Hello. Below are a few recommendations for trading in the Forex market on 3.08.2017

Calendar of anticipated events

11:30 UK. The index of business activity in the services sector

14:00 UK. The Bank of England report on inflation

14:00 UK. Interest rate decision

17:00 USA. The index of business activity in the non-manufacturing sector

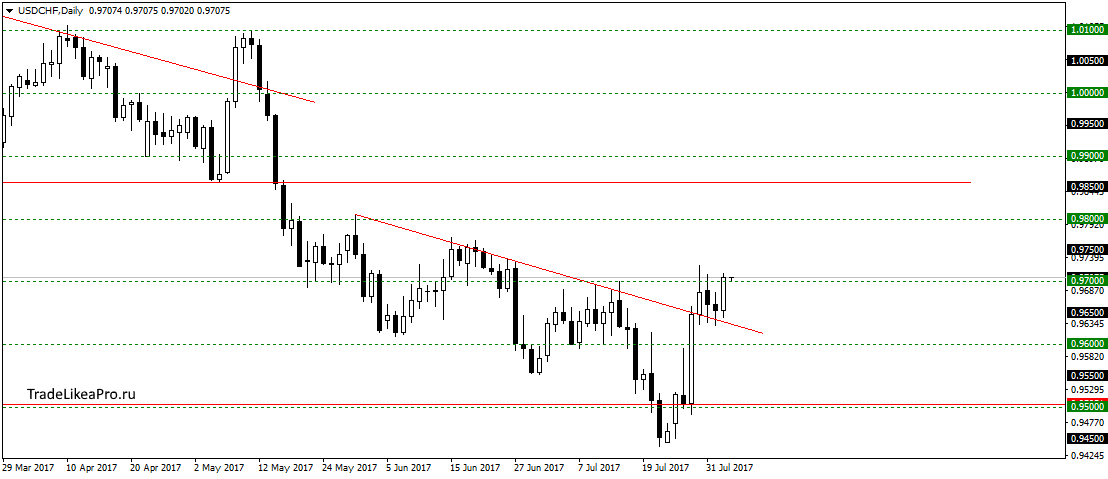

USDCHF

On the pair USDCHF has renewed highs and after a small correction resumed growth. Will probably turn permanently downward trend and will continue rising to 0,98500 and above. I think you should look for this pair to buy.

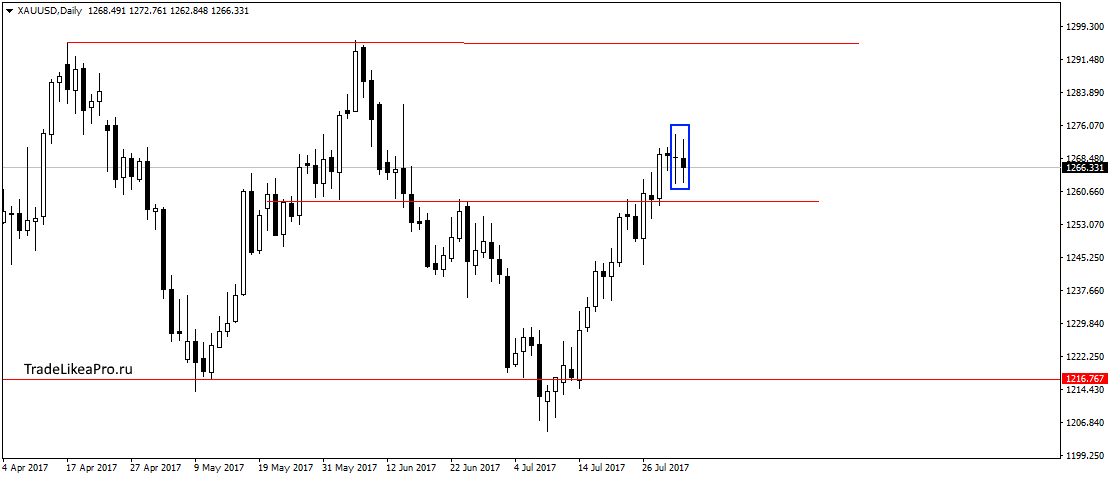

XAUUSD

Gold has already formed two Doji pattern in the area of prices 1266,88. Will probably go down even a little down in the correction and then will continue the up trend to 1295,80. Sales here do not consider, as they are against the trend.

