Hello. Below are a few recommendations for trading in the Forex market on 1.05.2020

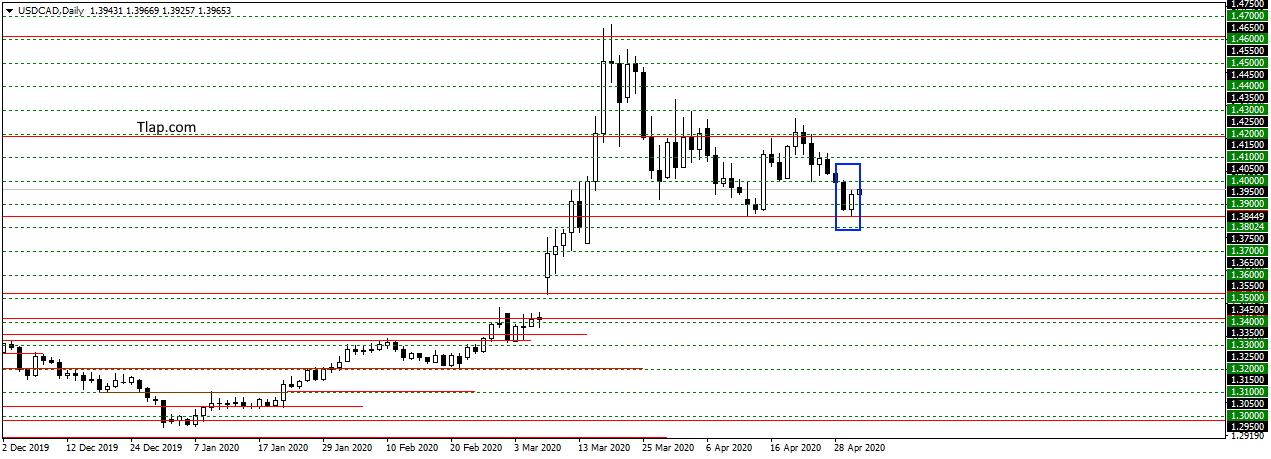

USDCAD

On a pair USDCAD formed a pattern of Internal bar rebounding from the level of 1,38500. It seems that price does not want to release from the outset and will resume again rise to the top 1,4200. You can look at here to purchase, the prices are decent.

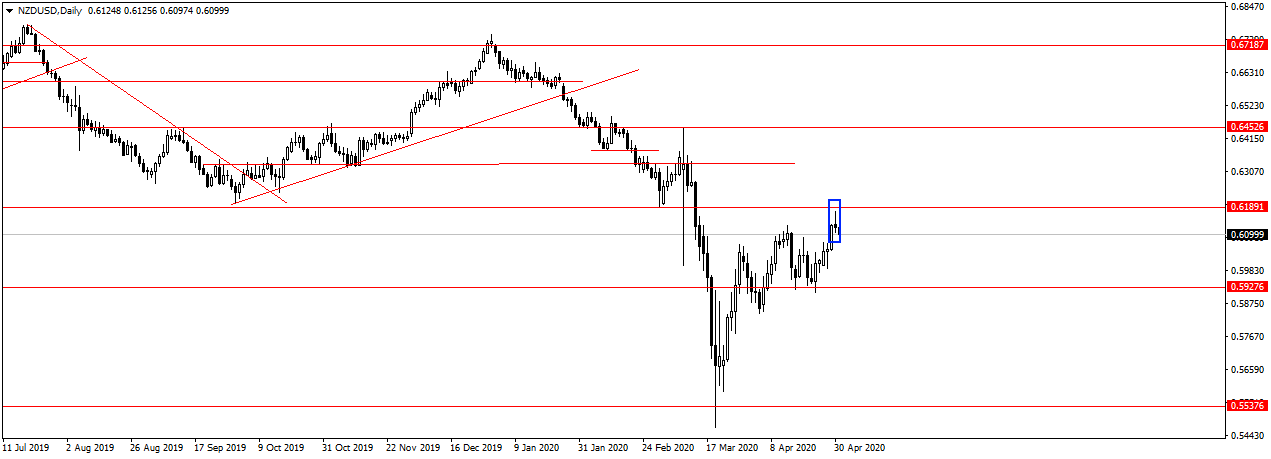

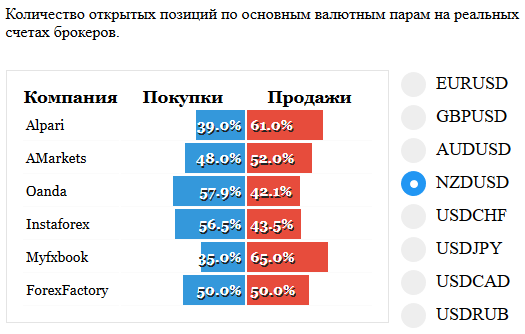

NZDUSD

On a pair NZDUSD has reached a very good level 0,6189 and formed a pattern Doji. Hence, perhaps, start a good fall, continuing the global trend down. I will look at there sales, but thoroughly to enter only after the recent lows near the level of 0,5927.

