lowered from 0.5 percent, matching analysts ‘ expectations. The fed’s Jerome Powell called it – a response to the coronavirus, but the markets pre-played the increase, reversing yesterday’s decline, after two days of growth.

The strongest response rate was observed in the gold actually played the recent four percent of plums, also slowed the growth of the Euro against the dollar.

Evening trends on the foreign exchange, financial and commodity markets will determine the indicators:

- 16-30 – Productivity of Canada

- 17-45 – USA PMI from Markit

- 18-00 – the employment Index in the non-manufacturing sector from ISM

- 18-00 – the Decision on stav from the Bank of Canada

- 18-30 – oil Reserves in Oklahoma

The Eurozone

- At the close of 1.08%

- CAC40 + 0,86%

- FTSE + 0.78 percent

European investors were able to finish the day in positive territory, thanks to the ECB’s announcement about the package point of care.

Interest-free long-term loans granted to the companies that are on the verge of bankruptcy due to the reduction in revenues, sales volumes and production because of the introduction of the restrictive measures to prevent the spread Covid-19.

The main economic news in the European session.

- 10-00 – retail sales Germany

- 10-30 – Inflation Switzerland

- 11-15 – PMI in the service sector of Spain

- 11-45 – PMI in the service sector of Italy

- 11-50 – PMI in the service sector of France

- 11-55 – PMI in the service sector Germany

- 12-00 – Composite PMI Eurozone

- 12-30 – PMI in the service sector of UK

- 13-00 – retail sales in the Eurozone