Hello. Below are a few recommendations for trading in the Forex market on 31.03.2020

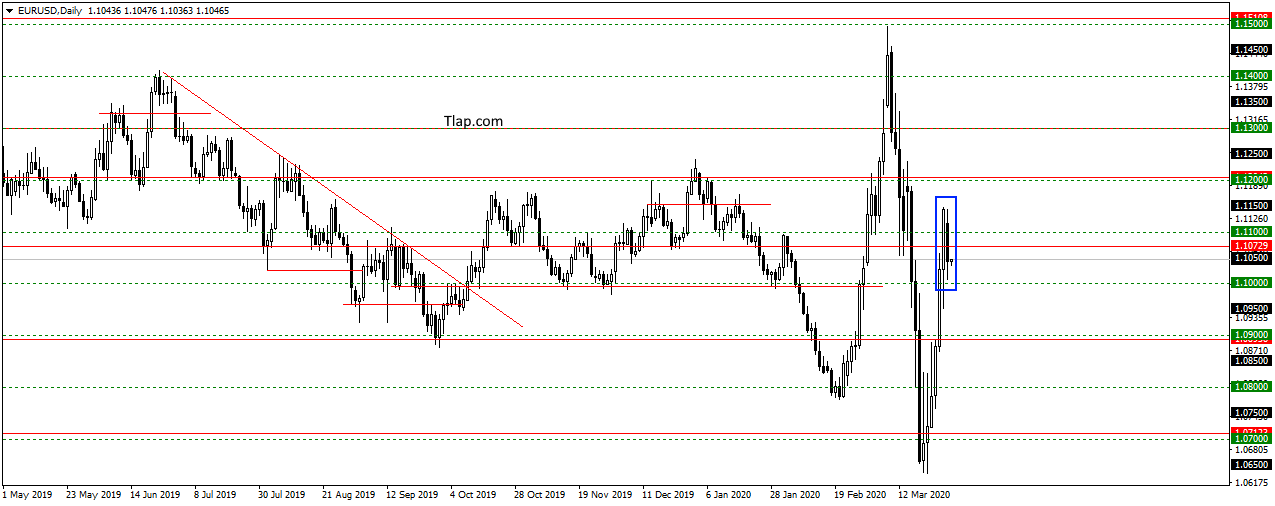

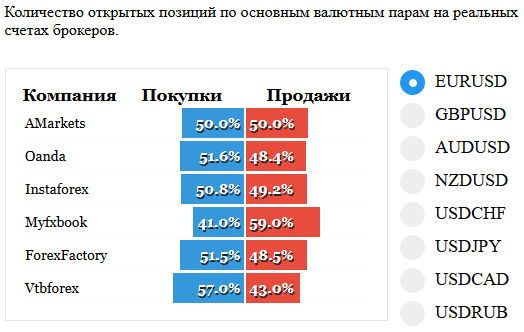

EURUSD

On EURUSD price stopped at the level of 1.1100 and formed pattern Inner bar. Now, perhaps there has finally finished correction and back to the drop rates and upgrade minimums. Look here to sales.

