Hello. Below are a few recommendations for trading in the Forex market on 12.06.2020

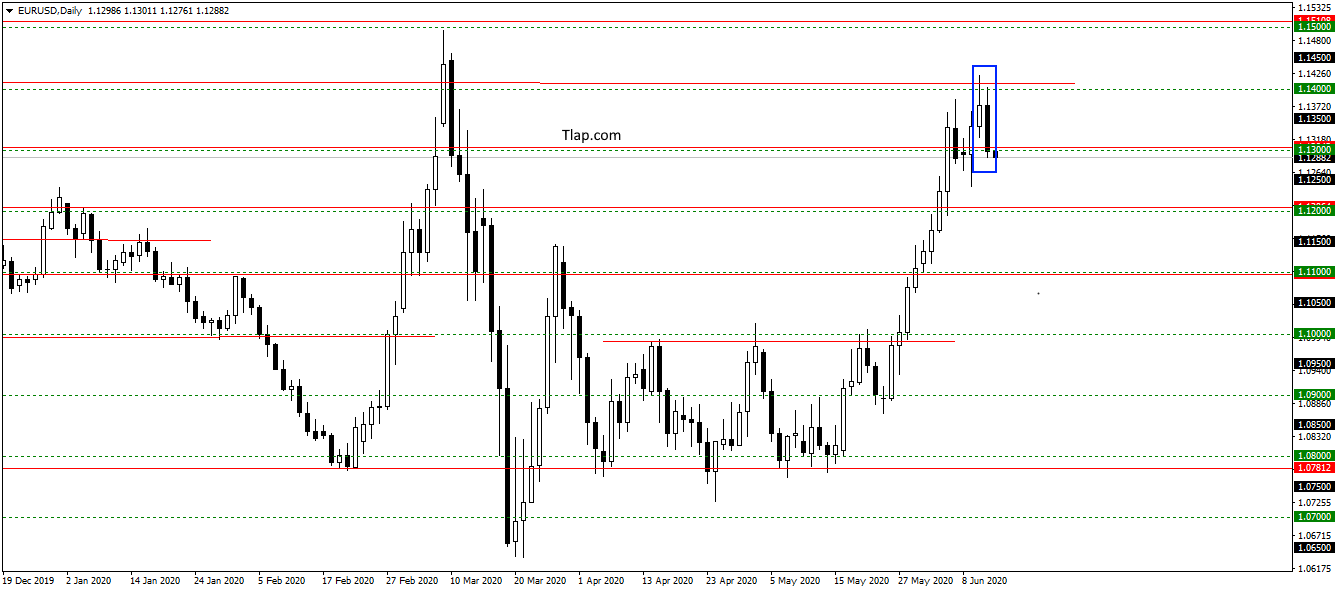

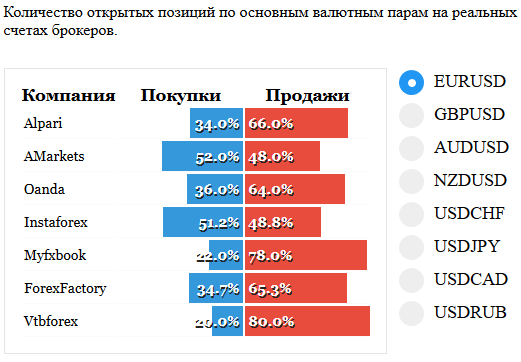

EURUSD

EURUSD bounced off the 1.1400 level. The pattern of Absorption turned out a bit blurry here. But overall, I think worth the wait downward correction, possibly in the area 1,11000. But in sales I will not go, they are against the trend in the statistics of transactions have the advantage of sellers.

