Hello. Quite logical pullbacks have begun everywhere, let's look at what you should pay attention to when trading in the Forex market on 04/17/2023

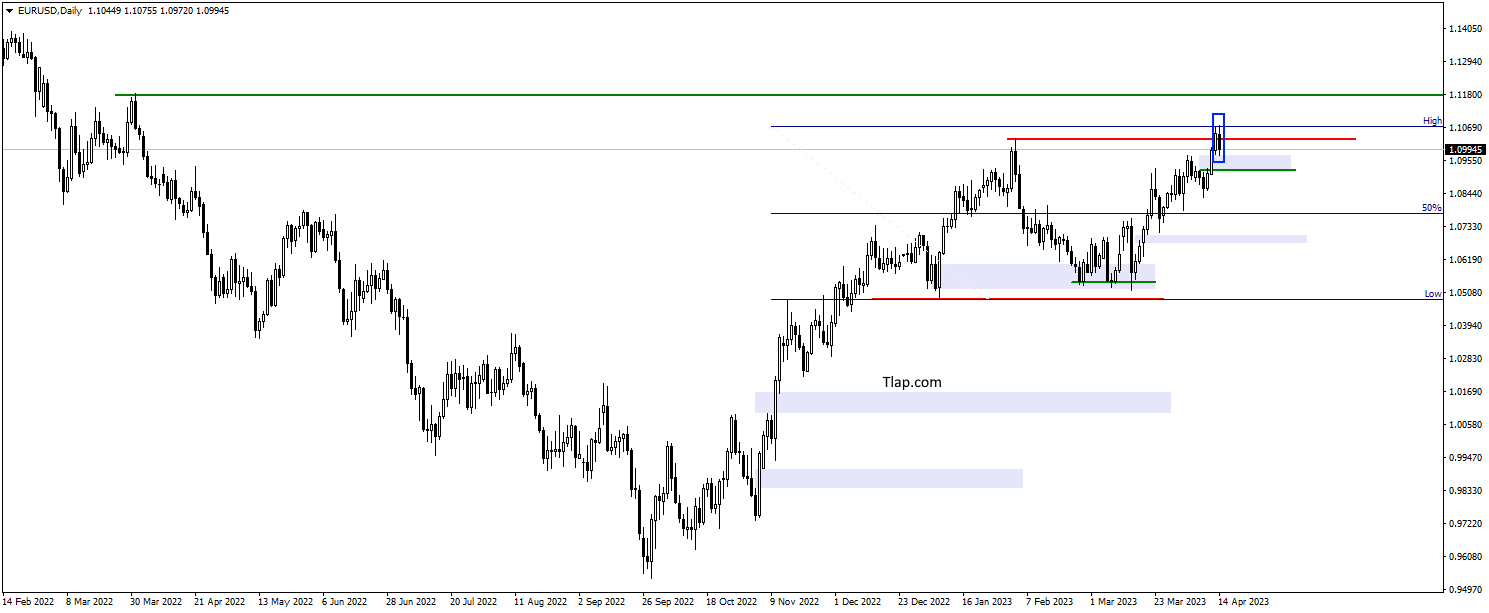

EURUSD

The EURUSD pair has updated highs and formed an Inside bar pattern. While I think it is worth considering the downward movement as a correction, logical targets for the FVG correction from below, ideally a descent to 1.0927. For intraday trading, quite reasonable goals. It’s too early to talk about a global downward march, and in the statistics of deals the mood is down, which does not encourage a fall.

