Hello. Below are a few recommendations on trade on the Forex market on 10.08.2017

Calendar of anticipated events

11:30 UK. The volume of production in manufacturing industry

15:30 USA. The producer price index

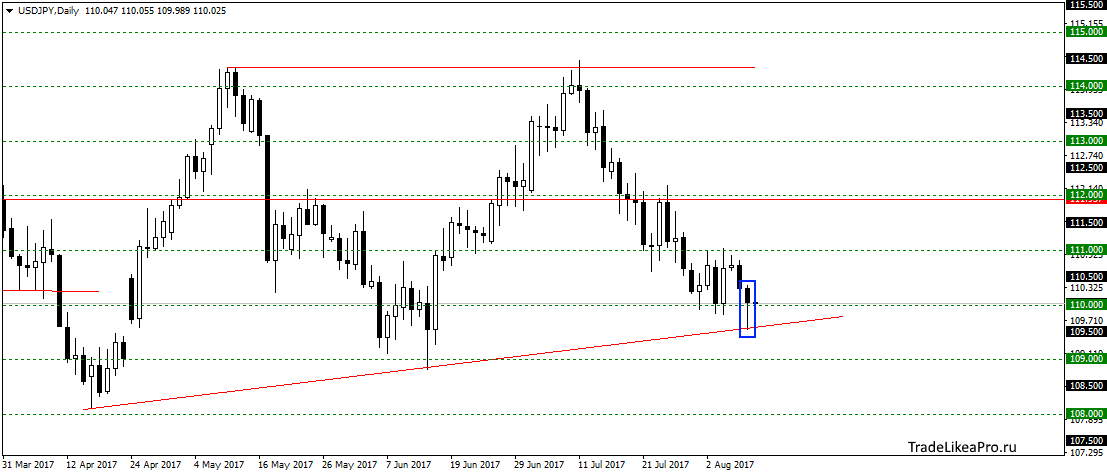

USDJPY

On USDJPY pair formed a pattern Pin-bar based on the lower boundary of the triangle in the area of 110.00. It seems that lower down the price not give and may start the growth of continuing growth inside the triangle. Buy there is nothing to consider, to observe the situation.

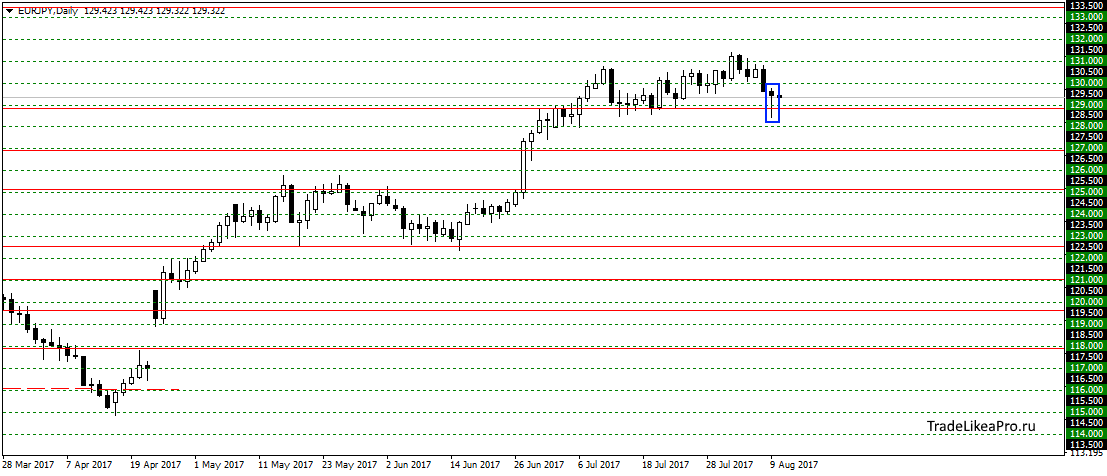

EURJPY

On EURJPY, the same pattern of Pin-bar at 129.00. likely the level will hold and price will resume growth at trend, after a long sideways movement. Consider purchase here.

