Hello. Below we look at some guidelines for trading on 3.04.2020

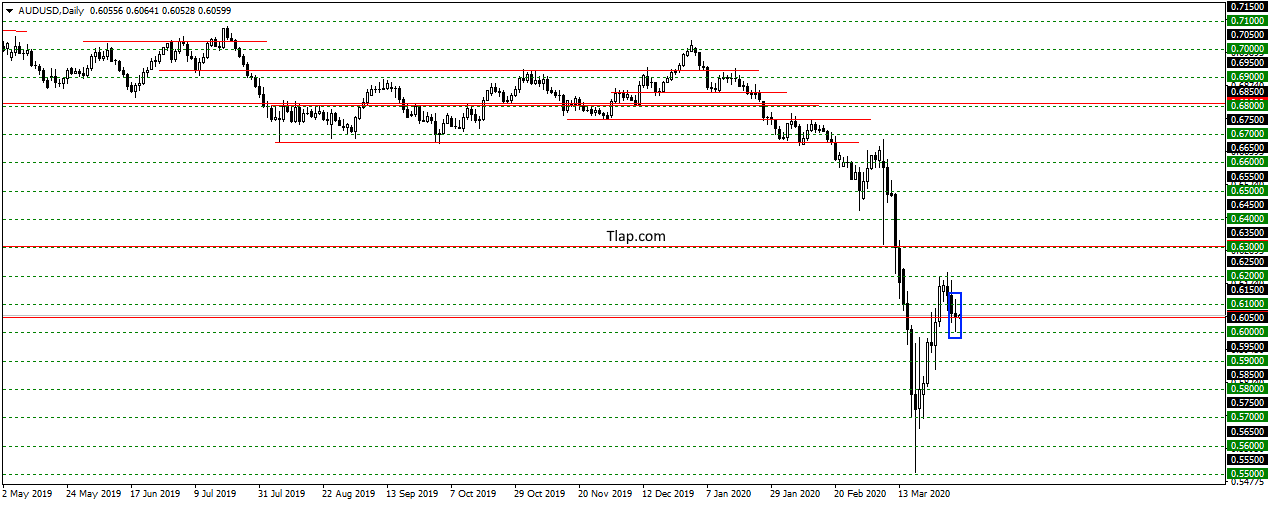

AUDUSD

On AUDUSD price has stayed level 0,60500 and formed a pattern Doji. Possible correction to a previously punched level over and continue growth. Consider here the purchase order 0,6300 and above.

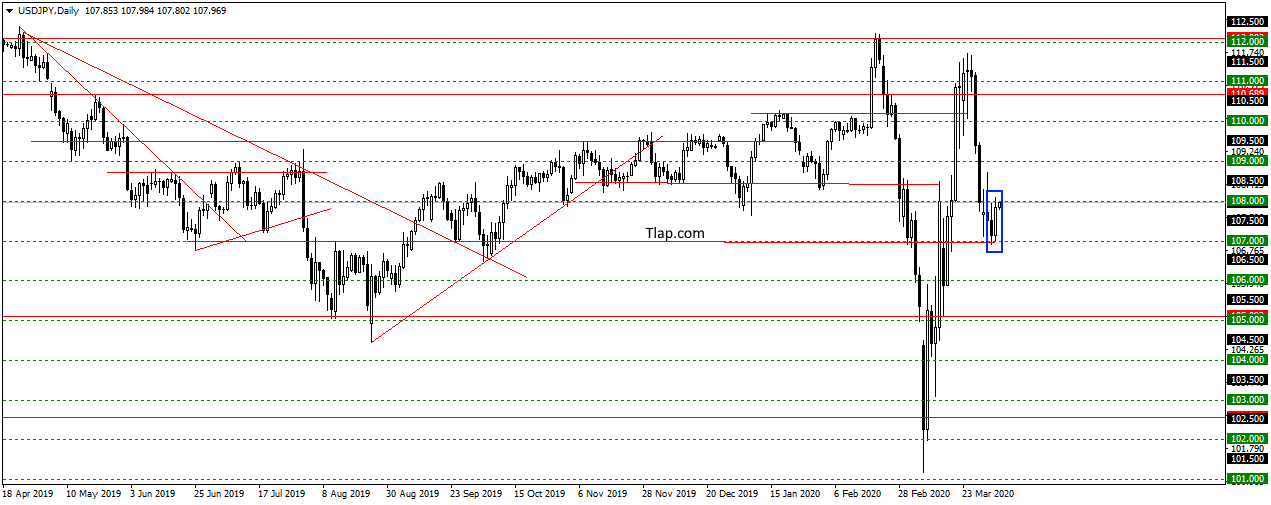

USDJPY

On USDJPY price has bounced of the level of 107.00 and formed the pattern of Absorption. I suppose that should expect growth to 111,000 and are waiting for there range, and uncertainties. The proposed motion is good, and I think it’s time to consider buying.

Fundamental news

APR

- KOSPI + 2,34%

- Nikkei 225 — 1,37%

- S&P/ASX 200 — 1,98%

- Shanghai Composite + 1.69 Percent, The Shenzhen Composite + Of 2.38%, Hang Seng Index + 0,84%

Asian markets finished mixed trading Thursday, investors follow local news and trends.

On the stock exchange of Australia have been profit-taking after two-day rally, the Nikkei dipped to high demand, raised in the profitability of the traditionally negative husbando Japan.

South Korean and Chinese shares rose following a sharp increase in oil prices. The PRC has commenced the procurement of a large volume of “black gold” to populate repositories.

This morning marked an important news:

- PMI in the service sector of China

- PMI in the service sector of Japan

- Retail sales Australia

USA

- Dow Jones + 2,24%

- S&P 500 + 2,28%

- NASDAQ +1,72%

The U.S. President at a press conference in the White House

The U.S. President at a press conference in the White House, has provided strong growth and launched a rally in the stock markets. Donald trump has announced that it has reached a preliminary agreement with Saudi Arabia and OPEC, to hold meetings for the purpose of limiting production.

Later, the cartel confirmed the information, soon will host a meeting of oil producers, perhaps some restrictions for the first time will take USA. Oil, however, have risen by 25%.

The fed used an additional incentive for the growth of stock indices, softening of reserve requirements for large banks by excluding from the calculation the Treasury bonds and deposits in the accounts of the FRB.

In the evening we will see the important statistics:

- 15-30 – the Number of employed according to the statements of the NFP and unemployment rate

- 16-45 – PMI from Markit

- 17-00 – employment Index and the index of purchasing managers from ISM

- 20-00 – the Number of drilling rigs according to statistics, the service company Baker Hunges

The Eurozone

- CAC40 + 0,33%

- FTSE + 0,47%

- DAX + 0.27%, respectively

Investors in the Eurozone remained aloof from the General trend aimed at purchase of shares, following strong gains in oil prices.

Stock indices also supported the plan of the European Commission for issuing $100 billion in preferential loans under the program SURE. It provides for targeted funds to support the most affected by the coronavirus EU countries: Italy and Spain.

The main indicators in the European session.

- 10-15 – PMI in the service sector of Spain

- 10-45 – PMI in the service sector of Italy

- 10-50 – PMI in the service sector of France

- 10-55 – PMI in the service sector Germany

- 11-00 – Eurozone PMI from Markit

- 11-30 – PMI UK services

- 12-00 – retail sales