Hello. Below are a few recommendations for trading in the Forex market on 13.09.2017

Calendar of anticipated events

11:30 UK. The average wage including bonuses

11:30 UK. The change in the number of applications for unemployment benefits

15:30 USA. The producer price index

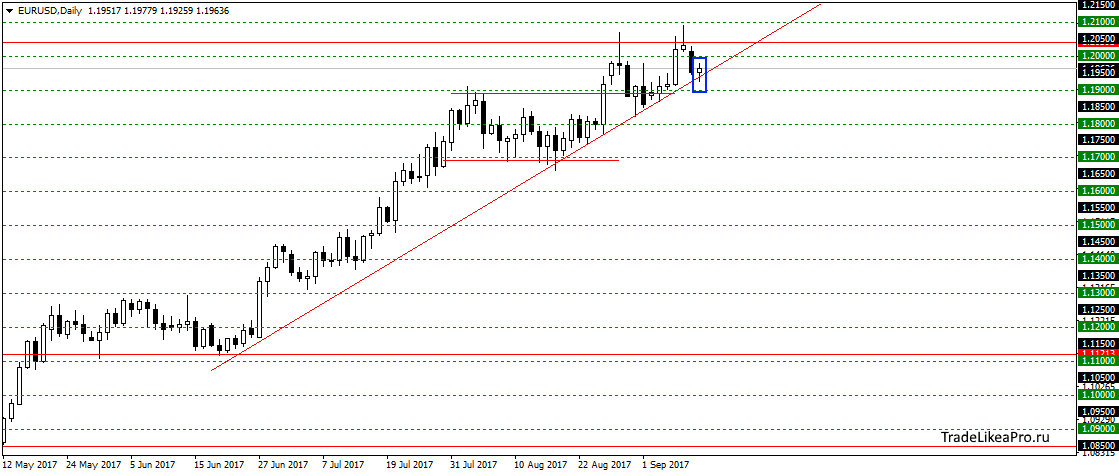

EURUSD

EURUSD has stopped on the trend line and formed a Doji. Perhaps there will be another attempt to pass the level 1,20500 and continue up trend. Buy here do not consider, as to the level of a small move in price.

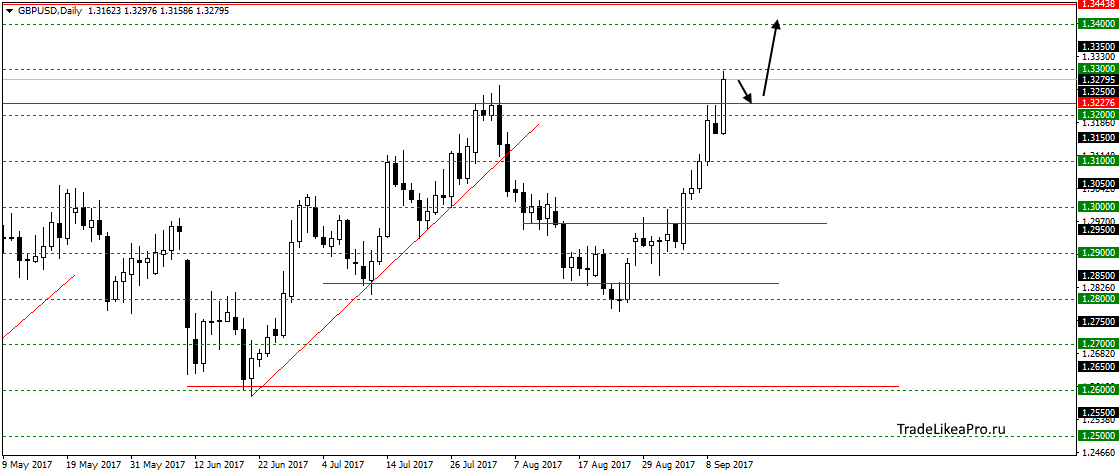

GBPUSD

On GBPUSD didn’t go to the correction and continued growth. Level 1,3227 broken and will probably continue to increase further. Signals in purchase in the form of patterns of Price Action, you can expect after the correction back to the broken level.

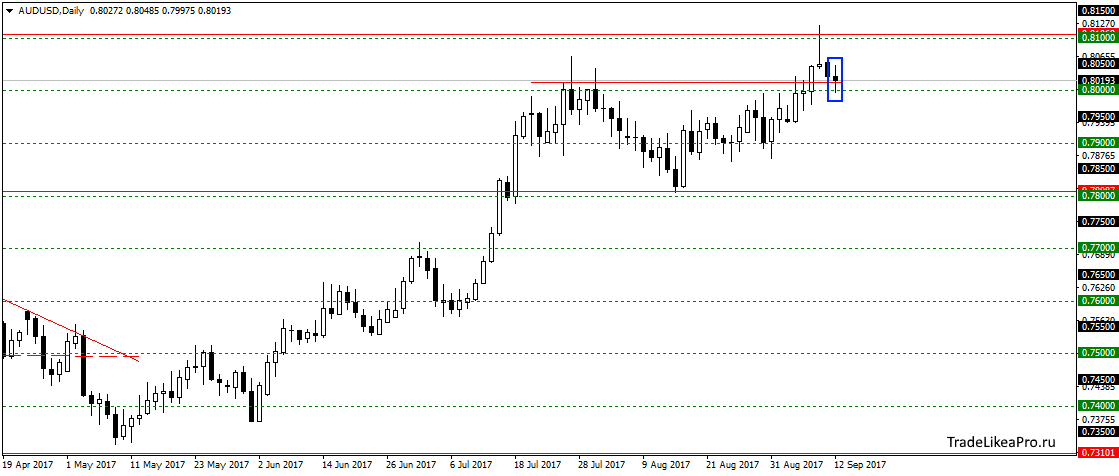

AUDUSD

On pair AUDUSD was stopped at the level of 0.8000. Likely to end the correction and resume growth. Purchases, here to consider not recommended, because the level is not far away.

