Hello. Below are a few recommendations for trading in the Forex market on 15.01.2018

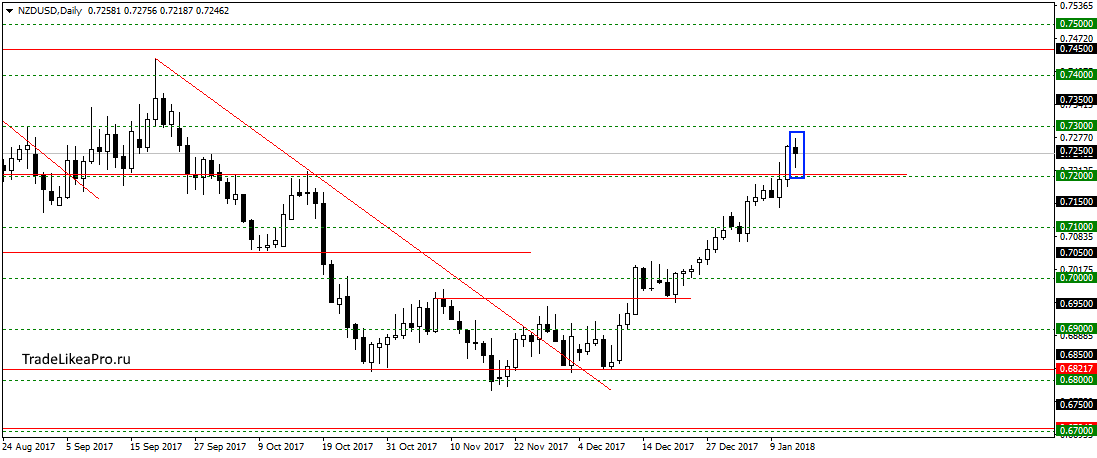

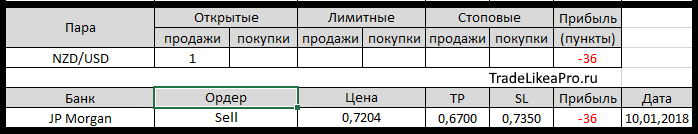

NZDUSD

On a pair NZDUSD formed a Doji pattern after the breakout of the 0.7200 level. Maybe go down a little more to the level of correction. But in General, expect to continue the growth trend. Consider purchase here.

EURGBP

On EURGBP pair formed a pattern Doji at the district level round 0,89000. For a long time in this pair is moving sideways, and now even taper into a triangle. Likely again go down to 0,87500. Sales do not see here, watch the developments.

