Hello. The market formed a small, calm and overall the situation has not changed. Below view of what you can pay attention to when trading tomorrow 18.06.2020

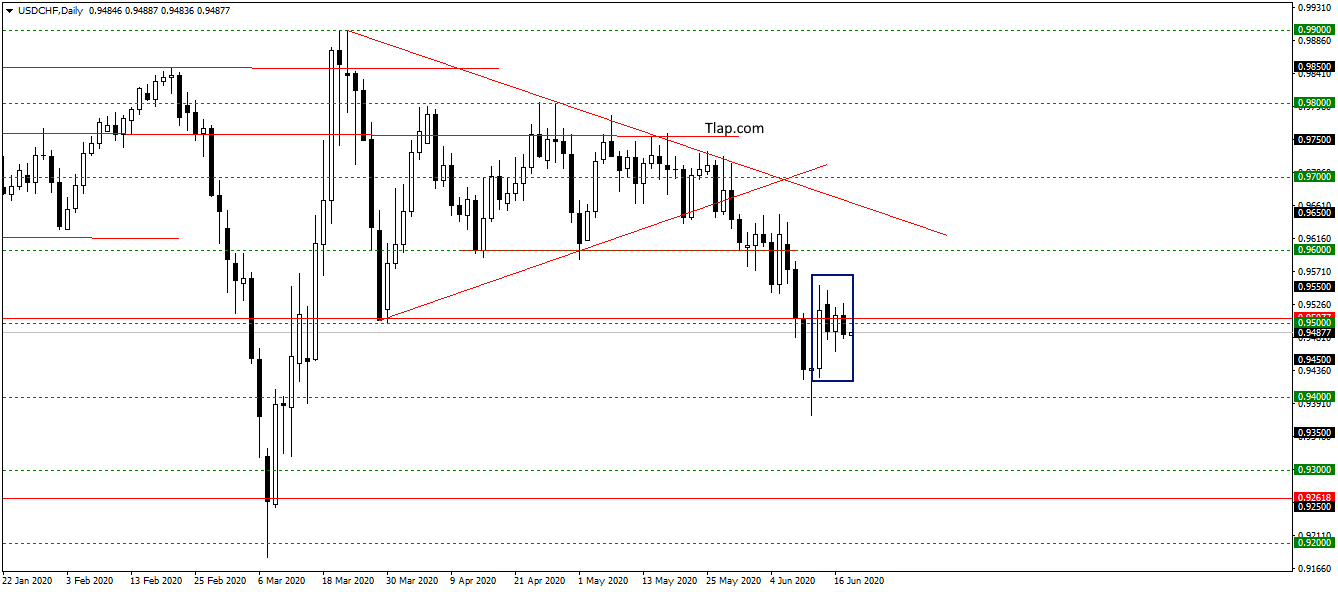

USDCHF

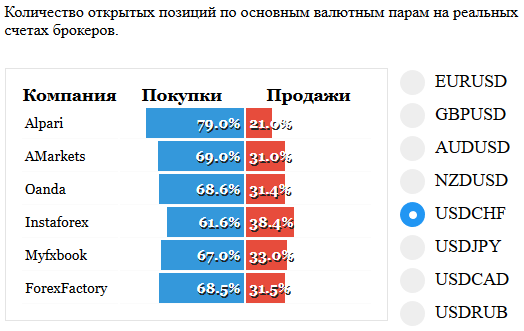

USDCHF pair on continue to move within the mother candle pattern inside bar below the level of 0,9500. In statistics deals have gained an obvious advantage of buyers. May complete the correction and will resume the fall of the developing down trend. Considering there are sales for purposes 0,92500 and below.

Fundamental news

APR

- Nikkei 225 — 0,56%

- S&P/ASX 200 + 0,83%

- Shanghai Composite + 0.14 Percent, The Shenzhen Composite + 0,19%, Hang Seng Index + 0,56%

- KOSPI + 0,14%

Asian markets on Wednesday had a positive growth of American markets.

Investors are betting on the policies of the us-China détente needed to solve China escalated internal and external issues. China came into confrontation with India in the time of increasing confrontation between the two Koreas and the return of coronavirus

To outsiders, environment fell, the Nikkei 225 crashed on the released indicators trade balance worse than expected.

This morning the news was released:

- New Zealand: GDP and employment

- Australia: unemployment rate and employment

USA

- Dow Jones — 0,65%

- NASADAQ + 0.15% of

- S&P500 — 0,36%

American investors in the fixed portion of the position due to negative external background and statistics.

The head of HSBC’s Noel Quinn voiced at the briefing return to plan a large-scale staff reductions

DJ fell to the resumption of plans of the largest Bank head HSBC to dismiss 35 thousand employees, according to the statements of its head Noel Quinn. The S&P500 “slid” down with the prices of oil, the sale of shares strengthened the construction statistics of new homes that came below estimates.

The next few days the attention of the American media will be focused on coming out the book of John Bolton. A former adviser to the President of the United States Donald trump publishes scandalous details of White House policy.

The major indexes of the U.S. session:

- 15-30 – Weekly jobless claims United States

- 15-30 – Manufacturing activity and employment Philly fed

- 15-30 – Prices n housing and the level of wholesale sales Canada

The Eurozone

- CAC40 + 0,88%

- FTSE up 0.17%

- DAX + 0.54% of

Inflation in the Eurozone, which coincided with expectations of analysts, allowed European stock exchanges closed with a positive result.

Investors add optimism to the expectation of the distribution plan coronavirus budget at the EU summit this week. Additional funding should support consumer demand and business.

The main event of the morning session – the decision on the level of the rate of the national Bank of Switzerland at 10: 30 and press conference at 11.00. At the same time will be released monthly report of the ECB. The meeting at the rate of the Bank of England will take place at 14: 00.