Hello. Splash of volatility in the markets, right, can not but rejoice. Although unambiguous signals while not a lot, but the current movement open before transactions are very encouraging.

Below you will see what you should pay attention tomorrow 10.03.2020

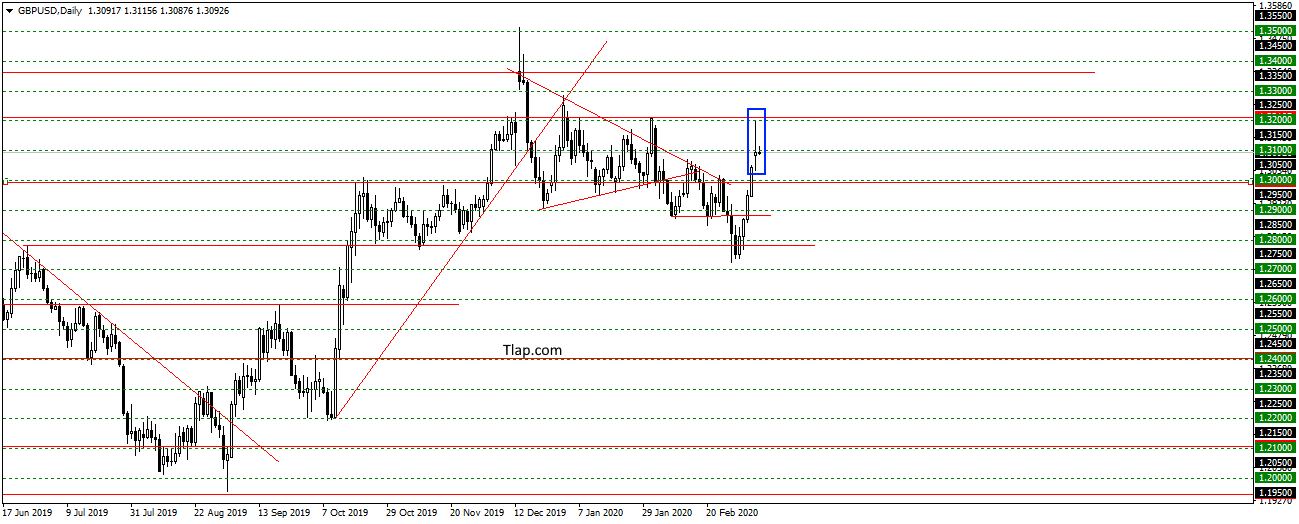

GBPUSD

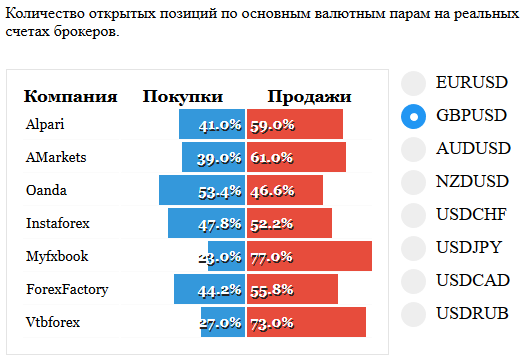

On the GBPUSD pair formed a pattern Doji rebounding from the level of 1.3200 levels. Is it going to Dolman if the trend is up. But according to the statistics of transactions, and the set of sellers seem to expect continued growth and an upwards trend. Look for buy on a pullback to 1,3000.

Fundamental news

APR

- The Nikkei 225 is 5.07%

- S&P/ASX 200 AND 7.33%

- Shanghai Composite — 3,01%, The Shenzhen Composite -4,09%, The Hang Seng Index Of 4.22%

- KOSPI — 4,19%

Asian markets fell on Monday after oil prices. Panic reduction in the cost of energy has occurred due to the collapse of the OPEC deal. The country of unlimited cartel can increase production from 1 St April. Investors expect fierce competition for markets, have lost the consumption on the background of the development of coronavirus.

In the end, the ranks of loss-making report of the I-th quarter will join mining companies, which will lead to a sharp reduction in GDP of several developing countries. Defaults of corporate crisis will affect the global economy in unpredictable ways.

The most important news this morning came from China:

- The consumer price index and producers

- Secondary stats in the morning – the NAB business confidence index Australia

USA

- NASDAQ — 7,29%

- Dow Jones — 7,79%

- S&P 500 AND 7.60%

Scientific Director of Saxo Bank Christopher Dembek Euronews says the current economic situation

American markets were no exception in “black Tuesday” showing the rapid decline of the stock. Scientific Director of Saxo Bank explained the panic of investors, “the perfect storm.

Christoph Dembek believes that falling oil prices was the last straw in a sea of negative effects, caused by the spread of the coronavirus that happened in a moment of weakness of the economy.

In light of recent events, traders could pay attention to the weekly oil inventories from the API Institute at 23-30. This is the only news of the evening session.

The Eurozone

- FTSE — 7,25%

- DAX of 7.94%

- CAC40 — 7,74%

Eurozone investors are selling the shares following the global trend, but the Euro continues to strengthen the course. Speculators expect a series of rate cuts by the fed down to zero in the first half of the year.

In the first half of the day will be released statistics:

- 9-30 – Employment in the private sector of France

- 13-00 – Eurozone GDP