Hello. Below are a few recommendations for trading in the Forex market on 30.04.2020

EURJPY

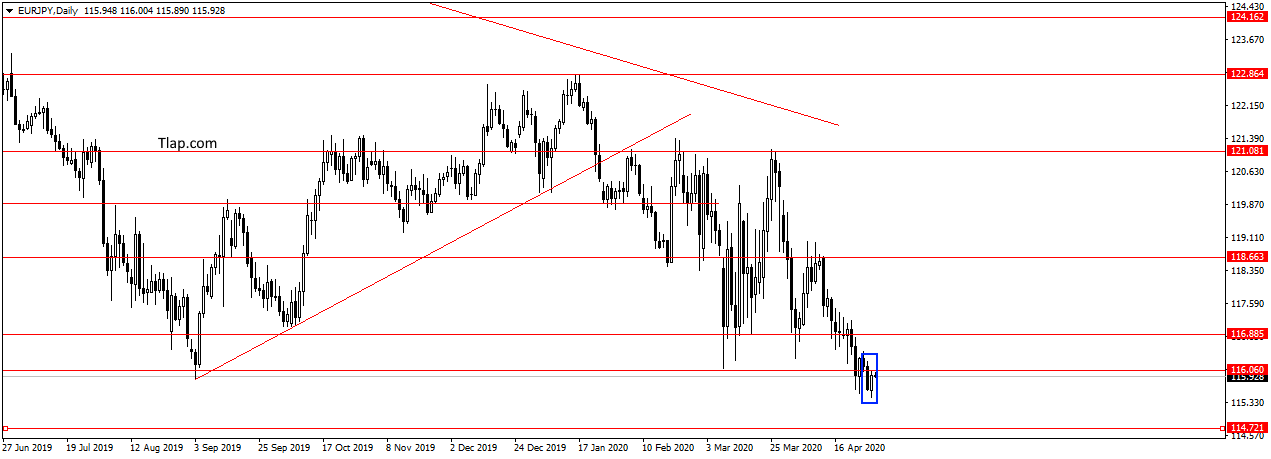

On EURJPY formed the pattern of Internal bar at the level of 116,000. Probably moving up the correction after breakdown of the level and continue falling prices. Consider then the sales order 114,72 and below.

Fundamental news

APR

- S&P/ASX 200 + 1.51% IN

- Shanghai Composite + 0.44%, The Shenzhen Composite + 0,12%, Hang Seng Index + 0.28% And

- KOSPI + 0,70%

- Nikkei 225 — the market is closed

Asia stocks rise, investors buy stocks on the background of the revision of the forecasts of the fall of the Asian economies by Moody’s in the smaller side. Analysts felt that China and India will maintain growth, least of all, the negative GDP will show South Korea.

This morning brought big news by country:

- Japan: industrial production and retail sales

- China: PMI in the manufacturing and non-manufacturing sector

- New Zealand: index of business confidence

- Australia: the size of credit to the private sector

USA

- Dow Jones + 2,21%

- S&P 500 + 2,66%

- NASDAQ + 3,57%

The fed meeting and subsequent press conference Jerome Powell, has motivated investors to buy U.S. stocks. The Agency has kept the rate at record low level of 0-0. 25%, with no hints of her growth in the coming year. The fed chief assured that he is ready to expand the set of measures to support enterprises at any time.

Basic statistics “vechirky”:

- 15-30 – the Cost individuals of the United States, the cost of labor the first quarter

- 15-30 – Issued in a week for new unemployment benefits

- 15-30 – Canada GDP and the price index for raw materials

- 16-45 – Chicago PMI

The Eurozone

- CAC40 + 2,22%

- FTSE + 2,63%

- At the close of 2.89%

Briefing the Vice-President of the European Commission Valdis Dombrovskis

Ahead of the ECB meeting, which will be held today, Vice-President of the European Commission Valdis Dombrovskis has announced about the decision on additional measures to support the banking sector. As in the last crisis 2008 year, financial institutions will be able to reduce backup volumes on loans.

According to the EC, announced at a press briefing by Valdis Dombrovskis, the steps taken will allow to increase volumes of crediting of households, mitigating the decline in consumer demand.

The main event of the European session will be the session of ECB at a rate of 14-45 and press conference, Christine Lagarde, 15-30.

Up to this point will be released:

- 8-30 – GDP France

- 9-00 – housing Prices in the UK

- 9-00 – Retail sales in Germany

- 9-30 – Retail sales in Switzerland

- 9-45 – the French Consumer spending

- 10: 00 am Leading indicators of Switzerland

- 10-00 – GDP and inflation Spain

- 10-55 – Unemployment and employment in Germany

- 12-00 – the consumer price Index Italy

- 12-00 – Inflation, GDP and unemployment of the EU