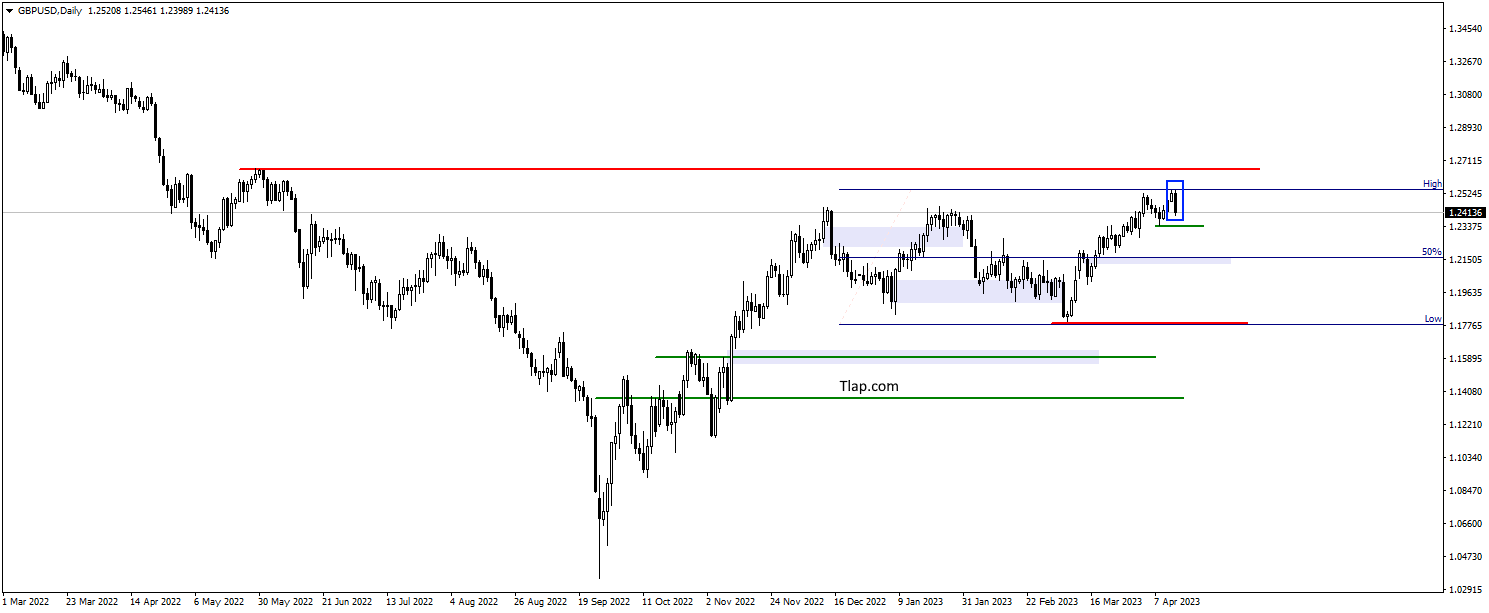

GBPUSD

GBPUSD also made new highs, formed a Double Top and an Absorption pattern. It is quite logical that at least we go lower to the area of 1.3289. There are stops of buyers, and sales on the breakdown of the double top. Let's see the reaction in this area, maybe there will be buy signals with targets of 1.2659.

USDCHF

On the USDCHF pair, as expected, they took the first correction targets of 0.8947 and formed an Inside bar pattern. I think we'll go higher to the FVG area, somewhere to 0.9000. And from there it will be possible to take a closer look at sales. The buyers in the deal statistics seem to really want the price to continue falling 🙂

On the USDCHF pair, as expected, they took the first correction targets of 0.8947 and formed an Inside bar pattern. I think we'll go higher to the FVG area, somewhere to 0.9000. And from there it will be possible to take a closer look at sales. The buyers in the deal statistics seem to really want the price to continue falling 🙂

