Hello. Let’s see what interesting to trade in the Forex market on Monday 14.08.2017

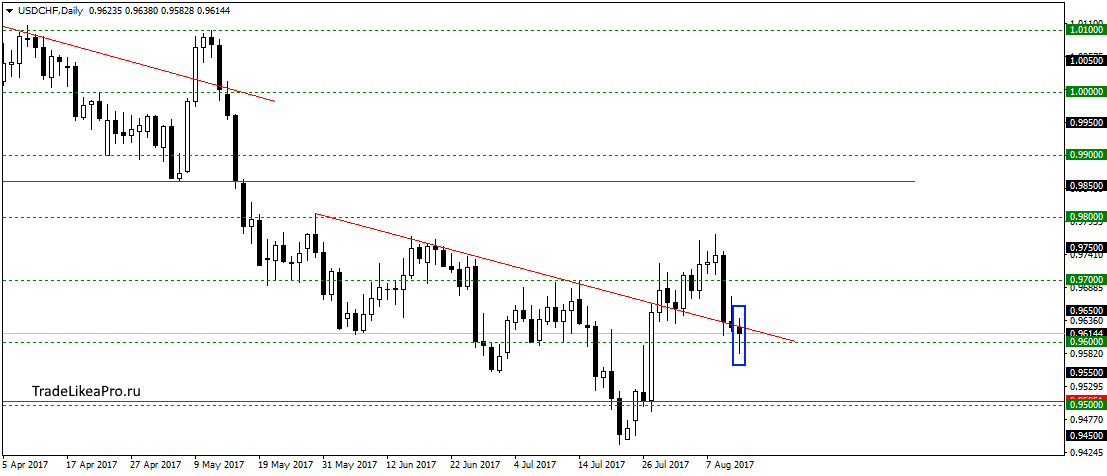

USDCHF

On the pair USDCHF formed a Pin-bar in the area previously broken trend line and the level 0,9600. Perhaps This is a signal to end the correction and resume the growth dolomya the trend is up. Consider purchase here.

NZDUSD

On a pair NZDUSD formed the Inner bar in the district rallies around 0.7300. Support good pattern there, but may start a correction to 0,74500 and broken trend line. Eyeing on this pair for sales with the expectation of a trend reversal.

USDJPY

On the pair USDJPY has formed a Pin bar at the level of 109,000. The price went beyond the boundaries of the triangle, and perhaps after a small correction will continue falling down trend.

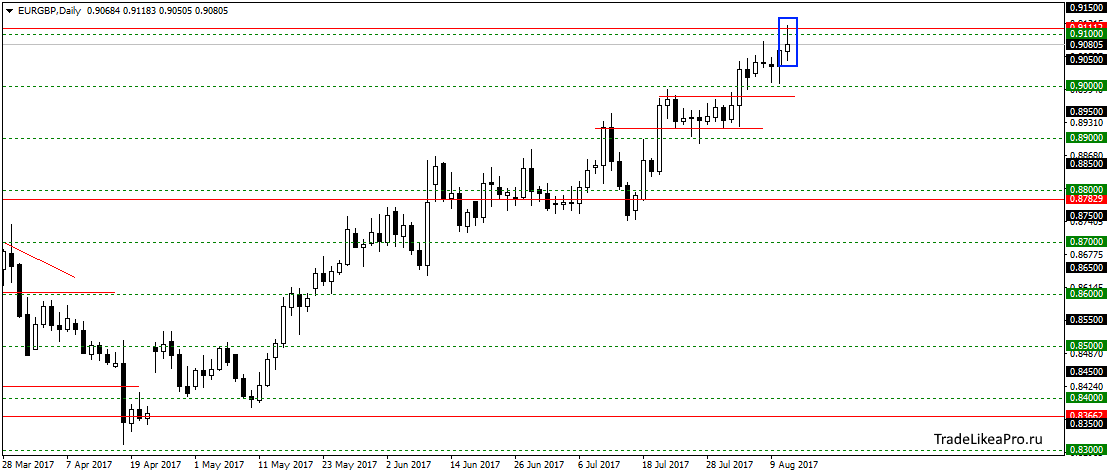

EURGBP

On EURGBP the pair has reached the level 0,9100 and formed a pattern Doji. Will probably start a downward correction, after which try to break the level 0,91000 and continue up trend.Sales here do not consider, as they are against the trend.

