Hello. Below are a few recommendations for trading in the Forex market on 7.03.2018

Calendar of anticipated events

15:30 UK. The annual budget

16:15 USA. Unemployment rate nonfarm

18:00 Canada. Interest rate decision

18:30 USA. Crude oil inventories

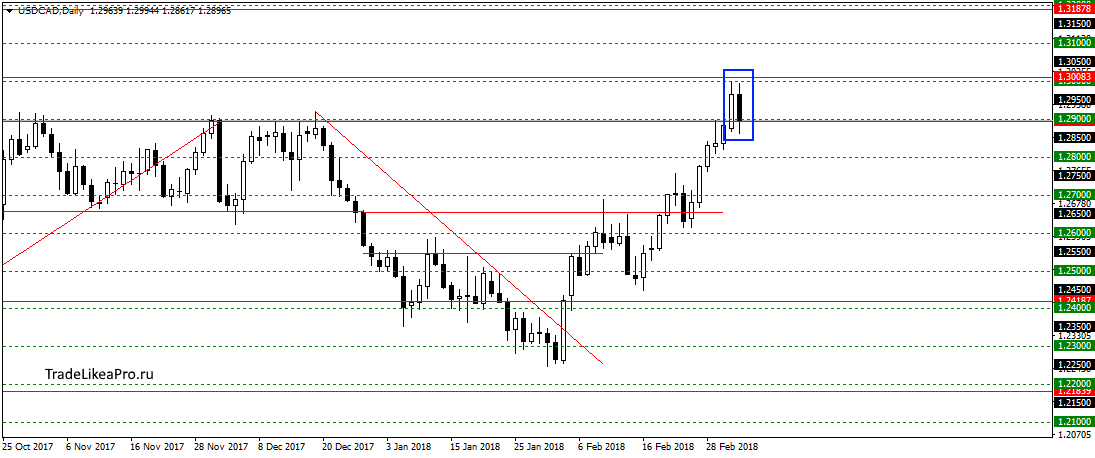

USDCAD

On a pair USDCAD formed a pattern of Rails rebounding from the level of 1,3000. Pattern reversal, but also as a small correction here is not waiting. Most of the time in sales. Perhaps go back down a bit, and then continue the up trend. Sales do not see here.

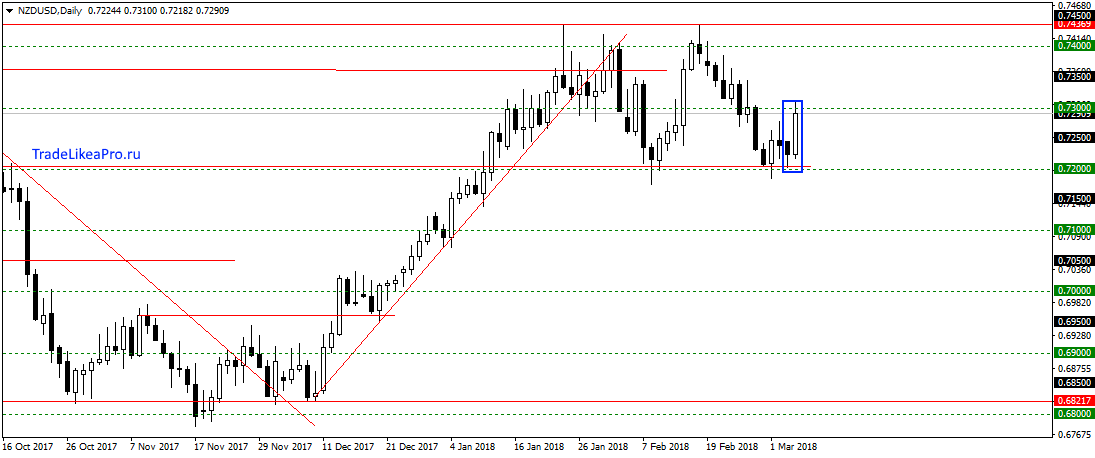

NZDUSD

On a pair NZDUSD once again rebounded from the level of 0.7200 and formed a pattern of Absorption. It seems that we continue to move sideways and expect the growth to 0,74500. The price move up to resistance is pretty good and I think we can consider here the purchase.

