Hello. Below are a few recommendations for trading in the Forex market 9.02.2018

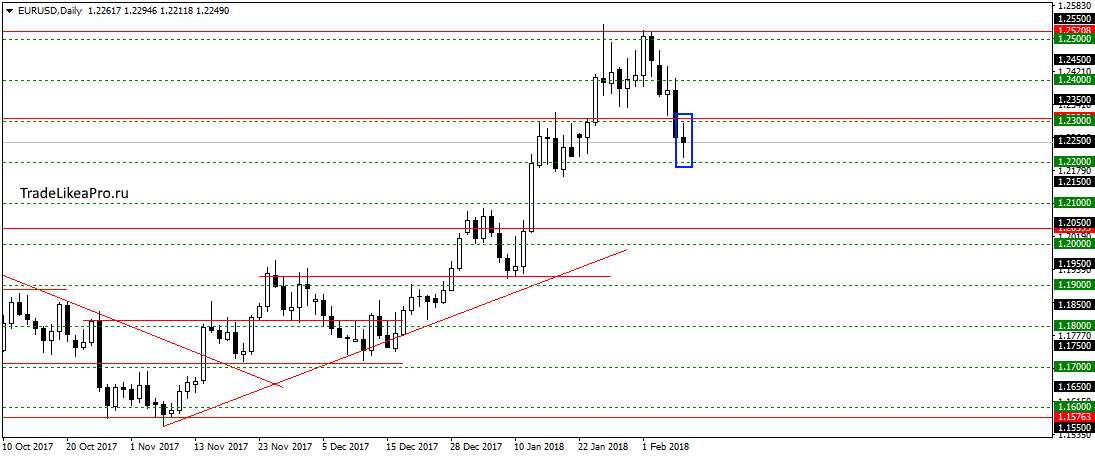

EURUSD

EURUSD move under the 1,2300 level and formed a pattern Doji. The preponderance of sellers is small. I think that we will continue to fall further 1,2100 and trend line. Transactions here are not considered, there is confidence in the trend reversal.

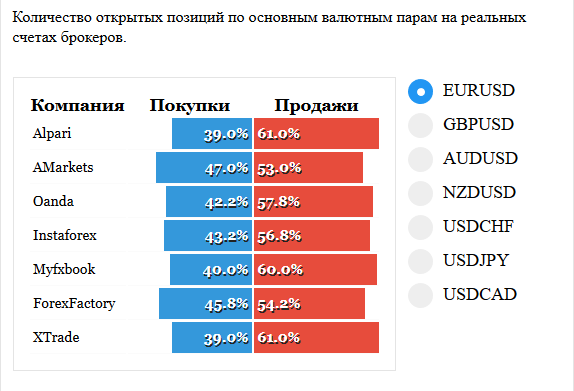

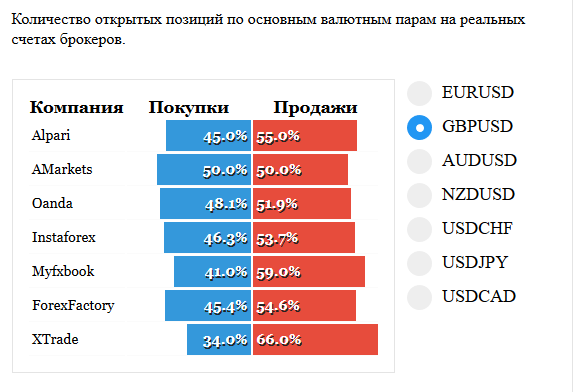

GBPUSD

On GBPUSD went up to a small correction up, and formed a pattern Pin-bar below 1,3900. Will probably continue to fall in the area of the trendline and 1.3700. Sales do not see here, wait for developments.

