The previous week we noted that the long-term primärtrenderna in most of the world was clearly positive, but that several exchanges were short-term overheated. At the same time, we noted that it is easy to underestimate the power of strong trends.

Sooner or later corrected, however, always trend underlying the slope to a more long-term sustainable direction with a real nedgångsfas as a result. We, however, thought not that we even found ourselves at a critical korrigeringspunkt and chose to vigilantly slip with the stock market up (OMXS30) with a view to 1700 points.

We were a little unclear in the above reasoning. We do not believe that the rebound that yesterday was initiated by Donald Trump förehavande is the beginning of a real nedgångsfas. However, we can now very well get to experience a healthy cooling of a moderate character, who takes away the overheating in the markets.

We believe, therefore, that we have reached a critical korrigeringspunkt, which precedes a nedgångsfas of greater dignity. The current recoil learn instead is likely to mean that it occurs attractive köplägen in shares that rebounds within a framework of clearly positive trends.

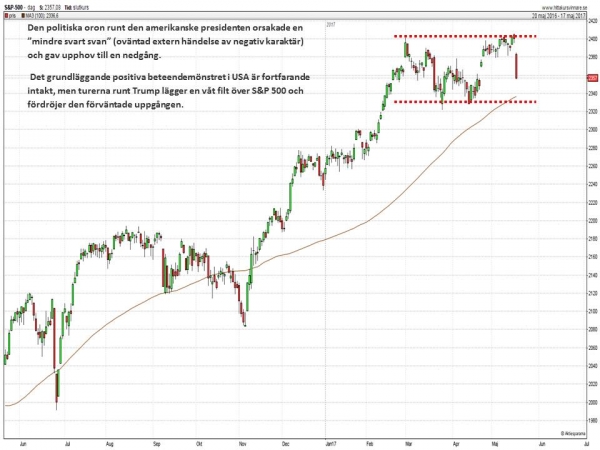

As late as Tuesday retained the united states (S&P 500) around the ”all time high”, but had not force to break up to new heights. Our conclusion was that patterns of behavior with very small fluctuations gave a clear impression that we considered was a concentrated effort, which would likely result in a continued rise.

We saw a concentrated effort was correct, but the political turmoil around the president of the united states caused a ”less black swan” (unexpected external event of negative character), which meant that the above lågvolatila pattern instead gave rise to a decline. The basic positive behaviour in the united states is still intact, but the tours around the Trump put a wet blanket over the S&P 500 and delay the expected recovery.

The united states

We have been, and still is positive to börutvecklingen in Europe, but wanted to see a consolidation/moderate rebound before Europe (after the French elections) continued to pursue the north. This did not materialize, however, and it was just a break with a few days of profit-taking before the buyers continued to drive the market upwards. To Europe now in the wake of the u.s. stock market rebounds, thus, is not remarkable, but instead it is much needed.

We were however a little too casual in our attitude to the tidigvarande sustained upturn. We do not believe, however, that it is worse than that of the consolidation/rebound which logically should have appeared at an earlier stage instead occur now. Considering that the adjustment starts from a higher level should be set on the in return can hurt a little more in the skin.

Our best estimate is a possible rebound of 2% to 4% and that this nedställ can mean attractive köplägen. The premise of the forecast is that it occurs in an orderly manner. We would during the Thursday and Friday against all odds to see two nedgångsdagar with panikliknande character, each 2 % in rising volume changing the psychological image for the worse and our forecast to learn when the need to be adjusted downwards.

Germany

In Asia, marked off by the u.s. turmoil. China continues to be disengaged from the global börstrenden and commutes for more than a year back in what can best be described as an irregular tradingintervall of bottenfaskaraktär. While most of the exchanges lately have challenged or passed their peak from 2015, then, China needs to rise almost 60 % from today’s level in order to succeed with this.

Japan’s renewed strength has been shaken by the weakness of the dollar, while India belongs to the most stable and positive stock markets in the world. Hong Kong, Singapore, south Korea and Taiwan quickly recovered the night of initial downs and is also stable with a stubborn upward. The strong oljekorrelerade the Russian stock market has piggnat after the oil price latest rise, but do not appear to yet be ripe for a further rise.

The price of oil has for almost a year moved sideways with a slightly positive undertone and the movement continues to be impulsive and svårprognosticerade. Our best guess is that the price will continue to commute around 50 dollars and this raw material is suitable for the present best for short term trading.

Oil

The base metals will be supported by a weaker dollar, and we are nogsam coverage on the copper price, which after a few months of slow decline starts to show gently positive trends, even if we are not attracted to set us on the purchase page.

Our view on the stock market in Sweden is, for natural reasons, similar to that of Europe. Provided that Wednesday’s decline is not followed by a panikliknande behavior with clear red nedgångsstaplar during high volume, we believe that the rebound will be limited and short-lived in nature.

Most likely, it will occur attractive köplägen, but we want to let the picture get clearer before we go on the purchase page. We retain our målkurs about 1700 points for the OMXS30 (now 1628) and believe that the current weakness is just a hack in the curve…

Sweden