Hello. Below are a few recommendations for trading in the Forex market on 6.11.2018

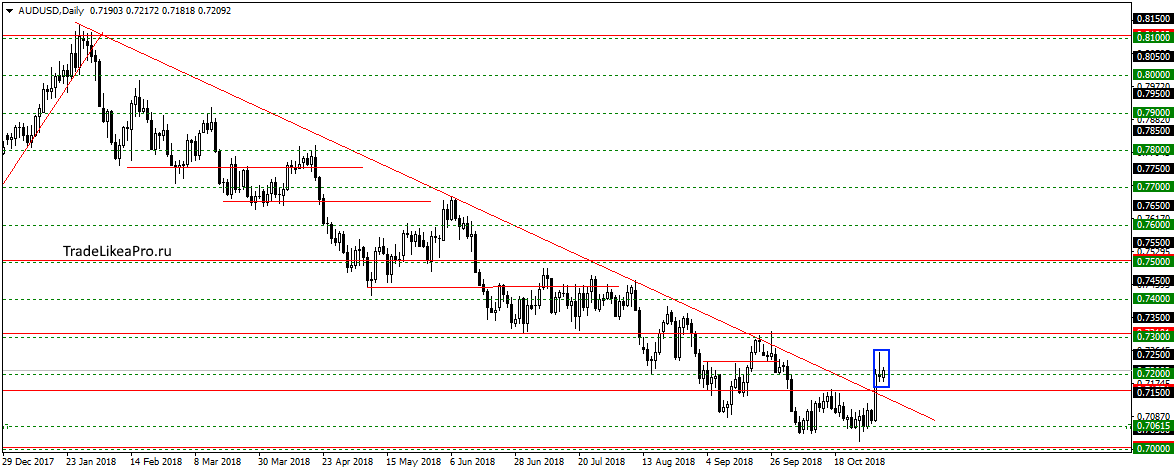

AUDUSD

On AUDUSD price was stopped after breakdown of the level 0,71500 and trend line. Probably go down a bit in correction, presumably in the area of the trendline. Then we will try to break down the trend is up. We will look for Price Action signals to buy.

Fundamental news

APR

- The Shanghai Composite -0,41%, The Shenzhen Composite Is 0.01%, The Hang Seng Index Is 2.08%,

- KOSPI is 0.91%

- The Nikkei 225 is down 1.55%

- S&P/ASX 200 — 0,53%

The statement of the US administration about the lack of instructions for the preparation of trade deals with China caused Asian markets to fall. The leader of the downward movement was the index of Hong Kong stock exchange as traders reacted to the decline in the October PMI for the services sector to 50.8, instead of analyst expectations of 52.9.

Press conference of the Head of the Bank of Japan Governor Haruhiko Kuroda

Japan became the second largest correction in yesterday’s session, the cause of which was the speech of the head of the Central Bank. Haruhiko Kuroda said the current bezvariantov tactics negative rates due to the General situation in the world economy, although it has recognized the destructiveness of dlan national banking system.

USA

- Dow Jones + 0.76 Percent

- NASDAQ 0.38 percent,

- S&P 500 + 0,56%

The growth of the American indexes have stimulated the published economic statistics – the composite PMI rose to 54.9 points, although analysts had expected in October, he will remain on the September value of 54.8. The largest contribution to this growth made the nonmanufacturing sector, sectorial index which rose to 54.8, exceeding the preliminary estimate of 54.7.

Technological NASDAQ is the outsider of the first session of the week – on the weekend it was reported about the leak of personal data of hundreds of millions of Facebook accounts. In some cases, hackers gained access to the correspondence by messengers. The scandal is gaining momentum, but traders locking in profits in advance, because the problem will affect all IT companies.

Forex traders paid attention to yesterday’s data on employment – they do not confirm the positive indicators of the labour market. This percentage decreases with the growth of the percentage of the working population. The participants decided to close some positions in the dollar, reducing the rate of its index against a basket of major currencies, taking into account the data and today’s midterm elections in the USA.

The Eurozone

- FTSE 100 + 0,14%

- CAC 40 -0,01%

- DAX -0,21%

The media revealed details of a secret agreement between the EU and the UK – the Customs Union will be saved, therefore, after leaving the EU business will not incur additional costs for duties. The London got the unilateral right to recover the customs at any moment.

Against this background, the FTSE 100 was the only rising index, while European investors were sold the shares upon restoration of sanctions against Iran – the country’s banks cut off from SWIFT.

On the first day of the week calendar of macroeconomic events in the Eurozone was empty, so traders played American negative, strengthening the EUR/USD pair in the afternoon.