Hello. Below are a few recommendations for trading in the Forex market on 31.01.2018

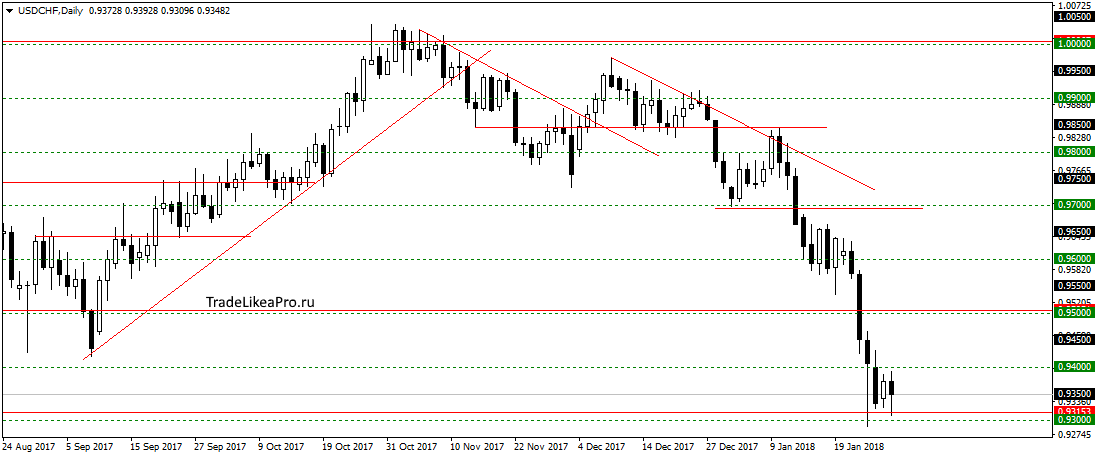

USDCHF

USDCHF pair on continue to move above the level of 0.9300. It seems that strength to go on down there and correction to 0,9500 will take place. Buy against the trend so I do not see here. But if you trade intraday you can try to buy, the expected course correction is good.

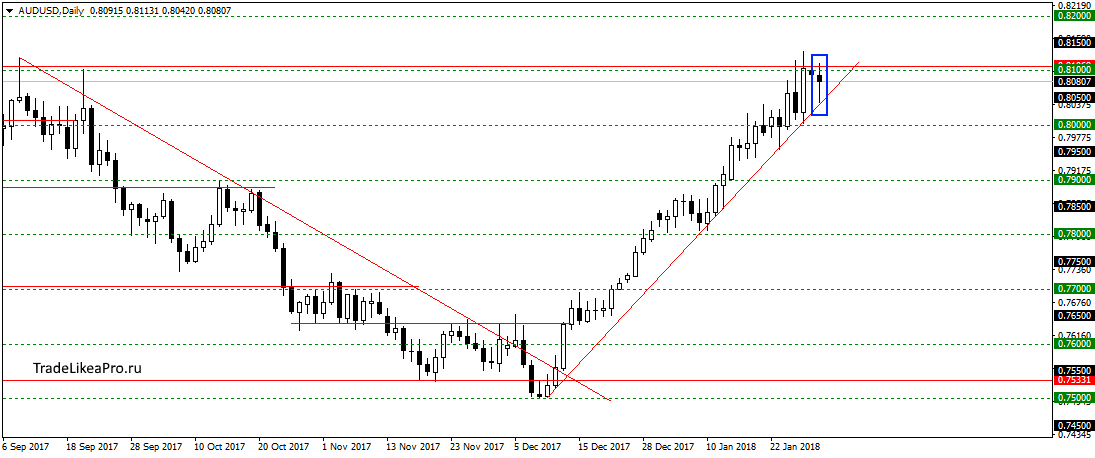

AUDUSD

On pair AUDUSD was clamped in a small triangle between the 0,8100 level and the trend line, and formed a pattern Doji. Probably will finish the correction and try to get through this resistance level and continue up trend. Purchase will look for a pullback after breakout of the level.

