Today, we reach crescendot on rapportsäsongen and almost all companies have reported figures for Q2. The stock exchange is a place where the improbable has an unusually high probability of occurring. This is especially true at times when a large amount of new and important information is presented, which always makes the reporting periods difficult from an analytical perspective.

We were in the previous week were positive for stock markets as a whole based on the promising patterns of behaviour, both nationally and internationally. The price movements for a number of large corporations indicated that it was a good opportunity for further rise provided strong reports. To point with the whole hand, just before the rapportfloden, however, is not serious and there must always be a mental preparedness that even well informed projections can fail.

In the previous reporting period was splendid, the wine flow from the ymnighetshornet and courses step in tune with surprisingly good results and bright future forecasts. The investor community had, of course, this in mind, and it is therefore not surprising that the stock market as a whole and several of the big east with a high for the year before the current week.

This time was, however, not a tasty wine to the investors, but instead they have had to settle for the most water in the glasses. The decline in Ericsson’s standing in a class of its own, but ABB, Assa Abloy, Atlas Copco, Getinge, Handelsbanken, Nordea, Sandvik, Telia, and Volvo have all reported numbers that resulted in clear nedställ in stock prices.

With certain exceptions, however, the results have been really good, but expectations were even higher assets, which explains the negative price movements. Indexmässigt however, we are talking not about some race, but the decline so far amounts to moderate three per cent.

The Swedish stock market can to some extent deviate towards the global stock market performance, but it falls or rises never greatly in their sole discretion without the larger price movements is always to a substantial extent correlated with the international börsläget

U.s. S&P 500 has surprised on the upside after a very good beginning of its reporting period and noted the ”all time high” for a couple of days ago. The Nasdaq, which is just a couple of weeks had to endure a minipanik, shows the same behavior and have also achieved new toppkurser. Asia provides a stable albeit currently overbought impression after continued surges in China, Hong Kong, India and south Korea.

The united states

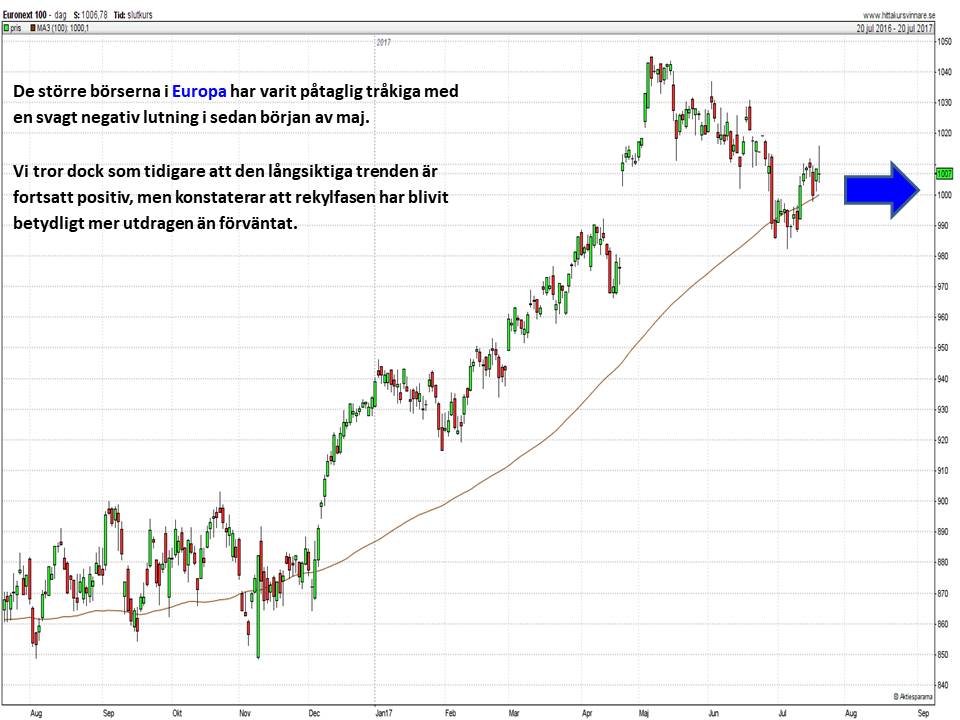

The major exchanges in Europe has been palpable boring with a slightly negative slope since the beginning of may. We believe, however, that previous to the long-term trend remains positive, but notes that rekylfasen has become significantly more protracted than expected.

