Hello. Below are a few recommendations for trading in the Forex market on 1.11.2019

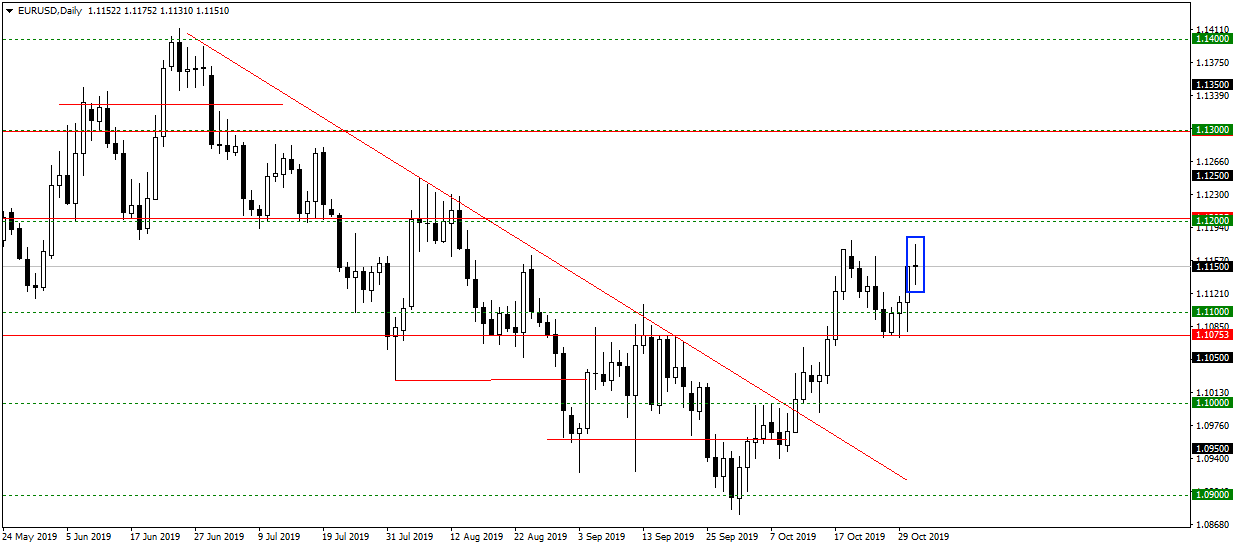

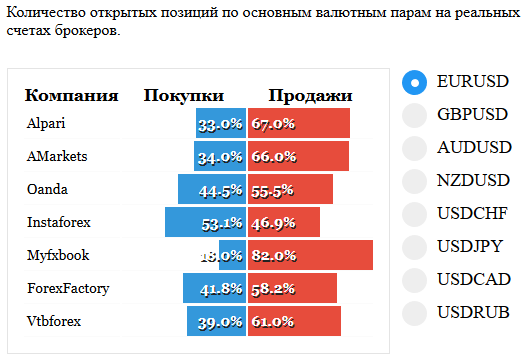

EURUSD

On EURUSD price stopped at the previous high and formed a pattern Doji. I think that you should wait for growth to continue on to the level 1,12000 and above. And the preponderance of sellers in the statistics of transactions that can contribute. The transaction pattern is not considered.