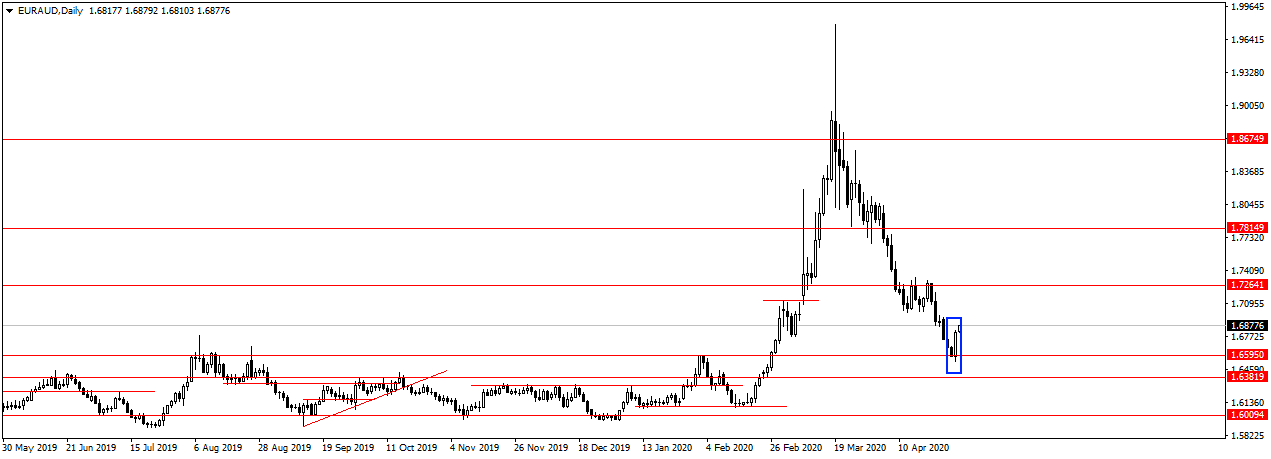

EURAUD

On the EURAUD pair also rebounded from the strong level 1,6595 and formed the pattern of Absorption. And so, you will start to look for confirmation of purchases, with the expectation that it will rebound and trend up.

Fundamental news

APR

- Nikkei 225 + 2,14

- S&P/ASX 200 + 2,39%

- Shanghai Composite + 1,33% and the Shenzhen Composite index + 1.97%, with the Hang Seng Index — the market is closed

- KOSPI market is closed

At the opening of Asian markets on Thursday, investors had plenty of reasons to buy shares. The first of these was the Shanghai composite index of overseas stock exchanges, which wins back the fed’s meeting. The second reason – double-digit growth of oil at the morning auctions.

Chinese stocks rose after a record recovery PMI figure exceeded expectations at non-manufacturing sector and has managed to maintain values above 50 in the manufacturing industry.

This morning came news by country:

- Australia: index of manufacturing activity, producer prices and new home sales

- Japan: inflation

USA

- NASDAQ — 0,28%

- Dow Jones — 1,17%

- S&P 500 0,92%

Economic statistics of the USA took stocks into negative territory. American households have reduced spending in March by 7.5% — a record since 1959-the year.

The reason is kartinah limitations, people continue to lose jobs. Published data for new applications showed an inflow of 3.8 million unemployed, the total number of which exceeded 30 million

The US economy is still far from the bottom, this is indicated by the indicators Chicago PMI, where the process of reduction of business activity.

US major indices:

- 17-00 – PMI from ISM

- 20-00 – the Number of working drilling rigs in the oil

The Eurozone

- DAX -2,22%

- CAC40 — 2,12%

- FTSE — 3,50%

EU investors staged Thursday pre-sale of the shares, after the last ECB meeting. The financial regulator has left unchanged the rate on loans and the asset purchase program QE.

This forced the participants to pay attention to the recession that occurred two leading economies, France and Germany, as well as a record decline in EU GDP.

The Minister of economy of Germany Peter Altmaier presents at the briefing, the annual economic forecasts

EU loss of 3.8% of gross domestic product, which was worse than analysts ‘ forecasts and the maximum rate of decline in the history of Eurostat. The Minister of economy of Germany Peter Altmaier presented a briefing on the GDP forecasts expecting an annual fall of 6.3% and recession up to 2021-year.

Across Europe celebrate Labor Day, markets are closed and no news, except the UK, where will be released:

- 9-00 – the Index of housing prices

- 11-30 – final manufacturing PMI