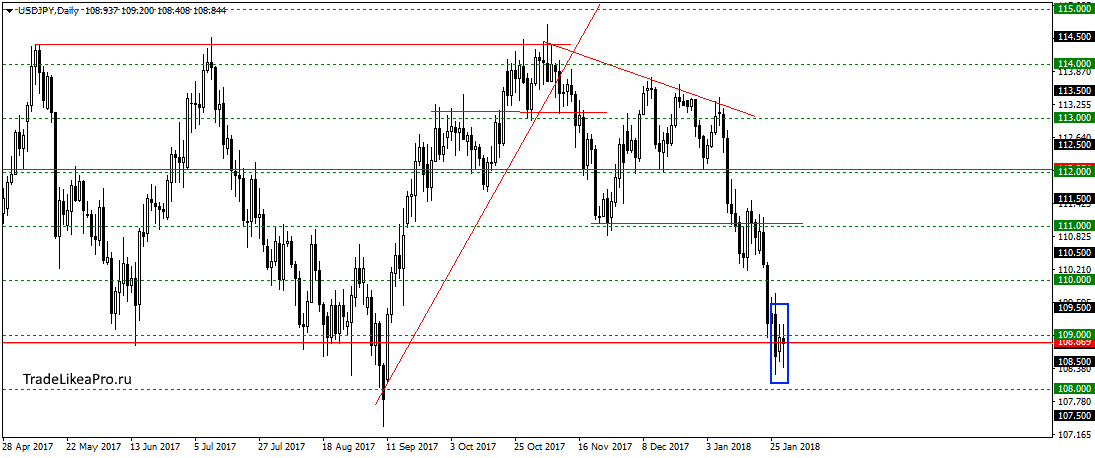

USDJPY

On USDJPY stopped in the area of 109.00 and formed a pattern Doji. Probably worth waiting for the correction up to the area of 110.00-110,500. The following are not considered because they are against the trend.

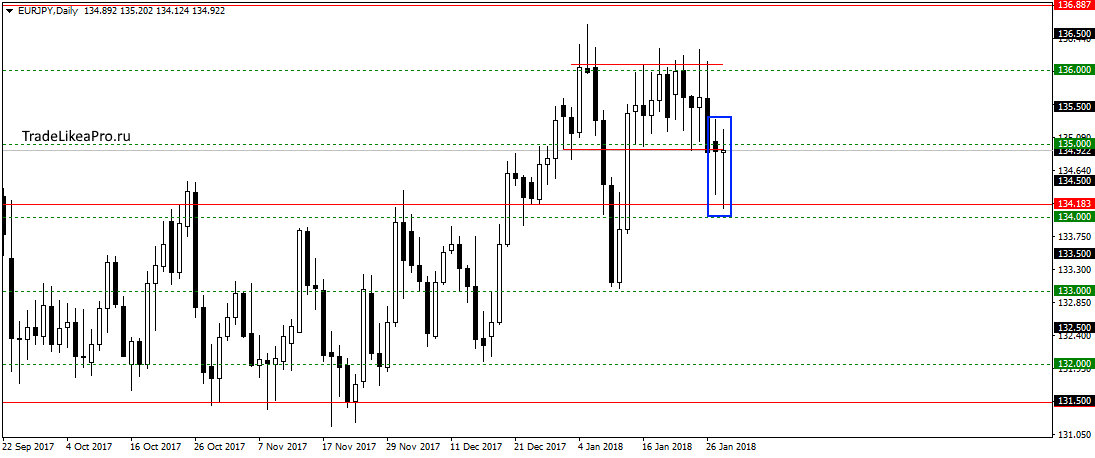

EURJPY

On the EURJPY failed to hold below the lower boundary of sideways trend and formed a pattern Pin-bar. Likely will resume growth at least of 136.00, or continue up trend. Consider purchase here.

GBPJPY

On GBPJPY as expected with went to the trend line and turned and formed a Pin-bar. Probably worth to wait for growth to continue to trend upwards. Consider here the purchase, the order 158,50.

