Hello. Below are a few recommendations for trading in the Forex market on 5.12.2018

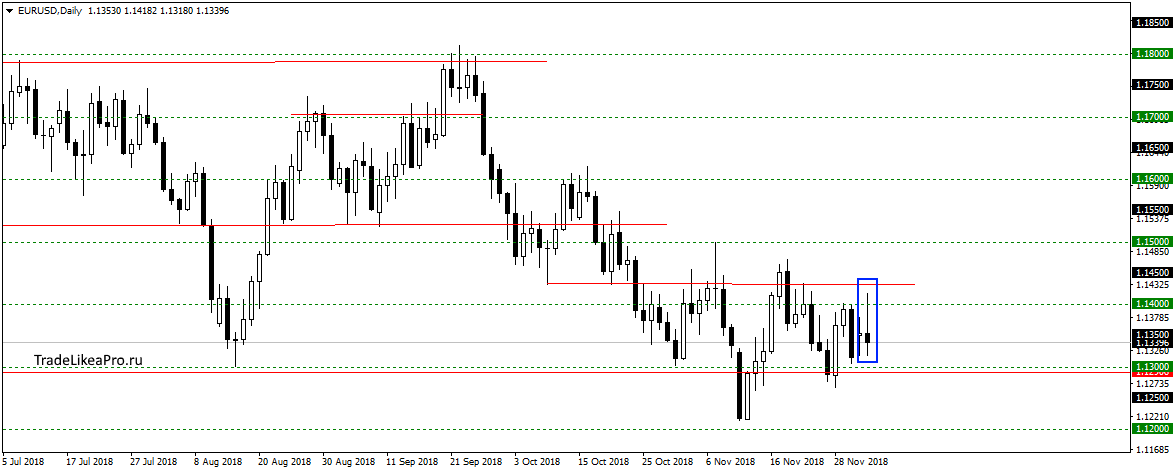

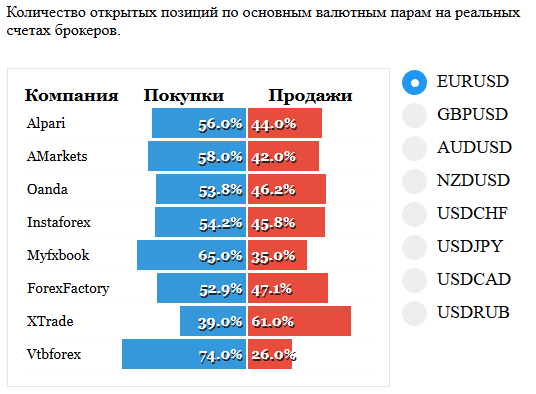

EURUSD

EURUSD one more attempt to go up and the Pin bar from the 1.1400 level. Supports strong pattern there. But the continuation of the trend down is not excluded. Sales here have not yet considered, because of the way the support level. Look for deals will be after breakout of the level and post.

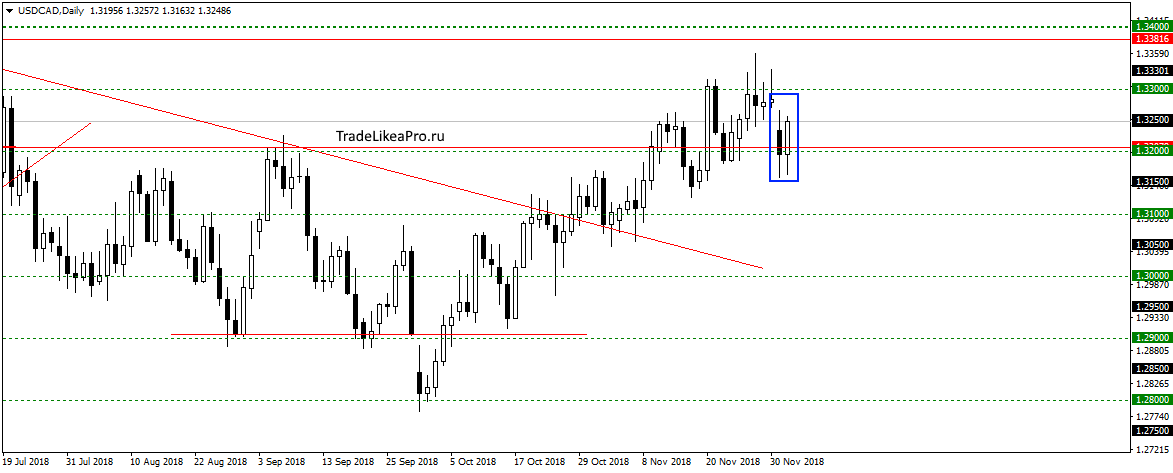

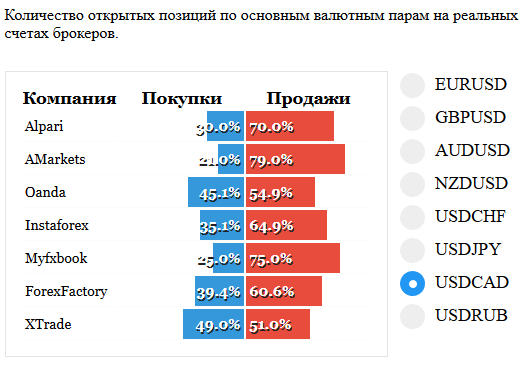

USDCAD

On a pair USDCAD formed a pattern of Rails rebounding from the level of 1.3200 levels. Will probably continue to increase further in the trend after the correction. The advantage of the sellers in the statistics of transactions may well contribute to this. Purpose shopping 1,34000 and above.