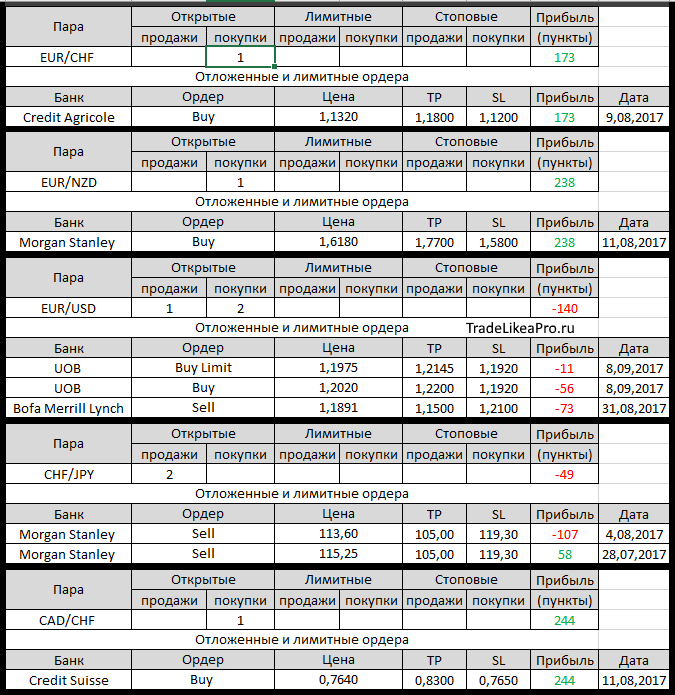

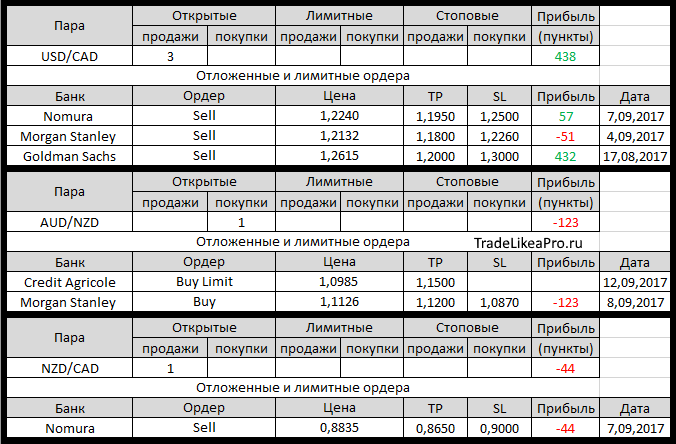

Open orders big banks

Changes in 12.09.2017

- UOB otstupite buying on AUD/USD with 0,8050 for 0,8010. Loss-40пп

- Deutsche Bank has worked with TR on EUR/GBP with 0,9284 on to 0.9000. Profit +284пп

- Credit Agricole placed a Buy Limit on AUD/NZD with 1,09850, TR -1,1500

Fundamental analysis

APR

Course Asian stocks fluctuated today, but remains near 10-year highs, and maintained record levels on wall street, while shares of Apple Inc. fell after the release of the new iPhone.

The widest regional MSCI index has closed near the high of 2007, while Australian stocks added 0.2%, while Korean rose 0.1%. Previously, S&P 500, Dow Jones and Nasdaq Composite closed at record levels, as investor tensions over the North Korea issue has completely dried up today.

USD rose 0.1% to 110.06 JPY but closed much lower daily highs, as investors still fear outbreaks of geopolitical tensions. However, today, the USD may find solid prospects for growth in the case of a report on the producer price index can be realized in a positive for the overall inflation of the estimates of the key.

Europe

European stocks rose again, following the successes on wall street, as well as bearish comments by a senior official of the European Central Bank.

At the closing bell the Stoxx 600 index showed a 0.52% increase or 1.99 points to 381.42. The German DAX added 0.40% or 49.53 points to 12524.77 and the French CAC 40 grew by 0.62% or 32.30 paragraph 5209.01. Shares of lenders jumped significantly down after yesterday’s rise, and perhaps the scandal surrounding the lawsuits of fraud to the head of subcreative Deutsche Bank played this role, although the fact a summary before — also is the place to be.

In the currency markets, EUR rose 0.03% against the USD to 1.1960. Speaking in Frankfurt, Vice-President of the ECB Vitor constancio said that the Council is confident today that the narrowing of policy can be partial, since even in this case, inflation target will be achieved but interest rates will be increase.