Hello. Below view on a few interesting points to trade in the Forex market on 4.08.2017

Calendar of anticipated events

15:30 USA. The unemployment rate

15:30 Canada. Employment change

17:00 Canada. The index of business activity

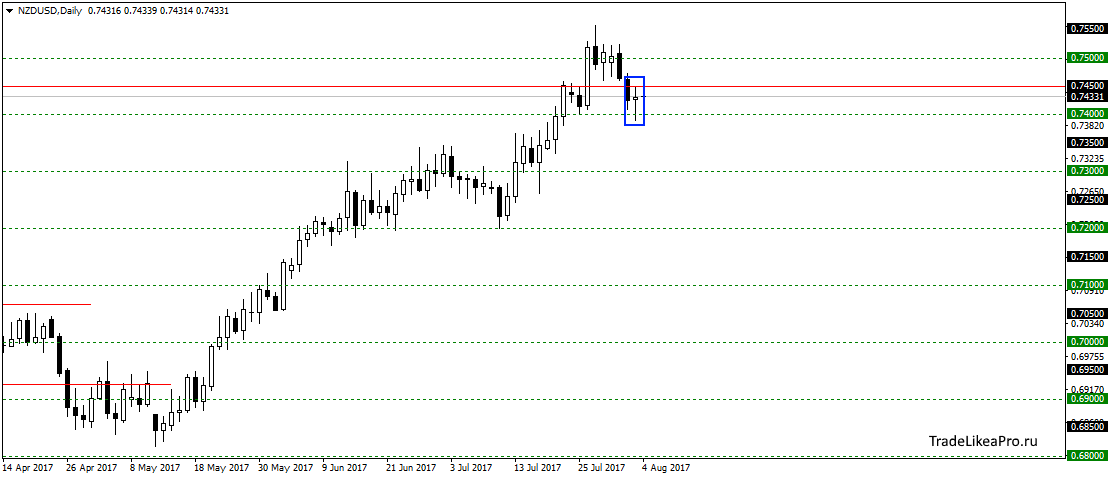

NZDUSD

On a pair NZDUSD formed a Doji pattern below the level of 0,74500. Probably will continue to fall correctives to 0,73500 or will break the trend on the downside. sales so far do not see here, the trend is still up.

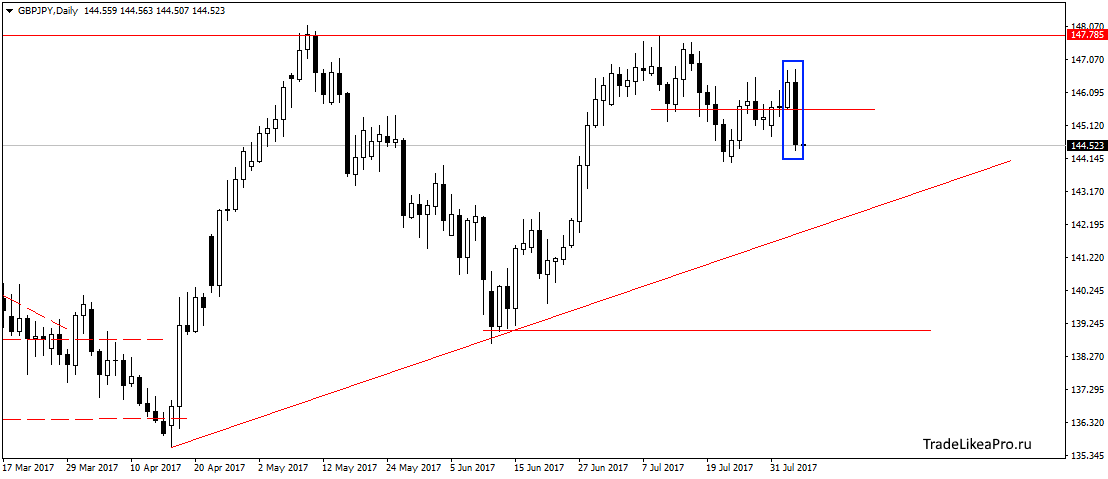

GBPJPY

On GBPJPY pair formed a pattern of Absorption in the area 145,58. It seems that continue to fall in the area of trend line or below to 139.000. I think you can look here to sales.

