Hello. Below are a few recommendations for trading in the Forex market on 15.06.2018

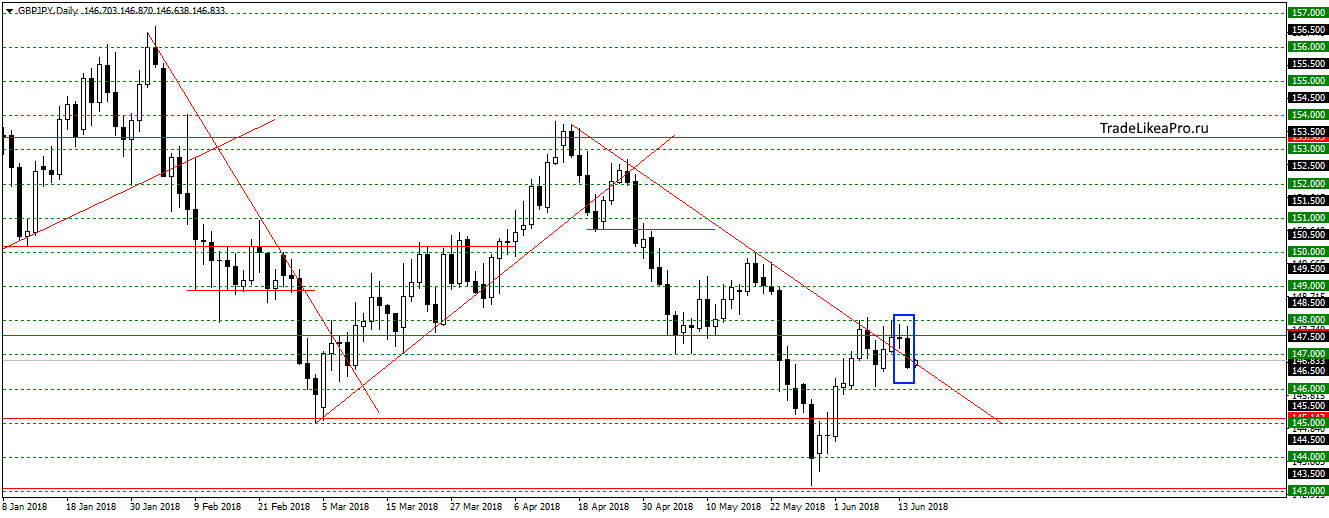

GBPJPY

On the GBPJPY failed to move above of 148.00 and bounced formed a patern Absorption. Pattern is area of the trend line that serves as a good support. Should probably continue to wait for the price to drop on the trend. Consider there sales.

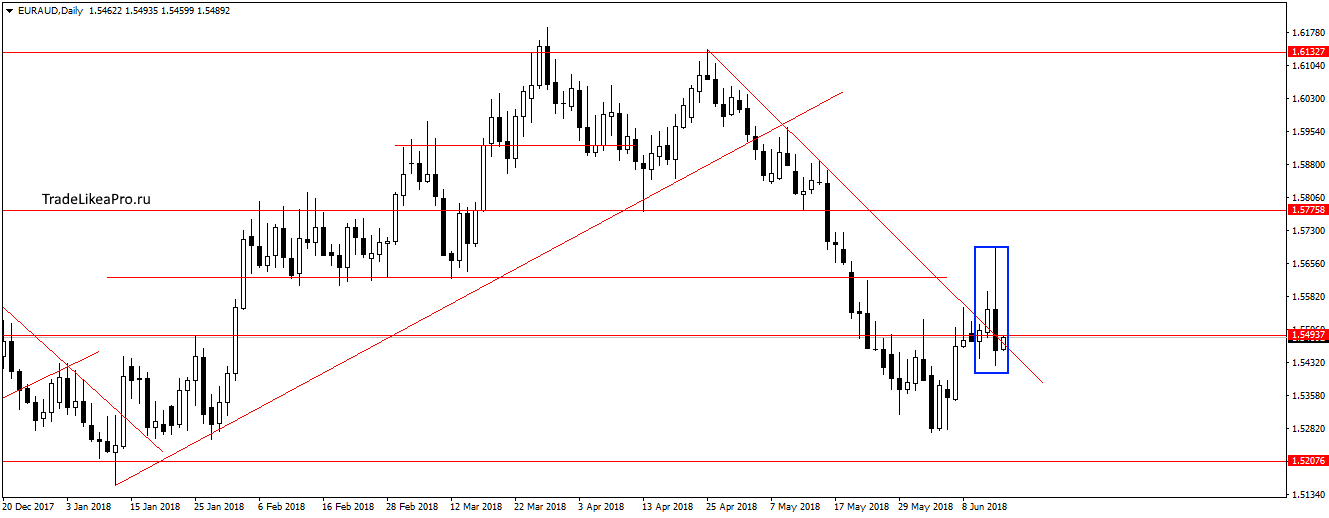

EURAUD

On the pair EURAUD tried to get up, but turned around and formed the Takeover. The pattern support in the form of trendline and the level 1,55000. Should probably continue to wait for the price to drop on the trend after the correction. Consider there sales.