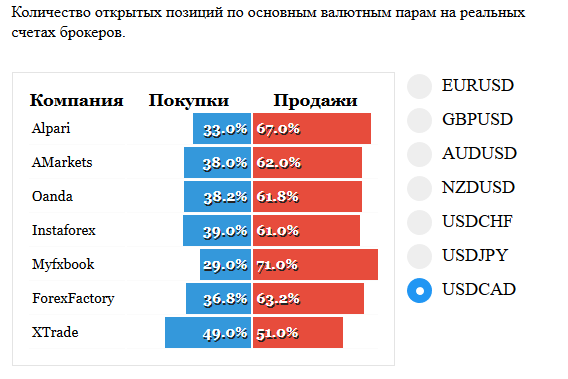

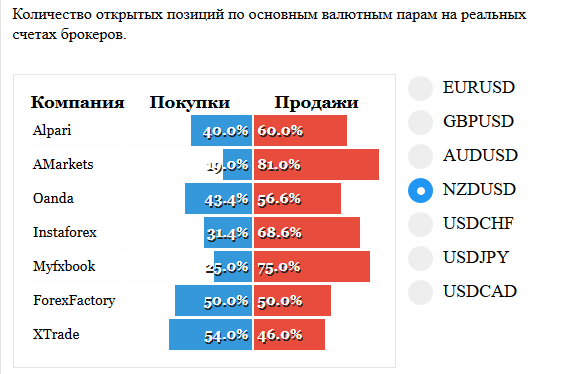

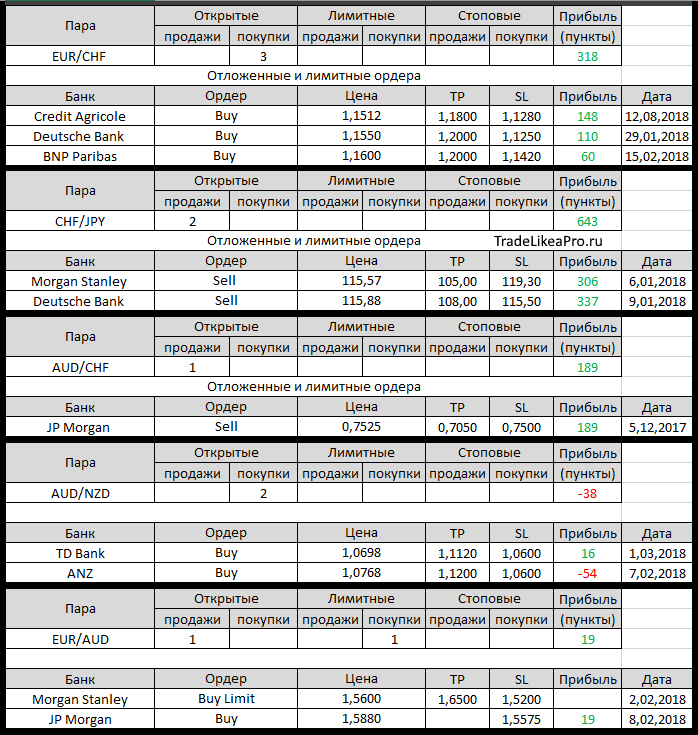

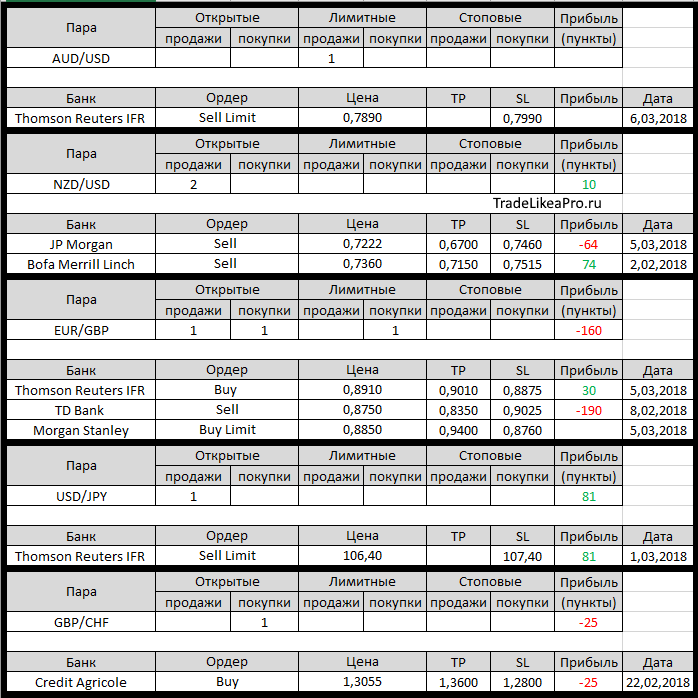

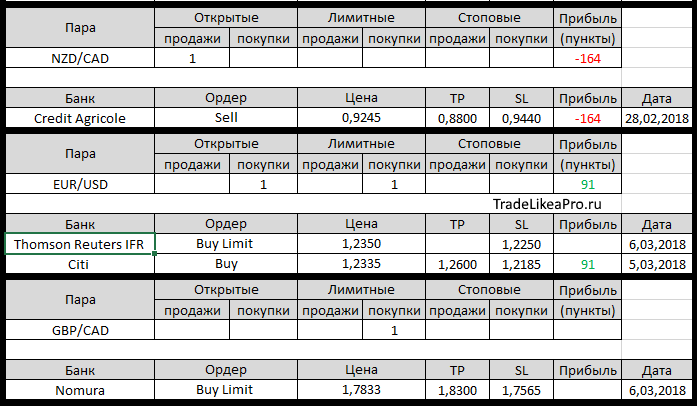

Open orders big banks

Changes in 6.03.2018

- Thomson Reuters IFR triggered a Sell Limit on USD/JPY from 107,40 at 106,40

- Thomson Reuters IFR changed a Sell on USD/JPY. Set TR on 105,05, changed SL 107.40 on 106,70

- UOB otstupite on sale for GBP/USD with 1,3800 at 1,3890.

Loss-90пп - Thomson Reuters IFR otstupite on sale for AUD/USD with 0,7762 for 0,7820. Loss-58пп

- Thomson Reuters IFR has placed a Buy Limit on EUR/USD with 1,2350,

SL – 1.2250 - Nomura placed a Buy Limit on GBP/CAD with 1,7833, TR – 1,8300,

SL – 1.7565 - Thomson Reuters IFR has placed a Sell Limit on AUD/USD with 0,7890,

SL – 0.7990

Fundamental analysis

APR

Asian funds and the US dollar tumbled today after a key advocate of free trade at the White house resigned. Now, investors concerned about risks that Donald trump will continue to tighten rates, flirting with the prospect of the escalation of global trade wars.

The S&P 500 futures fell more than 1%, presenting a dark background for Asian trade. Consolidated MSCI-index for Asia-Pacific fell 0.3% and Japan’s Nikkei weakened by 0.7%. Australian shares lost 1.1% and Hong Kong’s Hang Seng fell 0.4%, while Chinese blue chips CSI 300 closed flat.

Economic adviser to the White house and the main campaigner for free markets — Gary Cohn — resigned

