Hello. Below are a few recommendations for trading in the Forex market on 9.04.2020

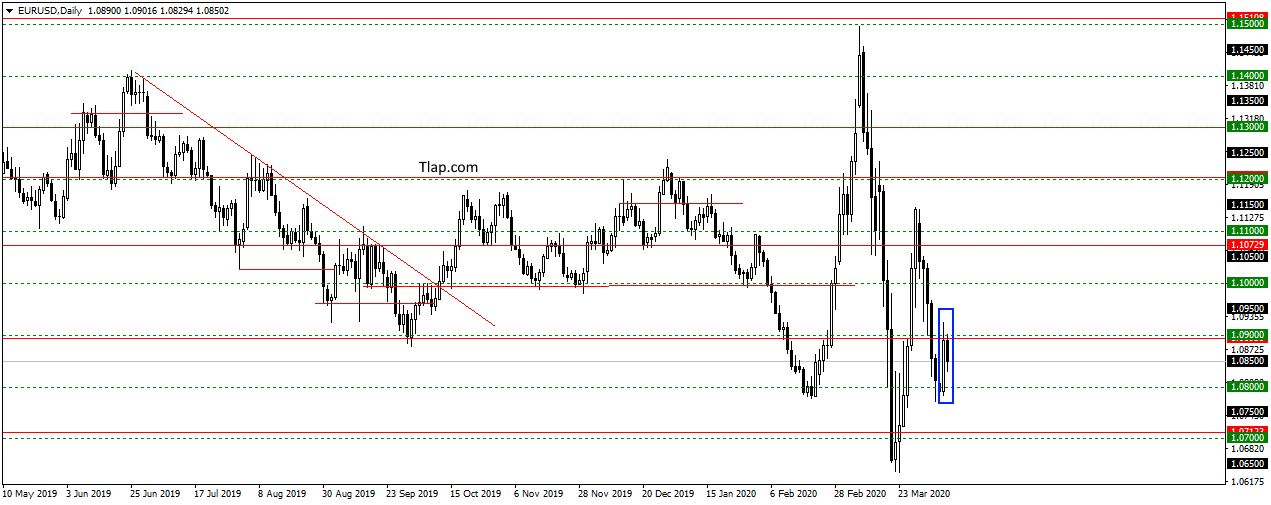

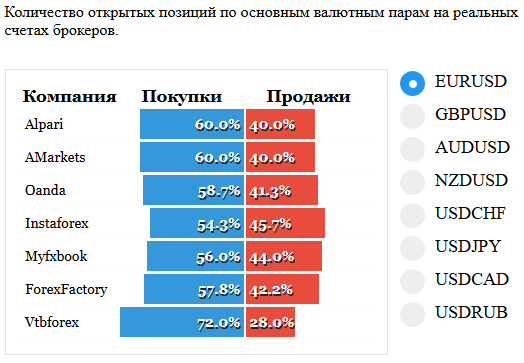

EURUSD

EURUSD ran into the 1.0900 level and formed pattern Inner bar. It is likely that the price down is not allowed and continue falling. A small margin of buyers in the statistics of transactions should contribute to this. Consider there sales goals and 1.0700 is below.

