Hello. Below view on a few interesting points to trade in the Forex market on 3.12.2018

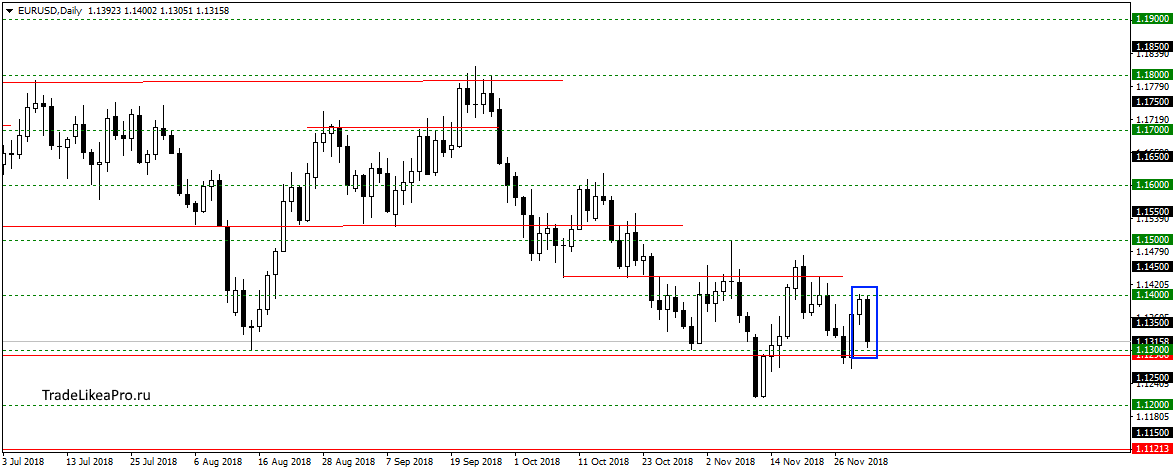

EURUSD

EURUSD formed a pattern of Absorption. Support as such has no pattern. But the continuation of the trend down is not excluded. Sales here have not yet considered, because of the way the support level. Look for deals will be after breakout of the level and post.

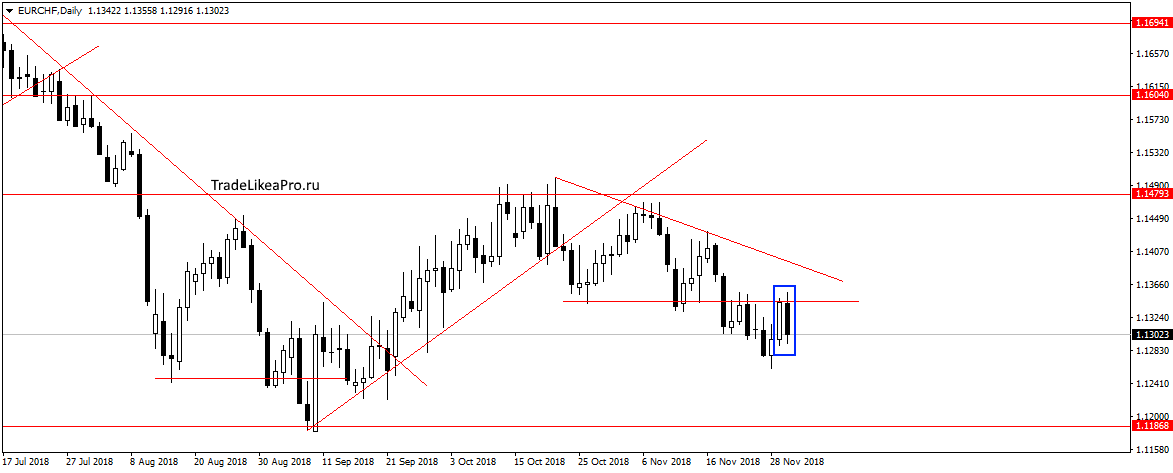

EURCHF

On the pair EURCHF formed a pattern of Rails rebounding from the level of 1,1345. Probably the correction is over and continue falling down trend. Goals for sales 1,11840.