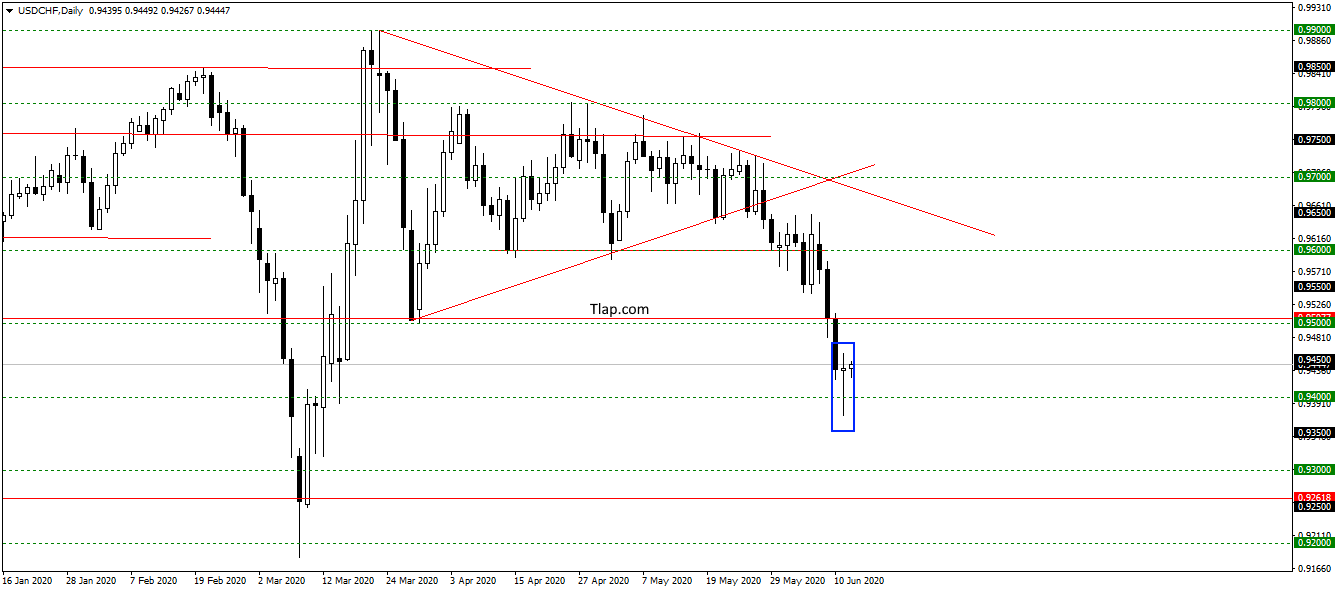

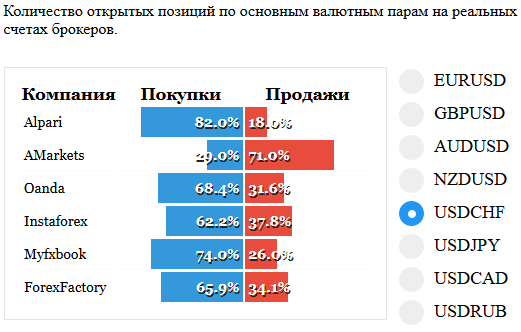

USDCHF

On the pair USDCHF formed a pattern Pin-bar. In addition to the round support level of 0.9400 levels I saw. Probably go to the correction to 0,95000 and from there continue to fall further with the trend down. Purchase do not see here, waiting for the signals to sell.

Fundamental news

APR

- Nikkei 225 — 2,82%

- S&P/ASX 200 -3,05%

- Shanghai Composite Index Down 0.78%, The Shenzhen Composite Is 0.81%, The Hang Seng Index Of 2.27%

- KOSPI is 0.86%

The Asian markets were trading Thursday in negative territory, reflecting the results of the fed meeting. Negative added statistics of Japan, where the business conditions index for large businesses set a new low.

The main news this morning:

- PMI and the PMI New Zealand

- The volume of industrial production of Japan

USA

- NASADAQ — 5,27%

- The S&P500 Of 5.89%

- Dow Jones — 6,9%

American markets went into a nosedive, following the collapsed 10% oil. The impact of the collapse in energy prices could not offset the reduction of unemployment and inflation, higher than analysts ‘ forecasts.

Statistics afternoon:

- 17-00 – expectations Index and consumer sentiment from the Michigan Institute

- 20-00 – the Number of drilling rigs in USA

The Eurozone

- FTSE — 3,99%

- DAX — a 4.47%

- CAC40 — 4.71 per cent

Fixation positions in the shares, became panicsel session on Thursday. Investors were not willing to significantly degraded the forecast from the OECD.

The Secretary General of the OECD Jose angel Gurria speaks with economic forecasts of world GDP

The Secretary General of the international organization Jose angel Gurria believes that the EU economy will lose 9.1% of GDP, is higher than the global loss in 7.5% of GDP.

Most affected are France, the state could lose 11.4% of gross domestic product in 2020-th year. On the news, the CAC40 index led the drop during yesterday’s session.

In the morning come the indexes:

- 9-00 – GDP, industrial production and the UK trade balance

- 9-45 – Inflation France

- 10-00 – Inflation Spain

- 12-00 –the Volume of industrial production in EU