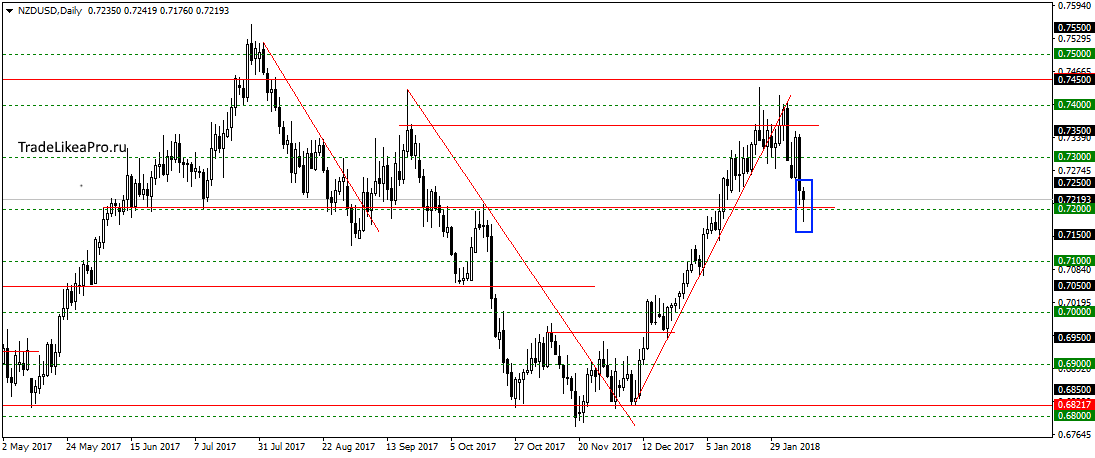

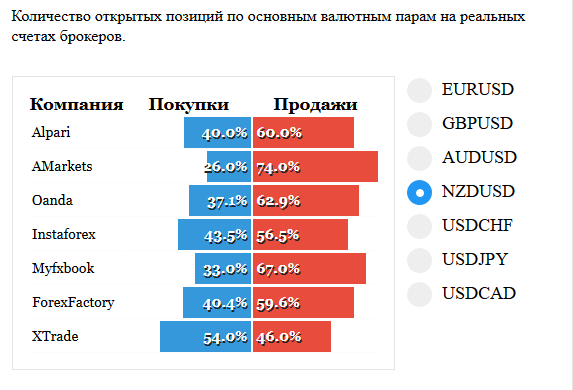

NZDUSD

On a pair NZDUSD has not gone beyond the level 0,72000 and formed a pattern Pin-Bar. sellers really a lot and probably go to correction up. Transactions in the against the trend.

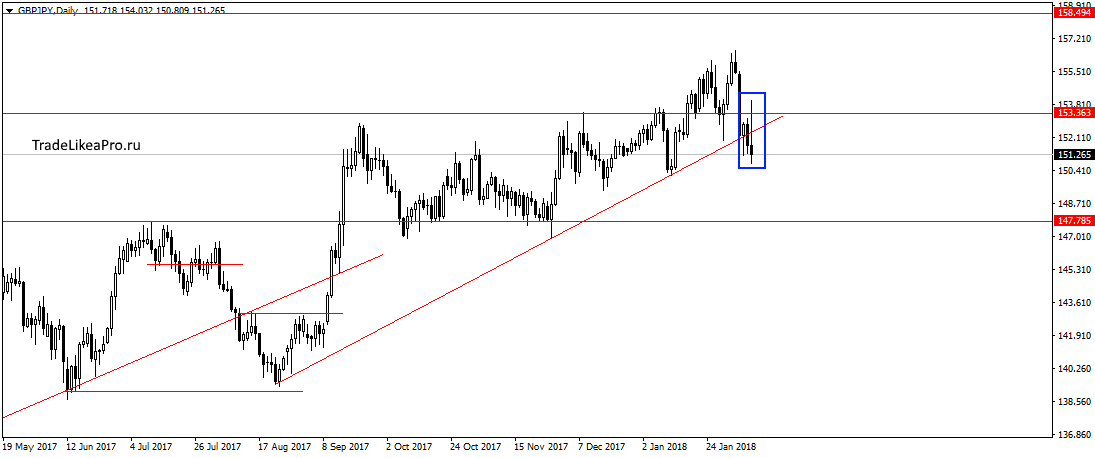

GBPJPY

Passed on GBPJPY trend line and after a small correction formed a pattern Pin-Bar. Will probably continue to fall 147,78 and below. Consider there sales.