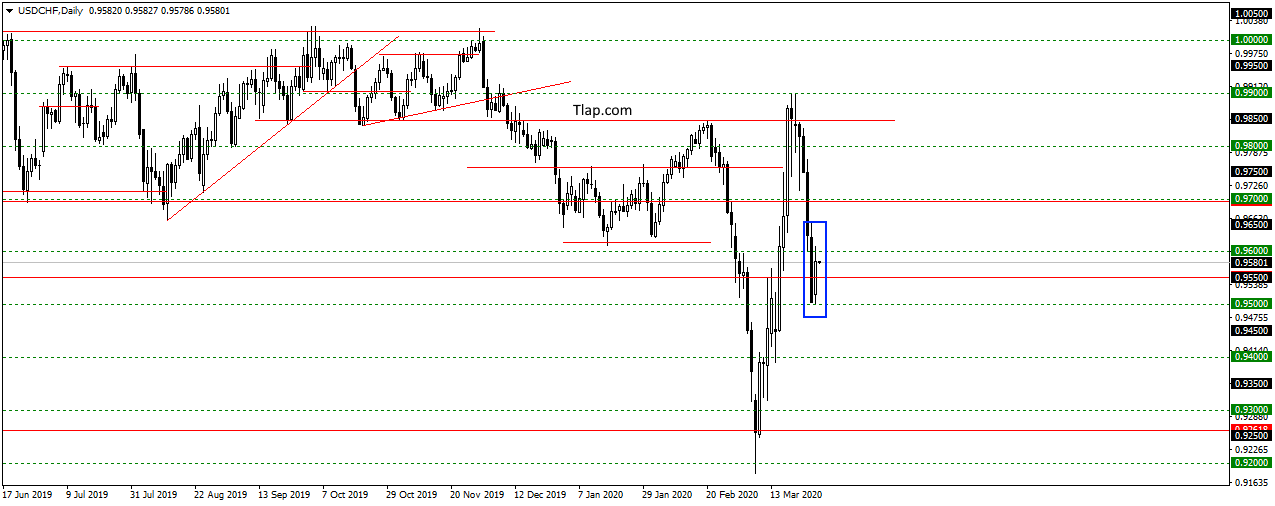

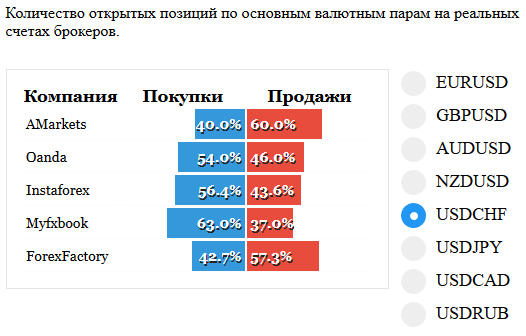

USDCHF

On USDCHF the same pattern of Internal bar at the level 0,95500. Want to see the resumption of growth and the continuation of the trend up. Consider here the purchase, objectives or targets 0.9900 1,0000.

Fundamental news

APR

- Nikkei 225 and 1.57%

- S&P/ASX 200 +7,00%

- The Shanghai Composite Was 0.9%, The Shenzhen Composite Of 2.03%, Hang Seng Index Of 1.32%

- KOSPI — 0,03%

Asian markets continued to fall on Monday, after a record decline in oil, pierced the level of day in the 2002-year.

Against this background, investors do not “see” measures of small business support from the government of China and an unexpected rate cut by the people’s Bank in 7-day reverse REPO.

Today came the big news by country:

- Japan: industrial production and retail sales

- China: PMI

- Australia: sales of new housing, business confidence, private sector credit

USA

- S&P 500 + 3,35%

- NASDAQ +3,62%

- Dow Jones + 3,19%

The real estate market data for pending, unexpectedly exceeded the negative expectations of investors, an increase of 2.4% in February, instead of falling by 1.1%.

Pandemic was unable to “kill” the long-term consumer demand, the short-term it must maintain the receipts of the Treasury $2 trillion.

Statistics support growing from 23 March, the trend in the stock markets, the indices tested local maxima.

Come out at night stats:

- 15-30 – GDP and the price index for raw materials Canada

- 16-45 – Chicago PMI

- 17: 00 consumer confidence Index SV in USA

The Eurozone

- FTSE + 0,97%

- DAX + 1.9 percent

- CAC40 + 0,62%

Italy first showed a minimal increase of people infected with coronavirus. The Minister of health Roberto Speranza attributed this to the effectiveness of the quarantine extended until the 12th of April.

The speech of the Minister of health of Italy, Roberto Speranza

The news of the decline, which coincided with a sharp rebound of crude oil, after falling to new lows, led to a positive closing of the session on European stock exchanges.

The main indicators in the European session.

- 9-00 – GDP balance of current account, business investment in the UK

- 9-30 – retail sales Switzerland

- 9-45 – Consumer prices and costs of France

- 10-55 – Level of unemployment in Germany

- 11-00 – Spanish GDP

- 12-00 – Inflation Italy

- 12-00 – Inflation In The Eurozone