Peter Lynch advocated often that you would look for ”boring” companies. The idea is that the activity is really boring or not very sexy is detected much later by the market, often long after they have begun to earn big money in relation to the valuation. He had himself t.ex. earned tons that he found a begranvingsbyråkedja with a försäkringslik model for the payment of the funeral no one wanted to take in during a long period of time, while its profit rose to the skies.

When I was at my largest holding in Catena Media’s annual general meeting in the spring, we were three third-party shareholders in place. The week after at LeoVegas we were closer to a hundred. The companies operating in the same sector and have roughly the same market capitalization and growth. Catena’s PE is lower and the market has been quite cautious to the company in the spring of at the same time as many other ”gamblingbolag” has measured up.

Something is different however, apparently in the market’s interest for the business between these two companies and it is likely that catena’s operations are more difficult to understand and even far osexigare than t.ex. The LEO’s. This is a bit ironic considering that affiliateverksamhet is one of the world’s really big ”industries” today and in principle cover the whole onlineekonomin.

For 20 years, then came Amazon’s founder Jeff Bezos that they would be able to pay other web sites if these were used to promote Amazon’s products, and people clicked on the link and then bought by Amazon. The t.ex. had a site about dogs could let Amazon do the advertising for the new hundböcker. It started soon companies that specialised in creating jämförelsesidor and the like that drove the traffic to the other sites. Thus was affiliateindustrin invented. These were dependent on getting high search engine result rankings, which required a large traffic to the page. Google then came in that they could charge money to let companies end up at the top in a special annonsavdelning when people searched for information and have then earned more money on this. To use the ”affiliateföretag” Hotels.com, Prisjakt, Bioguiden, etc. has paid off for more or less anyone who sells anything online. The vast majority believe that it is the only way to operate today – are not high on the relevant affiliatesidor, as well as the high, if you search on Google, you are not. The customer goes somewhere else.

Catena Media’s business concept is to buy up affiliatesidor in ”gambling” (with information on nätkasinon, sports games, etc., t.ex. Askgamblers), which already has a faithful besökarskara, and then operate them far more efficiently in-house within their own system, and, of course, take well paid by the operators for the traffic which they control to their pages just like the other affiliatesbolag. Catena’s sites tips t.ex. about where to get the best bonuses if you like to play on the oninecasionon, the best odds on a fotbollamatch, etc, Because the operators, as well as Amazon and others, has a margin of their business – the surplus, after profits are paid out – so can anyone who is good at generating traffic to an operator to take well paid. In the best case for catena’s Media you can share in the profits, in their case, around 40 % of the surplus so long as the new customer remains with the gaming operator.

This is of course very scalable as a large part of the business is automated and once you have built up their systems and their organization can handle very many pages without too high additional costs per new page (it currently has around 3000 pages). About two-thirds of the catena’s tillväst today come from this aggressive acquisition strategy with a number of new purchases every year, while the rest is organic growth with the formerly-owned sites. The result is in the end very impressive both on the top and bottom line. This is not least because you have to buy the pages are relatively inexpensive in many cases, given the profit because they not rarely run by young enthusiasts who in this way can cash out and start with something else with a hefty penny in the pocket.

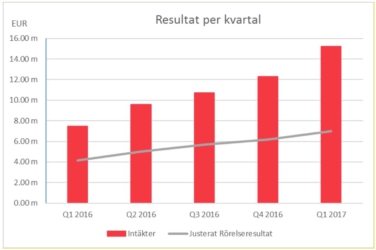

Image source: company’s Q1 presentation

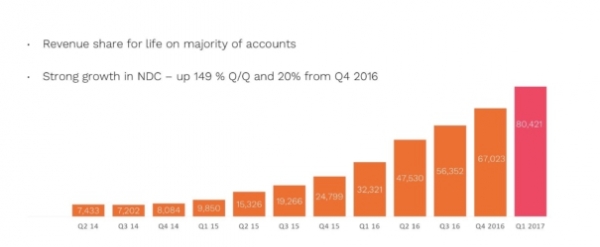

The most important indicators, however, is without a doubt the number of new customers (New Depositing Customers or NDC), or the one in the lead said to me: ”It is the only thing we look at.” This is completely natural and it is this which is catena’s production – to deliver customers to their customers. Everything else is secondary. When I have looked at the company in detail, it is this figure I assume. The growth in NDC correlates very well to revenue even if there is a natural postponement of the revenue. Last quarter was a new record (of course) in absolute numbers and as a tjugoprocentig growth against the previous quarter.

