Hello. Below are a few recommendations for trading in the Forex market on 16.06.2020

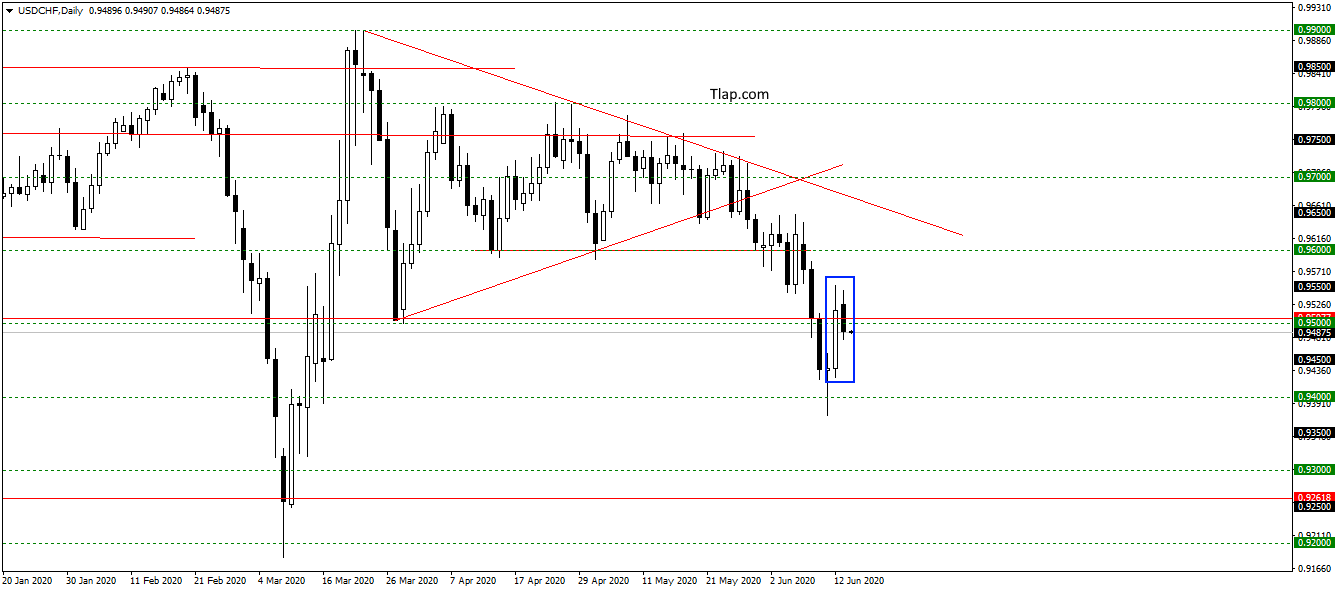

USDCHF

On the pair USDCHF has formed a pattern of Internal bar at the level of 0,9500. May complete the correction and will resume the fall of the developing down trend. Considering there are sales for purposes 0,92500 and below.

Fundamental news

APR

- Shanghai Composite — 1,02%, The Shenzhen Composite Of 0.53%, The Hang Seng Index Of 2.16%

- KOSPI and 4.76%

- Nikkei 225 — 3,47%

- S&P/ASX 200 -2,19%

Asian markets opened the first day of the week falling after the release of statistics and Sunday events. In China, the outbreak of coronavirus – part of the districts of the capital isolated. Against this background, began to decline oil prices. Decay indices increased after an exit of indicators of investment and industrial output of China, below analysts ‘ expectations.

Today the main attention should be paid to bet the Bank of Japan press conference will be held at 10: 00. The morning is already out statistics:

- The minutes of the Reserve Bank of Australia

- Housing prices in Australia

- Consumer sentiment in New Zealand

USA

- S&P500 + 0.83 Percent

- Dow Jones Up 0.62%

- NASADAQ + 1,43%

The American market started Monday with growth. Speculators are buying the stock on expectations of positive statistics and General rise of stock markets after a wave of new stimulus measures by world Central Banks, whose meeting will be held this week.

Positive sentiment helped the statistics manufacturing activity in new York. almost stopped falling in most of coronavirus-affected state.

Key indicators evening session:

- 15-30 – the Volume of retail sales in the U.S.

- 15-30 – Investments in securities of Canada

- 16-15 – the Volume of industrial production U.S.

- 17: 00 Speech By Jerome Powell

The Eurozone

- DAX up 0.32%

- CAC40 — 0,49%

- FTSE — 0,66%

European investors on Monday were disappointed with the deflation of Italy, released worse than expected. Countries has the opportunity to become a “second Greece” for the Eurozone, adding problems to Prexit.

Negotiations on economic terms of the divorce, the EU and the UK was at the highest, state level. The hangout, Prime Minister Boris Johnson with the presidents of the European Council and European Commission, have not yet led to breakthrough results.

In the morning session released statistics:

- 9-00 –Data on the UK labor market

- 9-00 – Inflation Germany

- 10-00 – the index of the ZEW Germany

- 12-00 – the index of the ZEW Eurozone