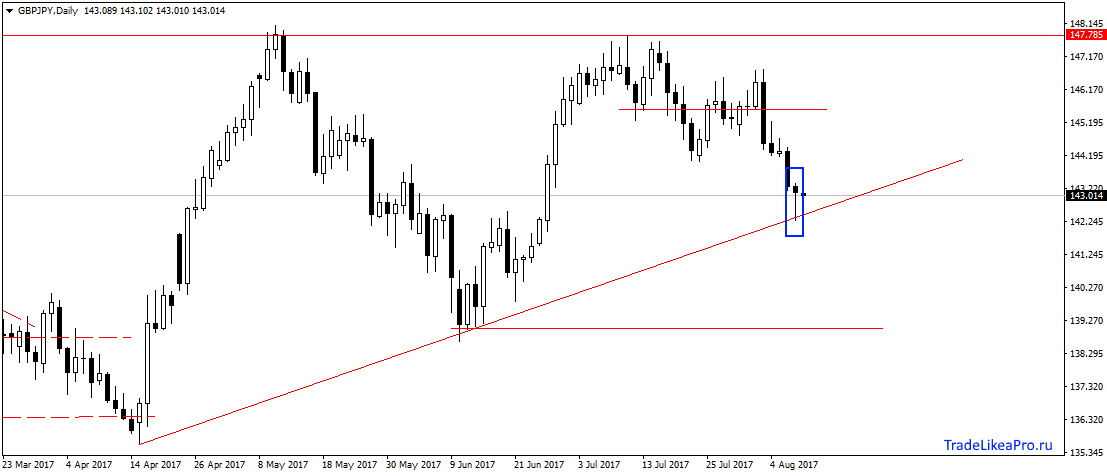

GBPJPY

On GBPJPY pair formed a pattern Pin-bar on the lower border of the triangle. Want to see the resumption of growth to the upper boundary 147,78 and above. Consider purchase here.

