Hello. Below are a few recommendations for trading in the Forex market on 21.11.2017

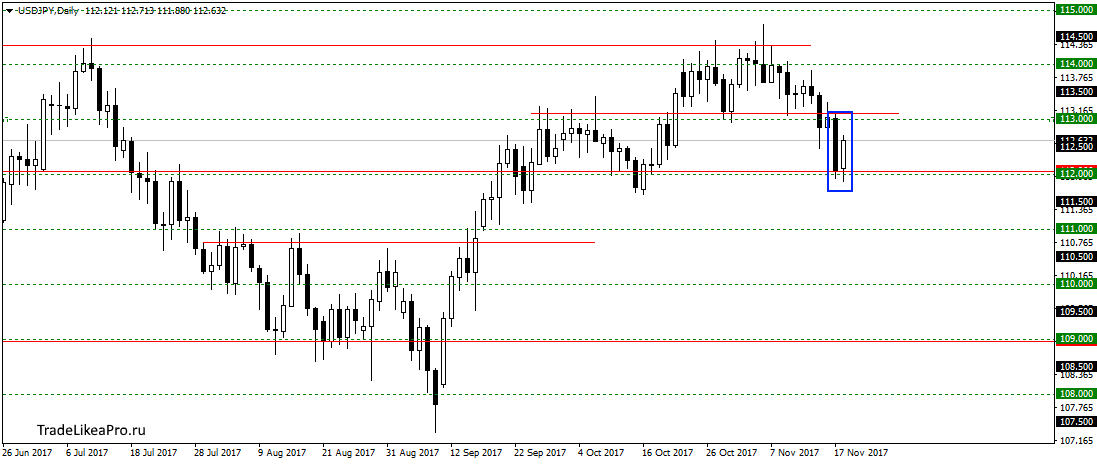

USDJPY

On USDJPY rebounded from the support level of 112.00, and formed pattern Inner bar. It’s probably a small correction to of 113.00 and will continue to break down the trend is downward. The not consider the sale will look after the breakout of 112.00.

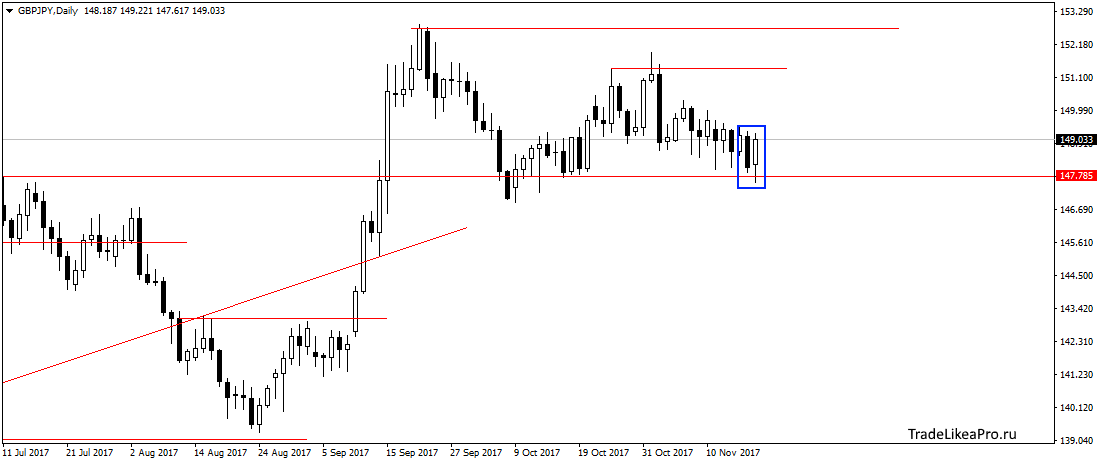

GBPJPY

On GBPJPY pair failed once again to pass the level 147,70 and formed Rails. Probably worth to wait for growth to 151,50 before another attempt to go down. You can try the purchase here, the expected course of prices is pretty good.