Economic adviser to the White house, Gary Cohn, the chief rival of the protectionists in the property trump said Tuesday that he was leaving. His departure was like snow on the head for bulls, barely sensing the rise in global risk appetite. In currency markets USD fell 0.6% to 105.45 JPY, trading near 16-month low of 105.24 referred to earlier on Friday. CAD fell 0.4% to 1.2929 USD and MXN retreated 0.4% to $18.82.

Europe

European stocks risk to open with a gap down today, despite yesterday’s modest gains. This is due to the global nature of tariff initiatives trump, able to put the trade relations of the EU and the United States at risk.

However, yesterday, the benchmark Stoxx 600 was not as receptive to close with gains of more than 0.13%, while Germany’s DAX added 0.19%. The French CAC 40 closed close to flat with a 0.06-percent increase. In parallel, the FTSE Mibtel in Milan bounced back sharply after losses earlier in the week and added more than 1.4%.

CHF has strengthened by 0.4% against USD to 1.0671, while the EUR rose 0.1% to 1.2420. Commodity markets also suffered from fears of slowing global growth. Futures for Brent crude lost 0.8% to 65.27 USD per barrel, while copper in London fell 0.3% to 6981.50 USD per ton, reaching a 1.4-percent gain in the previous session. Meanwhile, gold continues to stretch a rally from the previous day and reached 1340.42 USD per ounce, the highest level since February 26.