If the last year p.g.a. the case for Brexit vote was popular to figure out what ciderundret Kopparbergs Brewery so it should in the year be location to think about. I bought myself KOBR last spring and owns it still, a little late on the sider, one might think, given the recent years ‘ rise in the value of the company. The reason, however, was strictly värdeinvesteringsmässig because I realized that a company that from absolutely nowhere, can take over a significant part of the market in the country that drinks the most cider in the host must have the inherent qualities of both in the company and the products. Even if the Year thanks to its fine growth under the age of 20 had a PE of the stock market so I didn’t think it reflected the opportunities to continue to grow globally for a very long time to come (see previous post about värdeinvestering and growth).

Kopparberg framgångståg into the Uk via the genidraget first bet on the vacationing brits (and swedes) down in Spain, have been described in detail elsewhere. It was the start of the Year to travel out in the world that is still in progress and, I think, is still only in the beginning. However, it has been very popular among investors in many years to frown at Kopparbergs because the drinks ”fruit ciders” which can be found on the is usually very sweet and not ”real cider”, and so Many have also forgone the purchase of the share since it is not believed that the company would be able to maintain the market share when the big bryggerijättarna began to take an interest in this new segment for a number of years ago.

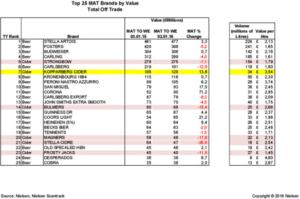

The year has, however, struck tvekarna on the fingers quite dramatically, and not only retained their early conquered the market share, but have expanded in the Uk and, in addition, according to the british statistics clearly take charge more for their products than the competition (see image below). This of course depends on the brand’s strength, a strength that many in Sweden don’t really understand but can be demonstrated easily with a twittersökning on the latest postings with the word ”Washington” on a summer evening. Even if they have been copied by both the English (Rekorderlig from Åbro and Briska from Spendrups) of the foreign giants like Carlsberg (Somersby), Coors (Carling) m.fl. so, they have said, done excellent.

Image Source: Avanza

The most appealing of the Year from a värdeinvesteringsperspektiv, I think, is that it is powered by a highly long-term goals (not different LVMH in this regard, see last week’s post) and it accelerates very slowly upon the world. Today they are outside the UK the strongest in Sweden, where it also has a very large sales of beer with bl.a. Sofiero and the High Coast and around the Mediterranean but is moving slowly but surely against both the united states, most recently with provförsäljning at Walmart, and Australia.

Kopparberg is said of sterling since 30 to 40 % (the data varies, is not accounted for separately by the company) of the sales are in the Uk. It has, however, begun to secure the course, but does not specify how much but the CEO is clear in both, with the pound’s significance to the last line and that it should not be exaggerated because it is crucial for the company’s sales growth and excellent margins. When the yes-side, as I said very unexpectedly won the Brexitomröstningen by the end of June 2016, the pound fell against the Swedish krona by more than 10 %, which was strengthened in the year/years by the course already had dropped a lot since the peak in 2015. Kopparbergsaktien was punished initially, but recovered later in the summer and autumn in the quarterly reports thanks to the fact that both Q2 and Q3 was stable and increased fondägande in the company.

Kopparbergs can take twice as much paid for the product (the column furthest to the right) as competitors, Strongbow and Carling.

The real urblåsningen in the course came with the Q4 report in February of this year when the earnings rose only marginally against the year before, something you don’t is what at which shareholders in the Year. All of the analysts previously warned of pundförsvagningen but so far have received a ”wrong” during the autumn was now in the water on their mill, and many rekar lowered (example) then it was felt that now the exam times, when the fine developments in recent years was largely valutadriven. I was not at all but saw it as the effect partly of course by the pound, but primarily to the seasonally weak fourth quarter were affected by the fixed costs are so large in percentage against revenues compared with sommarkvartalen. The operating margin weakened considerably by the high sterling a year earlier at the usual comparison against the year in which the revenues so to say, therefore, must bear many of the costs of running the company also has a seasonally weak quarter. One should also not underestimate that the euro is strong against the crown and that not everything is about the pound. Also, the dividend was increased from 4,40 to 5,90 sek spoke according to me against the that the company was in crisis.

Image source: the company

It is difficult to know what influenced the most, but after Q1:an com in may were dispersed again doubts that the Year winners trip would continue, and earnings rose by 3 % and sales in the british isles, it was announced to have increased by 14 %, which of course was pulled down again by the weaker pound. Just as the market seems to have meant after the report, I believe that this result, together with the pound now fairly stable course over 11 sek speaks to the concerns that previously existed was greatly exaggerated. Just like the CEO says will be affected by the pound, up and down, as you always have done but it is said that the sales to watch for as the owner.

Kopparberg is a very well-run company. It hasten slowly and sacrifice no margin to increase the turnover like so many other companies are prepared to make. It is, moreover, highly innovative and create new concepts regularly.ex. rosécider (which were immediately copied by competitors), Kopparkeg, Frozen Cider and Fruit Stock just to name a few of the last two years news. Together with a very strong brand and effective marketing goes probably their winning streak further.

You’ve really only scratched the surface outside of Sweden and the united kingdom. I can’t find any major threats other than a very strong crown against the pound and the euro, and this seems unlikely today, in any case not sustainable. The CEO has great importance, but I see it in each case as completely unthinkable that he would leave his life’s work voluntarily, but of course, it must be mentioned that a founder/CEO as in all similar enterprises is very important.

Kopparberg does not, however, getting better all the time really. If you ”just” manage to continue as before, then you will be able to grow in very many years. The brand is built up to its current level in 20 years and will only get stronger, ie, more well-known, with time. Then you also have a nice utdelningshistorik and could cope even with a hefty valutasmäll really good feels current score around 240 sek (PE 22 in the last four quarters, and a dividend yield of 2.5 %) very attractive.