Hello. Below are a few recommendations for trading in the Forex market on 23.06.2017

Calendar of anticipated events

10:30 Euro zone. The index of business activity in the manufacturing sector

17:00 USA. New home sales

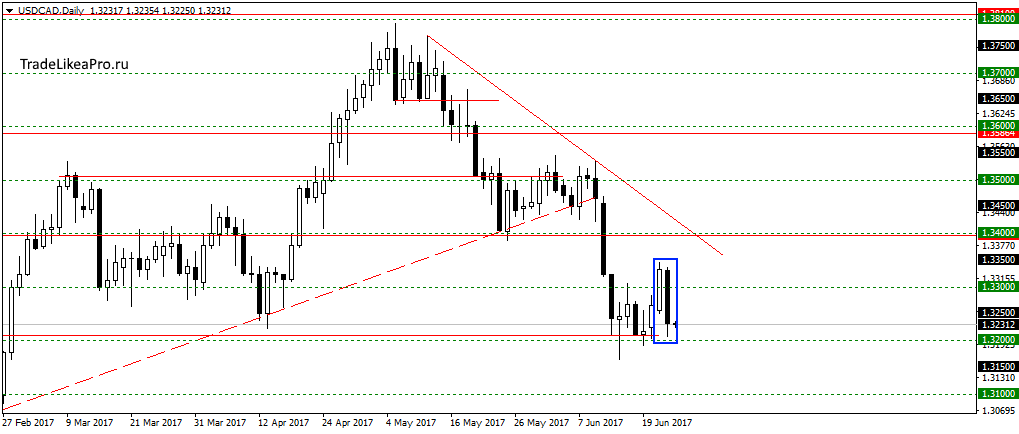

USDCAD

On a pair USDCAD formed a pattern of Absorption. Likely correction were done here and will try to continue the trend down. But the pattern of sales do not see here, because to pass the level of 1.3200 levels the move did not work and can again bounce.

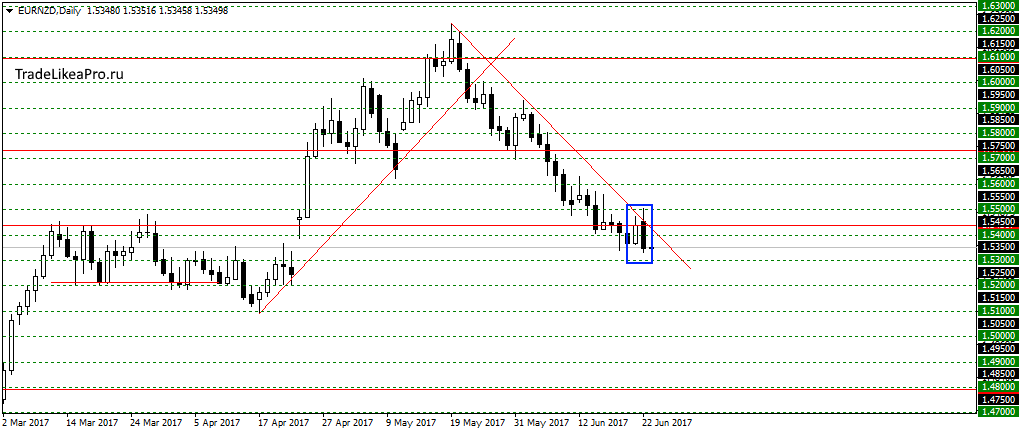

EURNZD

On the pair EURNZD same pattern of Absorption based on the level 1,54500 and trend line. To expect continuation of falling and then consider selling.