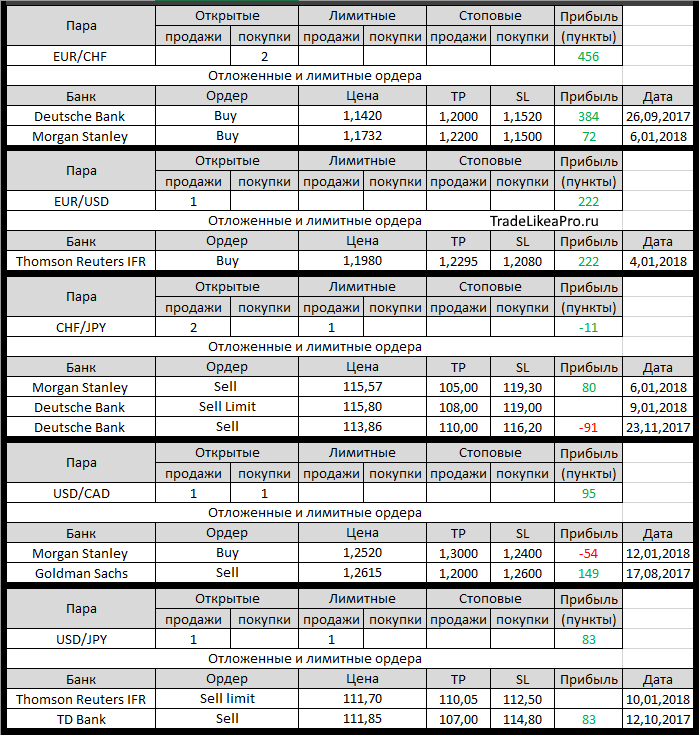

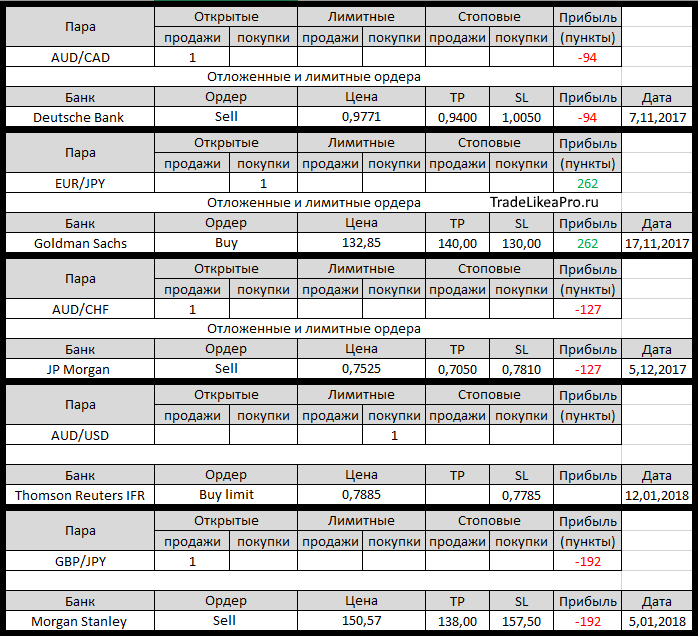

Open orders big banks

Changes in 12.01.2018

- Thomson Reuters IFR changed SL with 1,1895 on 1,1980 buying on EUR/USD

- Thomson Reuters IFR changed with SL of 0.8805 for the purchase of 0.8870 EUR/GBP

- Thomson Reuters IFR otstupite on sale for GBP/USD with the 1.3525 at 1,3620. Loss-95пп

- Thomson Reuters IFR changed a Buy on EUR/USD, TP with 1,2150 on 1,2295,

SL 1,1980 to 1,2080. - Thomson Reuters IFR changed the Sell Limit on USD/JPY/ Entrance to 111.95 111.70, SL 112,95 on 112,70

- Credit Agricole has worked with TR in the buy EUR/CHF with 1,1320 at 1,1800. Profit +480пп

- Thomson Reuters IFR closed Buy AUD/USD with 0,7825 for AZN 0.7850. Profit +25пп

- Thomson Reuters IFR closed a Buy EUR/GBP at 0,8855 of 0.8870. Profit +15bps

- Thomson Reuters IFR changed the Sell limit on USD/JPY. Set TR on 110,05, changed SL with 112,70 on 112,50

- BNP Paribas otstupite in selling EUR/USD with 1,2035 at 1,2150.

Loss-115п - Thomson Reuters IFR has placed a Buy Limit on AUD/USD with near 0.7885,

SL – 0.7785 - Credit Agricole load TR in a buy EUR/USD with 1,1770 at 1,2200. Profit +430пп

- Deutsche Bank otstupite in buying USD/CHF at 0,9670 0,9958. Loss-288п

Fundamental analysis

APR

Asian stocks reached a historic high on Monday after the indices wall street pulled a record run, as USD continued to fall as investors assessed the risks of rising interest rates in other developed countries.

Activity in the markets was muted, because the holidays in the United States has restricted trade. Consolidated MSCI index of Asia Pacific outside Japan rose 0.6 percent. Main index Australia has been strengthened at the level of 0.2%, while Japan’s Nikkei rose 0.3%. The index in Hong Kong jumped 0.9% to another indicator.

Last week the Dow increased profit by 2% and Nasdaq 1.8%, while the S&P 500 added 1.6%. Shares S&P 500 is likely to grow somewhere in the 12.1% for the quarter, and profits of financial companies will be around 13.2%.

The U.S. dollar index showed signs of a rebound in early session and fell to 90.839. USD weakened to a six-week low to 110.73 JPY, even after the Bank of Japan reiterated the commitment to maintain low rates.

Europe

Stock indices on the continent have proved at the end of last week, as two major German parties have reached a breakthrough in talks on forming a coalition after a 24-hour marathon, increasing the growth of asset prices in the single currency bloc.

The pan-European Stoxx 600 rose by 0.31%, while Germany’s DAX added 0.32% and France’s CAC 40 strengthened by 0.52%.

At the weekend it became known that the CDU of Angela Merkel and the social Democrats moved to planning official part of the meeting.

The Euro is trading at three-year highs near $1.2203, expanding 1.3% profit since Friday. The growth of the single currency was supported by speculation. The European Central banks developed policies to mitigate their massive campaign to stimulate monetary policy. Also Euro was supported by news of the German Chancellery by Angela Merkel that the social Democrats (SD) have advanced to formal coalition negotiations.