Image source: Q1-presentation

When you see these numbers becomes perhaps a little surprised by that PE for the current year is below 20 and the stock has struggled to rise in the years. It fell more than 10 % in the most recent quarterly report on vinstbesvikelse only really had to do with changing the tentative pay model of many customers against the ”revenue share” instead of a fixed revenue per customer, which it said would give higher income, but a little bit later in time. The market is thus not at all convinced which I feel sure is just because of the unknown, and certainly not the exciting industry it operates in.

However, I am also convinced that this will be amended in line with (if…) it continues to deliver good growth and profits. Given the large acquisitions it has made over the past several quarters, and organic growth, it is in principle inevitable that a similar growth in the NDC continues. It is really not any stranger than the fact that it took LeoVegas, which, nevertheless, has a much more fast-paced and exciting business, about a year of fine reports after its IPO last spring before the market suddenly perceived how good they really were (I also own the LEO) and the share uppvärderades over 50 % in two months. At the same time, of course, you can note that the Catena rose rapidly in 2016 after an IPO with a rather low score, and the amazing reports in 2016, so maybe it is not so strange if the share stood and stamped also for this reason. The market is waiting also on the p.g.a. the high the acquisition rate deferred relisting to OMX Stockholm, which can be a driver when (if) it will in the fall.

Another aspect that has undoubtedly burdened the Catena Media’s valuation is that the business is due to different writings about the type of business you have is very risky and the ”Google may at any time change their criteria for listing of search results”. It is true, of course, that Google has sole power over how to rank the results but these claims miss that this risk applies particularly to those who are cheating (”black hat”) with its pages in the attempt to get high but to have the highest traffic, which serious companies of course do not engage in, and that catena’s income also comes from purchased searches where they pay Google to rank high for our clients. Catena is thus an important customer today actually is one of the biggest Google has in Europe.

Other claims is that customers are now ”ledsnat to pay for the traffic and to stop using the ”affar” alternatively, run these comparison sites themselves. This claim is very oinsatt as I see it. Both driver gaming companies long ago own comparison sites that not have been a success and, of course, have credibility if the customer knows that it is they themselves who stand for the business and the content can be suspected to be biased to their advantage. The second is that this kind of sites as I said is everywhere and the gaming operators like hotels, airlines, etc. earn lots of it will customers to them even if you get share of profit on these new customers.

This does not mean that the business lacks the risk, of course. It is depending of the legislation in different countries and that it can continue to deliver to their customers. It is also dependent on the skills of Malta, and on the other office you have, something that costs why personnel costs have risen substantially in line with the expansion. This does mean, however, that said, do not in any way taking on the big risks, and with that it seems within just this sector, which the criticism has been about. It seems as I said in a very expansive industry that today is very large but that most do not have a clue yet. Which is a bit ironic considering how many who uses the t.ex. Prisjakt private today. CTM’s founder recently said in an interview that when it did its IPO last year, you had to explain its activities ”on a very basic level” for the analysts and fund managers who visited…

Catena Media’s goal is, of course, to become one of the largest global affiliatesbolagen in gambling and earn on their dominance. If they succeed with this, so is the current valuation to be very low. This chronicle does not provide space for a complete presentation of the company. I recommend the latest annual reports for the very generous descriptions of activities and the development and analyses from Swedbank and Carnegie, the only thing that the company follows, which perhaps also says a lot. Catena has also promised to fr.o.m. the next quarterly report to introduce new metrics in order to more thoroughly be able to explain their activities, which so obviously is poorly understood in the market. Kvartalspresentationerna is also available on the film for the interested.

Catena is, as well as all my other holdings and companies I am interested in buying a day a distinctly long-term holding. It is not reasonable to buy the company with few months horizon. It is a company that in a few years could be really great but have not yet been discovered or understood by the market. Neither more or less.