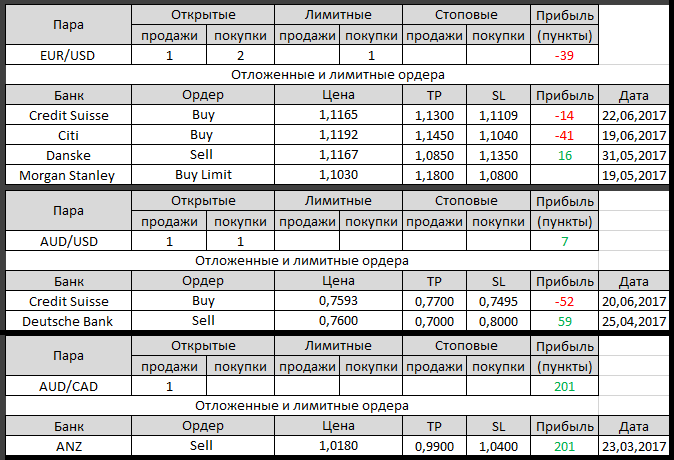

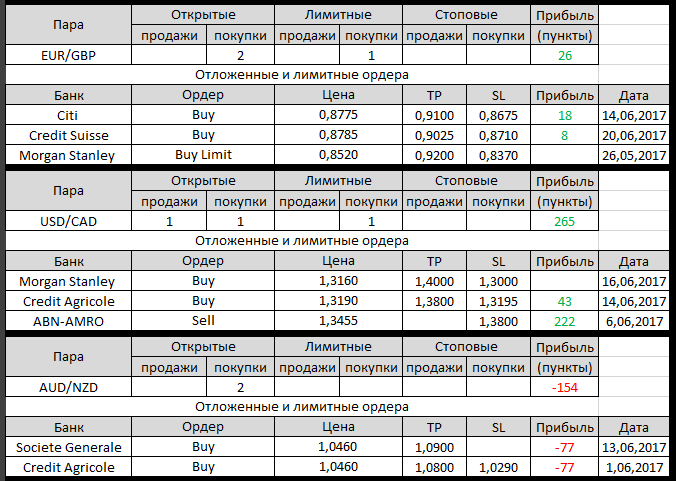

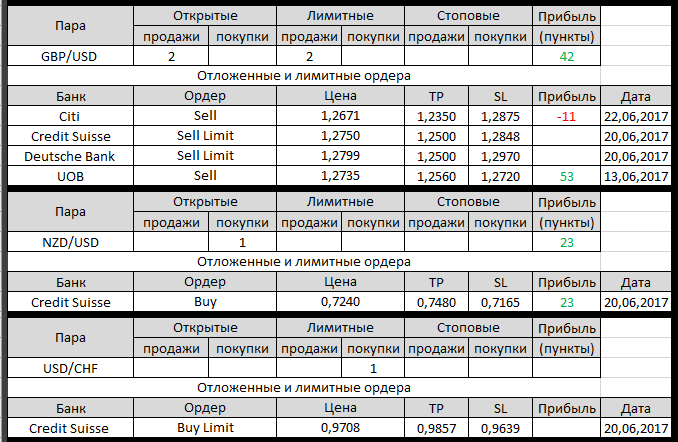

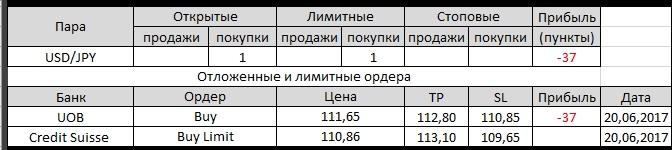

Open orders big banks

Changes in 22.06.2017

- Morgan Stanley work TR for sale on NZD/USD with 0,7260 on of 0.7250. Profit +10пп

- Nomura otstupite buying on AUD/NZD at 1,0400 with 1,0510.

Loss-110пп - Citi opened a Sell on GBP/USD with 1,2671, TR – 1,2350, SL -1.2875

- Credit Suisse changed TR from 1,2500 on 1,2550 in Sell Limit on GBP/USD

- Credit Suisse has opened a Buy EUR/USD quotes of 1.1165, TP – 1,1300, SL – 1.1109

- Credit Agricole has changed with SL 1,2950 on 1,3195 buying on USD/CAD

Fundamental analysis

APR

Asian stocks traded mixed today, but closed the week with gains, while oil prices rebounded from 10-month lows reached earlier this week. The US dollar is still holding above the Japanese yen in weekly terms, pointing to the stability of the appetite for market risks.

The widest regional MSCI index, excluding Japanese funds, almost unchanged today, but added 0.4% this week. At the same time, the Japanese Nikkei rose 0.1% and 1% for the week, reaching the highest level since August, 2015. On wall street have had mixed trading, where the index of health care companies in the lead with a weekly gain of 1%.

The U.S. dollar index fell 0.1 percent today to 97.488, but added 0.3 percent this week and 0.4 percent against the JPY in particular. Latest comments by fed officials supported a long term bullish trend for the us currency, and in addition, some of the leading investment strategists in Japan, such as ed Rogers, confirmed the forecasts about the prospects of stabilization of economic growth in the United States with his hand on the eve of Thursday.

Europe

The European markets also cheered, for the most part amid positive economic data and solid prospects for transactions on the corporate front. At the same time, forecasts for oil prices in 2018 leading analysts declined, where Barclays has revised the estimates from $67 to $57 per barrel.

The pan-European Stoxx 600 added 0.01% to 388.53 because growth was significantly limited by the reduction in trade stock of energy companies, and Germany’s DAX added 0.15% to 12794.00, while the French CAC 40 also grew 0.15 percent to 5281.93.

EUR strengthened against USD to the level 1.1158, but decreased by 0.3% in weekly terms. On the economic front, data mood French manufacturers weakened, with 109.0 108.0 in may to June, but at the same time, the overall mood of business circles has increased from 104.0 to 106.0.