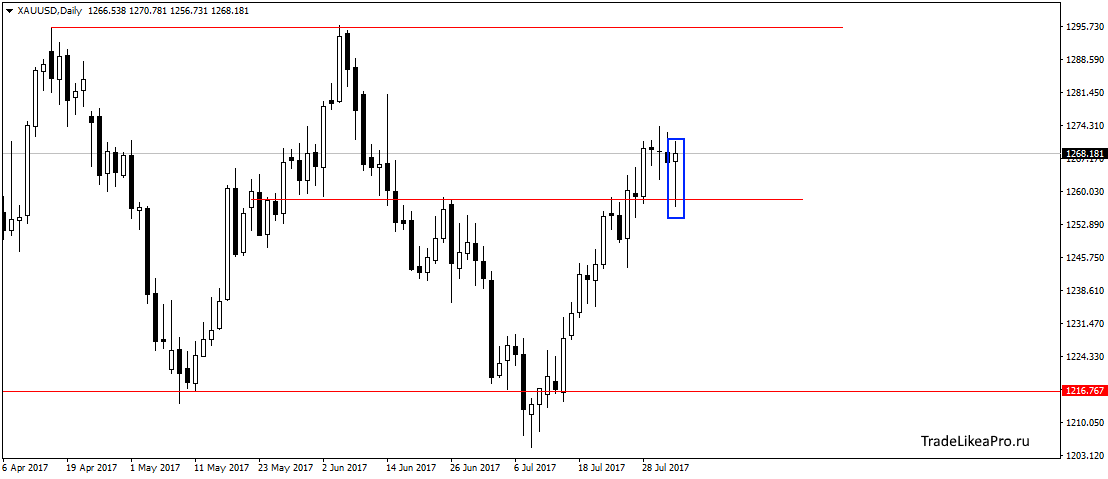

XAUUSD

Gold price formed a pattern Pin bar after Bouncing off the level 1258,00. Probably will continue the growth to 1295,00 the trend. Consider purchase here.