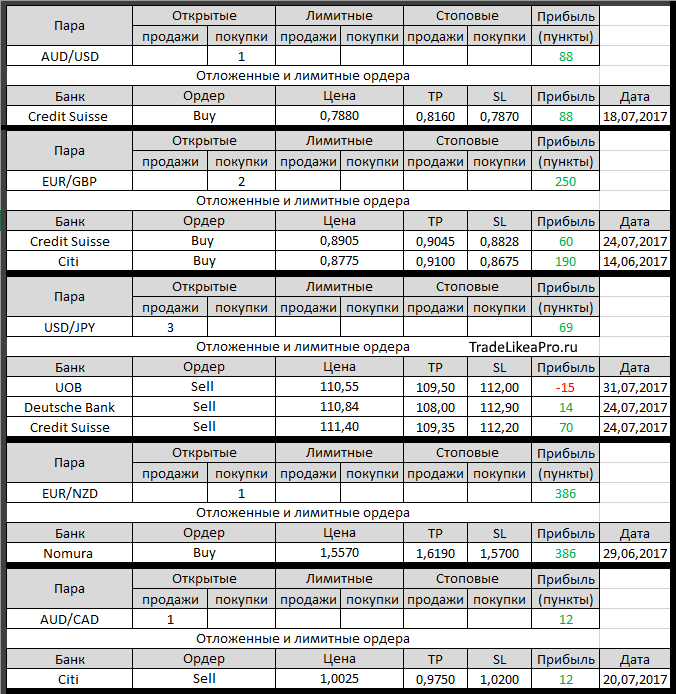

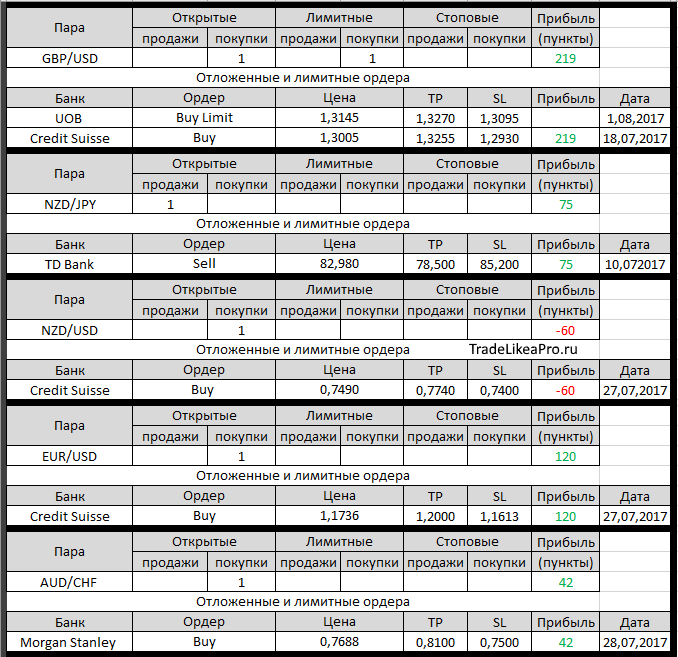

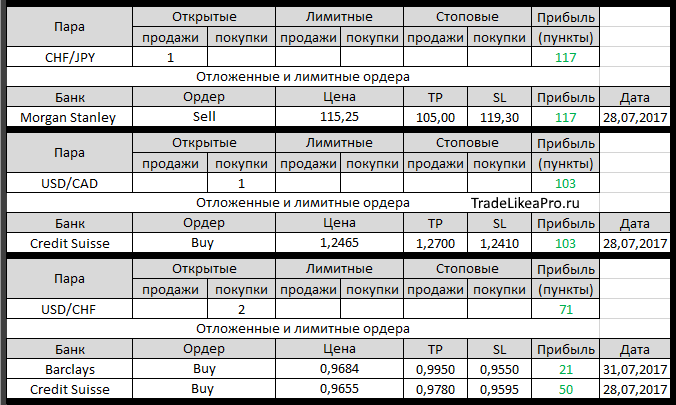

Open orders big banks

Changes in 2.08.2017

- Credit Suisse worked with TR in the buy EUR/JPY with 128,80 for 130,75.

Profit +195пп - Nomura changed with SL of 1.5250 at around 1.5700 in buying EUR/NZD since 1,5570

Fundamental analysis

APR

Asian stocks fell on Thursday, led by a downturn in the South Korean technology markets, while the us Dow Jones industrial for the first time exceeded at 22,000 points in their entire 121-year history. South Korean financial analysts say that this year, a significant correction in the technical promotions occurred.

The broad regional MSCI index fell 0.6%, while South Korea’s Kospi declined 1.6%. Japan’s Nikkei fell 0.3%. In new York, the S&P 500 added 0.5%. In General stock markets supported by growth in corporate profits these days.

JPY retreated from two-week high of 109.92 USD to JPY 110.69. USD, meanwhile, loses its force, as the rate of inflation in the US remains relatively weak, even though improvements in the labor market.

Europe

European stocks again closed with losses as a strong EUR and a weak season has arrived for banking stocks and the decline in commodity prices — there is a strong pressure on major industry.

The Stoxx 600 index lost 0.43% to 378.63, while the German DAX dropped 0.57% and French CAC 40 eased by 0.39%. Italy’s FTSE MIB, meanwhile, fell 0.18%. At the same time, producer prices have weakened less than expected, according to Eurostat. The producer price index fell to 2.5% in June, with forecasts pointing to prospects 2.4% decline.

The EUR is trading at 1.1845 USD after on the eve of Wednesday he reached 1.1905, which is the highest level since January 2015. The single currency increased sharply against the CHF by adding more than 4% in less than two weeks to the level 1.1488. GBP, meanwhile, is trading near 11-month highs against the U.S. currency in anticipation of the speech of the head of the Bank of England Carney.