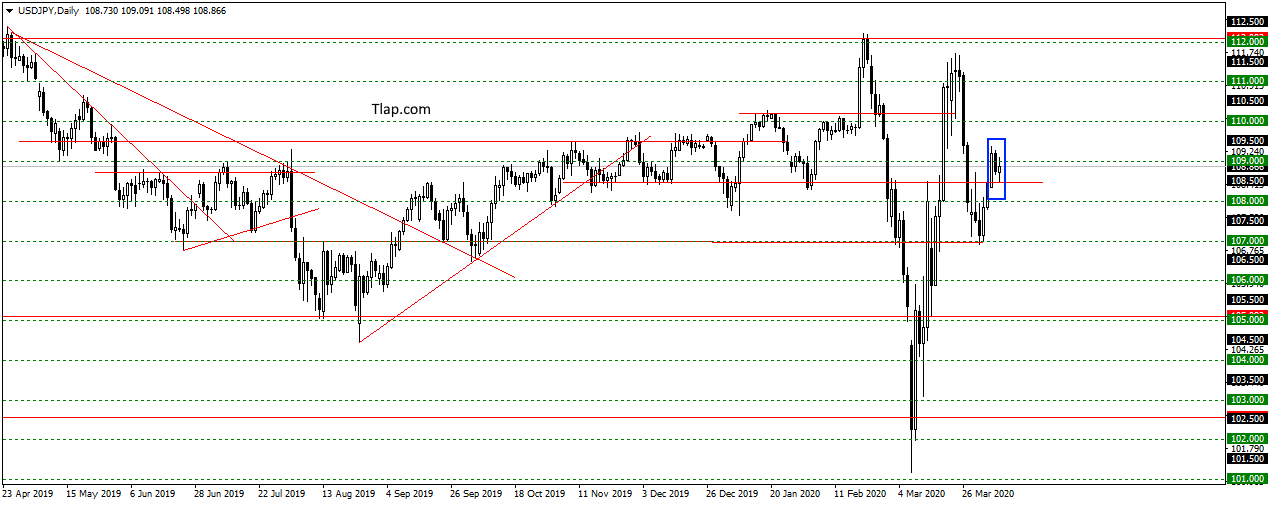

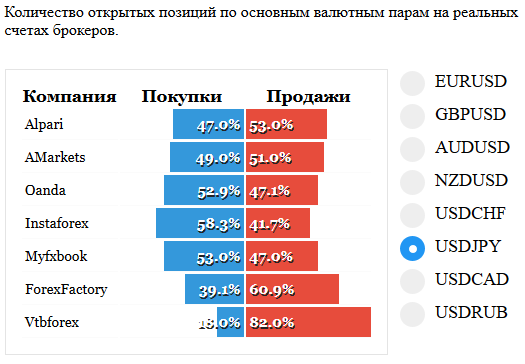

USDJPY

On the USDJPY after yesterday’s inside bar pattern formed a Doji patern, at the level of 108,500. It seems that the downward correction is over and continue growth rates. Consider here the purchase, purposes 112,000.

Fundamental news

APR

- KOSPI — 0,90%

- Nikkei 225 + 2,13%

- S&P/ASX 200 IS 0.86%

- The Shanghai Composite And 0.19%, Shenzhen Composite — 0,41%, The Hang Seng Index Was 1.17%

In the stock markets of Asia on Wednesday were sales, the cause of which is to reduce the investment rating of Australia and the season payments on corporate debt to China.

The Chinese authorities have managed to solve the issue internally, but 25% of the borrowings are denominated offshore bonds. These securities ‘ yields jumped to 15% because of the high likelihood of defaults on payments. They will become an obstacle for new loans and the financing of current bonds.

Plus only one Nikkei after the release of statistics for the balance of the current account, higher than the forecast of analysts. It shows that Japan in terms of coronavirus isolation has not lost its attractiveness for foreign investors.

With the morning came news by country:

- New Zealand: retail sales (cards, banks)

- Australia: the RBA report

- Japan: the President of the Bank of Japan

USA

- NASDAQ + 2,58%

- Dow Jones + 3,44%

- S&P 500 + 3,41%

American investors are actively buying shares on Wednesday, after the release of minutes from the FOMC and the emergence of insider information on oil.

Fed ready to keep rate at low levels until the appearance of clear signals of improvement in the economy. Obviously, it will not happen soon, the statistics of mortality – 2000 people per day, indicates only the first blow Covid-19.

Market participants ignored this sad fact, drawing attention to the decline in stocks of oil in storehouses before the OPEC meeting.

It is expected that countries will agree to limit daily production, but the US will have time to replenish the reserves of black gold at a cheap price. To the shores of the country are sent supertankers from Saudi Arabia.

In the second half of the day will be released news:

- 15-30 – jobless claims USA

- 15-30 –the producer price Index USA

- 15-30 – employment Change and unemployment rate Canada

- 17-00 – sentiment Index and consumer expectations from the Michigan Institute

The Eurozone

- DAX up 0.23%

- CAC40 + 0,1%

- FTSE — 1,44%

Official communiqué of the Chairman Mario Centeno following the meeting of the Eurogroup

The Chairman of the Eurogroup Mario Centeno, stated that the Finance Ministers of the EU countries are unable to ratify the plan of salvation a single economy.

Germany and the Netherlands against the allocation of Spain and Italy, concessional loans and loans from the European investment Bank.

The plan is three tranches, divided into several parts: 100 billion Euro to support the labour market of the EU 200 billion euros in preferential loans to small businesses, 240 billion aid to those most affected by Covid-19, countries.

In the morning come the stats:

- 9-00 – GDP, industrial output, trade balance UK

- 9-00 – trade balance Germany

- 14-30 – the Protocols of the ECB