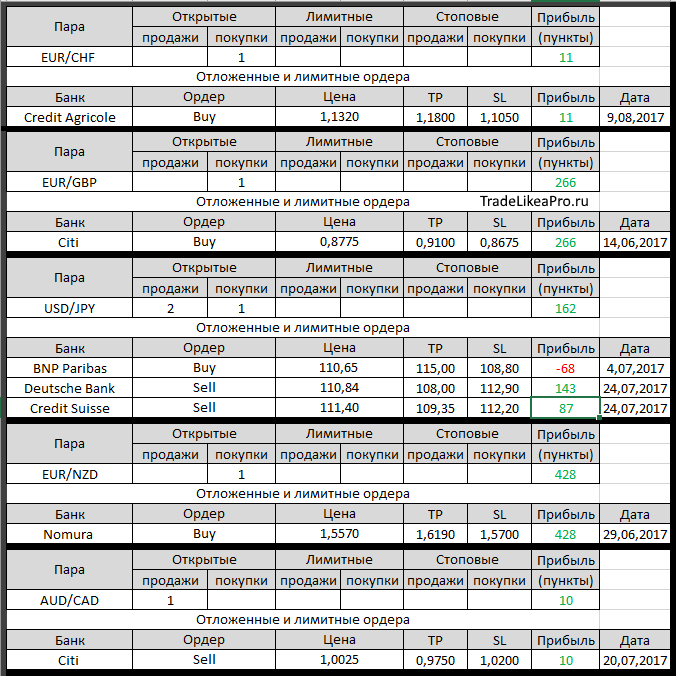

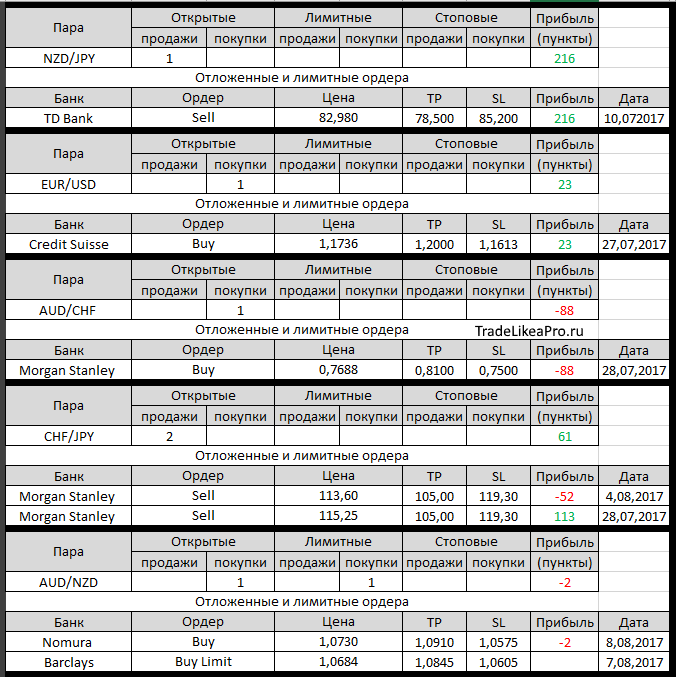

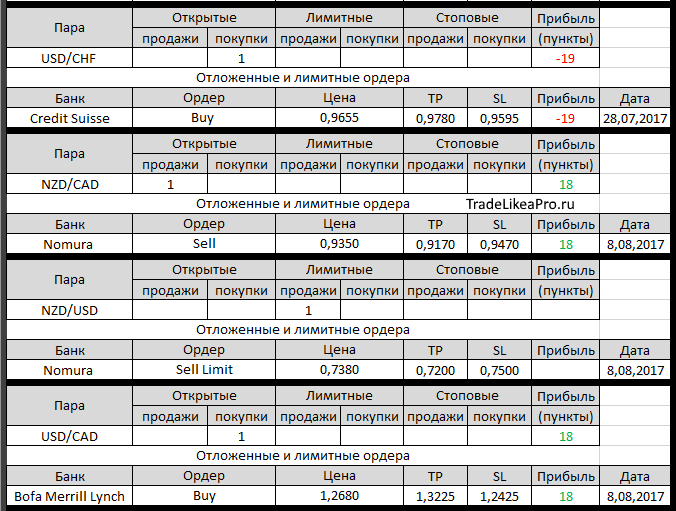

Open orders big banks

Changes in 9.08.2017

- Credit Suisse otstupite buying on AUD/USD with 0,7880 for 0,7870.

Loss-10пп - UOB otstupite buying on USD/JPY with 110,70 at 109,80. Loss-90пп

- Nomura changed with TR 1,6190 at 1,6350, at around 1.5700 with Sl of 1.5750 in buying

EUR/NZD - Morgan Stanley otstupite buying on USD/JPY with 110,85 at 109,70.

Loss-115пп - Credit Agricole opened a Buy on EUR/CHF with 1.1320, the TR – 1,1800, SL – 1.1050

- Citi changed the SL with 0,9480 on 0,9350 for sale on NZD/CAD

- Nomura worked Buy Limit on AUD/NZD since trading at 1.0730, TR – to 1.0910 with SL 1.0575

- Nomura triggered a Sell Limit on NZD/CAD from 0.9350

- Citi has worked SL at breakeven on GBP/CAD. Profit +13пп

Fundamental analysis

APR

Asian stocks eased as investors once again concerned about the growing tensions between the United States and North Korea, causing shares in Seoul fell to two-month lows, despite the fact that the demand for assets in a safe haven declined markedly.

The widest selections in the region, the MSCI index fell by 1%, extending early losses on Wednesday, while Japan’s Nikkei was down 0.1%. Shanghai stocks fell 1.1%, while the Hang Seng in Hong Kong fell as much as 1.6%. South Korea’s Kospi lost 1.2%, falling to two-month lows, despite the fact that at the end of July, broke several record highs.

In the currency markets was a significant tendency to decrease in demand for JPY and CHF, so USD was trading steadily near the level 110.030 JPY, after hitting a 109.560 earlier, reaching an eight-week lows. Currency markets await updates data of the producer price index in the U.S., which will be presented later today. Investors expect that relevant to the inflation trend will indicate the prospects of policy rates by the Federal reserve for the near future.

Europe

European stocks closed near session lows on the background of provocative comments from Pyongyang, where the news Agency of DPRK reported that ponders a potential missile attack on U.S. territory on GUAM.

Against this background, the pan-European Stoxx 600 index closed with a decline of 0.73% or 2.81 points to 379.84, and the German Dax down 1.12% 138.05 points 12154.00. The French CAC 40 fell by 1.40% or 73.19 points to 5145.70. The energy sector, however, was leading in growth, as the German energy group E. On has surpassed profit expectations in the last six months of the year.

EUR fell 0.2% to 1.1737 against USD and CHF also weakened by 0.2 percent to 0.9655 against the us currency, cutting the early 1% profit from the day before on Thursday. Meanwhile on the economic front, data Italian industrial production rose 1.1% from the previous month, far exceeding forecasts for a 0.2% increase, therefore there is the probability that the EUR will increase the potential for growth against other major currencies as strong reports from other sovereign Euro-zone economies.