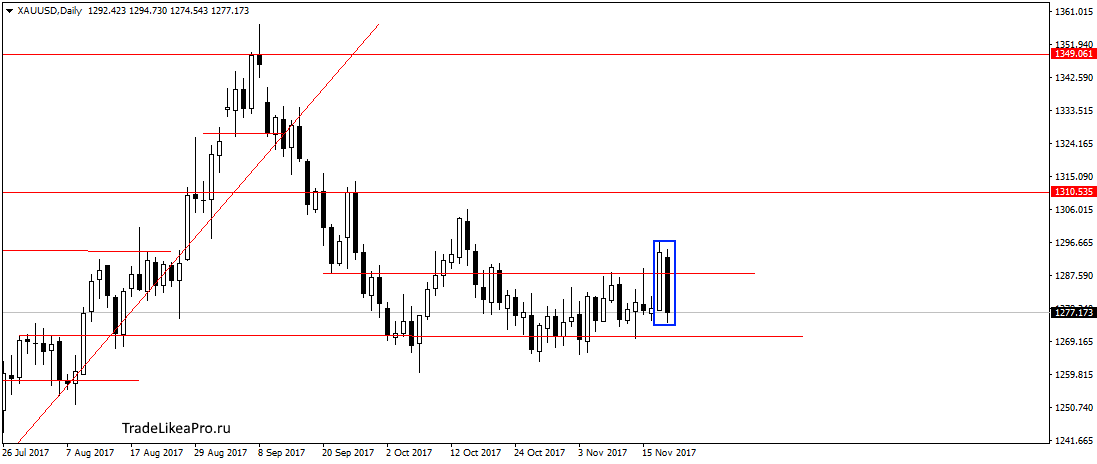

XAUUSD

Gold level breakthrough 1288,00 proved false and turned and formed a pattern of Rails. Waiting for the descent back to the bottom of the range, and possibly continue to fall below. Sales here will look after the breakout 12,6950.

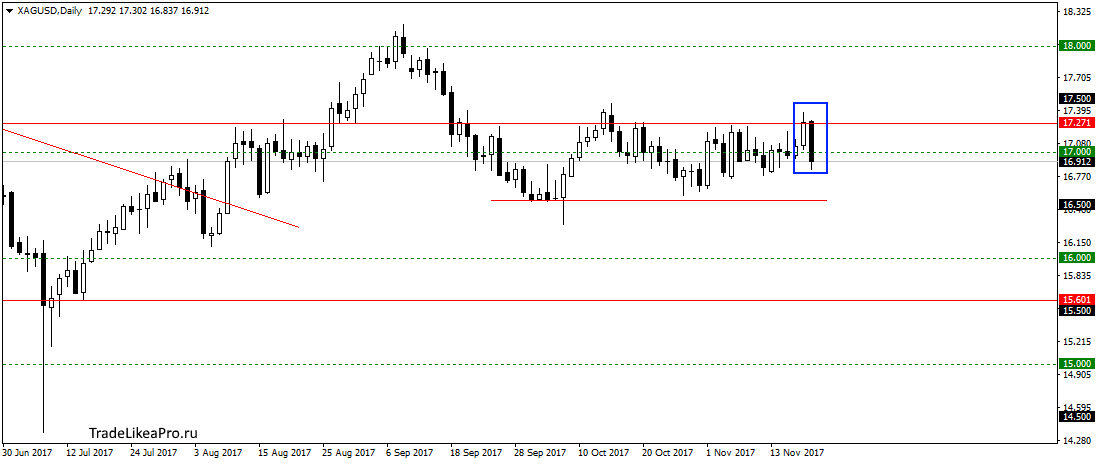

XAGUSD

Silver rebounded from the level 17,27 and formed the pattern of Absorption. Should probably wait for the fall to the bottom of the sideways pattern. Sales do not see here.