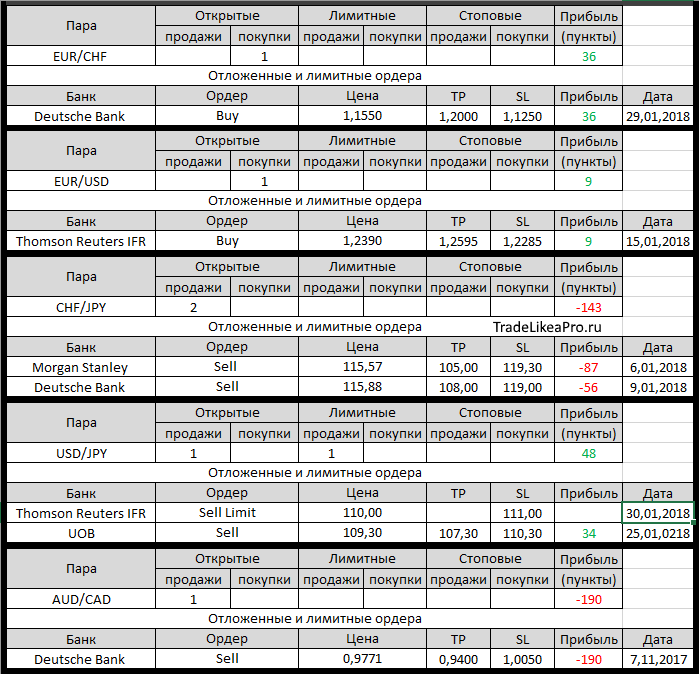

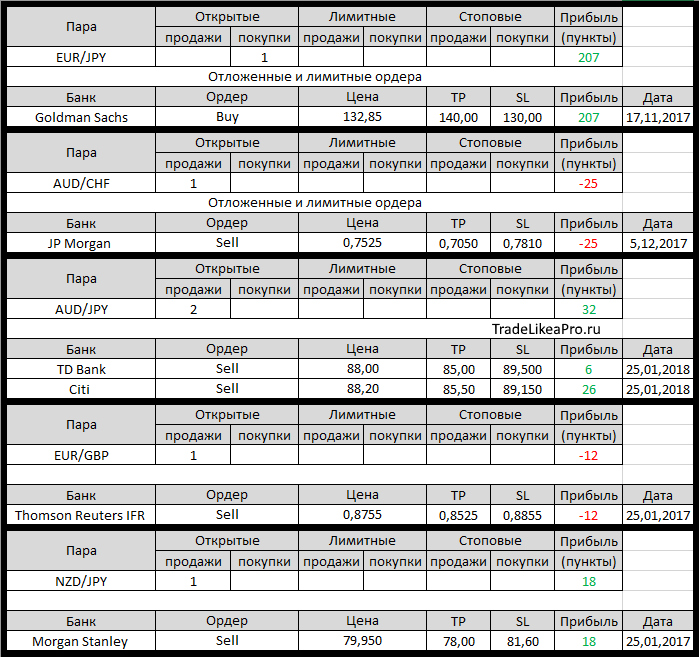

Open orders big banks

Changes in 30.01.2018

- Thomson Reuters IFR changed SL with 109,55 on 109,25 for sale on USD/JPY

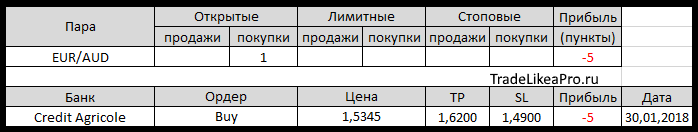

- Credit Agricole opened a Buy on EUR/AUD with 1,5345, TR – 1,6200,

SL – 1.4900 - Thomson Reuters IFR changed SL from 109.45 to 109,25 for sale on USD/JPY

- Thomson Reuters IFR closed a Sell USD/JPY from 109.45 at 108,80.

Profit +65пп - Thomson Reuters IFR has placed a Sell Limit on USD/JPY from 110.00,

SL – 111.00