Europe

One of the clearest and most well-defined trends in the financial markets is the strength of the euro against the dollar. In the summer of 2008 you had to pay 1,6 dollars for one euro, and less than seven years later, in march 2015, was almost parity then the price has fallen to 1,03 dollars.

After this panicky sell-off, the Eur/USD for more than two years time in a stretch bottenformation between 1.03% to around 1,14 and despite countless attempts during this period to break past the upper end of the range, these have inevitably defaulted until april and may of the current year. Then, the euro strengthened from 1.05 to 1,13, had the strength to retain the greater part of this rise, and then managed with force to break up out of the tradingintervallet.

Bottenfasen against the dollar is thus over, and we believe that both the Euro and the Swedish krona may strengthen considerably against the dollar. Exactly what is the impact of valutarelationen between the Euro/USD has for the stock markets in Europe and the united states are difficult to ascertain, but a too strong euro and ditto the weak dollar can create financial concerns, which is why we are monitoring this development very carefully.

Eur/USD

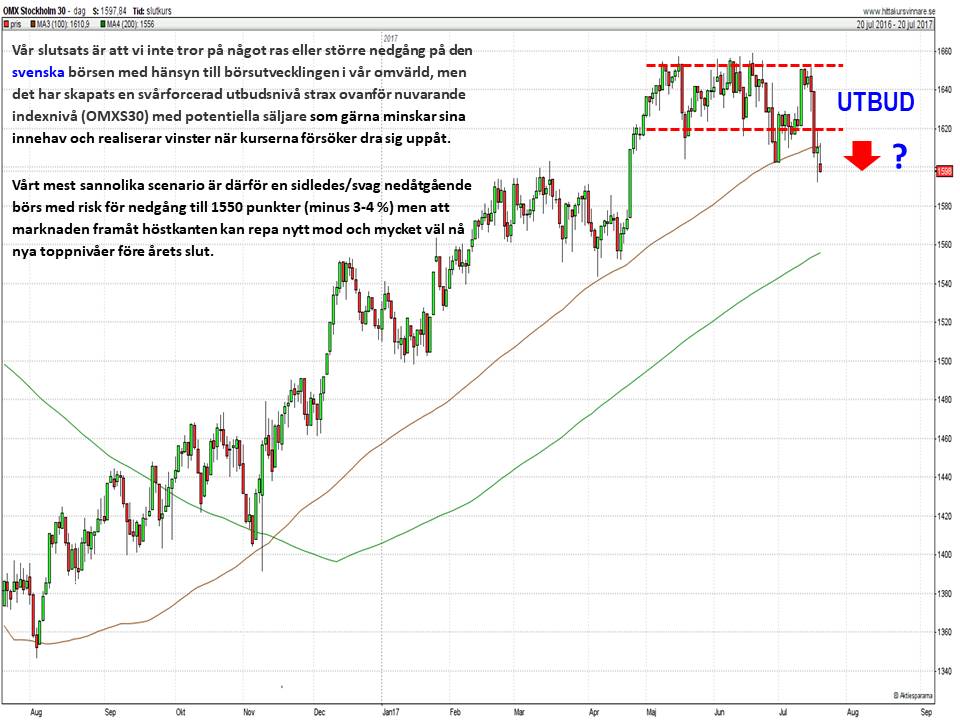

Our conclusion is that we do not believe in any racial or greater decline on the Swedish stock exchange with respect to stock market performance, in our environment, but it has created an impenetrable utbudsnivå just above the current indexnivå (OMXS30) with the potential sellers who are happy to reduce their holdings and realize the gains when the courses are trying to pull themselves up.

Our most likely scenario is therefore a sideways/weak declining stock market with the risk of decline to 1550 points (minus 3-4 %), but that market forward is the time can scratch the new mod and very well reach new peaks before the year’s end.

Sweden