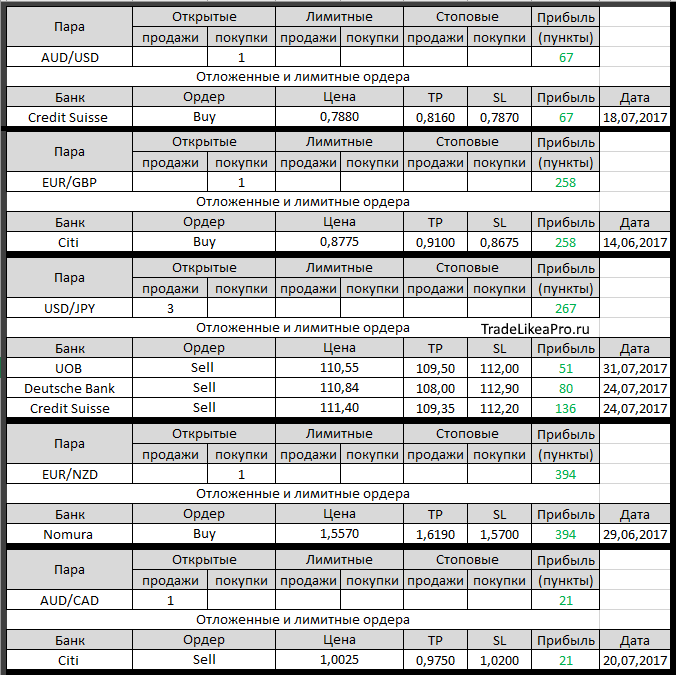

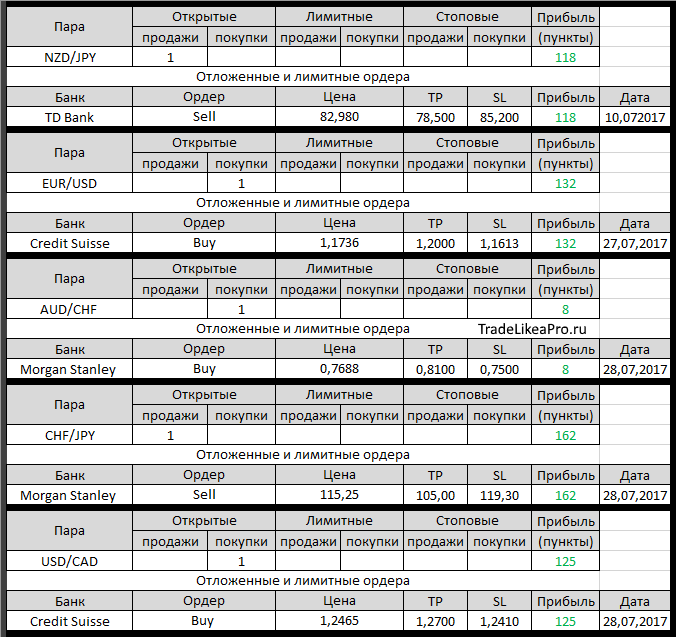

Open orders big banks

Changes in 3.08.2017

- Credit Suisse otstupite in buying NZD/USD at 0.7400 against 0,7490.

Loss-90пп - UOB of otmenit Buy Limit on GBP/USD at 1.3145

- Credit Suisse has closed on market purchase on GBP/USD at 1,3005 1,3220. Profit +215пп

- Credit Suisse worked with TR in the buy EUR/GBP with 0,8905 for 0,9045. Profit +140пп

Fundamental analysis

APR

Regional markets rose, despite the pullback in the technology sector on wall street, while the growth was driven by the prospects of a bullish read on employment in the United States, which will take place later today. In addition, the energy company received a strong impetus with the decline of commercial stocks of oil in the United States this week.

The widest index of MSCI’s Asia-Pacific grew by 0.2% and added 0.4% this week, reaching 24% growth in the current year. Japan’s Nikkei fell by 0.3% due to a stronger JPY, and it seems, completes this week with only relatively small gains. CSI 300 in China offset the early losses and gained 0.1 percent today. The Nasdaq and S&P 500 in new York rose 0.2 and 0.35%, respectively.

In currency markets, the USD weakened against the EUR by 0.1%, trading around 1.1880, dropping to its lowest level since January 2015 earlier on Wednesday. The U.S. dollar index traded near 15-month lows this week, losing 0.5% and 0.1% today, and down to 92.777. Against the JPY the U.S. currency a little stronger, but was not able to compensate for the most part, 0.6% of the total losses from Thursday.

Europe

European markets closed near intraday best levels after the Bank of England left interest rates unchanged. Among the problems of the Bank undervalued the General economic projections for GDP and low inflation, which is compounded by the current realities of the early brakcet initiatives.

The pan-European Stoxx 600 rose 0.13% or 0.49 points to 379.12, while the German Dax down 0.14%, or 17.49 points to 12163.99 and the French CAC rose by 0.46%, or 23.24 points to 5130.49. Also on the economic front, the purchasing managers index German purchasing surprised investors with an unexpected decline, falling to 53.1 in July from 53.5 in June — according to preliminary data.

EUR added 0.1% against the USD. At the same time GBP has reached nine-month lows against the EUR after the Bank of England kept interest rates at a record low 0.25%. In light of the low GDP growth forecasts of Britain for this year, it should be assumed that rates may go to zero or even negative values in the long term.