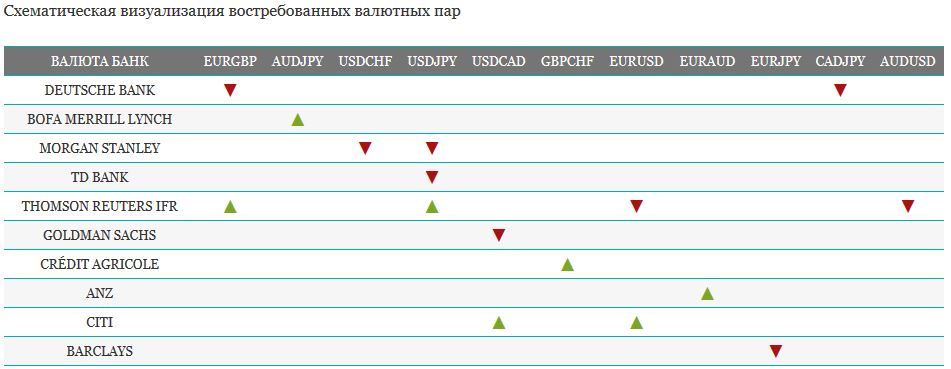

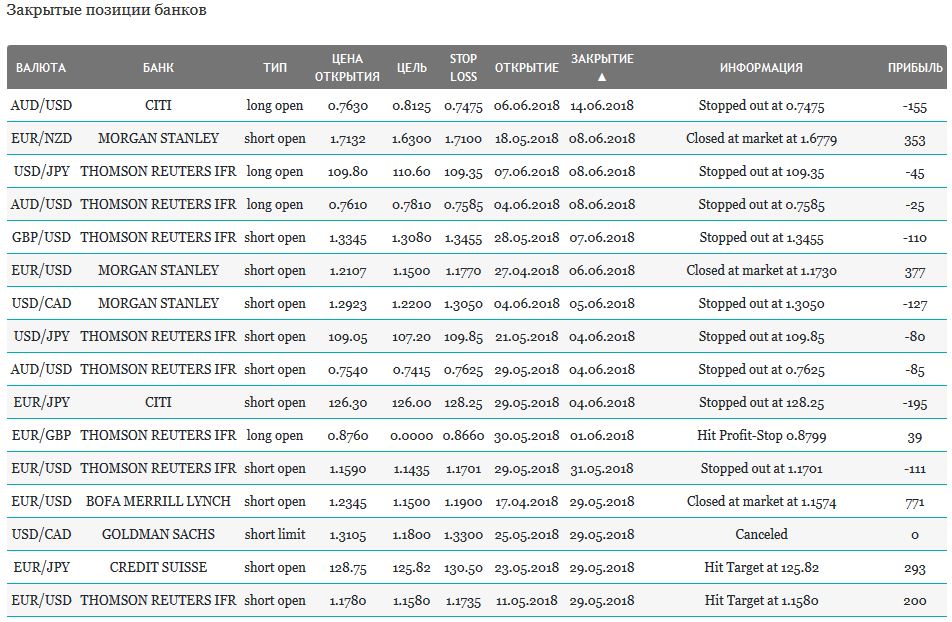

Open orders big banks

Fundamental news

APR

Stock markets in Asia are growing in anticipation of the publication of plans for monetary policy the Bank of Japan, together with the decision on the bet.

Last session ended for the indices of major exchanges of Asia Pacific with a decline, investors evaluated the results of interest rate hike, as expected, negatively perceiving the plans for two further enhancements and disappointed in the statistics of China retail sales – they showed an unexpected slowing to 8.5% in may, while in April the figure was 9.4%. Experts had expected growth of 9.5%, which together with the previous weak industrial production growth indicates a stagnation of the national economy.

USA

The outcome of the ECB meeting and positive data forced investors to play the stock markets of the United States “shopping”, while NASDAQ showed a new historical record, but Dow ends “near zero”.

Positive news came before the start of trading – retail sales may have exceeded expectations for two times is 0.8% instead of the expected 0.4% and the ECB reduced the asset purchase program. Sales at the end of the session related to the information about the unanimous approval of the EU retaliatory sanctions on the increase in duties by the US on imports of steel and aluminum.

The dollar index headed for a positive news ahead of experts ‘ forecasts of the economy, in the area of local highs.

The European Union

The main news of the trading session on European stock markets was the European Central Bank’s meeting and the subsequent speech by its leader, Mario Draghi.

Press conference of the ECB head Mario Draghi

As predicted by the experts rates have remained unchanged, while the program of purchase of assets QE will be reduced from October to 15 billion euros and will disappear before the end of 2018.

Due to the fact that the ECB expects lower economic growth in the Eurozone from 2.4% to 2.1% in 2018 and from 1.9 to 1.7% in 2019, Mario Draghi ensured the retention of interest rates at the current level until changes are positive dynamics.

Investors took the decision to reduce the QE as a positive signal, lifting the index by more than 1% during yesterday’s trading session.

Traders in the Forex market staged a total sale the Euro exchange rate is against the US dollar fell below 1,16