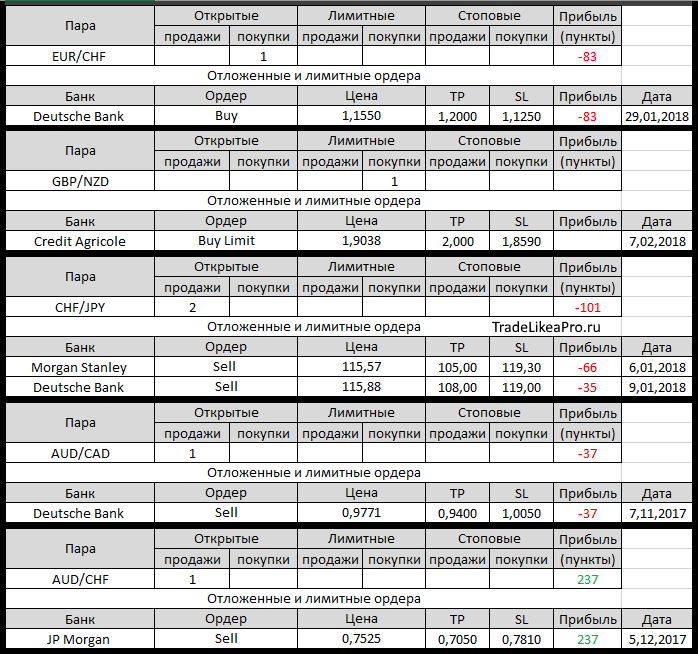

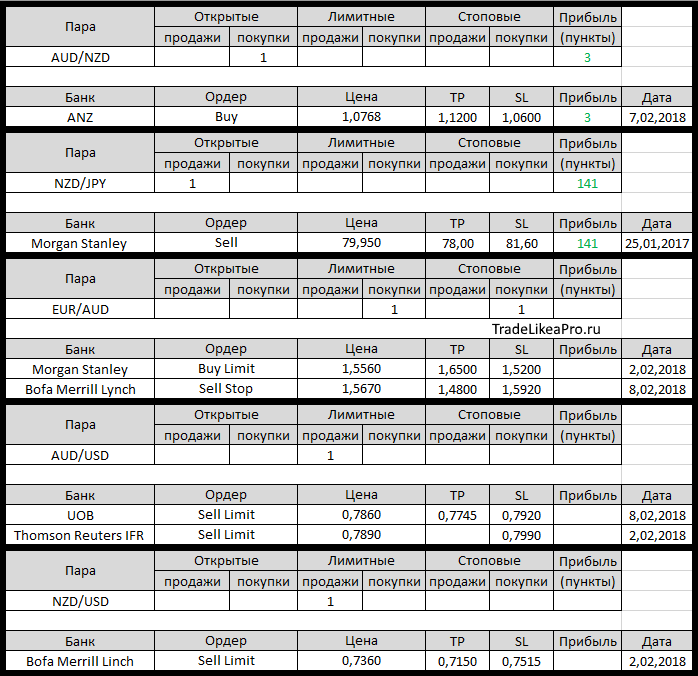

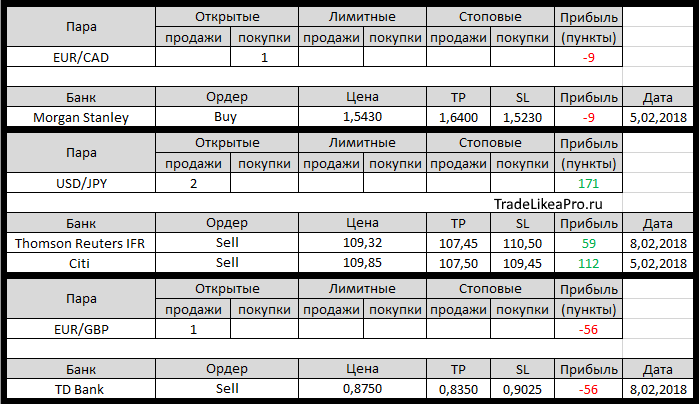

Open orders big banks

Changes in 8.02.2018

- Thomson Reuters IFR opened a Sell on USD/JPY with 109,32, TR – 107,45,

SL – 110.50 - UOB posted a Sell Limit on AUD/USD with 0,7860, TR – 0,7745,

SL 0.7920 - Credit Agricole has closed the market to Buy EUR/AUD with 1,5345 for 1,5677. Profit +332пп

- TD Bank opened a Sell on EUR/GBP with 0,8750, TR – 0,8350, SL – 0.9025

- Barclays otstupite buying on EUR/CHF with 1,1599 for 1,1503.

Loss-96пп - Goldman Sachs closed a Buy EUR/JPY with 132,85 at 133,00.

Profit +15bps - Bofa Merrill Lynch placed a Sell Stop with the 1.5670 area, the TR – 1,4800,

SL 1.5920 - Thomson Reuters IFR changed the Sell Limit on AUD/USD. Sign in with 0,7975 на0,7890, SL 0,8075 on trading around 0.7990

- Citi changed SL from 111.00 at 109,45 for sale on USD/JPY