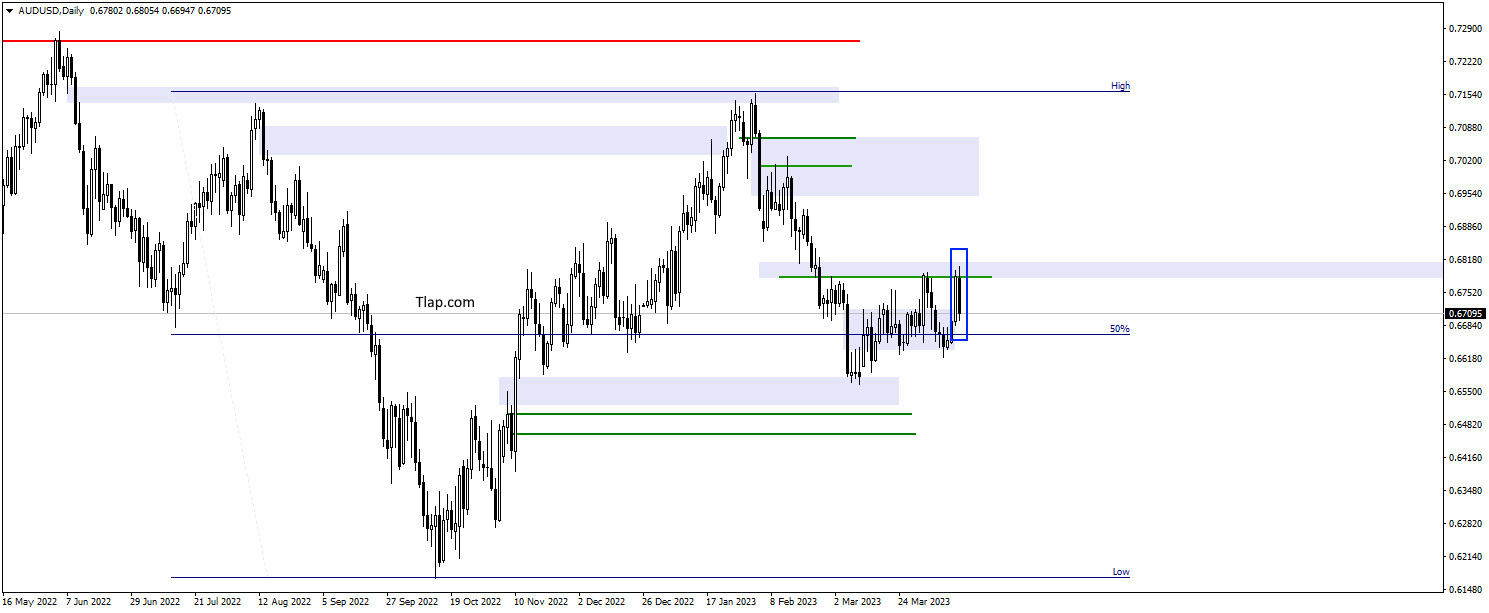

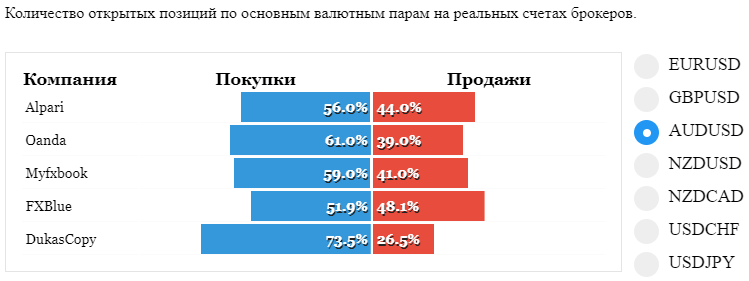

AUDUSD

On the AUDUSD pair, last week I wrote about sales, but there was again growth with falls on Friday and the Inside bar pattern. The price is flat, and so far does not let go of thoughts about sales, the highs have already been updated several times from above, and from below they are quite even. I would look at the price reaction in the area of the lower border of 0.6619. and draw further conclusions. So far, in general, I am for the fall.