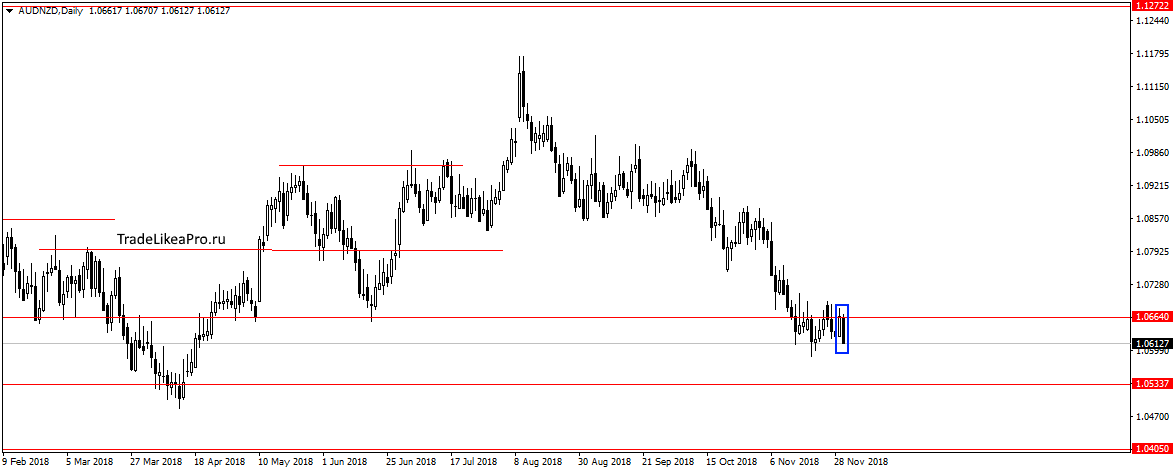

AUDNZD

On the AUDNZD pair moving below the level 1,06640 and formed the pattern of Absorption. Likely to go higher not enough and continue to fall on trend. Consider then the sales order 1,0533 and below.

Fundamental news

APR

- Nikkei 225 + 0,49%

- Shanghai Composite + 0,81%, Hang Seng + 0.21% And

- Kospi down -0.82%

- S&P/ASX 200 — 1,58%

On the last trading day of last week, Asian investors bet on the achievement of agreements between China and the United States, actively buying shares. The exceptions were the markets of South Korea and Australia, the Kospi index fell after the rate hike from 1.5% to 1.75% decline in the S&P/ASX 200 is correlated with the drop of “black gold”.

In the morning the positive results of the summit of G-20 overrides the negative economic indicators

— Australia:

- The decline in manufacturing activity in November to 51.3

- Fall to minus 1.5% in the number of building permits in October

- The decline in gross profit of companies in the third quarter to 1.9%, consensus 2.9%

— Japan:

- Capital expenditure the third quarter and 4.5% in the preliminary estimate of 8.6 per cent

— China:

- The index of business activity in the manufacturing sector (unchanged)

USA

- Dow Jones + 0,79%

- NASDAQ + 0,79%

- S&P 500 + 0.82% IN

The main event for American investors on Friday was the summit launched the woof of the States G-20, the first day of which was marked by the signing of a trade agreement between Canada and the U.S., which positively affected the markets.

The leaders of the United States, Canada and Mexico signed a trade agreement UMSCA, which will replace NAFTA

Today, the indices will continue to react to the results of the final part of the high meeting, announced on Sunday the reform of the WTO, the delay for 90 days the imposition of tariffs on China and a new trade agreement with that country.

After the opening exchanges of the USA will be released news:

- 17-45 PMI promsektore

- 18-00 employment promsektore

The Eurozone

Unpleasant curious case dropped out at the beginning of the G-20 summit spoiled the mood of investors, indices closed in the negative zone:

- FTSE 100 — 0,83%

- CAC 40 -0,05%

- DAX — 0,36%

The Federal Chancellor of Germany Angela Merkel missed the first day of meetings of heads of state by reason of failure of the aircraft. In the end, she was taken to Argentina normal flight of the Spanish airline, but a large part of political and bilateral negotiations had to be cancelled.

Today the Eurozone will have a big block of news at:

- 11-15 – retail sales in Switzerland (the annual figure for October)

- 11-15 PMI Spain

- 11-30 PMI Switzerland

- 11-45 PMI Italy

- 11-50 French PMI

- 11-55 PMI Germany

- 12-00 each other.

- 12-30 PMI UK