Hello. Below are a few recommendations for trading in the Forex market on 30.03.2018

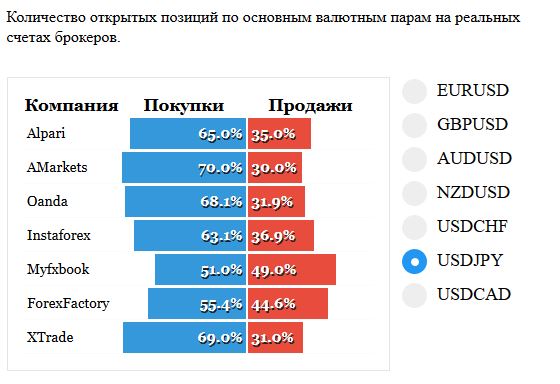

USDJPY

On the pair USDJPY formed a inside bar after the breakout of the trendline. Probably correction down after good growth. To speak about full-fledged fracture even earlier, and may continue the down trend if the advantage will remain on the buyers side.

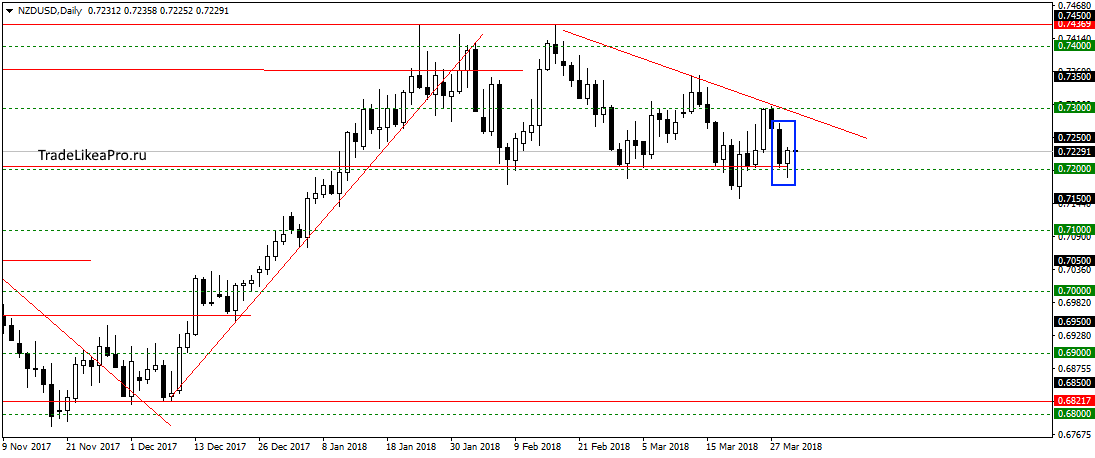

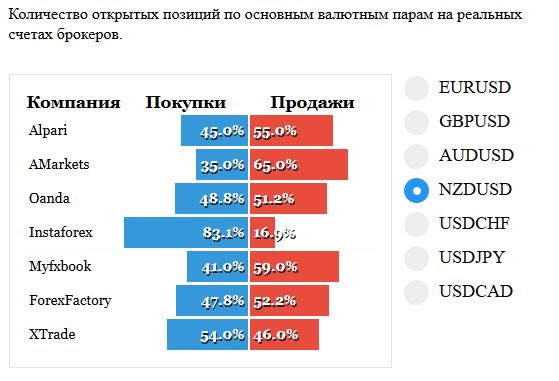

NZDUSD

On a pair NZDUSD price is not released beyond the boundaries of the triangle and below the level 0.7200, forming the Inner bar. The obvious advantage of transactions is not visible. Apparently, like me, all waiting for the development of the situation, and going beyond the boundaries of the triangle. Transactions here are not considered.

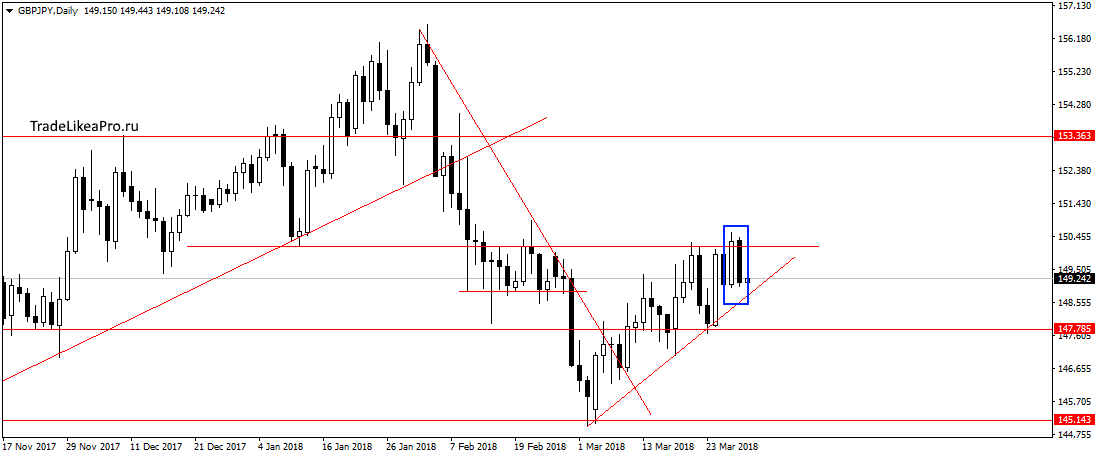

GBPJPY

On GBPJPY as the price is squeezed in a triangle between 150,15 level and trend line. Today formed a pattern of Rails. Hurry up with the sales then I will definitely not wait as a minimum the breakout of the trendline.

Open orders big banks

Briefly about changes in open orders banks:

Morgan Stanley closed a buy EUR/AUD(+335пп), selling for CHF/JPY(+391пп), purchase for CAD/JPY(+83пп)

Deutsche Bank closed the sale on the AUD/JPY(+212пп) and Citi closed the sale on the AUD/CAD(+26пп)

Thomson Reuters IFR is the only with stop on GBP/USD(-50пп)

UOB and Morgan Stanley opened a buy on USD/JPY. Maybe they know something.