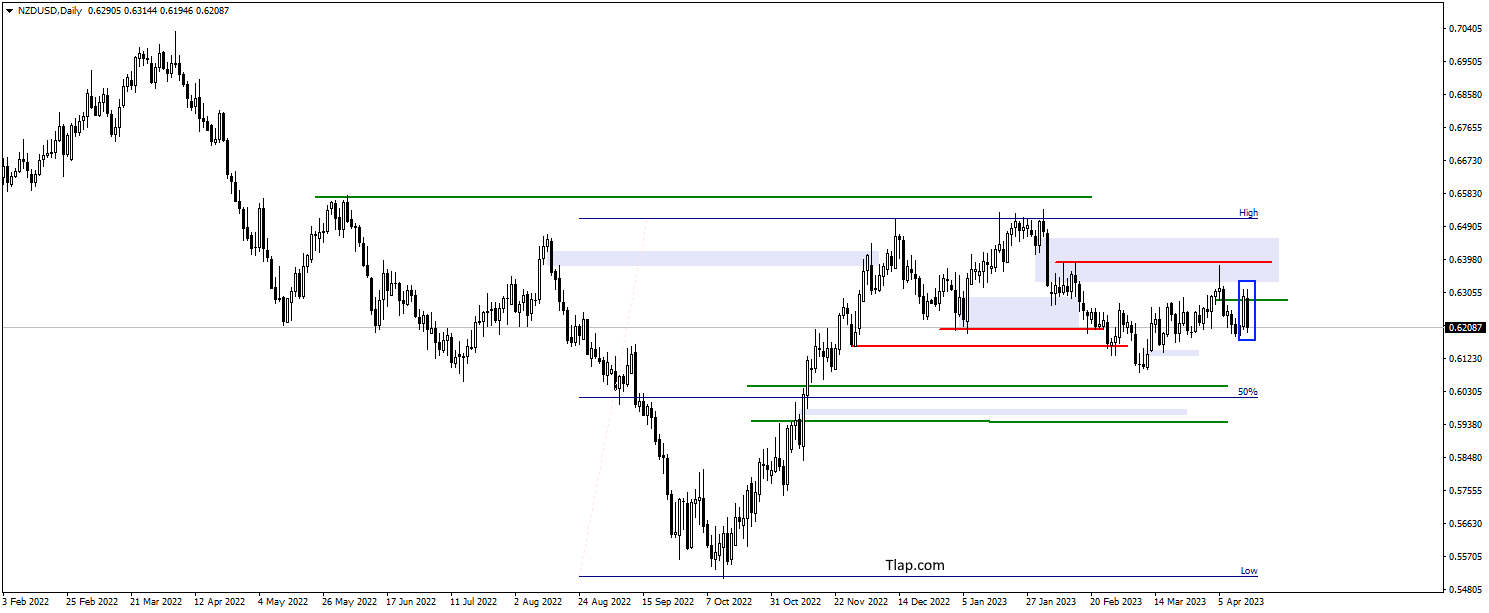

NZDUSD

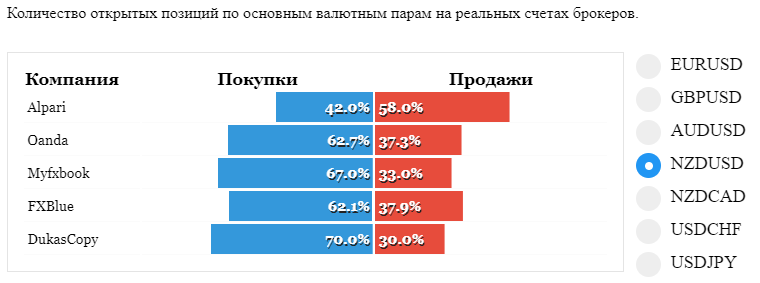

NZDUSD has a similar situation and the Rails pattern. From above, FVG was closed, and an order block in the form of a Pin bar, and the preponderance of buyers in the statistics of transactions. Therefore, I keep the same bearish mood here with the targets of 0.6040.

The correlation between the AUDUSD and NZDUSD pairs is quite good, and I just noticed, so I didn’t draw it. If we take the latest highs, then we have a SMT divergence. Fractals, again, are not finished, but one more fad in the direction of falling prices. 🙂