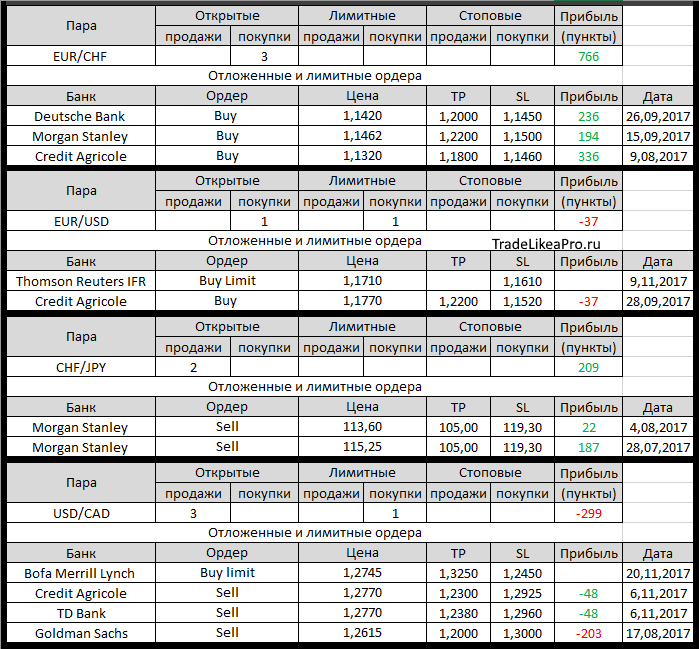

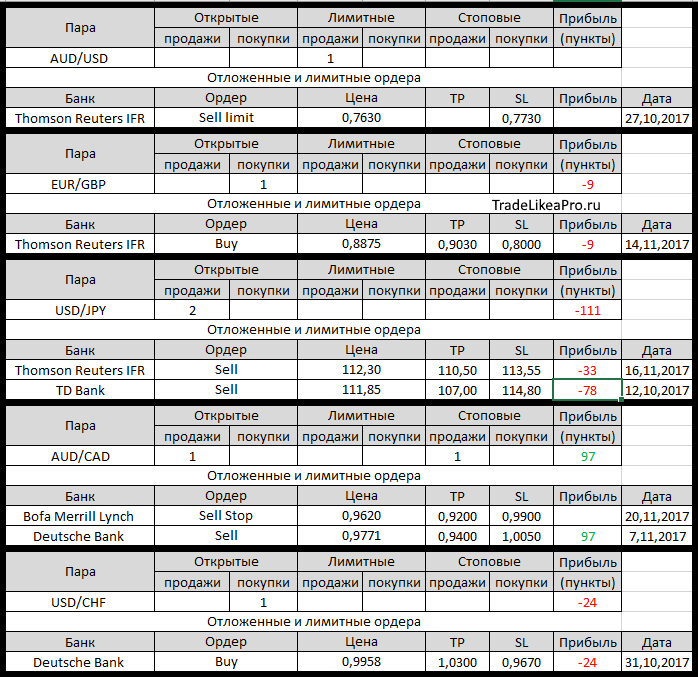

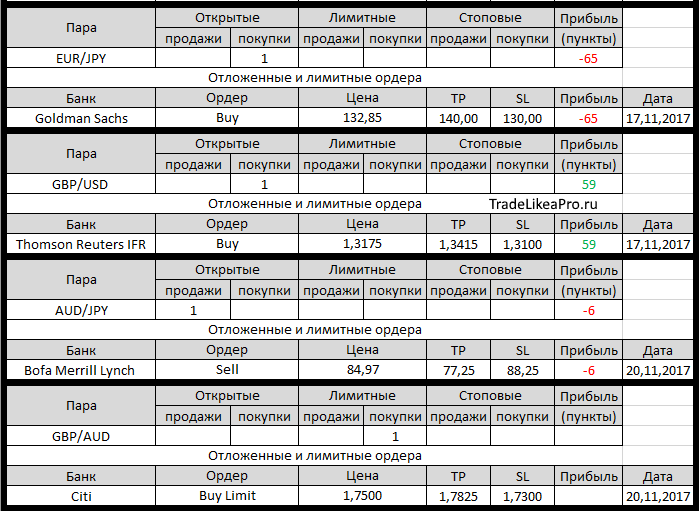

Open orders big banks

Changes in 20.11.2017

- Thomson Reuters IFR triggered a Buy limit on EUR/GBP with 0,8875

- Thomson Reuters IFR changed a Buy on EUR/GBP. Set TR on 0,9030. Changed SL on 0,8775 of 0.8000

- Thomson Reuters IFR changed the Sell Limit on USD/JPY. Sign in with 112,90 on 112,30, SL 113,90 on 113,30

- Citi placed a Buy Limit on GBP/AUD with 1,7500, TR – 1,7825, SL – 1.7300

- Thomson Reuters IFR triggered a Sell Limit on USD/JPY with 112,30

- Thomson Reuters IFR changed a Sell on USD/JPY. Set TR on 110,50, Changed SL with 113,30 on 113,55

- Bofa Merrill Lynch placed a Sell Stop on the AUD/CAD with 0,9620,

TR – of 0.9200,

SL – targets 0.9900 - Bofa Merrill Lynch placed a Sell Limit on AUD/JPY with 84,97, TR – 77,25,

SL – 88.25 - Bofa Merrill Lynch has placed a Buy Limit on USD/CAD with 1,2745,

TR – of 1.3250,

SL – 1.2450 - Bofa Merrill Lynch triggered a Sell Limit on AUD/JPY with 84,97