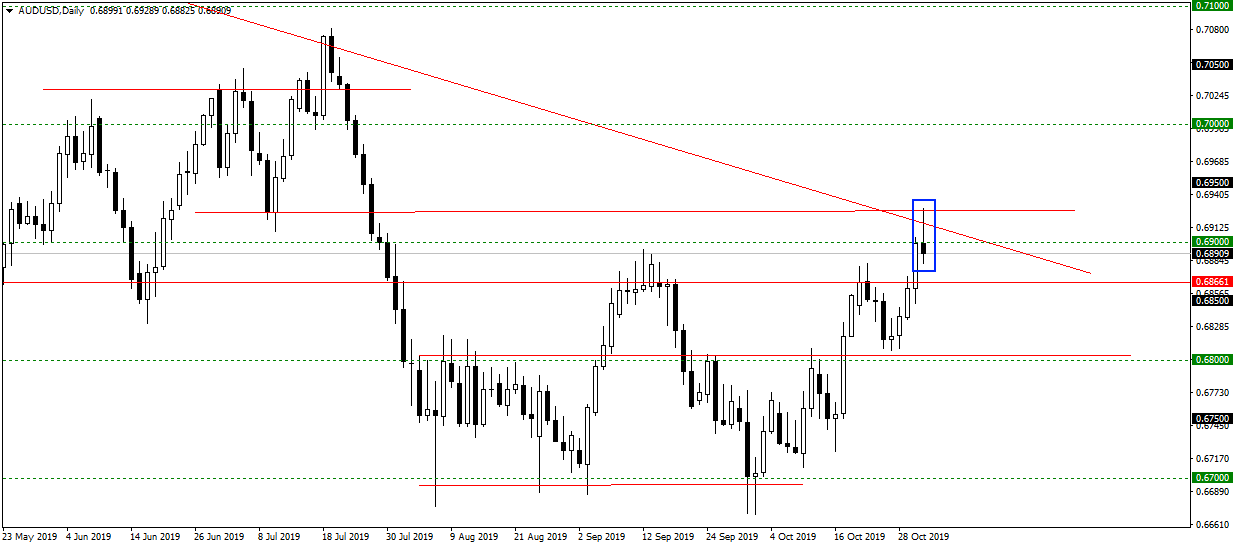

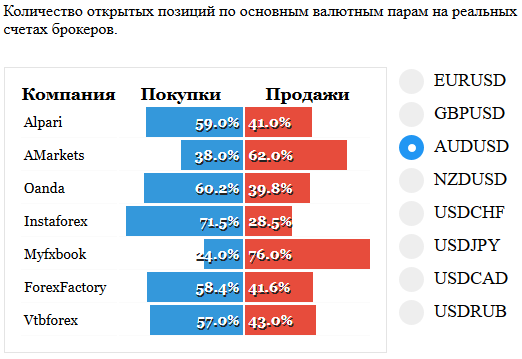

AUDUSD

On AUDUSD currency pair reached the level of 0,6900 and trend line. And formed a pattern Pin-bar. Probably should look at sales. But remember that not far down the level 0,68500, which can hold the drop. After his breakdown, and look for sales.

EURJPY

On EURJPY, the price did not manage to go far beyond the level of 121,08 and turned and formed the Takeover. To talk about the turn prematurely, but falling to the level of 119,77, I think we will continue. Transactions here are not considered.

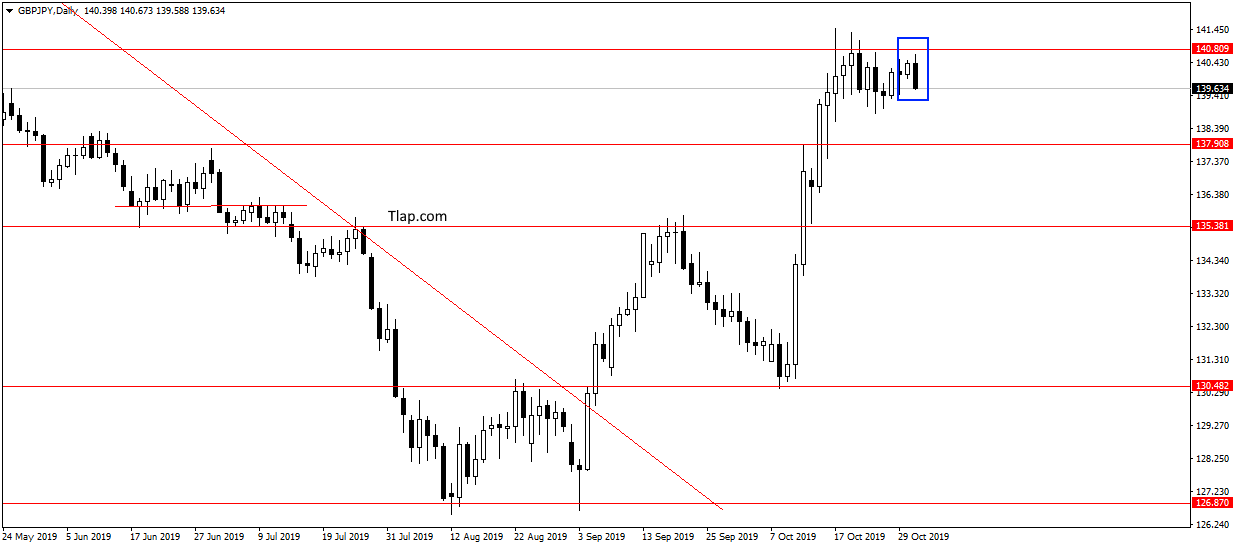

GBPJPY

On GBPJPY the situation is similar pattern, the Absorption level 140,80. Waiting for the correction to 137,90, and maybe even to 135,38. At these levels I will look for Price Action patterns, to purchase, in the direction of the main trend.

Fundamental news

APR

- S&P/ASX 200 — 0,39%

- Nikkei + 0.37 percent

- KOSPI + 0.15% of

- Shanghai Composite Up 0.35%, The Shenzhen Composite 0,48%, Hang Seng + 0,90%

Asian markets rose on positive news flow – the rate hike by the fed of the US and output growth in Japan.

In the red – Australia, whose index fell along with the volume of private sector credit, a zero change in the building permits and China, where reduced business activity in production and non-production sector.

This morning came news by country:

- Australia – producer prices and manufacturing activity

- Japan – the latest jobs and candidates

- China – PMI from Caixin

USA

- S&P500 — 0.30% Of

- The NASDAQ is 0.14%

- Dow Jones — 0,52%

Economic statistics, the United States sent on Thursday the U.S. indices are in negative zone. Worse than expected data showed the number of initial claims for unemployment, Chicago PMI and the costs of natural persons.

The evening will be released:

- 15-30 – employment (NFP) and unemployment rate USA

- 15-30 is the Average (hourly) wages and the share of active population

- 17-00 – PMI from ISM

- 20-00 – the Number of drilling rigs operating

The Eurozone

- FTSE — 1,12 %

- CAC40 — 0,62%

- DAX — 0,34%

Indices of European stock exchanges closed in the red, despite the positive dynamics of GDP growth and acceleration of inflation, better than expected. The participants drew attention to the decline in sales in Germany and rising unemployment in the Eurozone.

Speaker John bercow spends the last meeting of Parliament before resigning

The Parliament of great Britain “lost” the speaker, Brakcet will be without John bercow, became known worldwide, after numerous debates of deputies related to the country’s withdrawal from the EU. Yesterday was the last meeting under his chairmanship.

In the European session released statistics:

- 10-30 – retail sales and inflation in Switzerland

- 11-00 – PMI Switzerland

- 12-30 – PMI UK