Tradingportalen meet up with Pareto Securities, the broker which provides foreign exchange to the ISA – something, whether Nordnet or Avanza offers at the moment.

Thus the dominant and established Swedish nätmäklarna Nordnet and Avanza competition of a new, exciting ones, that offer both a wide trading range, innovative new services, as well as a significantly attractive pricing. Join us on Tradingportalen when we find out more!

The ambition is really at the top!!!

The goal is to consolidate its position as a leading nordic investment bank, offering a wide range of financial services under one roof. Pareto Securities was established in 1986, and is thus hardly a newcomer in the game, with more than 360 employees at 14 offices in 9 countries.

Pareto gives now in and challenges the Swedish online broker with an attractive pricing, wide range of value-added services as well as trading platforms. Among other things, was recently released Infront Web Trader, as well as opportunities to shiny a large number of u.s. securities to name a few. A big advantage for the traders, which is all right foreign securities, Pareto offers the possibility to link the foreign currency account to the ISK in the account, which may affect the avgiftsbilden significantly, when traders avoid acidic exchange fees…

Interested in what Sweden’s latest nätmäklartillskott has to offer? Grab a cup of coffee, sit down, and enjoy our exclusive interview with Pareto!

How has the launch in Sweden have gone so far, you have been the increase of clients you hoped for?

Since our launch in march we have seen a great deal of interest. There are many people who have heard of and want to know more about Pareto, as well as how they can become customers with us. This, we think, of course, is great fun! Those who like to trade foreign shares, see us as an unbeatable option. In addition to this we have many customers who participated in our primärtransaktioner and now may be a better solution to be able to make their investments with us.

What are the plans in the future for Pareto in the nordic market?

At Pareto in Stockholm, we meet Pavas Mehra & Olof Raneke,

at clients ‘ disposal on the Swedish market.

To consolidate our role as a leading nordic investment bank with a wide range of financial services – all under one roof. Our ambition is to provide our customers with a complete solution, whether it be stock trading, to participate in fund raising or get access to our analyses.

How does your support function, it is easy to get help if you encounter problems or have questions?

Customers who need help will arrive directly to us, without having to wait in telephone queues. We are both account managers and the brokers, hence you can find answers on the most advanced issues without having to be switched on. Of course, you can also reach us on email and social media.

Where is the money? Covered under the investor protection scheme if you are a customer of You?

Customers who have their money and securities of the Pareto are covered by both investor protection securities (replaces up to sek 250 000) as a deposit guarantee for the money (replaces up to 950 000 sek). Both the securities in which the funds will be recorded in the respective customer’s account.

Something we noticed is the ability to link the foreign currency account to their ISK. Can you tell us what the benefits of this are, and what currencies you offer in the current situation?

If, for example, sells shares in Apple and buy Google for the money without a foreign currency account, you have to pay both fees, but also up to 0.5 % in currency-spread. Make you the same deal on our ISA solution with the foreign currency account, you pay only courtagekostnaden and save up to 80 % in cost to trading. Sales notes are received in local currency. The advantage is obvious, with this is that our customers who have foreign currency account do not need to pay a currency spread, which of the other players is several times more than the courtagekostnaden. Even the case when you actually need to do a failover, we are only 0.2% and 0.4% for our PRO respective Premium customers. We offer all the currencies in the markets you can trade electronically with us.

In addition to Avanza, Nordnet and Degiro themselves launched commission-free trading up to 50.000, 80.000 as well as sek 1,000,000 in accumulated savings, Nordea has recently challenged with the sharp reduction of brokerage fees. Now you go into in the price war and offer a very attractive pricing and trading offering. Will we see further pressure on the courtagebilden, or do you think the market will go against alternative pricing models, such as the American Tradeovate done with their fixed monthly fee for its futures trading?

On the Pareto are met, we of the staff have an eye on the market!

We have noticed that some actors have chosen a pricing model where customers pay a fixed monthly fee for the trade, however, this is nothing we are considering. We want to encourage our customers ‘ trade, which our model does. With that said, we are negotiating like if tailor-made pricing models with more active investors.

If you ask the active investors, calls for professional analysis, advanced trading tools, and order execution as well as the possibility to participate early in the various forms of public capital raising and stock exchange listings. Here we have an edge over our competitors.

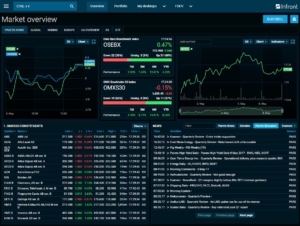

Something we are clearly seen on the us market is a shift towards web-based handelsterminaler. You launched the actual recently Infront Web Trader, tell us a little bit about the benefits of this service compared to the traditional handelsterminaler, and what we have to wait to come?