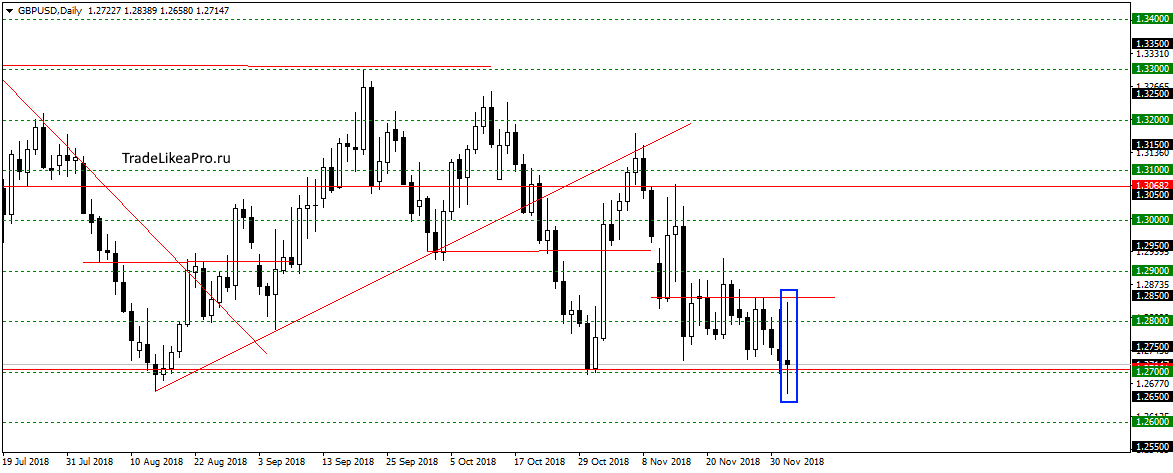

GBPUSD

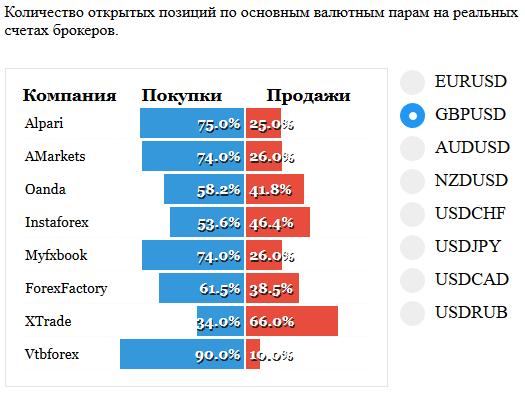

On GBPUSD formed another Pin bar on support level 1,2700. To trade it just is not worth it, from below a strong support level. today tried to go lower, but to gain a foothold failed. In the statistics of transactions shows that buyers gain and perhaps at their expense and will pass the level. The transaction is then not considered.

Fundamental news

APR

- Shanghai Composite + 0.42 Percent, The Shenzhen Composite + 0,43%, Hang Seng Index + 0,29%

- KOSPI down -0.82%

- S&P/ASX 200 — 1,01%

- Nikkei 225 — 2,39%

Chinese investors were the only one who has kept optimistic during yesterday’s trading, while there is negative news about the trade Commission of the U.S.-China shares are going to increase. On other sites sales were due to:

- Weak demand of gobongo in Japan, the Central Bank was forced to halve its coupon payments

- Rate decision the RBA has left its unchanged at 1.5%

- The decrease in annual inflation to 2.0% in South Korea

In the morning the trading on Asian markets are news:

- Australia’s GDP for the III quarter and the year – both figures came out worse than analysts ‘ expectations

- Chinese index of business activity in the services sector, in November it was below the previous month

USA

- Dow Jones — 3,1%

- The NASDAQ is 3.8%

- S&P 500 3,24%

Us investors took a negative transfer of the White House’s reference point the 90-day deferral of the introduction of new protective trade duties against China from January 2019 December 2018.

Thus, trade agreements in which China needs to increase imports of US goods to $1.2 trillion must be signed by February, i.e., the beginning of the national Convention, which looks like direct pressure on XI Jinping. Bidders do not believe in termination of a trade war, because China needs not only to significantly increase purchases, but also to abandon the terms of technology transfer instead of on the site.

Today US exchanges closed in connection with the funeral of the 41st President of the Country. At this time blow the news on:

- The index of business activity in the services sector in 17-45

- The beige Book will be published at 22-00

The European Union

- FTSE -0,56%

- CAC 40 — 0,82%

- The DAX up 1.14 percent

The Minister of trade United States Wilbur Ross outlined the terms of the cease trade war with China

Sales in the stock markets of Europe were provoked by the speech of the Minister of Commerce, voiced the conditions under which the White House ready to sign a new trade agreement with China:

- Restoration and increase of purchases of agricultural products

- Waiver of duties on cars of the American automobile industry

- Substantial purchases of liquefied natural gas

The volumes of the latter will force China to break the agreement with other exporters. Investors have raised concerns the silence of Beijing, which first announced the termination of a trade war, but now refuses to comment on negotiations.

Today, Europe is the main newsmaker of the day:

- 11-15 will be released PMI Spain

- 11-30 scheduled speech of the ECB President

- 11-45 – PMI Italy

- 11-50 – French PMI

- 11-55 – PMI Germany

- 12-00 – PMI for the Euro area

- 12-30 – PMI UK

- 13-00 – retail sales