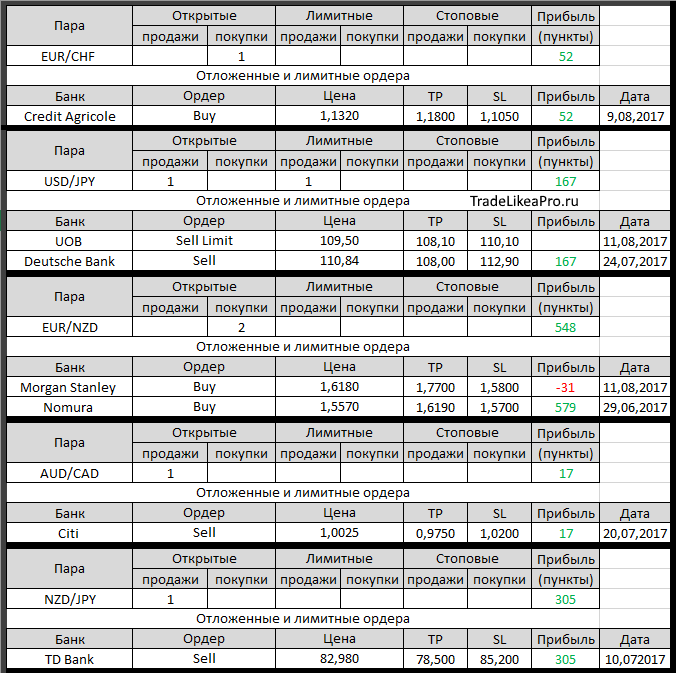

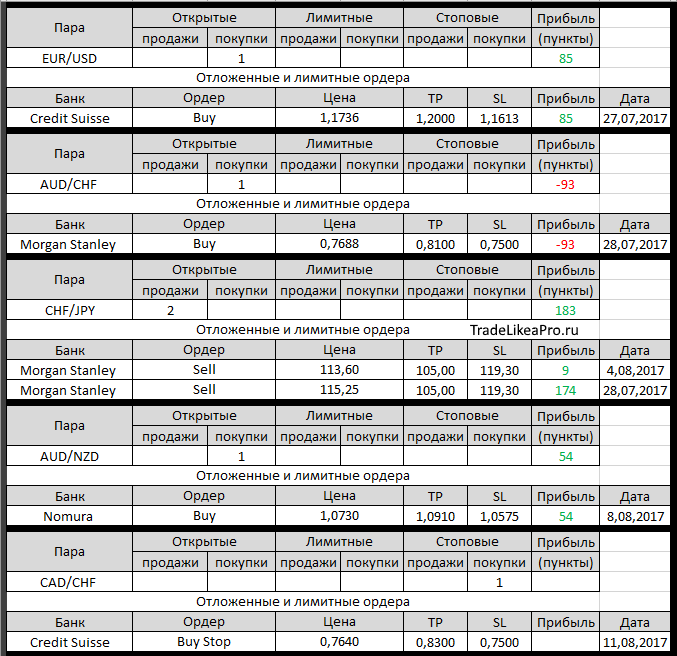

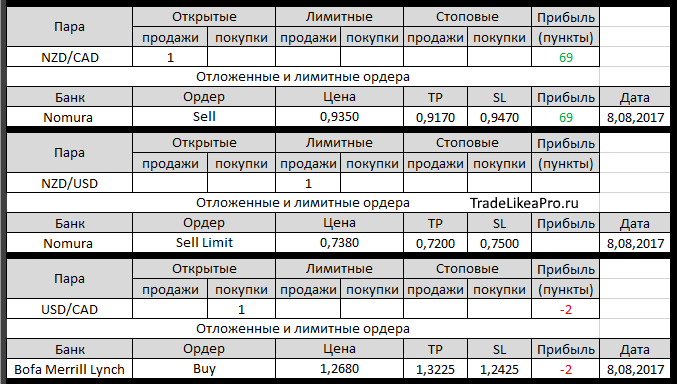

Open orders big banks

Changes in 11.08.2017

- Morgan Stanley has opened a Buy EUR/NZD with 1,6180, TR – 1,7700, SL 1.5800

- UOB posted a Sell Limit on USD/JPY with 109,50, TR – 108,10, SL 110.10 writing

- TD Bank changed the SL with 85,20 on 81,74 for sale on NZD/JPY

- Credit Suisse otstupite in selling USD/CHF at 0,9655 of 0.9595/.

Loss-60пп - BNP Paribas otstupite buying on USD/JPY with 110,65 at 108,80.

Loss-185пп - Citi srabotal TR in the buy EUR/GBP with 0,8775 for 0,9100.

Profit +325пп - Credit Suisse has placed a Buy Stop on CAD/CHF from 0.7640, the TR – line of 0.8300,

SL – 0.7500

Fundamental analysis

APR

Asian stocks rose today, ending losing sessions, and on a background of solid results close on wall street, while the growth of trade USD remains confined to the tensions on the Korean Peninsula and doubt that the fed will raise rates again this year.

Asian markets generally remained indifferent to the slew of economic data from China, which were weaker than expected. The widest index of MSCI’s Asia-Pacific region rose 0.8%, while Hong Kong’s Hang Seng added 0.9% and the Shanghai Composite rose 0.7%. Australian shares rose 0.75% and the Kospi index in South Korea has grown by 0.6%. Japan’s Nikkei lost 1% due to strong JPY.

In currency markets the U.S. dollar index against six major currencies rose 0.1% to 93.145, after losing 0.4% earlier on Friday. The JPY showed little reaction to GDP data for the second quarter, a decrease of 0.4% against the USD to 109.585, but is above most other major currencies. It is expected that geopolitical risks will remain on the agenda of the global markets in the near future, because North Korea tomorrow will celebrate liberation Day, marking the end of Japanese rule on the Peninsula.

Europe

Markets in Europe closed near session lows earlier, with the exception of German equities, as global investors assess the geopolitical risks associated with North Korea, the U.S. and China, are showing increased interest in hedging using safe assets.

The pan-European Stoxx 600 index closed with a decline of 1.07% and lost 2.8% last week, where the banking sector (-1.69%), basic industries (-2.66%) and technology sector (-1.09%) topped the list of dofollow. The German DAX closed flat on 12014.06, while the French CAC 40 fell 1.08% to 5059.82, while the Spanish IBEX 35 lost 1.60% to 10282.90.

EUR only marginally strengthened against the USD, adding about 0.05%, but strengthened against all other major currencies. EUR continues to strengthen long-term growth prospects trading course on the background of the current agenda of the ECB, pointing to the prospects for reductions in monetary stimulus for the economy. However today, as already mentioned, geopolitical agenda, which substantially limits the demand for the single currency too.