We offer, as the first Swedish player, our customers Infront Web Trader where we allow trading in securities in 14 different countries. As the name suggests, it is a web-based commerce solution, that is to say, log in via your web-browser and can access the advanced trading functionality from anywhere. In the coming time we will make the constant updating of our existing website www.paretosec.se, to develop further functionality like stop-loss in the web trader.

On the supply side, we have recently added to the 120 u.s. companies in our shortpool that you can shiny through us. Because we offer the opportunity to trade in both the u.s. and efterhandeln you can take advantage of the reactions that occur outside of the regular börstider. In addition to this we will shortly also offer approximately 100 european companies for short-selling.

Pareto are the first nylanserad trading platform directly in your browser!

Infront Web Trader

In addition to you Infront Web Trader offers you also the traditional Infront Active Trader, and even a mobile app Pareto Trader, what is the cost to get access to these platforms?

We are now going out with an offer where all new customers can try on the Infront Active Trader for free for the first month. After this, all of our Pro-customers of the terminal 475kr/month, regular price is 975kr/month. Is it more frequent, however, makes an individual assessment. New customers may also test the Web Trader, free of charge, for up to six months. Pareto Trader app is included for customers who have Active Trader or Web Trader, the regular price is, however, 49sek/month.

What are the benefits of becoming a customer of Pareto?

Through a market-leading commerce solution we provide our customers with a unique product to the market’s lowest prices in the class. As a customer of Pareto you also have full access to our analyses as well as the opportunity to participate in private placings, IPO and bond issues. It is currently not openly available to private investors – without that associated with high fees. We offer our audience a width which is strongly sought after, but which you do not fully have access to, all under one roof. In addition, we can through our Smart Order Router to reach out to some 30 venues, and thus gain access to more liquidity and over time provide our customers with better execution.

Which markets offer you trading on?

A small glimpse of handlargolvet at Pareto!

Electronically, we offer trade in Nordic countries, the Uk, Germany, France, Spain, Italy, the Netherlands, Belgium, Switzerland, Canada and the united states. Soon we will also be able to provide electronic commerce in Portugal & Austria. In addition, we offer trading via telephone in Poland, Russia, Australia, Hong kong, Japan, Singapore and south Africa.

You as a customer the opportunity to buy and sell funds, and how does your fondutbud out?

It is definitely a good idea, in short, electronically via www.paretosec.se. We will be launching a fondmarknad with the selected fund management companies with historically good results.

What do you have for margin requirements in the case of futures?

We hope in the coming months to be able to offer access to derivatives trading online, something several of our customers are asking for. In the first place, it becomes the OMX term but in the long run, the DAX, EUROSTOXX and other derivatives. We want to offer a professional product in all aspects.

How many employees work only for the Swedish market of Pareto, and where are You geographically?

We are currently just under 100 people working in and against Sweden. We are located in Berzelii Park, right next to the Norrmalmstorg in Stockholm, sweden. In large, we are closer to 360 employees spread across 14 offices in 9 countries.

What are the major trends and changes do you experience in the finance industry right now?

As you mentioned earlier, it’s undeniably a part of the courtagefronten, but we do not believe that the commission will go down to much lower levels. It is one thing to only offer the execution to customers, another to offer a range of value-added services. ”You get what you pay for” as it is called.

A clear trend we noticed is that exchange trading in Swedish companies has become increasingly fragmented. With it is meant that the trade increasingly takes place in alternative marketplaces outside of Nasdaq OMX. In, for Example, HM & Electrolux takes about 50 % and 30% respectively of the trade on Nasdaq OMX. The same thing we see in the US, where about 50 % of the trade in the Dow Jones 30 companies is made outside of Nasdaq & NYSE.

We are well positioned for this as we have a Smart order router that is read by the a 30 trading venues and dark pools for best execution of customer orders. To ensure the quality of our trading system we regularly check analyses from a ”kvantfirma” called Liquid Metrix. In this way, we can offer access to much greater liquidity without compromising our customers ‘ orders. To only send all orders to a particular market based on its cost structure is unfair to the customer and something we think should be changed in the market.

We Tradingportalen would like to thank You for your time, and wish You all the best of luck in the future!

Thanks for your time! We are confident that the Swedish investors will appreciate the personal service with us!

This is no ad and no compensation has been paid for this post. Tradingportalen is an independent operator that chooses to highlight interesting players in the market, which we believe to be of interest to our readers.